INVESTMENT REPORTS

Gold Reserve Inc. and Burford Capital

Exclusive report for Lifetime Members only

Exclusive report for Lifetime Members only

Gold Reserve Inc.: 2-10 times your money from Venezuela

17 March 2023

Not just Venezuelan expats, but also secretive fund managers have recently been piling into Venezuela – of all places!

Why would they chase assets in one of the world's most crisis-ridden countries?

Venezuela holds the unfortunate record for "the largest economic decline in modern history outside a war zone". During the 2010s alone, its potent mix of socialist policies, high level of corruption, hyperinflation, and international sanctions destroyed 80% of the economy.

It is now becoming apparent why there has been such interest among insiders in gaining exposure to Venezuela. Not only has the country's situation recently shown early signs of a potential turnaround, such as stabilised inflation stabilised and double-digit growth rates. On 15 March 2023, a catalyst became apparent that could give a critical matter necessary for a Venezuelan turnaround a LOT of momentum in 2023.

Undervalued-Shares.com introduces what may be the single best option to profit from a recovery – this is truly "hot off the press".

Notably, even US citizens are allowed to buy into it!

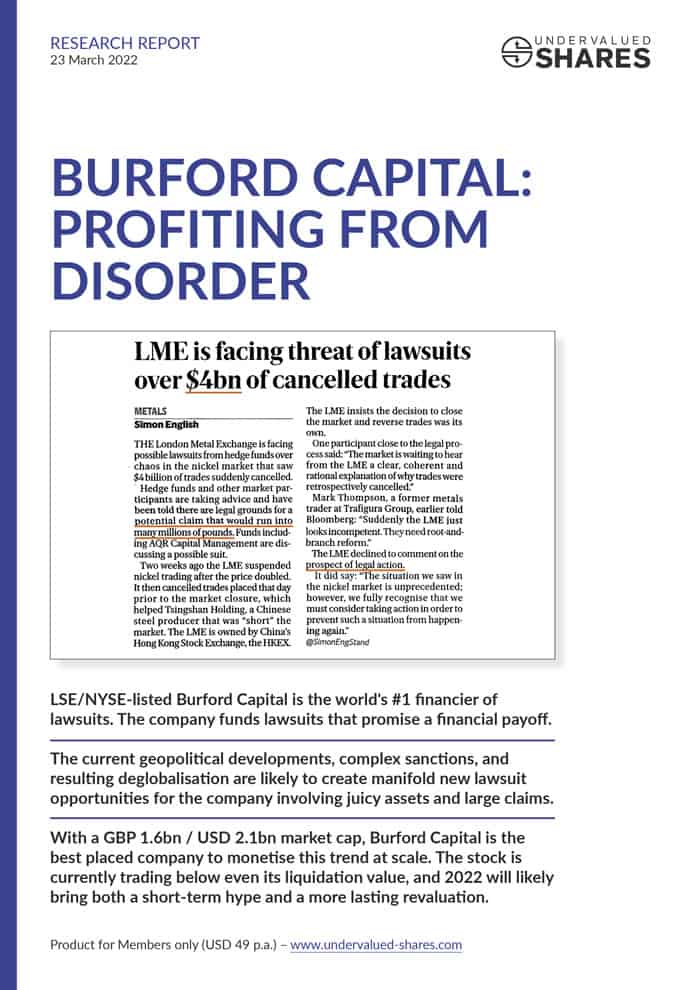

Burford Capital: profiting from disorder

23 March 2022

The current global situation has already produced several new trends that are obvious, such as rising food and energy prices, growing investments into defence, and a stronger focus on cyber security.

However, trends that are already known to the wider public have a distinct disadvantage when it comes to investing in them: they are usually already priced in, at least to some extent.

Which begs the question, which non-obvious trends are yet to emerge?

It currently looks like the coming years will see large-scale conflicts – politically, economically, and unfortunately maybe even militarily. We are facing an age of disorder.

What are some of the non-obvious winners of this trend? Which companies could benefit from disorder, and which stocks have yet to price in the upside of such scenarios?

Undervalued-Shares.com has done some lateral thinking.