Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

CRESUD S.A.: a crisis investing opportunity par excellence

(Full access for Members only)

CRESUD S.A.: a crisis investing opportunity par excellence

27 March 2021

What readers said about this report

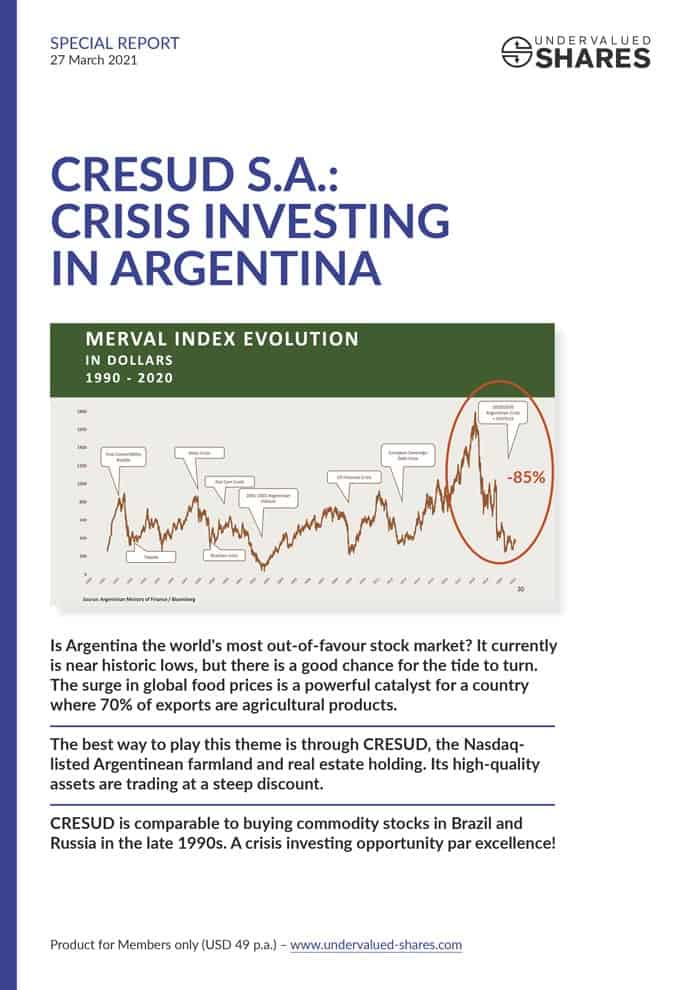

Each time the Argentinean stock market was struck by one of the country's infamous crises, it subsequently roared back into life again.

So far, whenever Argentinean assets were given away at fire-sale prices, it paid off to pick up high-quality bargains and wait for the next bounce.

To find the likely trigger for Argentina's next turnaround, you only need to check recent headlines about surging prices for agricultural products – the biggest increase in a decade!

Take a country that earns 70% of its export income through agricultural products, and throw in a price increase for individual agricultural products of 30%, 50% or 100%. It can turn into a game changer for the economy's overall constitution, at least by providing that all-important initial spark for getting the country's economic engine going again.

The surge in global food prices can be a powerful catalyst for Argentina, if the trend continues – as many believe it will.

The country may be in a tricky spot right now, but investors with deep pockets are already looking at it.

I have researched a company that owns some of the country's best assets. The stock of CRESUD S.A. is trading at discount prices, and it even offers a hedge against some of the challenges the world is currently facing, such as the return of inflation, and political risks in countries that were long perceived to have no political risks.

If you like to take a contrarian stance, CRESUD might be right up your street. I believe it is one of the smartest ways of betting on a turnaround of Argentina's fortune.

Not a Member yet? Sign up for a Membership - just USD 49/year.

Already a Member? Log into your account to download the report.

What readers said about this report

Mark T.

June 2021

I do my own research before every investment and was especially pleased by your CRESUD report, especially because Mr. Greg Alexander, Conifer Management, is also buying more of it.

