UK real estate stocks are trading at historically low multiples. Will they ever shake off the current doom and gloom?

Investing in Iraq – yet more gains to come?

Back in 2021, I set out to find the world's LEAST popular country for investors.

Iraq came out on top – a true contrarian pick.

Despite the country's reputation for conflict and instability, I saw real potential for investors. As a wrote at the time, "I wouldn't be surprised if the Iraqi stock market doubled over the next 12 to 24 months."

Double it did – and more. One little-known Iraq fund I flagged is now up 183% in USD terms.

It's time to take a fresh look – and uncover the next wave of opportunities.

True contrarian investing

My 2021 article about investing in Iraq is worth getting out again. It provides extensive background about the country, its stock market, and the likely future of its economy.

Surprisingly, Iraq's stock market had no less than 103 listed companies at the time.

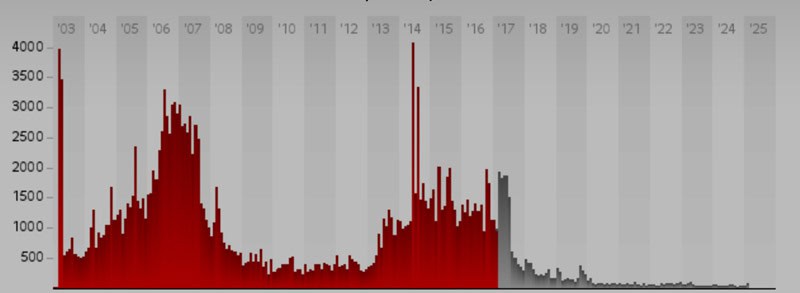

However, it had suffered from a devastating bear market, losing ground each year from 2014-2020.

At the end of this brutal period, the market was down 67%. This was a bear market of biblical proportions.

When it started to show new signs of life during the first months of 2021, my ears perked up.

As I wrote back then: "Between January and April 2021, it gained up to 29.2% - quite a move! … There hasn't been much reporting yet about the recent movement of the Iraqi market. When a market rallies without anyone reporting about it, my interest is piqued."

It was the right call.

As ever with such frontier markets, getting in on the act was the problem. Unless you maintained a specialised brokerage account, the stocks of local companies such as Baghdad Hotel (ISIN IQ000A0M7S83, ISX:HBAG), Iraqi Agricultural Products (ISIN IQ000A0M7TD0, ISX:AIRP), and Fallujah Construction Materials (ISIN IQ000A0M7TY6, ISX:IFCM) were almost impossible to invest in.

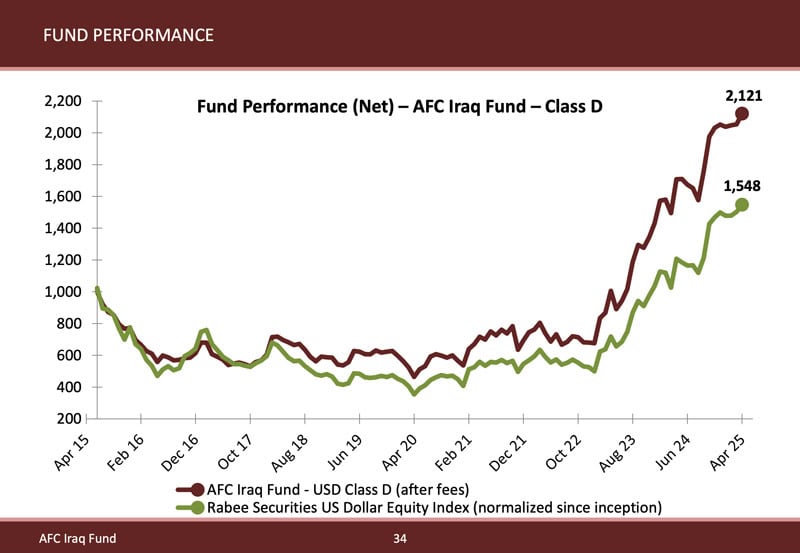

However, one fund was accessible to anyone with a minimum investment of a few ten thousand dollars: the AFC Iraq Fund. It has since produced a stellar performance, benefiting not only from a recovery of the Iraqi stock market but the Iraqi economy as a whole. Just as I predicted in 2021, Iraq was "a frontier market that is showing signs of life again".

Needless to say, almost everything in Iraq leads back to oil and gas.

A country floating on oil

Iraq's oil and gas reserves are staggering: with current proven reserves of 140bn barrels, Iraq is the fifth-largest oil country on Earth.

Remarkably, with only about USD 3 per barrel, Iraq has extremely low production costs, cheaper even than those in Saudi Arabia. Only Iran can currently produce even cheaper oil. While figures for this factor vary by source, it is widely acknowledged that Iraq is an outlier within the oil industry for its extraction costs.

Why the cost advantage?

In Iraq, oil tends to be near the surface and therefore quite easy to access.

When the Bible referred to a bush that kept on burning, it may have referenced a sight that is not uncommon in Iraq even today. Oil and gas can seep out of the ground and in some instances provide the fuel for what seems like an eternal flame.

Source: National Geographic, 1958.

So vast and lucrative are Iraq's oil reserves that the Arab world once demanded the country's oil riches to be split between the entire region.

Iraq's oil reserves could be even bigger than what is known today. The country's Western desert has seen little exploration so far, and some believe it will contain even more oil than the rest of the country. Estimates often cite 300bn barrels of oil in Iraq. It may even be closer to 400bn, according to "The Legal Dimensions of Oil and Gas in Iraq: Current Reality and Future Prospects" by Rex J Zedalis, a 2009 handbook covering the ins and outs of the sector. In any case, oil and gas are driving everything in Iraq.

Since the 1920s, these resources were first exploited by a handful of multinational oil companies: BP, Exxon, Mobil, Shell, Texaco, Gulf, and Chevron.

The involvement of "colonial" oil companies is a politically touchy issue, but it seems to have worked. By the early 1970s, Iraq had reached middle-income status. In regional comparison, it possessed a high-quality education and healthcare system, as well as modern infrastructure.

In 1972, Iraq nationalised its oil sector. The same political party that made the decision to expropriate Western oil companies later gave rise to Saddam Hussein, and the rest is history.

Security issues prevented investments

For many years, Iraq remained a no-go zone for foreign investors. After the invasion phase of the Second Gulf War finished in 2003, Western governments tried hard to mobilise foreign investment but mostly failed.

The country saw the brutal period of the Insurgency (2003-2011), followed by the rise of ISIS (2014-2019). During these years, Iraq was effectively inaccessible to all but government and military personnel. As the following chart shows, the number of violent deaths during this period was off the scale. It was only after the defeat of ISIS in early 2017 that order began to return.

Source: Iraq Body Count.

During these difficult periods, one area of Iraq with significant investment was Kurdistan, the semi-autonomous region in the north. Unlike much of Iraq, Kurdistan was somewhat safer, prompting ExxonMobil and Chevron to invest in the region's oil production. A small British company, Petroceltic International, and America's Hess Corporation also decided to explore in Kurdistan.

However, all four eventually decided to leave, mostly citing "significant operational challenges". This was a polite way of saying that a lack of legal certainty, mixed with complex politics and a dose of safety concerns, made capital investment in Kurdistan risky.

Only a handful of smaller companies decided to hang in there, including London-listed Genel, Gulf Keystone Petroleum, Norway's DNO and Canada's ShaMaran Petroleum.

The lack of legal certainty was at least as big a stumbling block as the risk of life. After decades of extreme upheaval, Iraq was still trying to find its feet, leaving companies without trust in the government to stick to agreements and protect investors.

Following the defeat of ISIS, however, circumstances started to change.

My 2021 article captured early signs that the situation was turning a corner.

Indeed, since early 2025 in particular, Iraq has delivered ample evidence that it is genuinely open for business.

Multinationals are moving in

BP was one of the original players in the Iraq oil sector from the 1920s-1970s, and the British oil giant was eager to return.

As Greg Muttitt outlines in his book "Fuel on the Fire – Oil and Politics in Occupied Iraq", a 430-page recount of key events during the country's difficult years:

"'Iraq is THE big oil prospect', began the minutes of the meeting at the British Foreign Office on 8 November 2002. 'BP are desperate to get in there.'"

BP had closed down its last operation in Iraq in 1974, following the nationalisation of the oil industry.

Yet, despite the best efforts by the US and UK governments in the early 2000s, BP and other oil majors weren't going to get back into the country just yet.

It wasn't until March 2025 – 51 years after its departure – that BP moved back into Iraq. Remarkably, it's now re-entering with all the more momentum, even though few outside of the oil industry would have even noticed yet.

Two months ago, BP secured final approval from the Iraqi government to redevelop the vast Kirkuk oil fields. The company committed to spend USD 25bn (!) over 25 years. In the initial phase, it plans to produce an 3bn barrels of oil, but the potential is far greater. According to BP's press release, "the wider resource opportunity across the contract and surrounding area is believed to include up to 20 billion barrels of oil equivalent."

Although Reuters covered the deal, it received little media coverage beyond specialised energy publications and Middle Eastern channels.

Source: OilPrice.com, 26 March 2025..

BP is not alone.

A few months earlier, France's Total had begun construction of a gas processing facility, marking the first stage of a major energy project. Although Total had already reached an agreement with Iraq in 2021, subsequent squabbling over contract details delayed construction. With an investment of USD 10bn over 25 years, the project is now finally underway.

Source: Gulf Business, 13 January 2025.

Unsurprisingly, Chinese companies are close behind. On 22 May 2025, news emerged that Iraq had signed a major oil deal with Geo-Jade Petroleum. The Chinese firm will build a refinery, two power plants, a petrochemicals facility, and a fertilizer plant.

Source: OilPrice.com, 22 May 2025.

Why the sudden rush by multinationals to invest multi-billions?

Iraq has now remained stable long enough and shown sufficient progress for foreign investment to return. The recent period of relative stability has had a cumulative effect: while few wanted to go in first, everyone is now rushing to get in at once. The country is even moving ahead with vital infrastructure projects, such as a major new pipeline to transport its oil to market.

Source: Energy Intelligence, 15 April 2025.

Much of this has only been announced in recent months, which is why the full magnitude of these developments has yet to register with many investors.

Iraq's emerging investment boom is an underreported story – for now. I believe it won't be long before it begins making headlines more widely.

Exploiting the delta between perceived and actual risk

To be clear, it is too early to claim that Iraq will be anything other than a challenging market to operate in. In 2023, Ghanim Anaz published "Iraq: Oil and Gas Industry in the 20th Century", a 500-page tome containing the sector's history as witnessed by the author during his 47-year tenure in Iraq's energy industry. As Anaz put it: "The huge revenues which are being generated by the export of oil are still going to waste down the drain through the funnels of mismanagement, greed and corruption."

After everything the country has been through, it will take decades for the wounds to fully heal. Domestic risks remain elevated, and Iraq's location comes with its own set of long-standing issues.

That said, investors should take note of the following aspect.

Whenever there is a delta between the perceived risk of a market and its real risk, investing in the stock market may allow you to exploit this difference.

Ultimately, that's what happened with the Iraqi stock market (and the AFC Iraq Fund) since 2021.

After the tumultuous 2010s, the market had been priced as though Iraq were to disappear off the face of the Earth.

Once investors realised that the country was turning a corner, the reaction was like that of a coiled spring.

What triggered this shift was the flow of information. Investors had been unaware of the changing situation, and once they realised, money started to flow into the market.

In 2023, the Iraqi market rose by 97.2%, followed by 44.8% in 2024 (measured in USD terms). Yet, it has only just returned to its 2014 level.

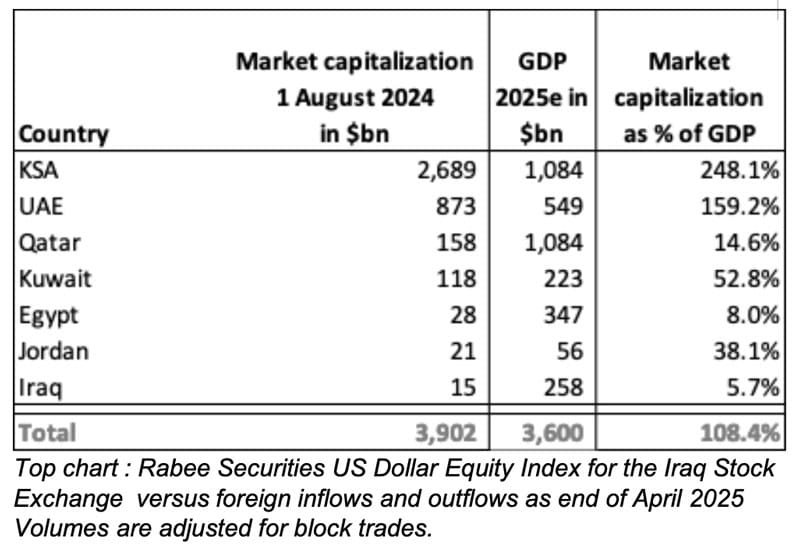

By some measure, Iraq remains an underdeveloped, underfollowed frontier market. E.g., the market capitalisation of all Iraqi companies stands at just USD 15bn. Relative to the country's GDP of USD 258bn, that's a national market capitalisation of just 5.7%. In contrast, other markets in the region tend to have ratios several times higher (see table).

