Image by Mats Wiklund / Shutterstock.com

According to media reports, LVMH, the world's largest luxury goods company, has an interest in taking over Richemont, the Swiss luxury group with a focus on watches and jewellery.

In fact, Undervalued-Shares.com reported just two months ago that:

"In luxury goods …. you either go big or go home. … Surprise developments could … kick off a wave of M&A as well as renewed interest in the sector as a whole."

Is Richemont a lucrative bid candidate, and which other luxury goods companies are worth looking at?

The "whispers" are getting louder

LVMH (ISIN FR0000121014, FR:MC) is a EUR 400bn giant, and one that was largely built on the back of acquisitions.

As a long-read profile of Bernard Arnault, LVMH's CEO and shareholder, summarised:

"Bernard Arnault, now the world's richest man, is known for his leadership of LVMH, the acquisitive French luxury conglomerate. Long before becoming a captain of industry, Arnault was a takeover artist, a pirate. The press called him 'the wolf in the cashmere coat.'"

Within the luxury goods industry, LVMH is increasingly in a league of its own, as stand-alone companies and smaller players are struggling with the enormous pressure to achieve economies of scale. Even Richemont (ISIN CH0210483332, CH:CFR) and Kering (ISIN FR0000121485, FR:KER) – both large, global firms with a market cap of EUR 73bn and EUR 70bn, respectively – pale in comparison to the might of LVMH.

In my December 2022 research report on Swatch Group, I pointed to whispers that Kering and Richemont would eventually merge – probably facilitated through a combined cash and shares bid from Kering for Richemont. Both companies have very strong-headed major shareholders, but both are also in urgent need to compete with LVMH. Jointly facing up to LVMH would make a lot of sense.

In a twist to the story, it has now emerged that LVMH itself allegedly wants to get its hands on Richemont.

According to Finanz und Wirtschaft, the highly reputable Swiss newspaper, Arnault had been stalking Richemont for quite a while now. In 2022, activist investor Bluebell Capital started a public attack on Richemont's governance structure, proposing a former LVMH executive to join the board of Richemont. Some say that Arnault was backing Bluebell Capital's push, and that he wanted to plant his own representative as a Trojan horse.

Bluebell Capital failed, and the truth will probably never be known.

Source: Capital.com, 1 September 2022.

However, it is clear that Richemont would fit neatly into LVMH's overall portfolio. The French group is strong in leather goods, whereas Richemont owns Cartier, the world's second largest watchmaker ahead of Rolex and also a producer of jewellery. LVMH's watch and jewellery flagship brand, Tiffany's, is only half the size of Cartier. Arnault is said to be vying to own the #1 in this space.

According to Bloomberg, it could be wiser for Richemont to seek an offer from Kering. Kering urgently needs to become less dependent on Gucci, which accounts for more than 50% and almost 70% of Kering's sales and operating profit, respectively. The assets of both groups would nicely complement each other. With Chloe and Alaia, Richemont even owns two fashion houses that could benefit from Kering's expertise in relaunching such brands.

For both Kering and LVMH, owning Richemont would be desirable and, to some extent at least, necessary to thrive in the increasingly scale-driven industry. Both now need to be nervous about their key respective competitor coming to an agreement with Richemont.

For the family that controls Richemont, the South African clan of Johann Rupert, this is a comfortable situation to be in. Richemont is now the bride that probably has two potential suitors. None of Johann Rupert's children will step up to run the group, and the 72-year-old multi-billionaire will have to secure his succession at some point.

Since 2015, the stock of Richemont has been the laggard of the industry, having risen by only 75%, compared to Kering's 205% and LVMH's 450%. This also reflects the respective operative performance of the three groups. Richemont has fallen behind, and it could benefit from leaning on a larger partner.

For a deal to have a chance to work for Richemont shareholders – both the Ruperts and everyone else – it would have to involve a premium of at least 25-30% to the current share price. This would be the largest ever acquisition for LVMH, but Arnault's group has sufficient firepower to afford such a EUR 100bn+ bid. Relative to Kering, LVMH could probably afford to offer a higher cash component. However, it would involve Johann Rupert, the family's patriarch, to truly cede control to Arnault. In a merger of Richemont and Kering, the Ruperts would be much more akin to a partner in a merger of equals.

