UK real estate stocks are trading at historically low multiples. Will they ever shake off the current doom and gloom?

The Channel Islands’ hidden investment gems

In 2020, I reported about the little-known stock exchange of the Channel Islands.

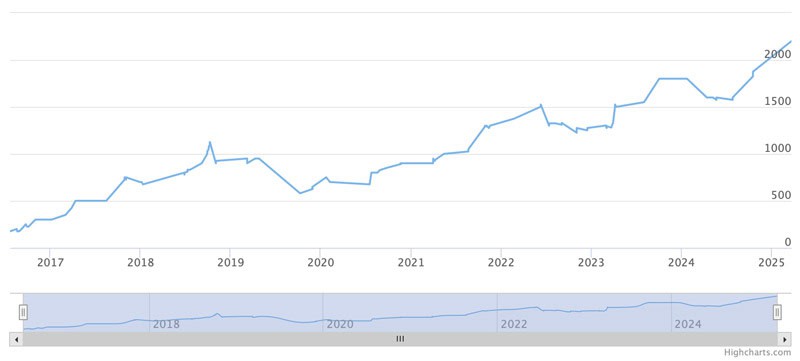

Itself a listed company, its stock was trading at 750 pence.

Last month, an American firm made a takeover offer of 2,250 pence.

This stock combined a ridiculously low valuation with a high-potential business. Think buying a high-growth fintech company with a quasi-monopoly and single-digit multiples – and that's before even mentioning the cash reserves. It was only a matter of time before someone was going to discover it.

Are there other hidden gems waiting to be discovered?

Famous (and less famous) islands

Even Brits are not always familiar with the special group of islands on their doorstep, often mixing up the the Channel Islands with the Isle of Man (in the Irish Sea) or the Isle of Wight (part of the United Kingdom).

The Channel Islands are located between the UK and France and consist of Jersey, Guernsey, Alderney, and Sark. Somewhat counter-intuitively, Channel Islands is a geographical term rather than the name of the jurisdiction. Guernsey/Alderney, Jersey and Sark are each a jurisdiction of their own. They govern themselves through their local parliaments – though even that is not an entirely accurate statement, and just about everything about the Channel Islands tends to be a bit too complicated to explain it in just a few words.

In any case, they are so-called Crown Dependencies. They are not part of the United Kingdom, and they have never been part of the European Union. Instead, they belong to the English Crown. What this means in real life is that there is a complex set of relationships between the Channel Islands, the Crown, and the United Kingdom.

In short, these islands are largely doing their own thing.

I wrote about them repeatedly already:

- "The (not so) secret Channel Islands Stock Exchange" (January 2020)

- "'The International Stock Exchange' is about to take off – catch it while you can" (April 2021)

- "The Great Escape: investing in Guernsey" (July 2021)

- "Sark: investment opportunity of a decade" (August 2020)

- "Sark – bidding for the Barclay estate and going public" (November 2023)

- "Sark – it's not a big deal" (November 2024)

These writings mostly covered Guernsey and Sark (the island where I reside).

To keep things fresh, today's article includes Jersey as well.

Jersey – an island transformed

Of the four main Channel Islands, Jersey is the best known, by far.

However, the most widely held belief about the island is wrong. It's that Jersey is a "tax haven" of the kind where shady characters would hide their money using numbered accounts or shell companies.

It is true that all the Channel Islands (including Jersey) have been low-tax jurisdictions since the 13th century.

However, the origin of Jersey's finance industry was never primarily in facilitating tax evasion. Instead, the island devised ways for investors to legitimately use it in order to avoid taxes and safeguard assets. While abuse did take place, MONEYVAL in 2024 confirmed that Jersey's effectiveness in preventing financial crime was among the highest level across jurisdictions evaluated around the world. The Financial Times has – quite rightly – switched from calling Jersey a "tax haven" to a "low-tax offshore centre".

The detailed history of all this is now available for the first time: "The History of Jersey as an International Finance Centre", authored by the late Colin Powell, was published posthumously in 2023. Powell had spent over five decades developing and guiding the island's financial industry.

His book lays out how in the 1960s, Jersey was still an island dominated by tourism (52% of the local economy) and agriculture (10%), with banking just in third spot (9%). In 1986, the finance industry overtook the tourism industry. Today, it's finance that rules the island's economy (37%), with tourism (5%) and agriculture (1%) being shadows of their former glory.

For better or worse, in the space of a few decades, Jersey's island economy has been entirely transformed.

Thanks to a deeply ingrained culture of small government, Jersey has long offered low tax rates, which attracted many new, often wealthy residents. They needed financial services, and wealthy investors from abroad also started to recognise the advantages of placing their assets in a politically stable and reliable jurisdiction. The 5,000 Jersey residents employed in the island's trust sector are currently safekeeping over GBP 1,000bn (USD 1,200bn) in private wealth for clients from the UK, Europe, the Middle East, Asia, and Africa. You could say that Jersey is a British variant of Switzerland and Liechtenstein.

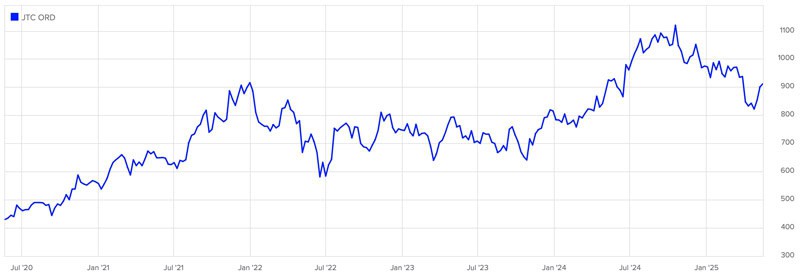

One company that successfully operates in Jersey's finance sector had already made an appearance in a January 2020 Weekly Dispatch: JTC (ISIN JE00BF4X3P53, UK:JTC). The financial services company has over GBP 400bn of assets under administration and now operates a global network of offices while remaining headquartered in Jersey. The stock has since risen from 429 pence to 880 pence, giving the company a market cap of GBP 1.5bn. JTC is a good bet for anyone looking for a proxy that allows them to buy into Jersey's finance industry. Listed in London, its stock is easily accessible and liquid enough for private investors. Looking at the state of geopolitics and the growing demand for safekeeping assets in stable, reliable jurisdictions, it's not difficult to imagine the stock doing well over the next five years, too.

JTC.

Small-cap aficionados might be interested in two other companies that deserve to be called Jersey native.

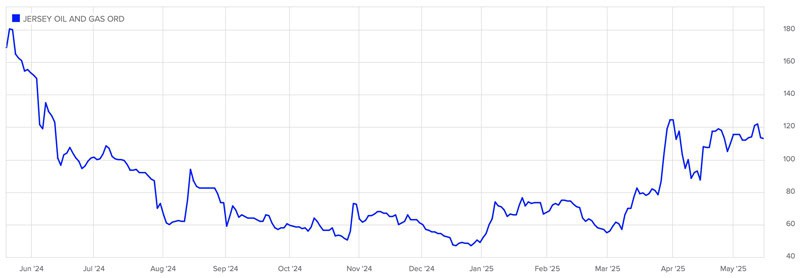

Jersey Oil & Gas (ISIN GB00BYN5YK77, UK:JOG) owns a minority stake in an oil field in the North Sea, called the Greater Buchan Area. Like many other British oil and gas companies, it saw its share price collapse 80% in 2023/24. It has doubled over the past months, despite the significant fall of the oil price. The company only has a market cap of GBP 37m, and the stock is extremely cheap relative to its projected cash flow – something that is spelled out in more details in the company's investor relations material. There is speculation that some larger UK players will want to gobble up Jersey Oil & Gas to make faster use of their large tax losses.

Jersey Oil & Gas.

Jersey Electricity (ISIN JE00B43SP147, UK:JEL) is the island's energy provider and 62% government-owned. The stock is currently trading at 11x the last reported annual earnings per share, and the ordinary stock has a dividend of over 5%. The company also has two categories of preference shares outstanding. Of the 600 shareholders that are known to be invested in the GBP 53m company, the vast majority hail from Jersey. It's an investment for local patriots, first and foremost. It's unlikely that the stock will ever garner much investor interest outside of Jersey.

On the sexier (or riskier) side of things are two cash shells that are based out of Jersey.

Bay Capital (ISIN JE00BKVHVW88, UK:BAY) has been looking for an acquisition target since listing as a blind pool-type shell in 2021. The company had GBP 4.7m of cash at year-end 2024, which roughly equates to its current market cap. These types of shares see a rally whenever there is speculation that a juicy acquisition target has been identified. E.g., at year-end 2024, the stock soared from 4 pence to 10 pence. Following its listing it had traded as high as 26 pence. It's now back at 6 pence, and the company is burning through GBP 1.5m of cash every year to sustain its status as listed company. Will it take off? Shell companies do occasionally produce outstanding speculative run-ups.

Bay Capital.

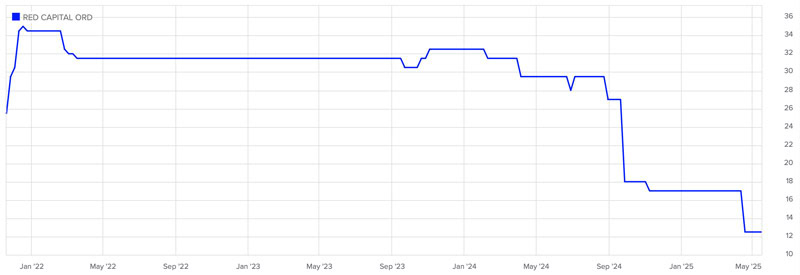

Red Capital (ISIN JE00BLB56J12, UK:REDC) also listed in 2021. The company has negligible remaining cash and a market cap of just GBP 1.25m. It could find an acquisition target, or raise more cash, or capitulate and delist. Based on the low market cap and the collapsed share price, the stock market does not currently seem to have much confidence that the company will succeed with an acquisition. Then again, you never know.

Red Capital.

For an island economy with just 120,000 residents, Jersey comprises a large number of listed companies: around 40 stocks. Many of these companies only have a small rep office on the island while running their actual operation from elsewhere (such as private equity giant CVC Capital (ISIN JE00BRX98089, Euronext:CVC), which is Jersey-registered but has its operative headquarter in Luxembourg and its main listing on Euronext). Companies often choose a place like Jersey for their registration, which is perfectly legal provided they evidence a certain amount of so-called "substance", such as holding directors meetings on the island. CVC Capital's co-founder and former chairman Donald Mackenzie also resides on Jersey, where he probably enjoys hanging out with other entrepreneurs of his type.

Source: ITV, 17 May 2024.

Large fortunes and semi-retired billionaires are something you also find in….

Guernsey – the underdog island

Guersey is very different from Jersey. Unlike its better-known counterpart which has a large Radisson hotel by the waterfront and an airport served by EasyJet, Guernsey hardly features any international chain operations, and relies on its government-owned national airline, Aurigny. With just 62,000 residents (half the size of Jersey), Guernsey made a conscious decision to retain much of its original character.

Guernsey's success in finance started when so-called merchant banks flocked to the island. These banks weren't set up to handle payments but provided finance to industry and commerce. At one point, over 30 merchant banks operated out Guernsey, as described in "A Historical Look at Guernsey and the Bailiwick", a little-known book published by G. H. Mahy in the late 1970s.

Much of the equity of this booming sector was provided by rich tax exiles who had made Guernsey their home to benefit from lower tax rates. Like Jersey, Guernsey was never really focused on providing numbered accounts or brass plate companies. Instead, the island's long-standing preference for small government simply made for lower tax rates and a business-friendly environment. To this day, a framework exists that requires the government of Guernsey to limit government revenue growth to 28% of GDP (compared to 45% in the UK, 49% in Germany, and 58% in France).

With Jersey as the Channel Islands' higher-profile finance centre, Guernsey always had to make an effort to carve out its own niche. It did so in the insurance business, where during the 1990s it became the world's third-largest centre for so-called captive insurance companies. Guernsey also became Europe's leading competence hub for the issuance of corporate bonds. As The Wall Street Journal once described in an extensive feature, in some years up to 40% of the corporate bonds issued in Europe originate from Guernsey. The island has many highly-qualified specialists for this sector, as well as common-sense, pragmatic financial regulations that make the jurisdiction more attractive than EU countries.

Source: The Wall Street Journal, 13 May 2019.

Like Jersey, Guernsey recently received a renewed thumbs-up from MONEYVAL as one of the best, secure and safe jurisdictions in the world for financial services. Clients sometimes complain that Guernsey is stricter with paperwork, but it pays off in the form of a so-called OECD White Listing. Anyone keeping money in Guernsey will never have issues doing business with other jurisdictions – something that clients of current or previously grey-listed jurisdictions – such as Dubai, Malta, or Cyprus – will have first-hand experience with. Keeping things extra-clean has made Guernsey's financial industry the success that it is, and there is a strong local culture of keeping it just like that.

At the centre of this thriving business with corporate bonds sits The International Stock Exchange Group (ISIN GG00BYYLRY96, TISE:TISE), formerly known as The Channel Islands Stock Exchange. Most of its over 4,000 (!) listed securities are corporate bonds which are listed on the low-cost "Recognised Stock Exchange" (a special type of legal status). A listing on such an exchange ticks a box that many institutional investors like to see before subscribing to a bond issue. TISE's new American owner is Miami International Holdings, a little-known but fast-growing holding company for financial marketplaces. MIH may well turn TISE into even more of a hub for finance business, potentially bringing entirely new business to Guernsey, as hinted at by the press release announcing the takeover.

The International Stock Exchange Group.

New business is needed in Guernsey. The finance sector makes up half of the island's economy, but this contains a fair few areas that may be under threat from AI. Indeed, the island's recent economic performance is rather mixed, and there is need for action. Guernsey's population is frustrated by the worst housing crisis since the end of the Second World War, a lack of infrastructure investments, a growing societal divide, and the potential introduction of new taxes such as a General Sales Tax. The island's election in June 2025 will be a heavily contested one.

Source: Guernsey Press, 8 May 2025.

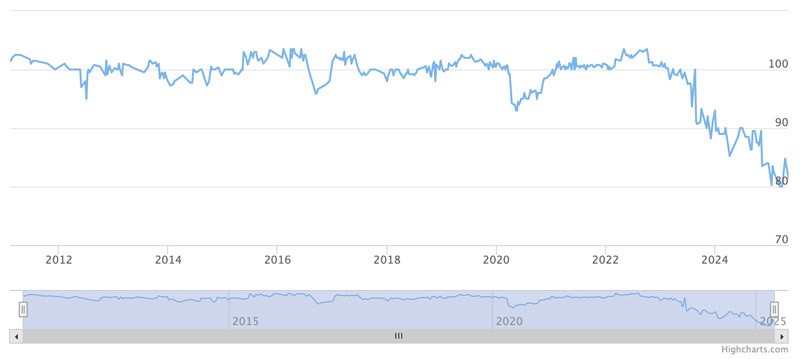

If Guernsey managed to navigate its way through these challenges, it could become one of the world's most outstanding places. For now, though, its society seems unusually divided and downbeat. It shows in the share price of the Channel Islands Property Fund (ISIN GG00B62DS151, TISE:CIP), arguably THE listed entity to get exposure to the future fate of Guernsey. Since I first mentioned the company in 2020, the stock has lost 20% of its value. While Guernsey's real estate market should be booming (at least as far as its "Open Market" properties for wealthy tax exiles are concerned), property prices have been trending south of late. This is also influenced by prices cooling off after the pandemic, when Guernsey closed its borders to live without restrictions and saw an influx of lockdown exiles as a result.

Guernsey's GDP per capita is still about 30% higher than that of the UK, which comes combined with a decades-long track record of keeping unemployment at almost zero. However, the degree to which Guernsey's economic engine has been stuttering lately is notable. The island's economy has grown a paltry 10% over the past decade, meaning Guernsey basically stagnates at a very high level. Within that is an increasing societal divide where those in finance earn over twice that of other sectors. The cost of a house has risen from 4x the average annual income in 1980 to 16x in 2023, and local companies struggle to grow as they cannot find housing for new staff. A local charity recently made local headlines when it suggested that sleeping pods had to be set up for homeless people – a matter previously unheard of in Guernsey. Some wonder whether Guernsey's success story is over for now and will be followed by a slow but ongoing decline.

Channel Islands Property Fund.

The property fund aside, Guernsey has very few homegrown companies listed on TISE:

- Pyne Gould Corporation (ISIN GG00BH47QH40, TISE:PGCL) was founded as a station business in New Zealand in the 1850s, but is now a Guernsey-based company that operates a wealth management business focused predominantly on investments in Australia, New Zealand, and the United Kingdom. Incredibly, it appears that the stock last had a trade take place in 2020!

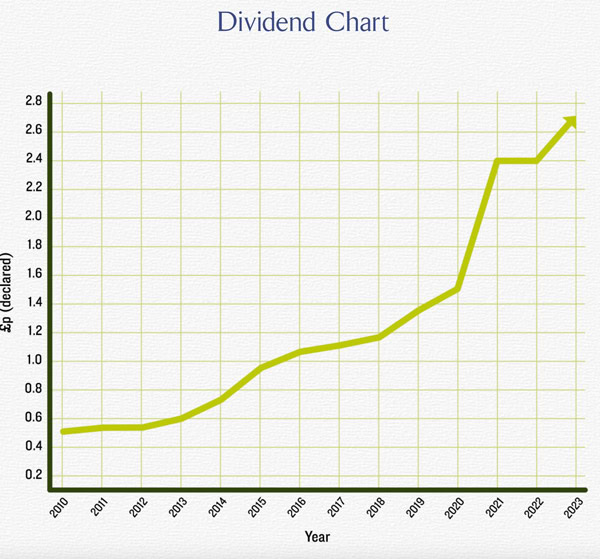

- Blue Diamond (private market segment of TISE) was originally founded in Guernsey in 1904 as the Fruit Export Company, and now operates 44 garden centres across the British Isles with more than 4,000 employees and annual revenues of around GBP 350m. The company has over 420 private shareholders, with 75% based in Guernsey. It listed in TISE's new Private Market segment, an OTC-style market. This may sound like a boring company, but it has achieved a very solid performance over the last ten years.

Source: Blue Diamond.

Unlike some of the examples from Jersey, Guernsey's homegrown companies tend to be less interesting for anyone but patriotic local investors. Besides, barely anyone from the outside world can actually trade on TISE. As yet, anything listed on TISE remains tise-eously difficult to access (pun intended!). This is something I am hoping the Americans will take care of.

Last but not least, just like Jersey, where Guernsey does stand out are the number of companies listed elsewhere that have their legal domicile on the island. According to Finchat, 31 such companies fall into that category, including Burford Capital (ISIN GG00BMGYLN96, UK:BUR). The Guernsey angle of these companies is almost irrelevant for investors, though – it's just a quirky footnote in their annual report.

Investing, residing – or visiting?

For now, it appears that Jersey will continue to outshine Guernsey in the finance sector. There are some local investments, but it's really only the Channel Islands Property Fund that I personally find interesting enough to follow.

It'll be interesting to watch, though, what the takeover of TISE by MIH and the upcoming Guernsey elections yield.

Given the staggering number of readers who ask me about safe havens for assets or places to take up residence, it seemed that another review of the Channel Islands was in order.

If today's Weekly Dispatch got you interested, do consider a visit – or the upcoming event for Undervalued-Shares.com readers in Sark, which I will host from 25-28 September 2025. Watch this space to find out more!

P/E of 2.5 and >20% dividend yield with this coal stock

Looking for a deeply contrarian, deep value investment with high payouts and buybacks?

The latest Undervalued Shares research report has one such stock in store for you. It's a coal stock, and it's currently trading at a bargain price.

In fact, it's the second time this stock is trading at such low valuation multiples. It was similarly cheap in 2021 and then soared by 15x.

It's unlikely that you'll see this stock do 15x again, but it should be a relatively low-risk 2-3x when the situation normalises – and you'll get plenty of dividends while you wait.

P/E of 2.5 and >20% dividend yield with this coal stock

Looking for a deeply contrarian, deep value investment with high payouts and buybacks?

The latest Undervalued Shares research report has one such stock in store for you. It's a coal stock, and it's currently trading at a bargain price.

In fact, it's the second time this stock is trading at such low valuation multiples. It was similarly cheap in 2021 and then soared by 15x.

It's unlikely that you'll see this stock do 15x again, but it should be a relatively low-risk 2-3x when the situation normalises – and you'll get plenty of dividends while you wait.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: