The next Argentinean crisis investing opportunity

(Full access for Lifetime Members only)

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

The next Argentinean crisis investing opportunity

29 May 2021

What readers said about this report

Pampa Energía is "crisis-tested": so far, each time crisis hit Argentina, the company has emerged bigger, stronger, and more profitable. Very importantly, it has plenty of cash in the bank. Bankruptcy is not a risk, nor is there a risk of nationalisation.

Some of the most experienced players have identified Pampa Energía as one of the best prospects for profiting from Argentina's latest economic crisis. Insiders have been buying up as many shares as they can get hold of. Also, a major, foreign player has been deploying money into Pampa Energía – but it takes a bit of investigative skill to uncover.

Right now, you can buy the stock at the same price as insiders have been willing to pay. It is traded on multiple exchanges, and there is no need for a broker who can trade in Buenos Aires.

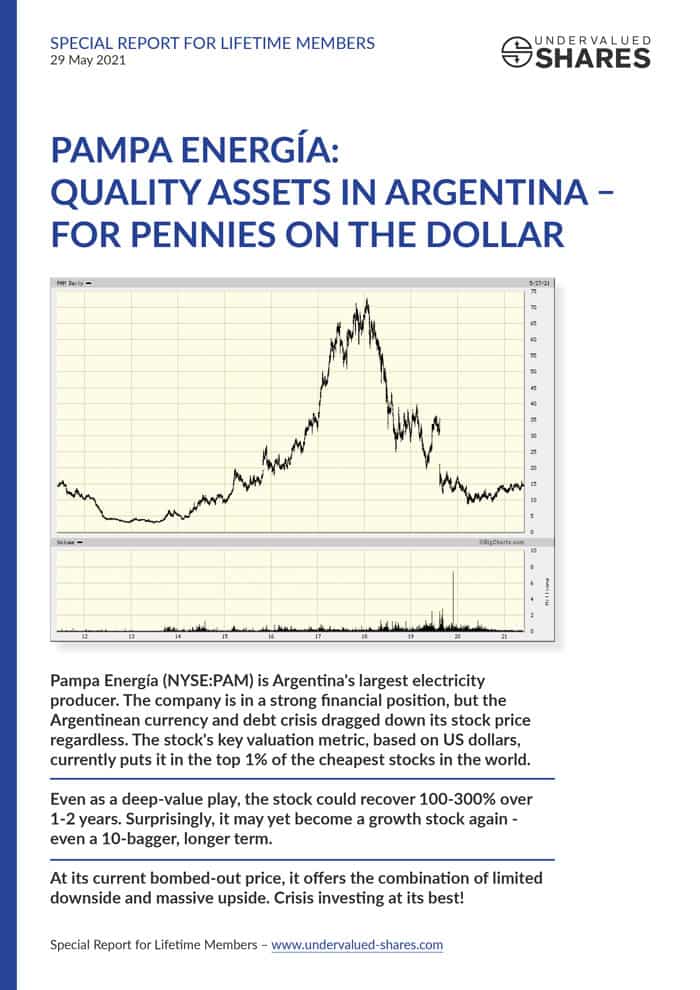

At its current bombed-out price, Pampa Energía stock offers the combination of limited downside and massive upside.

Crisis investing at its best!

There is one catch, though.

This investment has a limited capacity. There is a bit of competition for the available stock.

This opportunity is therefore exclusively available to Undervalued-Shares.com Lifetime Members.

Not a Lifetime Member yet? Sign up for a Membership - just USD 999/one-off.

Already a Lifetime Member? Log into your account to download the report.

What readers said about this report

David W.

December 2024

Thanks again for this one.

Ákos V.

September 2024

When I started to make myself familiar with your work, Pampa was one of those I saved myself to follow. Naturally never will forgive myself to not have any real position in that at that time....

Luis M. S. H.

June 2021

I've just finished reading your articles. Superb work! Loved them.

I couldn't agree more with all of it. It was like reading my own thoughts but it in clear, well-written English.

It's comforting to read a fellow analyst from another part of the world validating an investment thesis. You see, I've been pretty much alone here buying Argentinian stocks during 2020. Very few in our 50,000+ member Club wanted to buy local stocks at these prices... but I guess that's exactly what shows the market has hit rock bottom. It's all part of the market cycle, the end of a bear market. Everybody wanted stocks in 2018 at x10 current prices, but nobody wants them now (I was relieved to see, though, that when the time came we all subscribed to Cresud and IRSA's capital increase…).

Mike S.

June 2021

I actually bought some PAM as well after reading your report so thank you again for forwarding!

Sebastian G.

June 2021

I also find Pampa Energía very exciting. Some readers seem to be unable to control themselves, though, and buy straight away 😄👍🏻.

Luis M. S. H.

June 2021

I think you chose the best stocks in town. CRESY, IRS, IRCP and PAM explain about 60% of my local portfolio, maybe a little more.

Markus W.

May 2021

Very interesting report. By way of our mutual friend Kuppy I’ve come across the nice bon mot "Argentina is the place where capital goes to die." But let's hope there are exceptions.

Rodolfo S.

May 2021

I'm glad you analysed the PAMPA share. Well done!!!

Report updates

Not a Member yet? Sign up for a Membership.

Already a Member? Log into your account to download the report updates.

13 July 2022

Report Update (PDF - 0.8MB)

17 March 2022

Report Update (PDF - 0.5MB)

30 August 2021

Report Update (PDF - 0.1MB)