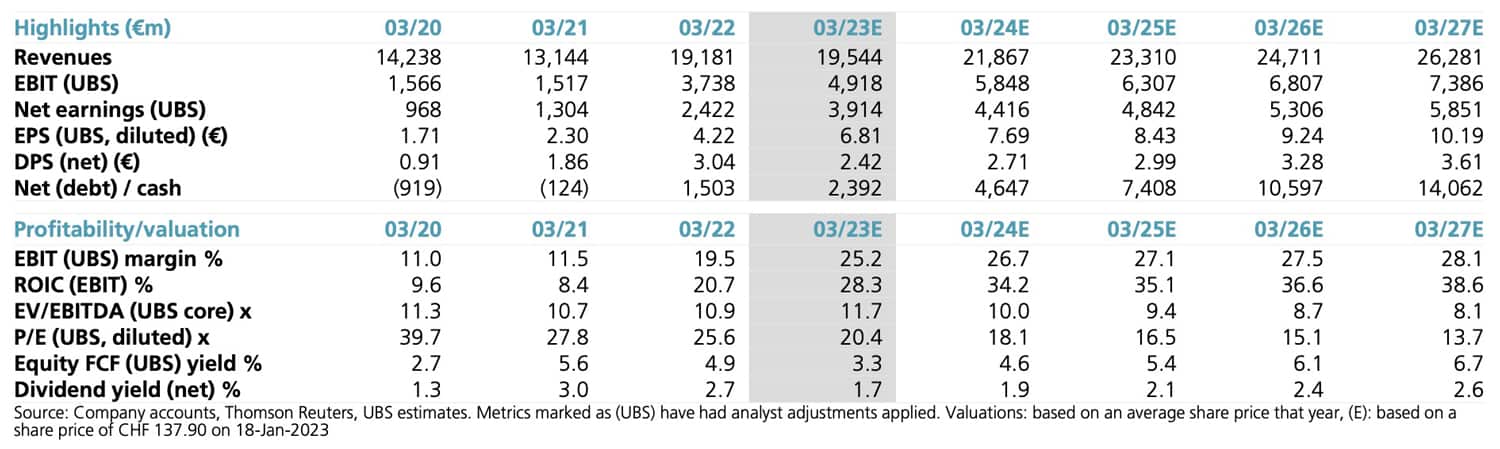

Source: UBS, 19 January 2023 (click on image to enlarge).

Is Johann Rupert open to offers, and will there be a negotiated bid or some kind of bidding war?

Rumours of an incoming mega-merger in the luxury goods industry have been around for years. This time, however, it does look like something or other is going to happen. 2023 and 2024 should be incredibly interesting years for anyone following this industry.

Besides Richemont, there are other stocks you can invest in to benefit from increasing M&A activity in the industry.

Check out these stocks

Undervalued-Shares.com Members recently received detailed research about two other luxury goods companies that are also getting a part of the action:

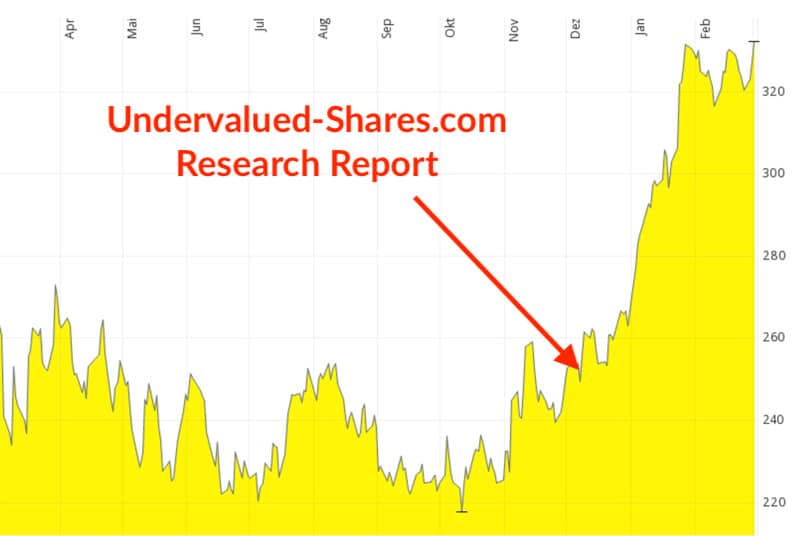

Swatch Group (ISIN CH0012255151, CH:UHR), the watchmaker that controls 17 brands, including Omega. The family-controlled group has had its share of difficulties, and the stock was reputed to be "boring" when my research report was published on 9 December 2022. Its price is now up 32%. Swatch Group could sell off one or the other brand, and the value of Omega alone would cover much of its current market capitalisation. There is renewed interest in watch brands following the stunning success CVC Capital had with relaunching Breitling, and this interest should continue to rub off on Swatch Group as the owner of a very large portfolio of such brands.

Swatch Group.

Aston Martin Lagonda Global Holdings plc (ISIN GB00BN7CG237, UK:AML), the iconic British luxury car brand. Aston Martin had already seen a de facto takeover by a group of new shareholders, following its disastrous 2018 IPO. Its publication of annual figures for 2022 on 1 March 2023 – the day following the release of my research report – confirmed "solid progress", and the stock temporarily shot up 19%. The stock is now de-risked, and even though Aston Martin is not a takeover target anymore, it will now continue to benefit from having a very strong group of new shareholders. If you missed investing in Ferrari (ISIN NL0011585146, NYSE:RACE) in time, this report should be a must-read for you.

There are other gems in the sector waiting to be discovered – such as Burberry (ISIN GB0031743007, UK:BRBY), the British brand whose trench coats in Burberry check print are one of the world's most recognisable luxury fashion items. As I pointed out in September 2021, the company's weak share price of GBP 1,800 made it vulnerable to a potential bid. In the meantime, the stock has rallied to GBP 2,500. A bid is now less likely – but who'd complain about the stock's performance?

Now that M&A in the luxury goods sector is seemingly kicking off in earnest, it's a good time to take another close look at the industry's most promising takeover and restructuring targets.

Latest stock pick out now

On 1 March 2023, Aston Martin shares surged up to 19% on the company's profitability forecast for 2023.

Is there more to come?

The latest Undervalued Shares research report looks into the track record of the new lead investor, crunches the company's numbers for the years 2023-2025, and reveals why there may be a few surprises along the way.

If you missed investing in Ferrari in time (which went up fivefold), this report is a must-read.

Latest stock pick out now

On 1 March 2023, Aston Martin shares surged up to 19% on the company's profitability forecast for 2023.

Is there more to come?

The latest Undervalued Shares research report looks into the track record of the new lead investor, crunches the company's numbers for the years 2023-2025, and reveals why there may be a few surprises along the way.

If you missed investing in Ferrari in time (which went up fivefold), this report is a must-read.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: