DWAC: Trump SPAC, growth stock, election tool?

(Full access for Members only)

Image: lev radin / Shutterstock.com

DWAC: Trump SPAC, growth stock, election tool?

5 January 2022

What readers said about this report

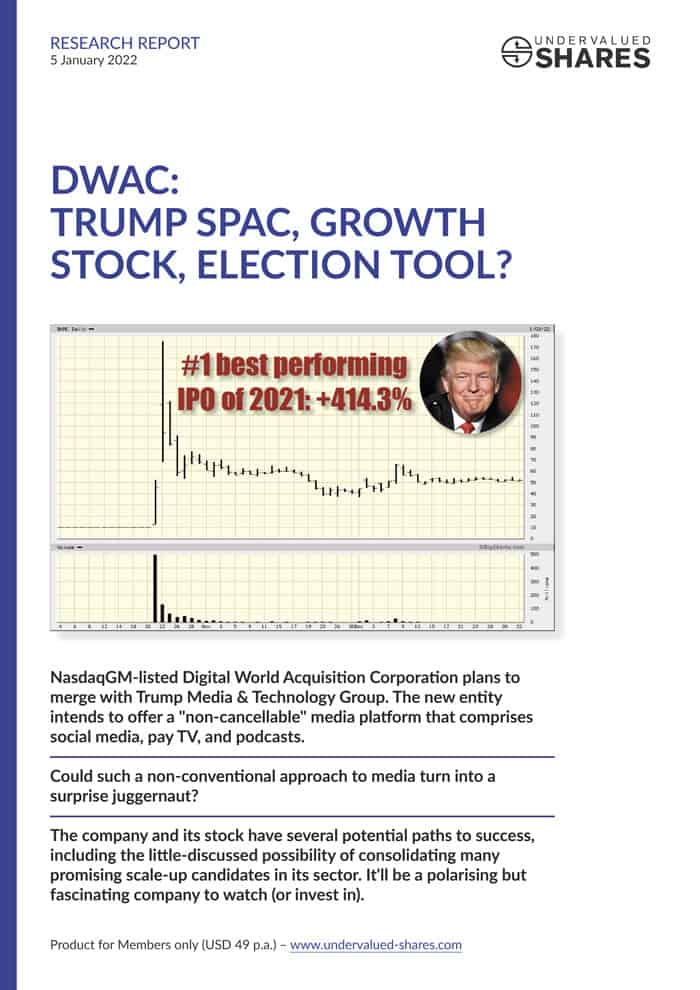

NasdaqGM-listed Digital World Acquisition Corporation has agreed to merge with Trump Media & Technology Group, the privately held media company created by former US president, Donald J. Trump.

The new entity intends to offer a free-speech, non-cancellable and non-woke media platform that comprises social media, pay TV, and podcasts. The first product is envisaged to launch in Q1/2022.

This company could have a golden opportunity in media – and this opportunity can probably only be unlocked by a Donald Trump, at this particular point in time, and using a US-listed company.

Does that sound too optimistic?

Other investors have just staked USD 1bn in cash on this company. Also, the stock was the #1 best-performing IPO in the US in 2021. This is a serious undertaking. Disregard it at your own risk – just as people did when Trump came down the elevator and ran against 17 other candidates.

Over the next few months, there'll probably be a few surprises coming out.

Not a Member yet? Sign up for a Membership - just USD 49/year.

Already a Member? Log into your account to download the report.

What readers said about this report

Gene G.

January 2022

Intriguing report on DWAC too. Not sure I have the balls for that one, though!

Report updates

Not a Member yet? Sign up for a Membership.

Already a Member? Log into your account to download the report updates.

1 December 2022

Report Update (PDF - 0.1MB)

2 May 2022

Report Update (PDF - 0.7MB)