UK real estate stocks are trading at historically low multiples. Will they ever shake off the current doom and gloom?

3 investment ideas from last night’s reader dinner

Undervalued-Shares.com is well-known for hosting dinners for its readers.

At these gatherings, everyone presents an investment idea informally speaking for a few minutes right from their seat at the table. By splitting the bill equally, each attendee effectively owns a stake in the event, avoiding sales pitches from sponsors. Attendees not only enjoy good food but also make new friends and leave with a basket full of fresh investment ideas to explore.

Below are some of the picks presented at last night's dinner in London, attended by 15 readers.

These summaries reflect how they were presented, without any additional editing or polishing. They are valuable precisely for that reason, and because I'm able to share them with you less than 24h after the event.

Idea #1: Gerresheimer

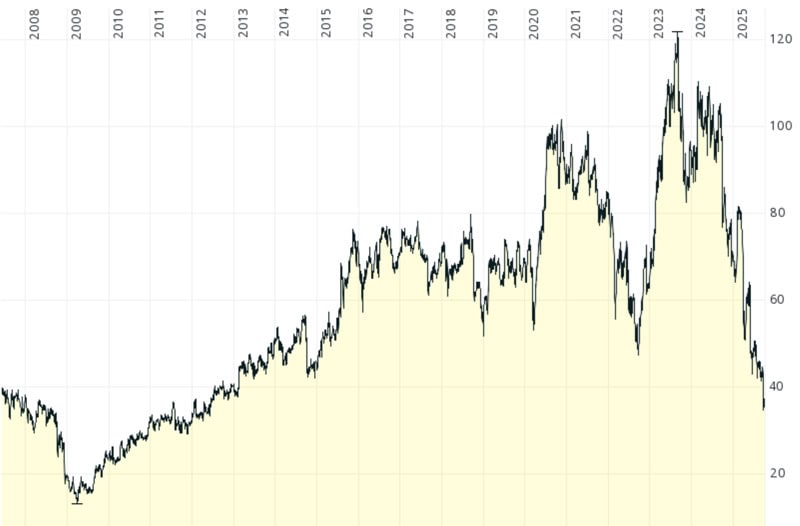

Gerresheimer (ISIN DE000A0LD6E6) is a German medical supplies company specialising in packaging products made from specialty glass and plastics. Its products are primarily used for medication and drug delivery devices.

As the producer of vaccine glass vials, Gerresheimer played a prominent role during the pandemic. In the 2021 financial year, the company was the world's leading manufacturer of such vials, with production volumes reaching around 3.5bn.

Today, Gerresheimer is best known for producing the injection pens used in Ozempic, the popular weight loss drug. While it also owns a plastics and devices division, that segment is smaller and has recently underperformed.

Since its pandemic-era peak, Gerresheimer stock has fallen by 70%. The business generated by the pandemic has slowed down, and shareholders have faced a string of bad news, such as a flooded US plant during Hurricane Helene in September 2024.

In early 2025, private equity firms KKR and Warburg Pincus formed a consortium to buy the company, initially offering nearly EUR 90 per share. However, KKR walked away from the deal in April 2025, when the stock was trading at EUR 80. Warburg Pincus followed in June 2025, when the share price slipped to EUR 50. Today, Gerresheimer trades at just EUR 37.

Gerresheimer.

The bad news for shareholders didn't stop there. Gerresheimer's CFO stepped down, and Germany's financial regulator BaFin launched an investigation into alleged accounting violations. This probe triggered the most recent drop in share price.

It raises some interesting questions. Were Gerresheimer's accounting irregularities leaked by the private equity firms? Could this be part of a wider strategy to re-enter with another bid?

Looking ahead, a potential catalyst looms. On 15 October 2025 – just 12 days from now – Gerresheimer is scheduled to hold an investor day. There is speculation that the company may use the event to announce the sale of its moulded glass business, which includes the glass vial business. Large investors have reportedly been pressuring the company to sell that business, and Gerresheimer's leadership will be desperate to present good news.

Source: Reuters, 5 August 2025.

If this were to happen, it could mark the start of a turnaround narrative for Gerresheimer.

There is no denying that a LOT of bad news is already priced in. With the upcoming investor day, a quick 30% upside is on the cards. A renewed private equity bid is also a very real possibility, if only at a price that won't be quite as high as the one offered earlier in the year.

Idea #2: i-80 Gold Corp.

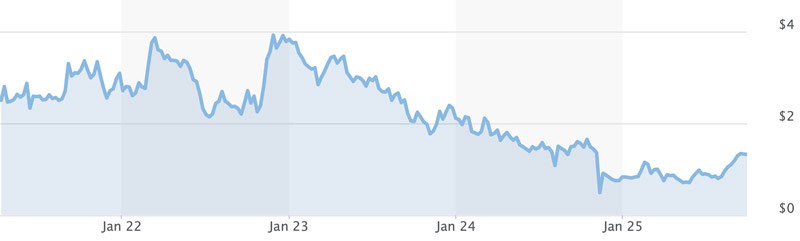

i-80 Gold Corp. (ISIN CA44955L1067, CA:IAU) must be the world's second-worst performing gold mine of the past five years. The company is led by a geologist, and as the old industry joke goes, you must never invest money in a mining venture run by a geologist. Geologists like to spend money on doing fun geology things, and thus consistently run out of money. Because of their cash burn and subsequent dilution, such companies become a default short. Case in point, over the past five years, i-80 Gold Corp.'s share price has fallen from CAD 4 to just CAD 1 – even though the gold price doubled!

i-80 Gold Corp.

In September 2024, i-80 Gold Corp. appointed a new CEO – an accountant, marking a significant change in how the company is run.

The new CEO promptly issued a going concern warning, which caused the share price to drop further. Everyone panicked.

However, change may be coming. With gold projects becoming bankable again and financing more readily available, i-80 Gold Corp. now has a chance to break from its old habits.

The company's new leadership believes it can build a mining operation with 600,000 ounces of annual gold production by 2032. To put that in perspective: gold miners of that scale typically have a market cap of CAD 8-10bn. By contrast, i-80 Gold Corp.'s current market cap is just CAD 1bn.

The company has a ≈CAD 1bn capex programme over the coming years, but about half of that could be internally funded from cash flow over time.

Even factoring in dilution caused by the capex programme and the price paid for comparable mining companies, i-80 Gold Corp. stock could be a 5-6x opportunity over the next few years.

Idea #3: Novo Nordisk

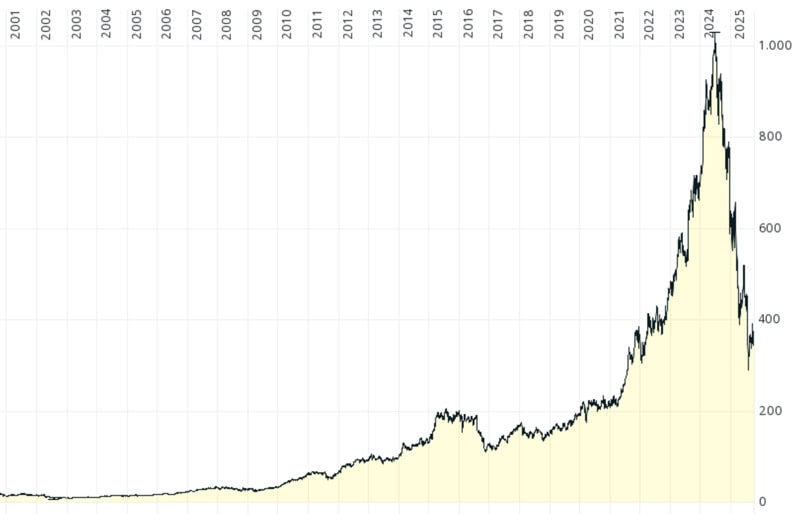

Novo Nordisk (ISIN DK0062498333, DK:NOVO) is one of the core holdings in the portfolio of a London-based Undervalued-Shares.com reader – part of the foundational set of ten stocks. For years, Novo Nordisk operated in a duopoly in the weight loss drug market alongside Eli Lilly and Company (ISIN US5324571083, NYSE:LLY).

Eli Lilly's stock has long benefited from the relentless flow of passive money into US stocks, and it continues to trade near record levels. The share price of Denmark-based Novo Nordisk, on the other hand, has come down from DKK 1,000 to under DKK 400 in just a year.

Novo Nordisk.

Some of the setbacks the Danes have faced over the past year need to be kept in perspective. For example, one of Novo Nordisk's drug trials reported 23% weight loss, slightly below the 25% that had been projected. This caused a huge disappointment and triggered the CEO's departure.

Novo Nordisk went from being Europe's most valuable company and basking in glory, to now having a renewed sense that some of its problems have to be rectified. A significant new trial is underway for CagriSema, the weight loss drug that previously disappointed but which the company is now working to rehabilitate.

Although generic versions of weight loss drugs have recently gained some market share, the global market is still likely to be dominated by branded products. Consumers tend to trust known brands, and major healthcare systems are only beginning to prescribe these drugs more broadly – and when they do, they often stick to established brands to reduce risk. The market has not yet priced in the strong chance that Novo Nordisk and Eli Lilly will once again emerge as a genuine duopoly in the weight loss drug segment.

By most measures, Novo Nordisk is comparable to Eli Lilly – yet it trades at just about one-third the multiples of its leading competitor. Once recent worries begin to fade, Novo Nordisk could reach a comparable valuation, offering 50-100% upside from current levels.

Making such ideas more accessible

The ideas described above are just a small sample of those shared at last night's dinner. Typically, 10-15 such ideas come out of an evening like this – but so far, only the attendees benefit from them.

We've made it a firm rule that all conversations at these dinners remain strictly off the record. Proposals to audio-record such meet-ups and use AI to transcribe discussions have been resoundingly voted down by most participants. There is real value in being able to speak freely, without concern that every word will turn up online. That said, it also creates a challenge: I cannot possibly write up all of these ideas, and certainly not at the pace I managed with the three highlighted above.

This year alone, I have hosted dinners in Munich, Berlin, Düsseldorf, Hamburg, Washington DC, Austin, Toronto, New York, and several other cities. London is my home turf, with 5-8 gatherings each year. I plan to keep doing this, and probably add a few more cities along the way.

These dinners usually bring together 12-16 participants, while my Weekly Dispatches go out to over 12,000 registered readers. Just imagine the sheer number of original investment ideas and valuable sector insight hidden among this global readership – especially if it keeps growing.

This is a resource that deserves to be unlocked for everyone's benefit – so how can it be made available?

Here's the rough plan:

- Provide a one-page template for summarising investment cases presented at each gathering.

- Create a Dropbox where participants can upload their summary.

- Make these summaries available either to all Undervalued-Shares.com readers, or exclusively to paying Members (most likely the latter).

What I'd love to hear from you is:

- How does this idea sound to you overall?

- Are you aware of any similar services out there?

- Are there any other good, complementary ideas that I should consider?

As ever, your feedback is most appreciated!

Millionaires are fleeing London! – Interview with Swen Lorenz (German-language video)

What's going on in Britain right now? With wealthy Brits leaving in droves – driven by concerns over security, crumbling infrastructure, rising living costs, and more appealing destinations like Dubai, Portugal, and Italy – what will this mean for the UK economy?

Jens Rabe and I explore whether anything good remains: is there room for optimism, and are there any attractive investment opportunities left to explore?

Millionaires are fleeing London! – Interview with Swen Lorenz (German-language video)

What's going on in Britain right now? With wealthy Brits leaving in droves – driven by concerns over security, crumbling infrastructure, rising living costs, and more appealing destinations like Dubai, Portugal, and Italy – what will this mean for the UK economy?

Jens Rabe and I explore whether anything good remains: is there room for optimism, and are there any attractive investment opportunities left to explore?

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: