Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Turning crisis into opportunity

(Full access for Members only)

Turning crisis into opportunity

3 August 2022

The stock featured in this report has started to creep up ever since things got really bad.

It's currently one of the few stocks that trades above its 200-day average and close to its 52-week high. Such relative strength is always worth taking note of, since it's usually a sign that more gains are to come.

The company in question has a fairly unique investment thesis. It's about time someone spells out its unique story in a no-holds-barred research report.

You'll learn about a stock that:

- Is trading at its 1999 level, but could have a decade of growth ahead.

- Is bolstered by massive buy-backs (up to 33% of the share capital by 2026).

- Has a truly outstanding management team.

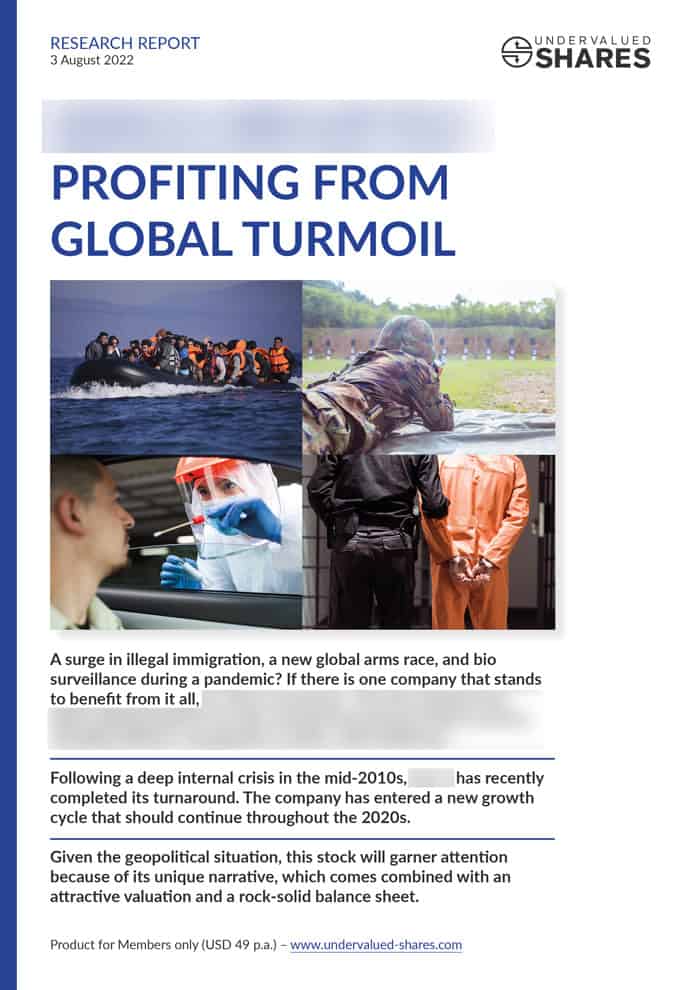

This company has growth opportunities not despite the difficulties that the world is experiencing, but because of them.

Not a Member yet? Sign up for a Membership - just USD 49/year.

Already a Member? Log into your account to download the report.

Report updates

Not a Member yet? Sign up for a Membership.

Already a Member? Log into your account to download the report updates.

13 September 2022

Report Update (PDF - 0.6MB)

8 August 2022

Report Update (PDF - 2.2MB)