Britain offers many unloved, undervalued stocks. Opportunities come from takeover candidates, changing politics, and special situations.

Liechtenstein banks as EU crisis winners?

The tiny Principality of Liechtenstein is an oasis of stability.

It's one of the few countries in the world without debt, crime, unemployment, and political insanity.

Unlike Switzerland, Liechtenstein's financial services companies have easy access to EU markets.

Two of its banks are publicly listed on the Zurich stock exchange.

A research trip down south

Switzerland is one of my favourite countries.

I recently visited Zurich, where I had dinner with a dozen Undervalued-Shares.com Lifetime Members.

I set out to Liechtenstein the following day, which is 1.5h away if you take the efficient Swiss railway and bus system. The train ride gives you a picture-perfect experience of travelling along lakes, mountains, and luscious green pasture land.

Blink, and you may have missed it. The Principality is tiny, with a landmass of just 160 square kilometres (62 square miles) and a population barely surpassing 40,000. Still, I have several Lifetime Members there and met with a few, including two who travelled from Munich and Stuttgart. One even brought a lovely bottle of local whisky!

Needless to say, whiskey is not what the microstate would be famous for.

It's the banks that matter, and the unique services they offer.

So is Liechtenstein a place where the rich hide money?

If that's your understanding of the world, think again. Just like other jurisdictions formerly called "tax havens", Liechtenstein had to adapt to changing times and reinvent its business model.

Adapting to the 2020s

In the olden days, you could carry wads (or suitcases) of cash to Liechtenstein, Switzerland or other tax havens and hide them there.

Unless you spilled the beans yourself, no one would ever know.

However, the era of bank secrecy, numbered accounts, and anonymous shell corporations began to fade during the 2000s, as international organisations like the OECD started to push for so-called tax transparency.

Since 2010, a global system of sharing tax information has been gradually put in place. While some countries adopted the new system faster than others, it's now firmly established almost everywhere.

If you hold an account (or other investments) outside your home country, banks and financial services providers where they're held will report this information to your home country. They can do so because anyone opening an account abroad has to provide tax numbers and other personal data.

For decades, Liechtenstein (and Switzerland) had made a very comfortable living out of providing discrete banking services. During the 1990s, Liechtenstein banks charged 1% of the cash paid in by customers. A German who carried 200,000 deutschmarks in handy 1,000 mark notes to Liechtenstein would have paid 2,000 deutschmarks in fees purely for the bank to process the deposit.

Since the dawn of global tax transparency, Liechtenstein banks have had to change their USP and find new reasons to justify their comparatively high fees.

Unsurprisingly, since 2013 the number of banks operating in Liechtenstein has dropped from 15 to eleven. While banking consolidation is global, it's clear that the country's financial sector has had to realign.

Today, three of the eleven banks in Liechtenstein hold about 90% of the market share combined.

Two are listed on the Swiss stock exchange, and both worth a closer look.

Liechtensteinische Landesbank (LLB)

Liechtenstein's largest bank (by far) is LGT, formerly called The Liechtenstein Global Trust, with a market share of around 60%. It is entirely owned by the ruling family and has over CHF 350bn (USD 420bn) in client assets.

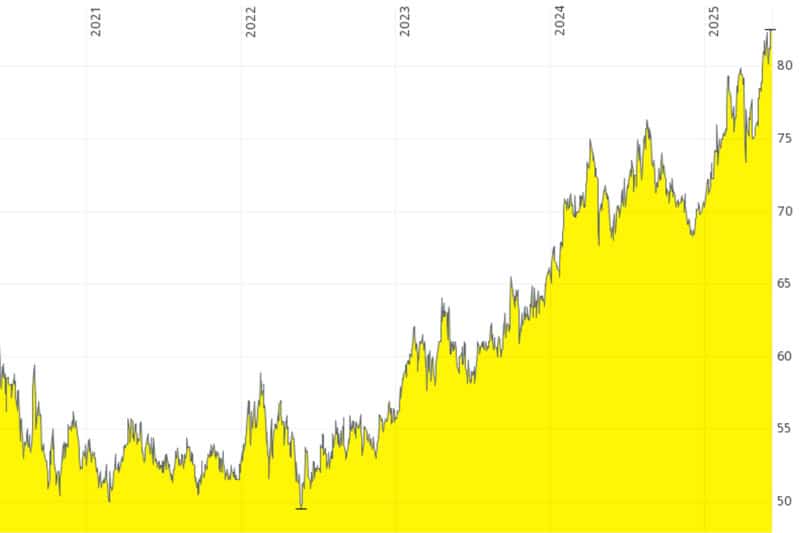

The second-largest bank is Liechtensteinische Landesbank (ISIN LI0355147575, SIX:LLB), commonly referred to as LLB. It has a market share of just under 20%, and its stock has been doing quite well of late.

Liechtensteinische Landesbank.

Over the past three years, LLB stock is up 60%. With a market cap of CHF 2.3bn (USD 2.8bn), this is a bigger bank than you'd expect to come out of a tiny jurisdiction.

How did LLB manage to thrive while losing its USP?

The truth is that there are many reasons to bank in Liechtenstein:

- Wealth storage in a politically and economically stable jurisdiction.

- Fast, flexible local service for setting up trusts, holding companies, and similar services.

- Personalised service (no outsourcing to call centres in India).

- Access to innovative financial products, e.g. crypto.

In the late 2010s, LLB started to carve out its own niche.

It turned itself into the Liechtenstein bank that is more easily accessible for clients in certain countries of the European Union (EU). LLB expanded into Austria, acquiring three banks and now earning 20% of its business from Austrian clients. Given the deep historical ties between Liechtenstein's ruling family and Austria, it's a natural fit.

Few outside the finance industry realise that Liechtenstein banks and service providers have privileged access to EU markets through Liechtenstein's membership of the European Economic Area (EEA), a free-trading extension of the EU which also includes Norway and Iceland. The membership sets Liechtenstein apart from Switzerland, where banks do not enjoy this type of access.

As a result, unlike their Swiss counterparts, Liechtenstein-based fund managers can market funds to EU investors via the EU passport system, and wealth managers can freely approach EU clients, because their governance standards align with the EU.

Liechtenstein's banks can now use this to their advantage.

In fact, Liechtenstein's finance industry could see a new boom over the coming years – this time not driven by undeclared cash but by EU citizens looking to keep savings in a jurisdiction that is closely linked to the EU yet shielded from its political risks. Along with Guernsey in the Channel Islands, Liechtenstein is one of the few viable options for EU citizens wanting to diversify wealth without leaving the European continent.

LLB is a well-run business. Its cost-income ratio of 64% is typical for a Liechtenstein bank, and it has proven adept at integrating acquired businesses abroad. Its stock rise over the past three years reflects the markets' confidence in LLB's future amid a changing world.

LLB stock comes with a 2026 p/e of 14 and a 3.2% dividend yield. While in terms of valuation, it's neither here nor there, the bank has a low-risk business with plenty of room to grow, and limited competition in its home country. Rising interest rates could provide further tailwind.

This is a situation that bankers can only dream of at….

VP Bank

Though the third-largest in Liechtenstein, VP Bank is a minnow compared to the top two. It has a 12% market share, while the other eight banks combined share 8%.

Originally known as Verwaltungs- und Privatbank, VP Bank's shareholders have had a rough time. The bank's stock has gone sideways for 15 years, and lost 78% since its peak in 2000. With a market cap under CHF 500m (USD 600m), it barely makes a splash.

VP Bank.

What had happened?

VP Bank is the shrinking violet among Liechtenstein's top three banks. Founded in 1956, when Liechtenstein was mostly agrarian with just two banks, it remains primarily controlled by the late founder's foundation (23%), with two other local foundations holding 10% and 11%. In today's world, such local, long-term ownership is a plus.

With CHF 50bn in client assets. VP Bank is about half the size of LLB but last generated only about 15% of the earnings of its next-largest competitor. It recently had a cost-income ratio of 85%, which it aims to get down to 75%. In banking, scale does count.

On the other hand, despite its shortcomings, VP Bank can afford to pay generous dividends. Based on the expected 2025 dividend of CHF 4 per share, the share has a 4.5% yield.

In November 2024, the bank made its interim CEO permanent. His leadership style suggests no dramatic shifts in the bank's tempo and temperament. This may be reassuring for conservative clients who want VP Bank to stay as dull as possible, but it's not going to turn VP Bank shares into a dynamic investment.

A hidden gem in Europe

Liechtenstein has much that deserves admiration.

In fact, its governance could serve as a model for the rest of the world. Prince Hans-Adam II, its current ruler, is passionate about the state having to serve the people rather than the other way around. His book, "The State in the Third Millenium", available in multiple languages, is arguably one of the best on the subject.

With a ruling family that runs the country like a private enterprise, the Principality will likely continue to thrive, if only quietly.

A cataclysmic event that sees savers fleeing from the EU could turbo-charge Liechtenstein banks, because of their easier accessibility.

In such a scenario, owning LLB stock could be an interesting investment – a combination of a hedge and a growth investment. Meanwhile, expect steady gains – at the unhurried Liechtenstein pace!

It's a fascinating country and a great place to visit. For investors, it's mainly a place for storing money, buying innovative financial services or enjoying outstanding personal service from financial services companies. Beware, though, their fee schedule will be to match!

However, if you are looking to "hide" money from your tax authorities, you are about 20 years late.

Out now: A forgotten leader in European finance – poised for a comeback?

European finance stocks rarely get investors excited – but that's exactly where the opportunity lies.

These stocks may seem dull, but with the right catalyst, they can deliver exceptional returns.

The stock featured in the latest Undervalued Shares report offers one such opportunity.

Once priced at a premium, it is now valued at its lowest multiples since the Great Financial Crisis, despite strong fundamentals.

What's holding it back? A good shake-up – which already seems underway.

Out now: A forgotten leader in European finance – poised for a comeback?

European finance stocks rarely get investors excited – but that's exactly where the opportunity lies.

These stocks may seem dull, but with the right catalyst, they can deliver exceptional returns.

The stock featured in the latest Undervalued Shares report offers one such opportunity.

Once priced at a premium, it is now valued at its lowest multiples since the Great Financial Crisis, despite strong fundamentals.

What's holding it back? A good shake-up – which already seems underway.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: