Gold stocks remain undervalued, with considerable upside potential. I picked the brain of Dominic Frisby, who has just released a new book on gold, to get his take.

Future PLC – publisher as AI winner or AI loser?

London-listed Future PLC is a publishing giant that few people have heard of.

With hundreds of magazines, websites, and newsletters under its umbrealla, the company reaches 1 in 3 consumers in both the UK and the US.

During the 2010s, Future was a high-flyer – its stock surged 40x. More recently, though, it has lost 80% of its value, as AI emerged as a threat to traditional publishing models.

Could the situation reverse, and turn Future into an AI winner after all?

Future PLC.

A summer of learning and exploring

Over the past month, I challenged myself to level up in the field of AI – not by trying apps or writing lots of prompts, but by going back to uni.

Harvard Business School offers an online course called "Competing in the Age of AI". Alongside a cohort of 500 other executives, I spent four weeks learning what it takes to lead and transform traditional businesses into AI-first companies.

As someone who has led several companies, I have long believed that understanding how businesses are run also helps you assess their investment prospects.

Because it was an online course, I was eager to test my learnings in a real-life scenario. Luckily, when I called an "AI dinner" in London, readers and colleagues practically kicked down the door.

I promised participants that I wouldn't just share general insights, but also present one specific investment case in the context of AI. Any questions that came out of the discussion, I would forward to the company's IR department, before turning it all into a free Weekly Dispatch.

It was an ambitious plan, especially given that AI is such a broad and complex topic.

Useful learnings

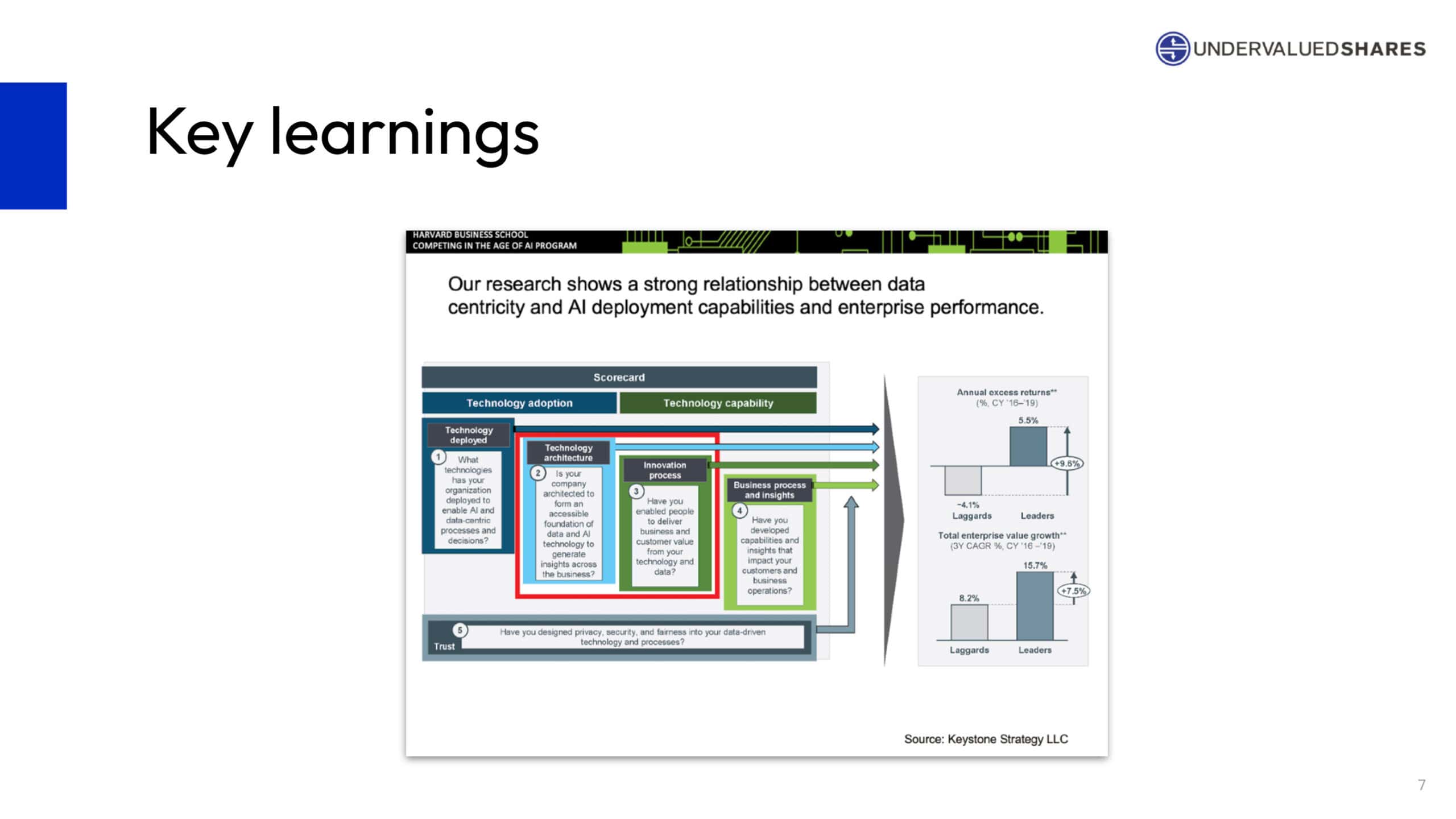

My presentation deck – which also shared some of the slides from the Harvard course – showed a strong link between data-centricity, AI deployment, and overall enterprise performance. While not entirely surprising, it's worth emphasising given how compelling the metrics put together by Harvard really are.

Click on image to enlarge.

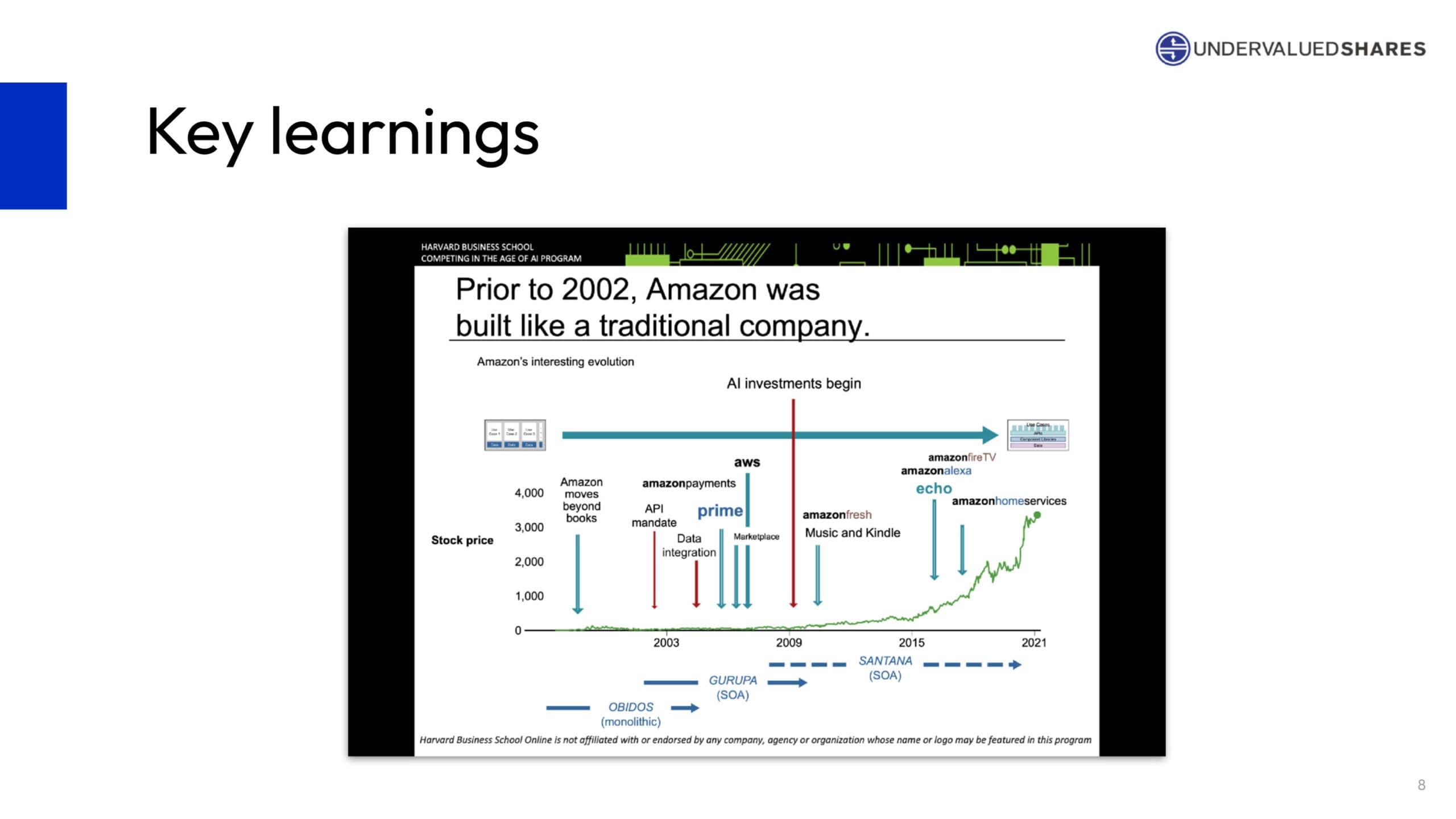

One of the takeaways from the course was that it *is* possible to turn a traditional company into an AI-first company. It's easy to forget now, but Amazon was once a completely traditional business. That changed in 2002, when it embarked on a radical transformation – one that turned it into what it is today.

Click on image to enlarge.

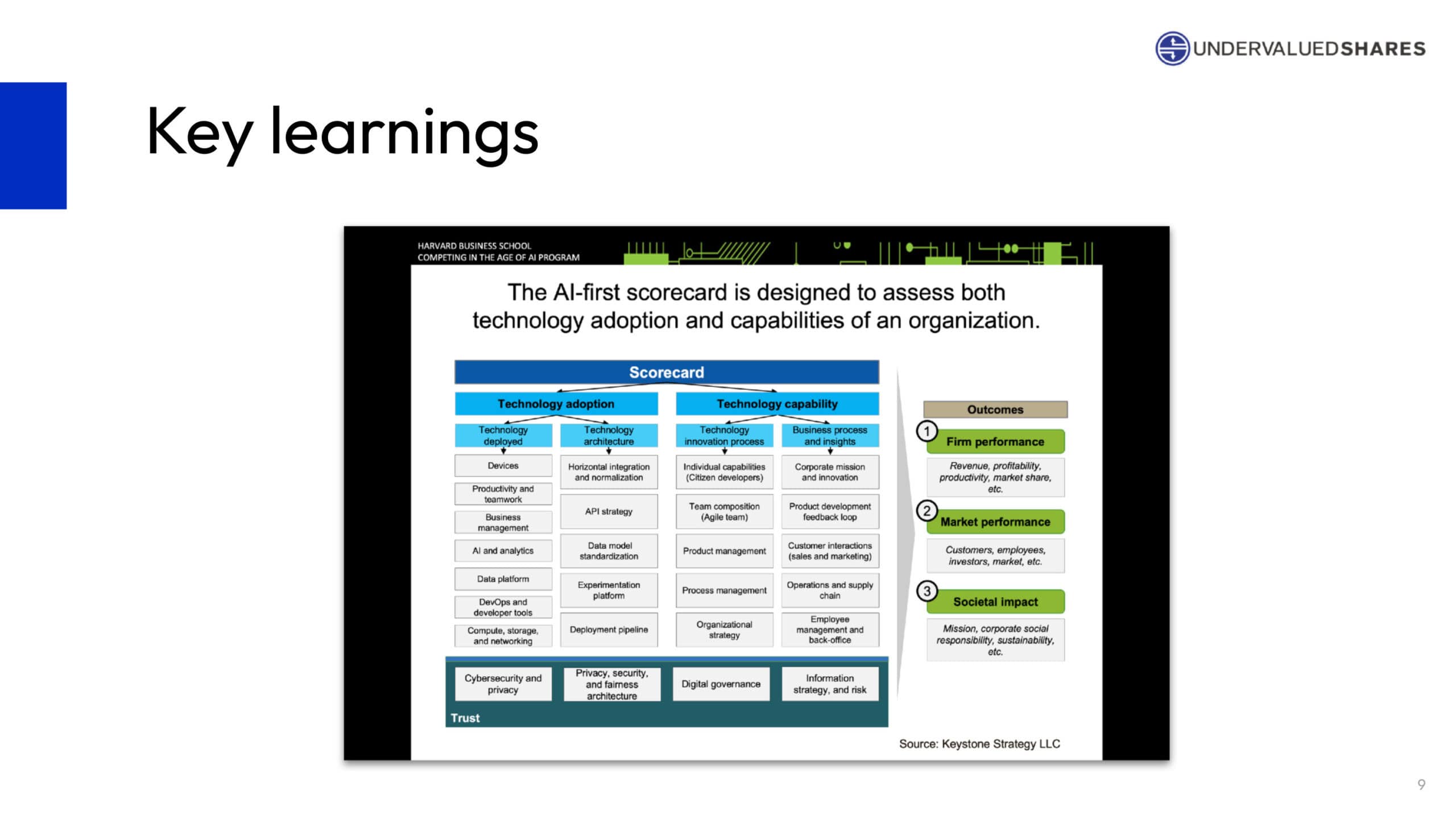

To assess a company's progress toward becoming AI-first, Harvard Business School developed a scorecard framework. Of course, it relies on companies being willing to share the necessary data – but if you can get the data, it's a useful tool.

Click on image to enlarge.

I paid USD 2,000 for the course. You could argue that by buying the course leaders' book (which has the same name as the course), you'd get 99% of the content for 1% of the cost. What you'd miss, though, are the soft factors, such as connecting with like-minded executives from around the world.

After finishing the course, I wondered where to apply my new insights?

Picking a familiar industry

The public discourse around AI is so vast and complex that I decided to make things easier for myself by choosing an industry to focus on.

Publishing websites, magazines and newsletters is something I know well. I have been involved with that industry in different capacities for over 30 years.

It's also an industry that everyone believes is under severe threat from AI.

Click on image to enlarge.

Without a doubt, the rise of AI has put pressure on publishers in several ways:

- Search engines like Google now offer AI-generated summaries of articles. Many users no longer click through to the original sites but just read these summaries. This has led to a drop in web traffic, and fear of a "Google Zero" scenario.

- AI companies "steal" content to train their AI. Newspapers and book publishers are suing for license fees, with several high-stakes lawsuits still ongoing.

- Traditional publishers carry the cost of human editorial staff, while AI-based companies can generate content "for free".

How is Future PLC (ISIN GB00BYZN9041, UK:FUTR) affected by these developments?

The company employs 1,000 "inhouse editorial experts" who produce content. It generates money through several channels: selling content directly, running an affiliate marketing business via the "GoCompare" price comparison site for financial products, and acting as a de facto ad agency by delivering engaging cross-channel advertising opportunities to clients. AI promises to generate content without much (or any) human involvement, and it also threatens to eliminate middlemen such as ad agencies. It's no surprise that the company's share price is down.

It's worth noting that Future's share price decline began well before AI gained such prominence. After rapid growth through acquisitions in the 2010s, the market started to question whether former star CEO Zillah Byng-Thorne had been using inflated paper currency to buy businesses facing secular decline. The AI threat only became a prominent part of the bear case more recently.

It's palpable, however, how much the perceived threat of AI is hanging over the company.

Then again, this has become so obvious that you have to wonder: is all this priced in already? Given that AI is the hottest topic across the media, wouldn't you expect management to have taken some countermeasures by now?

Indeed, Jon Steinberg – the CEO who replaced Byng-Thorne – went on a podcast in mid-2024 to discuss his views on AI content licensing deals.

Click on image to enlarge.

In early 2025, Future appointed its then-Chief Technology Officer, Kevin Li Ying, as new CEO. If a company wants to get serious about becoming tech-savvy, what better move than promoting your longstanding CTO to CEO? At least, that's the optimistic interpretation when replacing Steinberg after just two years.

Click on image to enlarge.

Last month, the company released a new tool that uses AI to help its advertisers get maximum engagement for their ad spend.

Click on image to enlarge.

Will this be enough to chart a new course for Future?

Another important factor is that AI may not live up to all the hype.

In my view, claims that AI will be as revolutionary as electricity are typical Silicon Valley hype. If you want to explore this viewpoint further, check out the recent long-form blog article "The Hater's Guide To The AI Bubble", or grab a copy of "The AI Con: How to Fight Big Tech's Hype and Create the Future We Want".

To be clear, there is no denying AI will change parts of our lives, and some jobs will be affected more than others.

Still, I'd summarise the likely developments in publishing as far from black and white – more a lot of grey. I don't see it becoming a choice between "AI or Human", but rather a thoughtful process that will include:

- Improving efficiency (faster research, support with editing).

- Booster for creative thinking (deep research, supporting ideas generation).

- Supercharging audience engagement (AI-generated visuals).

- Better connecting audiences and advertisers (data-driven).

If my expectations turn out right, AI will bring more of an evolution than the imminent revolution that Silicon Valley often promises.

This new technology will support – not replace – human journalists. We're likely to see human capabilities augmented rather than human intuition replaced altogether. In this context, high-quality content could increasingly help build communities. Who knows, some former content businesses might even pivot to become more event-centric? Adapting to change is something the publishing industry has been doing for decades, if not centuries.

"Could a new golden age lie ahead for companies that have the strategy, the tech and the scale to fully capitalise on this new way of operating?", I asked my London dinner group.

The recent "AI dinner" with 20 of my readers.

I warned participants upfront that I had taken an optimistic stance to spark debate, and that I wanted to learn from their combined expertise to arrive at a firm, solid view. "Please be brutally critical and don't hold back", I asked them.

As it turned out, they weren't going to easily sign up to an optimistic stance on Future.

Crowdsourcing intel from my readers

Broadly speaking, Future's annual revenue of around GBP 800m is split fairly evenly between three segments: content, advertising, and affiliate marketing.

In 2024, magazines still accounted for 25% of revenue. But do they really have a future? One reader – part of the younger generation – commented: "I have never picked up a magazine ever." Another reader described how difficult it has become even in London to find shops selling specialist magazines.

To analyse Future's exposure to both the challenges and opportunities of AI, we'd need a better handle of key metrics and data around user demographics:

- What is the average age of the company's magazine readers?

- What are the sources and stickiness of the company's web traffic, and how sensitive has it been to AI-induced changes so far? How much does the company's lead generation depend on Google?

- How has the churn rate among subscribers changed in past years?

To get a better picture, we'd also need more detail about the nature of Future's advertiser income. Not all advertising is alike. For example, Yahoo is also a publisher, but a significant share of its traffic comes from advertising within its own email platform – essentially an internal walled garden. How does Future's advertising income compare?

Doubts also exist whether Future's content model is suited to the new media landscape. The company claims its 1,000 "editorial experts" produce 2m (!) articles per month. This suggests that automation is already being used in some way. How does this chime with concerns that you need to have either generalist content produced entirely by machines or something that is clearly produced by a human?

I sent these and other questions to Future's IR department – and received very helpful answers the following day.

60% of the company's web traffic comes from Google. As the July 2025 prospectus for the placement of GBP 300m of guaranteed notes stated in its section on AI:

"The Future Group depends on its ability to market, distribute and monetise content through search engines and social media platforms. These platforms could decide not to market or distribute some or all of its products and services, and/or change their terms and conditions of use at any time, including how they incorporate or rank third-party content in AI-driven search experiences or generative AI outputs. Additionally, the Future Group's ability to retain top search engine optimisation ("SEO") rankings may change, making it harder for consumers to find the Future Group's content. A material proportion of traffic visits to the Future Group's websites derives from organic referrals via third-party search engines. Transactions effected by consumers in this way result in higher margins to the Future Group, as there are lower associated direct costs. Search engines do not accept payments to rank websites in their organic search results and instead rely on algorithms to determine which websites are included in the results of a search query. An unexpected change in how search engines or their AI-powered features (such as AI- generated summaries or direct answers) prioritise search traffic or if these AI features reduce the need for users to click-through to the Future Group's websites, could have a material impact on the Future Group's ability to generate traffic to its websites, causing a reduction in advertising inventory and potential e- Commerce traffic which, in turn, could have a material adverse effect on the business, results of operations, financial condition and/or prospects of the Future Group. For the year ended 30 September 2024, approximately 49 per cent. of the traffic to the Future Group's websites originated from searches."

While Future doesn't disclose demographics of its magazine readership, it does provide a helpful breakdown of its revenue: "Our overall advertising is about 1/3 of the Group's revenue, with 25% of our revenue being GoCompare which is a different business model, same goes for B2B which is ~8% of our revenue and ~30% of our revenue (50% of the B2B business) is magazines which is not impacted by google. About 25% of our advertising revenue in B2C is branded content so not reliant on sessions."

Future maintains that it strikes the right balance between utilising technology to optimise its operation and ensuring its content retains a human touch: "The reason why our traffic is resilient is because it is powered by human and provides original, expert content. We have ~200 brands and to fuel content on these brands requires human expertise. It is worth noting that our editorial staff is passionate about what they write about: our gaming editorial teams are gamers for example. We have a powerful tech stack to ensure our process are efficient but they don't replace the creation of content."

Valuation

The company currently has a market cap of GBP 780m. Combined with its net debt of GBP 250m, it has an enterprise value of GBP 1,030bn. In 2024, the company's free cash flow amounted to GBP 222m. Net debt stands at a relatively modest 1.1x EBITDA. The adjusted 28% operating profit margin was both relatively high and stable.

"What kind of peers are there and what multiple do they trade at?", one participant asked.

As ever, you can debate what constitutes a suitable "peer" for this particular company. Public markets also always show a broad range of valuations for any one industry, often driven by idiosyncratic features of individual companies.

An informed buyer with industry expertise would probably pay 4-5x EBITDA for such a business in a private market transaction. That is roughly what Future is trading at.

One aspect playing into the valuation are the company's ongoing share buybacks. In 2024, it returned GBP 69m to shareholders. In December 2024, another buyback programme for GBP 55m was approved, and yet another GBP 55m buyback tranche got approved in May 2025 which is currently underway.

These are chunky buybacks. They show the company is serious about returning capital to shareholders. Equally, you could argue that such extensive buybacks distort valuation metrics. If they hadn't happened, where would the share price be trading?

Also, how likely is it that the company has to report a whoopsie-daisy quarterly result, given the weak UK consumer economy?

Shareholders will get more clarity at a webinar scheduled for 26 September 2025. At this online event, the new CEO and his team will lay out their strategy and product roadmap in more detail. The IR department has confirmed a replay will be made available afterwards.

No doubt, AI will feature prominently in the presentation and discussion.

Out now: an asymmetric opportunity

London's AIM market is far from straightforward. Many brokers don't even offer access. Transparency is often lacking. And many stocks go unnoticed.

But that's exactly where the most compelling special situations emerge.

The latest Undervalued Shares report – out today – uncovers one such overlooked stock.

With upside of at least 50-100%, it's an asymmetric opportunity you won't want to ignore!

Out now: an asymmetric opportunity

London's AIM market is far from straightforward. Many brokers don't even offer access. Transparency is often lacking. And many stocks go unnoticed.

But that's exactly where the most compelling special situations emerge.

The latest Undervalued Shares report – out today – uncovers one such overlooked stock.

With upside of at least 50-100%, it's an asymmetric opportunity you won't want to ignore!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: