Gold stocks remain undervalued, with considerable upside potential. I picked the brain of Dominic Frisby, who has just released a new book on gold, to get his take.

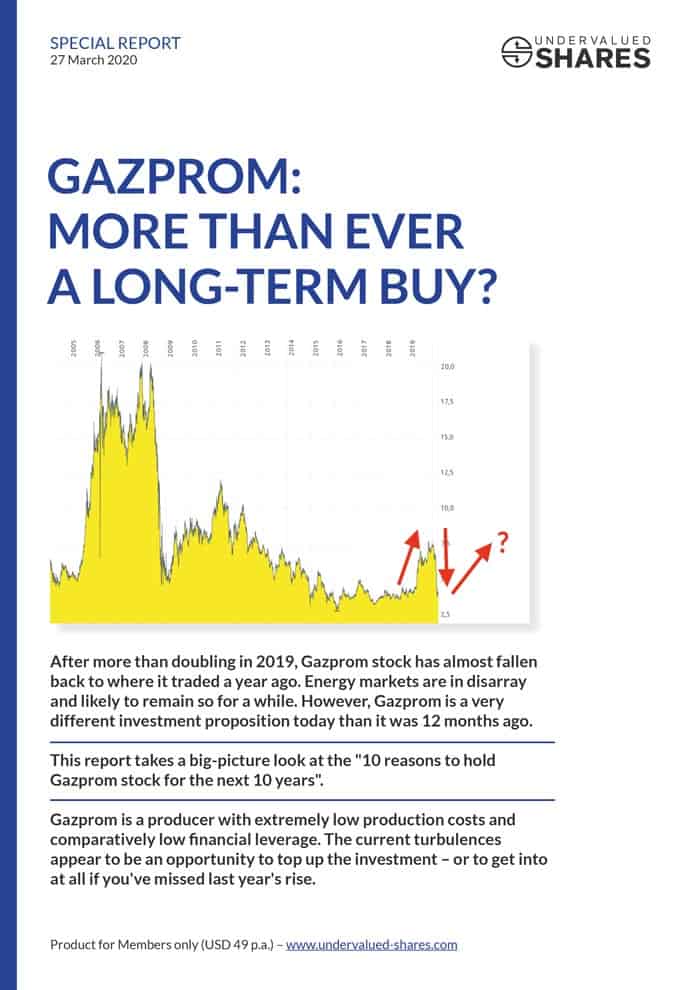

Gazprom: more than ever a long-term buy?

(Full access for Members only)

Gazprom – massive dividends and value catalysts galore

27 March 2020

What readers said about this report

There is a short-term perspective on Gazprom, and then there is its longer-term potential.

In the more immediate future, investors who buy now can expect significant dividends. The most up-to-date estimates make for an estimated 2021/22 dividend yield of 12.6% and 17.8%, respectively. This is possible because the company has the world's lowest production costs for gas. Even if energy prices remained under pressure, Gazprom will continue to earn billions of dollars each year.

Looking a few years into the future, there are ten exciting aspects to consider, including:

- Potential IPOs of subsidiaries.

- The sale of non-core assets, which could yield billions of extra cash.

- China becoming as large a Gazprom client as Germany.

There is a lot that the wider investing public does not currently have on its radar.

Would you have known that from 2020 onwards, the bonuses of Gazprom's management team also depend on the stock price performance?

Gazprom stock is currently trading at a price that does not even cover the value of the company's pipeline network – and all other assets are effectively thrown in for free.

Not a Member yet? Sign up for a Membership - just USD 49/year.

Already a Member? Log into your account to download the report.

What readers said about this report

September 2021

Now the other analysts are coming out of the woodwork and praising Gazprom. You can rightly praise yourself for having known it beforehand.

June 2021

I'm actually familiar with your (excellent) work. I remember reading your work on Gazprom a few years ago. We even bought Gazprom back then for ourselves and also to some clients. We are holding tight to those stocks, it's still probably the cheapest large-cap stock in the world. So, thank you for that!

Manuel P.

June 2021

It looks like Gazprom is finally going up. Another one I will continue accumulating because it is still dirt cheap.

Vanes N.

June 2021

I've subscribed a while ago and plan to resubscribe soon, but a few of your tips have netted me quite a decent sum, especially good old Gazprom. 🙂

Steve P.

May 2021

Great email today on Gazprom, couldn't agree more on its bright future! In addition to everything else they have going on, I think their Amur plants helium production could be another massive boost that is currently not priced into its business once it comes online. The infrastructure Gazprom is currently building is just of phenomenal scale! Thankfully Russia's quick actions were able to avert the plans for a war in the Donbass - though it means the expected 'Russia is evil' crash of Russia's stocks I was expecting won't eventuate yet.

David S.

April 2021

It is really great that you were right on point with the Porsche AG and Gazprom shares!

Marko H.

February 2021

Regardless of whether it's Twitter, Porsche, Gazprom or (company name hidden by Undervalued-Shares.com), your reports are really great and regularly get me in front of the wave.

Michal B.

February 2021

Thanks for the recent updates, especial on Gazprom my first and so far most succesful investement.

Aaron W.

January 2021

And thanks again for all your great investigative-style analyses. I've been riding with you on (company name hidden by Undervalued-Shares.com) and Gazprom too – I missed the first Gazprom window (though that's how I found you) but bought a bit in early Q4. I also took a small (company name hidden by Undervalued-Shares.com) stake in 2019, then your insights and corroboration on it through the crisis helped me meaningfully increase the position near the lows last year. So thank you!!

Wulf S.

January 2021

I’m always happy to get news from Undervalued Shares, because it always opens up new horizons. It's not like I jump on it every time and buy straight away (e.g. not (company name hidden by Undervalued-Shares.com)), but things like (company name hidden by Undervalued-Shares.com), Gazprom, Twitter or Just Eat are also mega-interesting from a content point of view and of course convey a depth of information that one would normally never get without very deep research. Keep it up!

Matthias R.

November 2020

I opened a small position for Gazprom when it was lower than you initial analysis and are up 3 times more than your newsletter costs yearly.

Anders B. I.

October 2020

Saw you first when you analyzed gazprom with Sven Carlin - liked it alot. After being value investing for 3 years, Swen Lorenz is one of my go-to private investment analysers.

Shounak

September 2020

I really enjoyed your report on Gazprom. I thought it was inspired.

Silvano A.

May 2020

I have read your report on Gazprom with interest. There are indeed interesting ideas.

Chris P.

April 2020

I especially enjoyed your reports on Porsche Automobile Holding SE, Gazprom and (company name hidden by Undervalued-Shares.com).

Sebastian G.

April 2020

I've already had Gazprom in my portfolio and will continue to buy. However, I've only just come across IAG and Porsche because of your work and would like to thank you for it.

Thomas T.

March 2020

So far, I've implemented four of your investment ideas myself. I have since sold Gazprom and (company name hidden by Undervalued-Shares.com). Those were great trades!

Report updates

Not a Member yet? Sign up for a Membership.

Already a Member? Log into your account to download the report updates.

12 September 2022

Report Update (PDF - 0.1MB)

18 July 2022

Report Update (PDF - 0.6MB)

12 May 2022

Report Update (PDF - 0.2MB)

13 April 2022

Report Update (PDF - 1.2MB)

1 March 2022

Report Update (PDF - 0.3MB)

4 November 2021

Report Update (PDF - 0.2MB)

3 September 2021

Report Update (PDF - 0.7MB)

20 July 2021

Report Update (PDF - 0.2MB)

17 May 2021

Report Update (PDF - 1.3MB)

16 February 2021

Report Update (PDF - 0.9MB)

15 February 2021

Report Update (PDF - 1.1MB)

Get my best investment ideas each year

Join my global audience (Members from over 80 countries!) for hard-hitting investment research that you won’t find anywhere else.

Unlimited access to in-depth investment reports and regular updates - for just USD 49/year, or USD 999/lifetime.

FIRST TIME HERE?

LET'S WORK TOGETHER

Copyright 2021 - Undervalued Shares. All rights reserved. | Privacy Policy | Cookies | Terms & Conditions