Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Israel gas report

(Full access for Members only)

Israel gas report

2 April 2019

What readers said about this report

The gas reserves discovered in the "Levant Basin" have started to redraw the political map of the Middle East, and they may even become relevant for energy supplies in Western Europe. If you don't know about any of this (and hardly anyone does!), this 104-page report will provide you with all the background information and source material.

Israel as a hydrocarbon superpower

The country of 9m has long been hyper-successful economically, but it was entirely reliant on foreign energy. Following the gas discoveries, Israel is now switching to: i) Virtually complete energy independence; ii) 70% of all power provided by clean, cheap gas by 2020, when previously 70% of all energy was produced burning imported, expensive and dirty coal; iii) Generating billions of dollars from energy exports, and even creating a Sovereign Wealth Fund. Between now and 2030, the domestic gas market of Israel is projected to grow at a staggering 11.4% p.a., compared to the global gas market growing just 1.6% p.a.

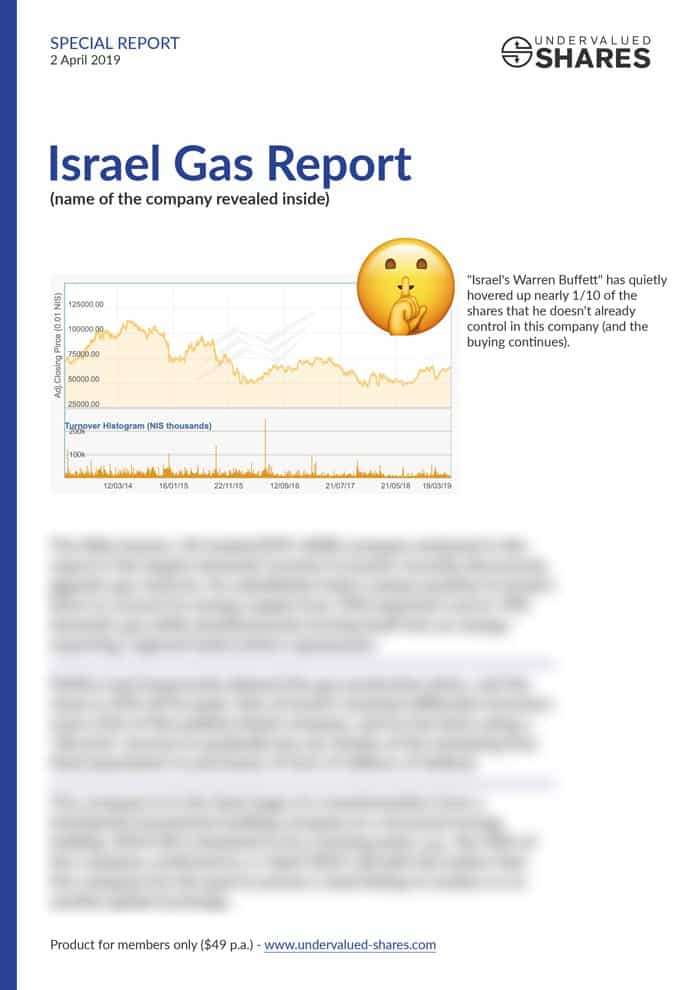

"Israel's Warren Buffett" is hovering up shares

The one company that is at the heart of the entire Israeli gas opportunity is majority-owned by one of Israel's most successful long-term investors with a $4bn fortune. Using a process that makes it less obvious what is happening, he has been hovering up additional shares in the open market – worth tens of millions of dollars. Evidently, he believes they are a good investment at the current level.

A dual listing in London?

Shares of this Tel Aviv-listed company are already traded as OTC-ADRs in New York, Frankfurt, and Berlin – making it easy to trade for those who know about this opportunity. However, the company lacks exposure and currently does not have a single significant disclosed shareholder besides its billionaire majority owner. In a 1 April 2019 conference call with the author of this report, the company's CEO confirmed that it is the goal to list the share on the London Stock Exchange (or a similar global exchange). This is bound go hand-in-hand with changes to its dismal investor relations and/or a global roadshow. Also, a global bond issue beckons, which could help to turbo-charge the company's dividend policy. To my knowledge, no other investment service has connected these dots yet.

Buying at the same price as "Israel's Warren Buffett"

Private equity companies, start-ups, and brokers regularly want to sell shares to you at a multiple of what they paid for their own stake. Here is an opportunity to buy shares at the same price at which the major shareholder – a mega-successful investor – is comfortable buying more shares. This is an investment opportunity exclusively researched in such detail by Undervalued-Shares.com.

Not a Member yet? Sign up for a Membership - just USD 49/year.

Already a Member? Log into your account to download the report.

Israel

Get an understanding of the actual investment prospects of what has become one of the world's most successful economies. Check my list of "130 fun and amazing facts about Israel and its economy". You'll be surprised!

Domestic gas consumption

Buying into Israel's rapidly-growing domestic gas consumption is possibly one of the smartest ways of gaining a low-risk, high-leverage exposure to Israel's macro-economic growth story.

Dividends galore?

During the past ten years, this company has paid out 67% of its current market cap in dividends, even though gas from its biggest field is only starting to flow in 2019! The report analyses why the company is likely to implement an aggressive dividend policy in the years to come.

What readers said about this report

Niels G.

March 2023

Thanks for this great call! I love reading your reports (and blog).

Jakob H.

April 2021

Thank you again for yet another interesting analysis that you present to us. I like the fact that you look for undervalued stocks that is also related to long term trends and is therefore also likely to be long term compounders. I am now invested in (company name hidden by Undervalued-Shares.com), (company name hidden by Undervalued-Shares.com), JET, (company name hidden by Undervalued-Shares.com), (company name hidden by Undervalued-Shares.com) and (company name hidden by Undervalued-Shares.com). So you definitely have had an impact on my portfolio for the last year or so. I view your reports as inspiration for a modern Munger-like investing approach.

Based on the stories on Poland growth story i also invested in Mo-bruk (Polish) in the ESG area, as i believe that the increased wealth will result in a continued improvement of ESG in generel terms.

Mathias S.

January 2021

I’ve just read your report about (company name hidden by Undervalued-Shares.com). First of all thank you for your great work.

Zeljko O..

March 2020

I think the (company name hidden by Undervalued-Shares.com) thesis was sound; special situation, off the beaten path, variant perception, owner with great investing track record, aligned incentives, insider buying, cheapish valuation. That's the type of investments I get excited about and why I'm subscribed to your service.

Frank T.

January 2020

I wanted to thank you….(company name hidden by Undervalued-Shares.com) had a great start 🙂

Ayoade E.

October 2019

Thank you for your very informative analysis of (company name hidden by Undervalued-Shares.com) and the subsequent update.

Zeljko O.

September 2019

The (company name hidden by Undervalued-Shares.com) story is very interesting and promising.

Rüdiger S.

July 2019

Following your investment ideas, I actually got into (company name hidden by Undervalued-Shares.com) with a few thousand euros, because dividends appeal to me, I rarely sell and only invest long term. In addition - and not just for dividend reasons - I have long been a fan of oil and gas producers and (besides Gazprom) long RDS.B, BP.PLC (after Macando) and MRO. So it was easy for me to decide in favour of (company name hidden by Undervalued-Shares.com) ADR.

Simon W.

May 2019

Came across your website today. Have already read your report on “Israel Gas”. Very insightful, I must say. Thank you very much indeed!

Report updates

Not a Member yet? Sign up for a Membership.

Already a Member? Log into your account to download the report updates.

31 January 2022

Report Update (PDF - 1.1MB)

5 July 2021

Report Update (PDF - 0.7MB)

29 January 2021

Report Update (PDF - 0.1MB)

1 December 2020

Report Update (PDF - 0.5MB)

28 July 2020

Report Update (PDF - 0.2MB)

5 June 2020

Report Update (PDF - 0.2MB)

1 May 2020

Report Update (PDF - 0.1MB)

17 April 2020

Report Update (PDF - 0.5MB)

27 March 2020

Report Update (PDF - 0.1MB)

12 March 2020

Report Update (PDF - 0.2MB)

23 August 2019

Report Update (PDF - 2.3MB)