Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

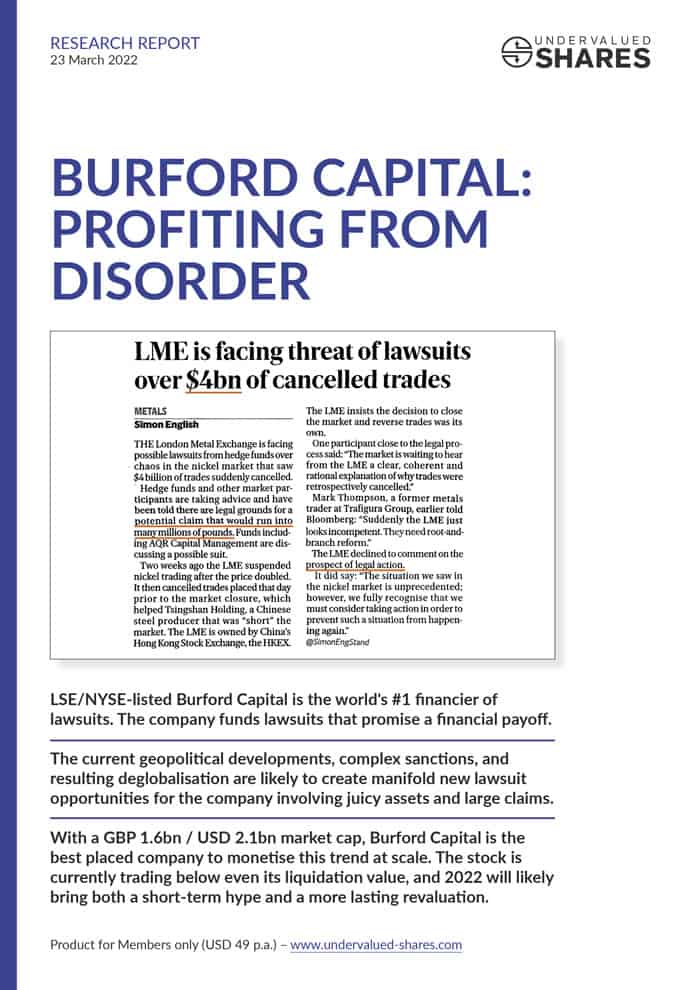

Burford Capital: profiting from disorder

(Full access for Members only)

Burford Capital: profiting from disorder

23 March 2022

What readers said about this report

The company featured in this report is truly one of a kind.

Burford Capital is the world's #1 financier of lawsuits, and it is set to benefit mightily from manifold new lawsuit opportunities.

- There is a specific catalyst coming up in June 2022, which I believe will lead to a short-term hype driving the stock price higher.

- 2022 and 2023 should see an ongoing revaluation of the company, because of a whole number of catalysts that are gradually going to become apparent.

- The company's valuation has a quirk that is quite remarkable – you will not have seen anything like it before!

- Burford Capital operates in a growth market, and disorder in the world will only make its business bigger, stronger, and more profitable.

Outside of the investment case itself, I promise you'll learn something interesting about how the world works.

Not a Member yet? Sign up for a Membership - just USD 49/year.

Already a Member? Log into your account to download the report.

What readers said about this report

Greg A.

September 2023

I am reaching out to say thank you for your comprehensive research report on Burford Capital Limited (BUR). After reading your analysis and performing internal due diligence, we, (company name hidden by Undervalued-Shares.com) – a family office, began buying in May 2023. As of yesterday, the investment had a return of 24.87%. This morning, based on review of their six-month earnings report (see link below) , I increased my stake which slightly increased my per share cost basis from $12.38 to $13.78 and yielding a current ROR of 12.70%. I expect my long-term investment horizon will yield continued positive returns particularly in the wake of this week’s favorable ruling in the YPF litigation (potential $1.02B pay-out to the firm). The thoroughness of your insights are much appreciated. Excellent work!

Gene G.

March 2022

Fascinating report, Swen. You do a great job explaining the investment case. I will be keeping a close eye on this one. Thanks for the idea.

Report updates

Not a Member yet? Sign up for a Membership.

Already a Member? Log into your account to download the report updates.

3 April 2023

Report Update (PDF - 0.7MB)

15 August 2022

Report Update (PDF - 0.3MB)

10 June 2022

Report Update (PDF - 0.3MB)