Luis M. S. H.

June 2021

I've just finished reading your articles. Superb work! Loved them.

I couldn't agree more with all of it. It was like reading my own thoughts but it in clear, well-written English.

It's comforting to read a fellow analyst from another part of the world validating an investment thesis. You see, I've been pretty much alone here buying Argentinian stocks during 2020. Very few in our 50,000+ member Club wanted to buy local stocks at these prices... but I guess that's exactly what shows the market has hit rock bottom. It's all part of the market cycle, the end of a bear market. Everybody wanted stocks in 2018 at x10 current prices, but nobody wants them now (I was relieved to see, though, that when the time came we all subscribed to Cresud and IRSA's capital increase…).

Miguel T.

June 2021

Great article that was about Cresud!

Luis M. S. H.

June 2021

I think you chose the best stocks in town. CRESY, IRS, IRCP and (company name hidden by Undervalued-Shares.com) explain about 60% of my local portfolio, maybe a little more.

Pablo C.

May 2021

Excellent call so far Swen! Spectacular analysis as usual. As you pointed out, there are some hidden gems in this god forsaken country (still in heavy lockdown run by a bunch of sociopaths).

Andrew K.

May 2021

I'm loving it. Keep it up.

Michael B.

May 2021

The stock of CRESUD is very much to my liking. This is how I became aware of Argentina. There are certainly more deep-value treasures out there. Would be great if you could do some more treasure hunting 🙂

André D.

April 2021

Great report about Cresud - Big Value!

Ingo K.

April 2021

I became aware of your blog through Lyn Alden and you ultimately piqued my interest when I noticed that you were writing about an agricultural play in Argentina. After reading the Cresud report, I am looking forward to more of your reports and will now delve a little deeper into Cresud’s numbers myself in order to manifest my investment decision.

Omer N.

April 2021

Great report with great insights!

Milind D.

April 2021

I am a subscriber to Undervalued Shares and thought to drop a message to you of praise for the way you write your reports. For any investor looking to invest the metrics and financials tend to supersede the narrative of investing in a particular company. I especially liked the way you described the narrative for CRESUD and in a way Argentina and have also liked the narrative that you have written about investing in Volkswagen/Porsche.

Lars K.

April 2021

I also appreciate the opportunistic companies you find such as Cresud. Sometimes I would with that you dive a bit deeper into valuation – but that being said – a lot of people spend a lot of time on spreadsheets and not enough on the catalysts.

Eric K.

March 2021

Many thanks for your report on Cresud. Super exciting and I agree with you on many points: sooner or later these assets will be valued again at an appropriate price.

Julius G.

March 2021

Cresud is also an exciting company, just as Argentina would be a great country to live in. Adding up the assets that Cresud owns makes it appear that an investment is a no-brainer.

Max M.

March 2021

CRESUD seems like a real nobrainer to me..... Pretty much at the bottom, shouldn't fall much lower and should benefit if inflation hits. Many thanks once again for another of your ideas that I can implement right away without having to think twice.

Tobias E.

March 2021

Interestingly, the Propiedades Comerciales S.A. ($IRCP) caught my attention a few weeks ago because of a dividend distribution of $3.53 at a share price of then $13.25, but I haven't had a chance to take a closer look at the company since, especially because you had also mentioned Argentina in an annual outlook video with Jens Rabe. So this report came at just the right time. Thanks a lot for this!

Marshall B.

March 2021

Fascinating report on Cresud.

Gene G.

March 2021

Nice idea, Swen. This is exactly the kind of opportunity that I look for.

Alex A.

March 2021

Great report on Cresud and Argentina.

Report updates

Not a Member yet? Sign up for a Membership.

Already a Member? Log into your account to download the report updates.

7 March 2022

Report Update (PDF - 0.7MB)

18 May 2021

Report Update (PDF - 0.6MB)

7 May 2021

Report Update (PDF - 0.4MB)