Source: Rabee Securities.

Iraq's ongoing transformation – both politically and economically – does not yet appear to be priced in. Price/earnings ratios are in the mid-single digits but based on depressed earnings, i.e. there is lots of potential for companies to improve profitability through internal measures while also experiencing significant growth.

Currently, there are probably no more than 35,000 investors who have traded on the Iraqi exchange, and less than 5,000 of them could be described as active. Local institutional investors are almost non-existent, and the few foreign investment funds active in Iraq manage a total of just USD 250m.

In other words, the big money has yet to arrive in Iraq's stock market.

It begs the question, what options are available to those eager to participate in what could be a true ground-floor opportunity?

AFC Iraq Fund

Investing in Iraqi stocks has become easier, with the country's leading brokerage firm, Rabee Securities, now offering an online trading app. The firm's English-speaking website includes a section for foreign individuals and entities interested in opening an account.

However, for all intents and purposes, investing into one of the available funds – such as the AFC Iraq Fund – is the easiest option.

The AFC Iraq Fund is managed by Asia Frontier Capital in Hong Kong. Its principal, Thomas Hugger, is a highly experienced, well-known player in frontier markets. For this fund, he collaborates with Ahmed Tabaqchali, the fund's Chief Strategist and a dual British-Iraqi national with over 25 years of experience in financial markets.

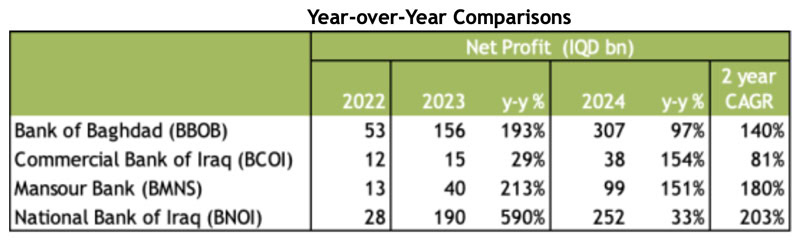

The fund is currently focused on Iraqi banks, which comprise the bulk of its portfolio. In 2024, for the second consecutive year, the country's leading banks reported exceptional net profit growth.

Source: Rabee Securities, Iraq Stock Exchange, Asia Frontier Capital.

In frontier markets, basic industries often offer the best returns, and Iraqi banks are a prime example. In 2023, the total number of bank accounts rose by 51%, the usage of bank cards grew by 22%, and the adoption of e-wallets increased by 68%. The number of shops accepting electronic payments more than doubled, growing 115%.

These are the base effects witnessed in countries that move from cash-only to the next level of development. Once a country's day-to-day commerce runs more smoothly thanks to the availability of cheap, reliable, and convenient payment options, other industries start to catch up.

It's a flywheel effect that should unfold for years to come. After all, Iraq's predominately young population has a lot of catching up to do, and almost all economic activity will require payments, financing, or other forms of financial services.

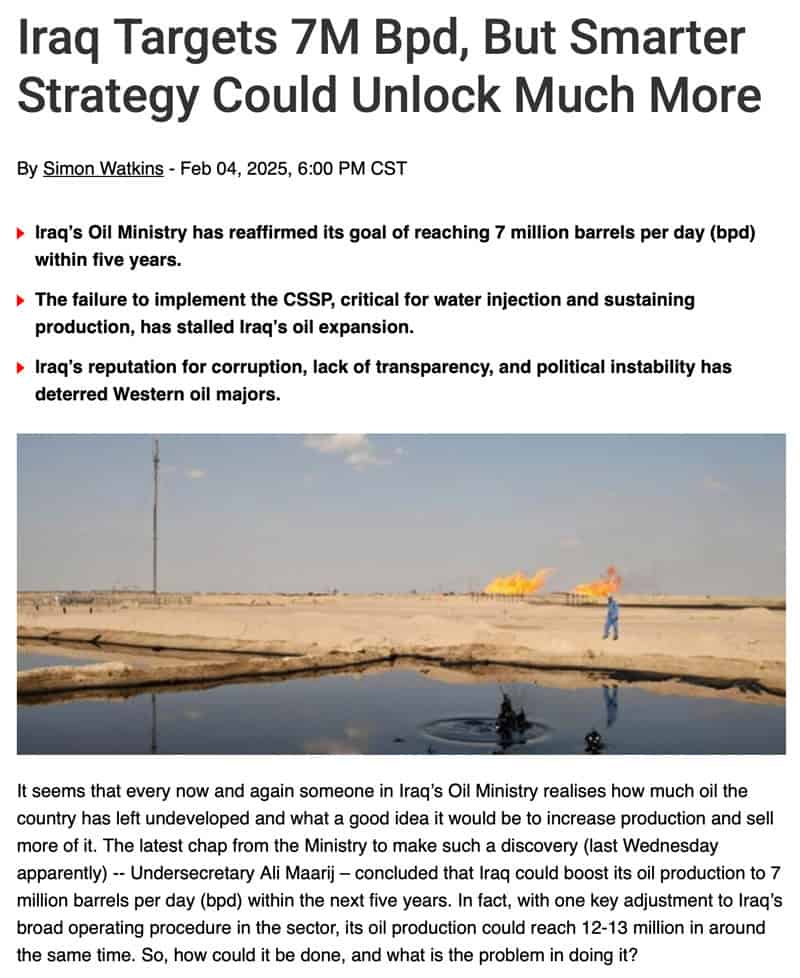

Needless to say, Iraq won't become a developed nation overnight and will continue to face challenges. While oil exports to the US are exempt from reciprocal tariffs, the lower oil price weighs on the country's income. However, Iraq plans to significantly increase its production. In January 2025, it produced oil at a run-rate of 3.9m barrels per day, aiming to reach 6m barrels per day by 2028 or 2029. If achieved, this volume growth should more than offset lower prices. There are even recent – but speculative – plans to even aim for 12m-13m barrels per day by 2030.

Source: OilPrice.com, 4 February 2025.

One way or another, Iraq wants to unlock a lot of growth in its oil production which in turn will fuel further growth in the rest of the economy. After four decades of wars and crises, the country's population is eager for better times.

The AFC Iraq Fund offers broad, diversified exposure and has a track record of outperforming the broader index. It's open to non-US investors from USD 10k, and to US investors from USD 50k. As an alternative investment fund, it requires some more paperwork to invest, but the returns so far have made it worthwhile.

Source: Asia Frontier Capital.

Alternatively, there are a few Iraq-related opportunities listed in London.

The Kurdistan oil plays

Iraq's Kurdistan province was always a story slightly separate to the rest of Iraq, thanks to the semi-autonomous status granted in 1970s and the different composition of its population.

In fact, Kurdistan became so economically successful that some media spoke of a veritable Wirtschaftswunder.

Source: Prospect, 22 August 2012.

Two London-listed stocks give investors an easy option to gain focused exposure to Kurdistan's oil industry: Genel (ISN JE00B55Q3P39, UK:GENL) and Gulf Keystone Petroleum (ISIN BMG4209G2077, UK:GKP). Both companies made a conscious decision to stay invested in the region when other oil companies chose to step aside. There is also Canada's ShaMaran Petroleum (ISIN CA8193201024, CA:SNM) which is part of the well-known Lundin Group.

Initially, their derring-do paid off in the form of sky-high valuations and significant cash flow from their oil wells. The stock of Gulf Keystone Petroleum soared 40-fold during the late 2010s. ExxonMobil reportedly considered a GBP 7bn bid for the company.

The party abruptly ended when the Iraq's national government and the Kurdistan provincial government clashed over an oil pipeline from Kurdistan to Turkey. Baghdad felt it wasn't getting its fair share from Kurdistan's profitable oil sales to Turkey and forced the pipeline's closure.

This moved the share prices of both of these companies even lower, already weighed down by a weak oil price. Still, both continued to generate cash by selling a limited amount of oil locally by truck and at discounted prices.

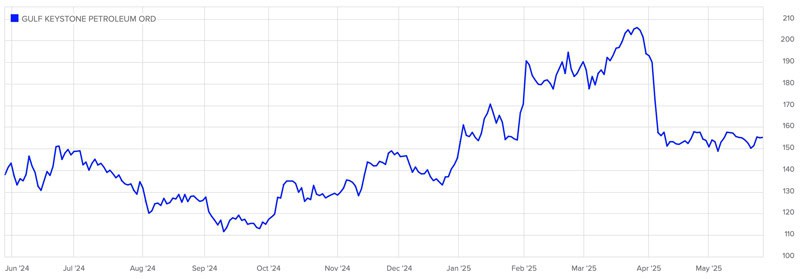

Undervalued-Shares.com Lifetime Members received an in-depth analysis of Gulf Keystone Petroleum in December 2023. At the time, the stock was trading for little more than its cash reserves, and it promised tremendous upside if (or when) the pipeline to Turkey got reopened. The stock doubled in value because of ongoing talks about the pipeline, but it has recently given up some of these gains because of the low oil price. (Now is probably a good time to revisit this opportunity.)

Gulf Keystone Petroleum.

The same might also hold true for Genel and ShaMaran Petroleum.

Besides, there is one truly high-octane investment opportunity – pun intended.

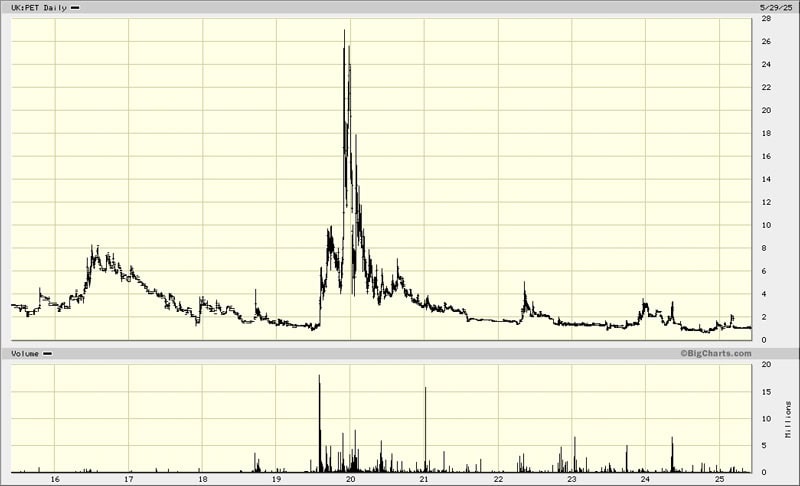

Oldie but Goldie – Petrel Resources

One story long-standing readers will recall is that of Petrel Resources (ISIN IE0001340177, UK:PET). The Ireland-based, London-listed company was the first publicly listed firm with an ambition to move into Iraq. I first reported about it in the early 2000s, just before the Second Gulf War, when it was a little-known penny stock.

When the war's invasion phase ended in 2003, Petrel Resources advanced its plans for oil production and exploration in Iraq through reviving a dormant oil field and exploring for oil in the country's underdeveloped Western desert.

Because of the tremendous upside of these plans, the stock went up 50-fold.

Despite ongoing efforts, however, Petrel Resources never managed to execute its plans, and the share price eventually fell back to its original level.

Petrel Resources.

During the 2010s, the stock mostly flatlined, with only occasional brief spikes.

As a penny stock with seemingly blistering potential, many of these short-term recoveries saw the share price multiply several times over. E.g. in 2019 it became the AIM market's best-performing stock, soaring 1,700%. Yet again, the market was hoping for the plans in Iraq to go ahead. Yet again, the hopes were dashed, and the share price crashed back down.

Petrel Resources.

Will Petrel Resources ever come good?

Some say the company serves to enrich its directors rather than shareholders. Others point to BP's example, which despite its financial might and political connections also needed until 2025 to finally succeed with projects it started in the early 2000s.

Interestingly, in 2022, two directors, John Teeling and James (Jim) Finn, bought out another group of shareholders with a significant stake. Teeling now holds 15% and is the largest shareholder, Finn comes 7.4%. In March 2025, investors subscribed to a small share placement to provide operating capital, priced at 1.05 pence with a two-year warrant for another share at 2 pence.

With 207m shares outstanding and a share price of 1.1 pence, the company's market cap stands at just GBP 2.28m (not a typo!). Once again, Petrel Resources is an absolute minnow with minimal trading liquidity and little investor attention.

Now that BP has closed the loop on a 23-year-circle, can Petrel pull off something similar?

As reported on 6 March 2025, the company is in conversations with the Iraqi government to assess new projects in Iraq:

"The security situation in Iraq continues to improve, while an investment slow-down since 2014 has led to potential improvements on contract terms which should improve scope for development

Petrel has recently submitted an application to assume an existing contract east of Baghdad:

- 4th bid round award in 2012, at a remuneration per barrel of $5.38.

- Block 8 covers 6,000 km2 in Wasit and north-eastern Diyala.

Petrel has previously conducted a Technical Cooperation Agreement on the Merjan oil-field in west-central Iraq, in a 50% partnership.

…. Discussions may also cover Petrel's past studies on the Merjan-Kifl-West Kifl area, and the Mesozoic and Paleozoic potential of the Western Desert."

Would any such project be viable given the current weakness of the oil price?

A recent article in the Wall Street Journal revealed an interesting development: ExxonMobil and Chevron are in a legal stand-off over an oil field in Guyana. This unprecedented dispute has has stunned the oil industry. Why the fuss, some observers wonder?

The Wall Street Journal has the answer: "What it highlights is how valuable big, low-cost oil fields really are in a world where it's getting harder and harder to find them".

Iraq is THE jurisdiction for such low-cost, major oil fields that are underexploited or even awaiting discovery. Oil majors will be interested in securing them, and they won't worry about short-term oil price fluctuations. At only USD 3 per barrel, oil production in Iraq would be profitable even if the oil price continued to fall further.

Could Iraq experience an oil boom like the one unfolding in Guyana? And does Petrel Resources stand any chance of securing a slice of that cake?

With two decades of experience, an established network, and a history of engaging with the authorities, the company undoubtedly has some value. Its management owns a combined 20%, and its AIM listing could raise further funding if necessary. As news about Iraq's developments spreads, interest is likely to grow.

Petrel Resources now has an office in Iraq again. When I recently reached out, the company described its current conversations in Iraq as "sensitive".

Petrel Resources is what I call an "intelligent lottery ticket". With Iraq's oil upside, someone punting GBP 1,000 (or GBP 5,000) could make enough money to buy a small car, or even a cheap apartment – or lose everything. Still, the odds of a positive outcome are far better than a lottery ticket.

With its low market cap, another hype could send the stock soaring 5-, 10- or even 20-fold.

Will we see yet another Petrel mini-hype? You be the judge.

Iraq is coming in from the cold

I have a strong feeling that we'll be hearing a lot more about investing in Iraq throughout the rest of the 2020s.

I had planned travel there this year and report from the ground, but it wasn't concerns about safety that stopped me. Iraq remains on the US ESTA blacklist. I could visit Iraq but would have to forfeit my ESTA visa, which is too much hassle.

However, work is underway to resolve this issue. Tourism is already picking up, mostly with domestic visitors, but international interest is growing. As the Financial Times noted in a March 2023 travel feature: "On the 20th anniversary of the US-led invasion, tour operators are returning to the country and – despite official warnings – their trips are selling out."

If the visa issue became easier, Iraq could see many more visitors, boosting its profile as an exciting place to visit or even invest in.

To help folks like myself, the Iraqi tourism authorities have recently engaged with the US government about the visa problem.

Source: Iraqi News, 25 May 2025.

Will there be an Undervalued-Shares.com reader trip to Iraq someday?

Time will tell. In the meantime, Iraq-related investments are poised to do well as the gap between perceived and actual risks narrows.

Out now: A forgotten leader in European finance – poised for a comeback?

European finance stocks rarely get investors excited – but that's exactly where the opportunity lies.

These stocks may seem dull, but with the right catalyst, they can deliver exceptional returns.

The stock featured in the latest Undervalued Shares report – out this week – offers one such opportunity.

Once priced at a premium, it is now valued at its lowest multiples since the Great Financial Crisis, despite strong fundamentals.

What's holding it back? A good shake-up – which already seems underway.

Out now: A forgotten leader in European finance – poised for a comeback?

European finance stocks rarely get investors excited – but that's exactly where the opportunity lies.

These stocks may seem dull, but with the right catalyst, they can deliver exceptional returns.

The stock featured in the latest Undervalued Shares report – out this week – offers one such opportunity.

Once priced at a premium, it is now valued at its lowest multiples since the Great Financial Crisis, despite strong fundamentals.

What's holding it back? A good shake-up – which already seems underway.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: