UK real estate stocks are trading at historically low multiples. Will they ever shake off the current doom and gloom?

Allocating to Europe (part 1): Germany

"Germany-bashing" and "Germany doom porn" are everywhere.

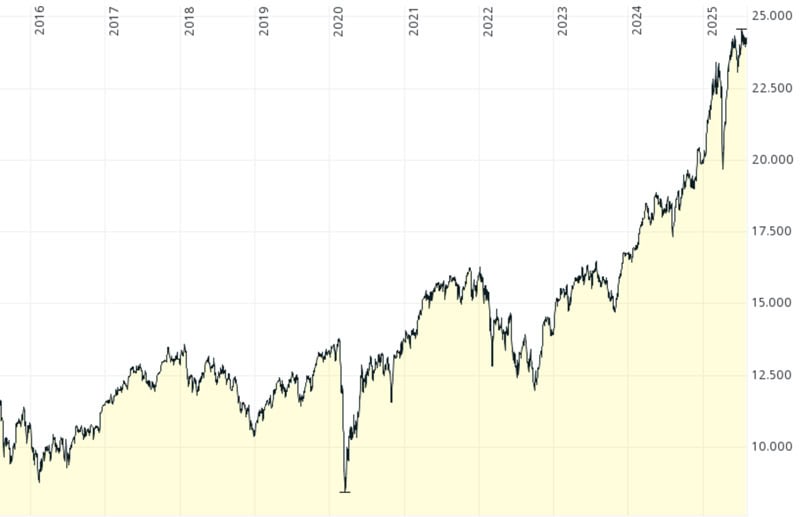

Yet the German DAX index is at an all-time high.

How is that possible – and are more opportunities still out there for investors?

(Of course there are!)

DAX.

Invest when things look bleak

2023 was not a good year for investing in German companies, or so it seemed.

The German economy was stagnating. Households had less disposable income, and businesses struggled to keep their faith in the future.

A long list of complaints and worries dominated the news:

- High energy prices, driven by caused by Germany cutting itself off from Russian energy and betting heavily on "renewable" energy.

- Public schemes such as health and pension insurance facing unprecedented financial pressures.

- The government attempting to counter severe demographic decline through unchecked mass migration.

- Lack of investing in schools and universities.

- Many industries having missed the digital revolution.

- Germany's fabled state-owned railway no longer functioning reliably.

Source: The Times, 12 August 2023.

This was a far cry from the impression the rest of the world had of the country just three years before. In 2020, John Kampfner's "Why the Germans Do it Better: Notes From a Grown-Up Country" had become a surprise bestseller in the UK, declared "book of the year" by The Guardian, the New Statesman and The Economist. Its central claim? Germany had forged "a new paradigm in stability" that the rest of the world ought to follow.

Few books ever aged so badly.

By September 2024, The Telegraph had to report: "German economic growth downgraded as confidence 'in freefall'".

In December 2024, The Times headlined: "Comparisons to chaos of Weimar era are usually overblown. Not this time.".

In February 2025, The Wall Street Journal published: "Why Germany’s Confidence Is Shattered and Its Economy Is Kaput".

Yet, across these years of negative headlines, being invested in the German stock market was not a bad thing at all.

In mid-2023, the DAX index comprising Germany's 30 top companies was at 16,000. It's now above 24,000, up 50%.

In May 2023, when I published "Vonovia – a German property bargain?", the stock of Germany's largest residential real estate holding was trading at a 65% (!) discount to net asset value because of the country's issues. It subsequently recovered and is currently up over 50%.

Investors should always keep in mind that a country's economics is not the same as a country's stock market. (Think of investing in Argentina three years ago as another good example!)

Germans still needed a roof over their heads, and buying big city residential real estate at a 65% discount was a panic-driven bargain with an attractive risk/reward ratio.

Other German property companies have also recovered from their bargain-level lows. As ever, finding the most promising area to invest in is a moving target. Today, other sectors are emerging that make the German stock market compelling for some investors to deploy capital.

This will be of interest to American investors who don't want to bet 100% of their wealth on the future of the US dollar. As described in last week's introductory article on allocating money to Europe, risk diversification and avoiding overexposure to a single currency may be reason enough to consider investing in the Old Continent.

As always, it takes some effort to work out the best area to invest into.

Time to look at German carmakers?

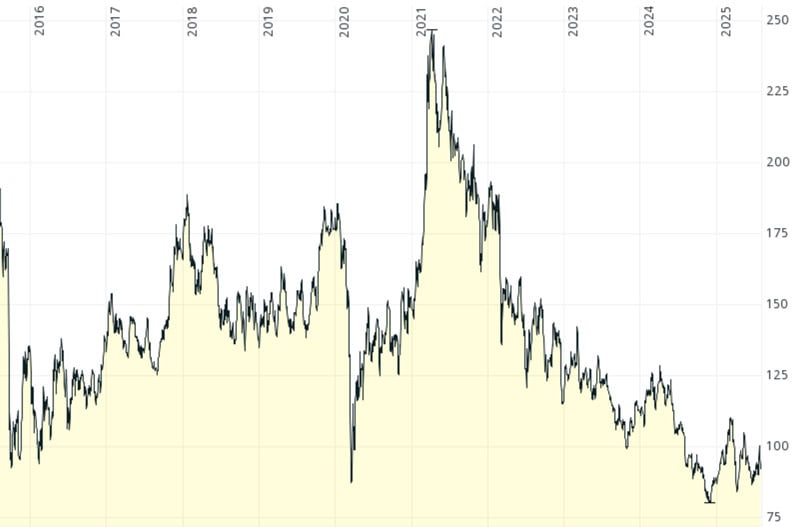

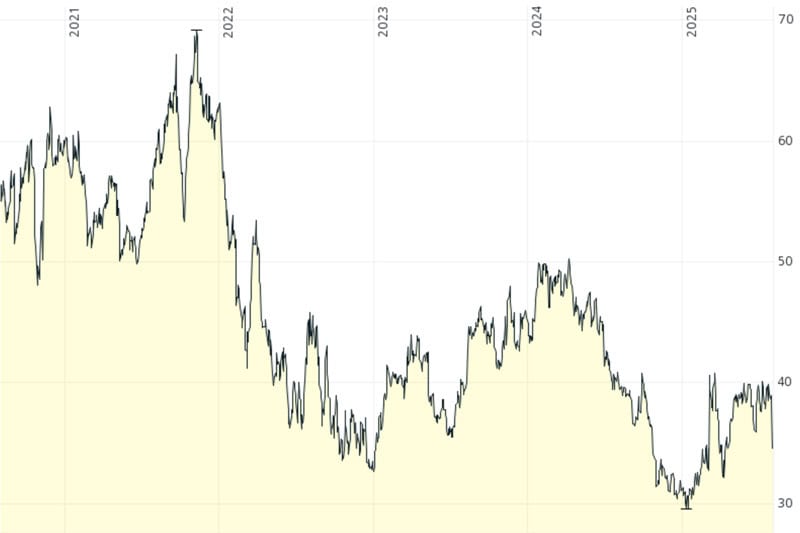

One other highly visible sector is that of German carmakers. The car industry had formed the backbone of Germany's economy for a long time, and a quick glimpse at some of the charts makes you wonder what's up. Volkswagen (ISIN DE0007664039, DE:VOW3), literally a synonym for the German car industry, has seen its share price obliterated – down 60% since 2021.

Volkswagen.

Volkswagen famously made an outsized bet on electric vehicles – but did so relatively late. In an effort to make up for poor timing, the company doubled down on its strategy, a move that has since backfired for reasons that are now clear. Additionally, Volkswagen faces fierce competition from Chinese car manufacturers, who produce comparable cars at half the price. Such a steep price difference is difficult to compete with, even under the best of circumstances.

Would I touch Volkswagen's stock right now?

The company's current situation remains highly uncertain, and the stock's risk/reward ratio does not yet add up in my mind.

Elsewhere in the sector, current valuations and future growth prospects are simply not yet attractive enough.

Compared to Volkswagen, Mercedes-Benz Group (ISIN DE0007100000, DE:MBG) and BMW (ISIN DE0005190003, DE:BMW) benefit from a stronger perception of "Made in Germany" luxury. Still, their share prices have only gone sideways and aren't quite the bargain that you'd think they are.

One carmarker that stands in a niche of its own is Porsche (ISIN DE000PAG9113, DE:P911), whose share price is down two-thirds since early 2023. However, the stock was quite overvalued following its high-profile IPO and has now come back to a more reasonable level. It's not exactly a bargain. This could be different for Porsche Automobil Holding (ISIN DE000PAH0038, DE:PAH3), the Porsche family's holding company. This stock is trading at a substantial holding discount, but whether the family will take effective action to narrow the discount remains uncertain, given how long the holding company's situation has persisted.

For deploying capital in Germany, its fabled car industry is not the obvious place.

Defence and infrastructure as stimulus winners?

What's particularly interesting about Germany are its coming fiscal stimuli. As reported last week, Germany is about to do what the Biden administration had done in the US over the last few years: increase the country's national debt in favour of short-term spending.

Whatever you think about this politically or in terms of being unfair on future generations, it will provide a windfall for many companies. Over the next decade, Germany will spend at least EUR 1,000bn on defence, infrastructure, and related industries. As these things go, once politicians are hooked on handing out cheques, they often up their plans later. An analysis by the Financial Times concluded that Germany could even take on EUR 2,000bn in extra debt over the next decade, thanks to its strong balance sheet. Having abandoned its long-held anti-debt stance – steadfast since 2008 – Germany now has considerable room to unleash fiscal stimulus on its economy.

Some companies have yet to fully reflect the expected government support in their share prices.

What are the most obvious winners?

Defence, of course.

Germany is looking to re-arm itself, and it is leading the alliance of countries that supply Ukraine with more weapons.

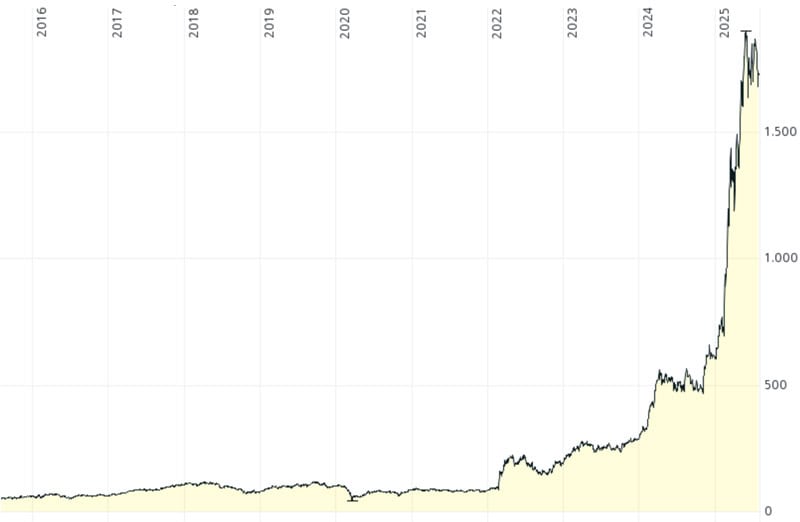

As a result, the stock of Rheinmetall (ISIN DE0007030009, DE:RHM) is up nearly 25x over the past four years.

Rheinmetall.

Another well-known German defence stock is Hensoldt (ISIN DE000HAG0005, DE:HAG), which is up 10x because of its involvement in military radar and other defence-related electronics.

Re-arming Europe will be a decade-long project, so is it still time to get in? Should investors buy any dip?

Over many decades, it has been proven repeatedly that the valuation you pay for an investment is the single most important factor in determining your long-term performance. Tempting as it is to jump on a "hot" investing subject, German defence stocks have already had their future growth priced in – and then some.

I have similar concerns for German construction companies.

A few days ago, the EU's transport chief, Apostolos Tzitzikostas, told the Financial Times that Europe's roads, bridges, and railways were ill-equipped to support the movement of tanks, troops, and military. To prepare the continent for the defence scenarios that EU leaders are now planning for, narrow bridges will need widening, and missing bridges will have to be built. This is on top of the fact that much of Europe's infrastructure is crumbling, and needs upgrading for the benefit of its citizens.

One obvious beneficiary should be Hochtief (ISIN DE0006070006, DE:HOT), Germany's largest firm for infrastructure and construction services. The problem is that the stock is also up nearly fourfold since 2022. As a firm that works globally, the percentage impact of the European stimulus package on Hochtief's business will not even be that great. Besides, it's not still unclear exactly what form these infrastructure investments will take.

Hochtief.

If anything, I'd spend more time digging into the midsized and smaller German companies connected to construction and infrastructure. As described in last week's Weekly Dispatch, news about public companies tends to spread more slowly in Europe. Within the midsized segment, there are still bargains waiting to be found.

Case in point, the MDAX index of medium-sized German companies has gained just 10% since mid-2023. Limited local investor interest and sparse analyst coverage have caused these stocks to lag behind the broader market – something I expect to change, though, especially in one compelling area.

Enter: the overdue digitisation of Germany's economy and government.

It's an investment theme I am very excited about.

Digitising Germany as an up-and-coming theme

Building tanks and bridges makes for good headlines, but the truly exciting investment opportunity in Germany could lie in bringing its IT infrastructure up to scratch.

This sector is more complex to report on and mainly involves companies that aren't (yet) internationally-known brands. That makes it all the more interesting, because it's often among these lesser-visible companies that investors can find the next outlier investment success.

In 2010, an Undervalued-Shares.com research report looked into one such company: Hypoport (ISIN DE0005493365, DE:HYQ), a software company that aimed to build the Germany's leading platform for mortgages. The country's mortgage market is not something that firms like Google would get involved with, and while it may have seemed like a niche, its sheer scale (reflecting the size of the German economy), turned it into a huge opportunity. The stock went up 100x.

If you know your way around German small- and mid-cap companies, you can make similarly surprising finds. Take the space sector, for example: while Elon Musk's SpaceX grabs all the headlines, Germany had its own space sector champion – OHB SE. This space and technology group grew to 3,000 employees and even turned a profit. The stock was "growth" but trading at "value" prices, a combination I find very compelling. In 2023, American buyout firm KKR swooped in and made a takeover bid. While OHB is no longer publicly listed, it serves as a great example of how you can find outstanding tech companies in Europe, often at bargain valuations with very advantageous risk/reward ratios.

Germany has a lot of homework to do in terms of:

- Digitising its outdated public sector.

- Taking industries such as healthcare into the digital age.

- Bringing AI into traditional sectors to make them more competitive.

- Building the communication infrastructure needed for a digital economy.

Many investors know at least one name for sectors such as defence, construction, or automobiles – but could you throw out a name for the entire trend of Germany investing in its digital infrastructure?

Exactly!

That's why it's so worthwhile to look at this sector.

You'll then find firms like secunet Security Networks (ISIN DE0007276503, DE:YSN), Germany's leading cybersecurity company and an IT security partner of the German government. When it comes to building a resilient, effective digital infrastructure for the country, secunet will most likely stand to benefit. Its stock hasn't moved since 2023, and the price is actually down two-thirds since its pandemic-era level. With a EUR 1.4bn market cap, it's certainly liquid enough not just for private investors but also for smaller investment funds.

secunet Security Networks.

Another company to keep an eye on is Bechtle (ISIN DE0005158703, DE:BC8), Germany's largest independent IT systems integrator. When companies or the government want to improve their IT architecture, Bechtle is the firm to call. It generates 40% of its revenue from government clients, and 45% from European Mittelstand companies (= small and medium sized companies). The stock remains 50% below its record price, and the company has a market cap of EUR 5bn.

Bechtle.

Both secunet and Bechtle exemplify the kinds of opportunities currently available in Germany. Each stands to benefit from the coming stimulus packages, and could play a key role in Germany's efforts to reinvent itself and accelerate its digital transformation.

When in doubt, I'd buy companies that offer growth at value prices – instead of chasing hot stocks that have already priced in a decade's worth of growth.

At the end of the day, the valuation you pay is the single biggest determinant of your long-term investment performance.

Stay tuned for parts 2 and 3, which will deal with the countries around the Mediterranean and the UK.

Gold at record high – time to switch to gold mining stocks? (German-language video)

The price of gold is soaring – nearly doubling since 2022 – yet many gold mining stocks are still stuck in neutral. Why the disconnect?

Join my chat with Paul Petzelberger of SdK Schutzgemeinschaft der Kapitalanleger e.V. to discover what's driving gold's surge, why miners often lag behind, and what savvy investors should watch for when picking gold mining stocks.

Gold at record high – time to switch to gold mining stocks? (German-language video)

The price of gold is soaring – nearly doubling since 2022 – yet many gold mining stocks are still stuck in neutral. Why the disconnect?

Join my chat with Paul Petzelberger of SdK Schutzgemeinschaft der Kapitalanleger e.V. to discover what's driving gold's surge, why miners often lag behind, and what savvy investors should watch for when picking gold mining stocks.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: