UK real estate stocks are trading at historically low multiples. Will they ever shake off the current doom and gloom?

How to buy into the world’s cheapest real estate

Image by Damira / Shutterstock.com

Where in the world can you buy the cheapest real estate – AND get an *additional* 67% discount?

Cuba, of all places! And there is one forgotten company that gives you exposure to this opportunity (though you might need an account with UK brokerage firms AJ Bell and Hargreaves Lansdown).

I explained it all, at this week's Weird Shit Investing conference in London.

Buying a house for just USD 2,300

If you want to buy into the world's cheapest real estate, you have to look at Cuba.

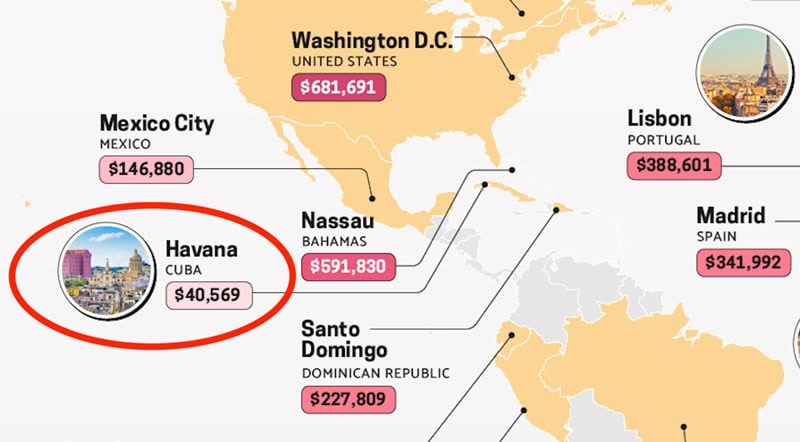

Based on a statistic drawn up by NetCredit, in 2023 the median house in Cuba cost USD 40,000. This compares to prices in the Dominican Republic being 5x higher, and more expensive Caribbean locations costing 5-20x more.

Source: NetCredit, "The Average Price of Homes in Capital Cities" (2023).

Prices have since fallen further, and smaller houses in need of renovation may now cost just a few thousand dollars – or USD 2,300, which is what one TikTok influencer recently paid for a house.

Source: CiberCuba, 18 June 2025.

That's quite a change to the prices Cuba saw in the mid-2010s, when Fidel Castro's successor, Raúl Castro, reformed real estate laws which permitted private property (if only with lots of regulations and limitations).

What followed was a real estate hype that could keep up with those of hardcore capitalist nations. Some waterfront homes in Havana leaped in value by a factor of 10x and became worth USD 1m.

Today, the price of the same buildings would probably be lower by 80-90%. It's back to square one for the Cuban real estate market.

Worse still, for most real estate in Cuba, there is currently no buyer at all. Reportedly, in an apartment building with 23 apartments, all 23 apartments are currently for sale. Hundreds of thousands of Cubans are fleeing the destitute island economy each year, and the property market has effectively collapsed under the weight of massive oversupply.

Even a house that costs just USD 2,300 is expensive for locals. Cubans earn between USD 30-100 per month, and materials as well as equipment are expensive (and usually impossible to get hold of). Relative to local incomes, real estate prices would have to fall yet further.

Then again, there may soon be a wave of TikTok buyers. Cuban nationals living abroad can buy real estate with few restrictions, and the idea of spending one month's worth of savings from a well-paid job in the US to buy a HOUSE in Cuba could just become a new trend. It'd be a variation of the meme stock craze.

How to get in on the act?

There is one forgotten stock listed on the London stock exchange that allows you to do that.

Introducing CEIBA Investments

CEIBA Investments (ISIN GG00BFMDJH11, UK:CBA) has a real estate portfolio in Cuba that is valued at USD 130m even during current market conditions. With 100% of its portfolio invested in Cuba, it's a pure play.

CEIBA owns a six-building office complex in central Havana. The Miramar Trade Center is widely recognised as the best office block in the nation's capital. It has a 97.5% occupancy rate and last year generated net income after tax of USD 13.5m.

CEIBA also owns a hotel in Havana, and three beach hotels in Varadero, Cuba's principal beach resort destination. All of them are either four- or five-star hotels and profitable, despite suffering from low occupancy.

Last but not least, CEIBA owns a brand new five-star hotel near Trinidad, a UNESCO World Heritage Site. It only opened last year and was already profitable, despite ending its first year with a 32% occupancy rate.

CEIBA has applied a discount rate of 24-27% to value the future cash flow of the properties.

Why are these assets worth looking at right now?

Cuba has deep economic problems, including inflation, currency devaluation, and capital controls. CEIBA, however, has hard currency income. 100% of the hotel bookings are earned in euros and US dollars, and some of the tenants of the office complex are paying in US dollars.

In a sh** economy like Cuba, what you want is hard currency income!

To be clear, Cuba's ongoing economic woes do affect CEIBA on multiple levels:

- Tourism is down because of multi-day electricity outages.

- CEIBA's legally required local joint venture partners temporarily withheld dividends, which made CEIBA's funds partially "trapped" in Cuba.

- It's a challenge to operate luxury hotels when basic supplies are not available. How to explain to the guest of a five-star hotel that there is no toilet paper?

CEIBA also faced an existential financial threat from a USD 25m bond, which was up for repayment in its entirety in March 2025.

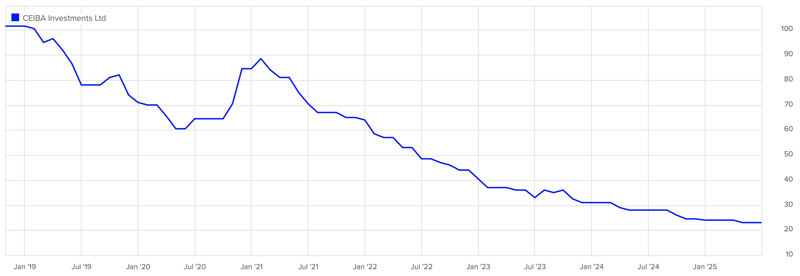

The company went public in 2018, and its fortunes have since taken a dramatic turn for the worse. The share price was down 77% when I presented the investment case to participants of the Weird Shit Investing conference (my annual gig to bring together a smart set of private investors, funds manager, and family offices).

CEIBA Investments.

Then again, CEIBA may be turning the corner:

- The bond's terms recently got renegotiated for a phased repayment over five years.

- USD 20m of "trapped" funds in Cuba were freed up, indicating that contracts and property rights do count something even if the Cuban government is your joint venture partner.

- Using its hard currency income, CEIBA is buying basic supplies abroad.

CEIBA's management has gradually reduced its estimates of the assets' value. Between 2018-2024, its net asset value per share fell from USD 1.53 to USD 0.94. At the current exchange rate, that's a net asset value of GBP 0.69 per share.

On top of that, the market assigns a discount to the net asset value. The share was trading at 23 pence just before I presented this case – a 67% discount compared to the net asset value and a double discount on top of the depressed net asset value.

Does that make it a bargain worth investing in?

I spelled out the pros and cons of this investment case in my Weird Shit Investing conference presentation.

A broadly comparable special situation among London-listed funds was presented at the same conference last year, and it went on to rise up to 200% within just nine months.

CEIBA is a bit of an oddity, and trading liquidity is very limited. Those 40% of its share capital that are in free float are worth about GBP 13m based on current prices. That makes the stock large enough for private investors to get in, but it's hardly of interest to larger investors.

"Weird" special situations come in all shapes and sizes – and many of them can be found in Europe.

As one participant in London said: "In the US, there are few overlooked special situations and lots of money. In Europe, there are many overlooked special situations but no money."

Will the tide of American money turn its attention to Europe to benefit from the undervalued bargains and special situations on the Old Continent?

Much evidence points that way.

Get more such weird ideas…

… in "Weird Shit Investing 2025 – The Manual" – coming your way on 4 July 2025.

As the official summary of the Weird Shit Investment conferences in Hong Kong, London, and New York, the manual compiles the ideas of all 48 speakers in one handy format.

It'll also contain a number of insightful, educational interviews with some of the participants.

As a Weekly Dispatches subscriber, you don't have to do anything. Just wait for the manual to hit your inbox next week!

Get more such weird ideas…

… in "Weird Shit Investing 2025 – The Manual" – coming your way on 4 July 2025.

As the official summary of the Weird Shit Investment conferences in Hong Kong, London, and New York, the manual compiles the ideas of all 48 speakers in one handy format.

It'll also contain a number of insightful, educational interviews with some of the participants.

As a Weekly Dispatches subscriber, you don't have to do anything. Just wait for the manual to hit your inbox next week!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: