Seaport Entertainment Group is a NYSE-listed play on the revival of New York’s southern tip. I visited the neighbourhood to evaluate the opportunity.

Apollo Global: the new Berkshire Hathaway?

(Full access for Members only)

Apollo Global: the new Berkshire Hathaway?

21 April 2021

What readers said about this report

Apollo Global Management, one of the world's leading alternative asset managers, is best known for its stellar track record in managing private equity funds. However, these now make up just 20% of the company's business. Apollo should soon be known for something else entirely.

The NYSE-listed company is about to undergo a transformation, entailing the most far-reaching changes since its foundation in 1990.

Later this year, Apollo Global will merge with Athene, a provider of retirement savings solutions. Merging the investment management expertise of Apollo Global with the distribution capabilities of Athene will be a game changer. The public hasn't realised it yet, but this is huge!

Importantly, it will also create an entirely new narrative around Apollo Global.

The company had recently been suffering from several PR disasters. Over the coming months, a change in leadership, an overhaul of its controversial governance structure, and a new focus on retirement saving will likely give the company (and its stock) a fresh start.

Apollo Global's new investment narrative is just starting to emerge. It will be centred around building its own version of the strategy used by Warren Buffett at Berkshire Hathaway – using the money of an insurance company to generate additional earnings.

As a side effect of these changes, Apollo Global is likely to be included in the S&P 500 index in 2022, probably ranking around #250. Index funds and other investors will then pay more attention to the company.

There is an immediate opportunity to potentially make 50% over 6-18 months, as well as a longer-term opportunity, namely that of Apollo Global turning into a multi-decade compounder with a high dividend yield. For 2022 and 2023, the dividend yield is expected to come in at 5% and 7%, respectively.

The company has a USD 22bn market cap and its stock is extremely liquid.

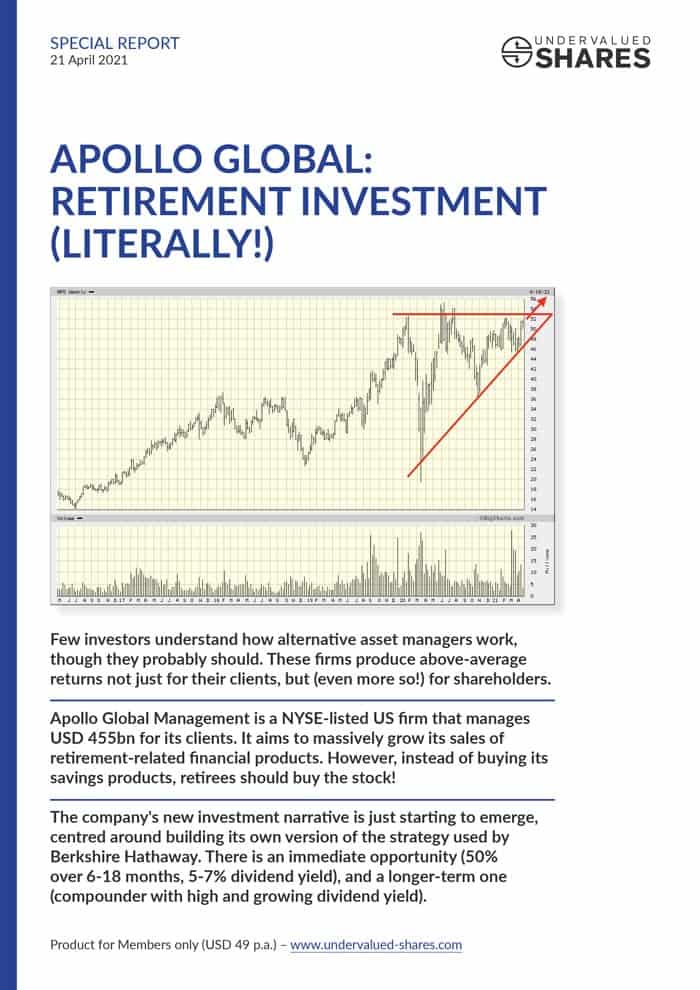

Its chart looks like a break-out is imminent – so check this report soon.

Not a Member yet? Sign up for a Membership - just USD 49/year.

Already a Member? Log into your account to download the report.

What readers said about this report

October 2021

I'm afraid to follow up, not to thank you but for fear of jinxing the up movement of APO. It's up nearly 50% since your call. I got the story when you presented it, I know the industry and it all made sense as to your analysis and went forward with investing in it. ... Thank you for an outstanding call.

July 2021

You really nailed it with APO. It appears the best benefit among many from the merger of Athene is- their cost of capital to do their PE deals goes down and the consistency of cash flow allows them to act immediately when they see opportunities. And their recent acquisitions - latest is Hilton in Anaheim, shows they have an eye for value. And bringing in Motive Partners to upgrade their tech is another internal value play.

Michael N.

May 2021

I very much liked the report on Apollo.

Tobias M.

May 2021

Thanks to your report I got heavily involved in Apollo Global.

Alexander G.

April 2021

Fascinating report, just finished it. Chapeau. Since I've been invested in this area previously, I do know what it means to enter the depths of the engine room 😉

Report updates

Not a Member yet? Sign up for a Membership.

Already a Member? Log into your account to download the report updates.

8 August 2022

Report Update (PDF - 0.3MB)

29 April 2022

Report Update (PDF - 0.3MB)

2 November 2021

Report Update (PDF - 0.1MB)

20 July 2021

Report Update (PDF - 0.1MB)

Get my best investment ideas each year

Join my global audience (Members from over 80 countries!) for hard-hitting investment research that you won’t find anywhere else.

Unlimited access to in-depth investment reports and regular updates - for just USD 49/year, or USD 999/lifetime.

FIRST TIME HERE?

LET'S WORK TOGETHER

Copyright 2021 - Undervalued Shares. All rights reserved. | Privacy Policy | Cookies | Terms & Conditions