My network of readers has become an invaluable source of investment ideas. Even if you don’t attend my reader events, you can still benefit from their insights.

Lower Manhattan as a product – is it working yet?

When I featured Seaport Entertainment Group in a research report in March 2025, its stock was as out-of-favour as they come.

It has since risen up to 39%.

But how does its real estate portfolio actually stack up?

To find out, I spent seven consecutive days visiting its facilities – a Peter Lynch-style test of the product itself.

Here are my findings.

Yours truly getting into the New York vibe.

Investing when cities are down-and-out

New York has faced a number of challenges recently:

- A glut of empty office space following the pandemic.

- Spiralling crime rates, driven in part by factors like police defunding.

- Residents (and companies) relocating to more business-friendly states, such as Texas.

These trends have impacted real estate values, as well, leading to a bifurcated market for office space.

To be clear, cities are never a single, uniform real estate market – they're made up of countless micro-markets. In New York, some of these micro-markets have recently begun to show early signs of a potential resurgence, as highlighted in a recent article by the Financial Times.

Source: Financial Times, 25 August 2025.

Within New York, Lower Manhattan is its own universe. What used to be the Financial District is now rebranded as "FiDi", an allegedly up-and-coming residential area where large office buildings are being converted into apartments. I covered this trend in detail in my February 2025 Weekly Dispatch "How to invest in iconic New York real estate".

There is one company that gives investors focused exposure to the fortune of this neighbourhood: Seaport Entertainment Group (ISIN US8122152007, NYSE:SEG).

The company owns a real estate portfolio of which 90% is located in Lower Manhattan. It was spun off from a much larger, now-bankrupt property holding and listed as a separate entity. The remaining 10% of the portfolio consists of assets in Las Vegas.

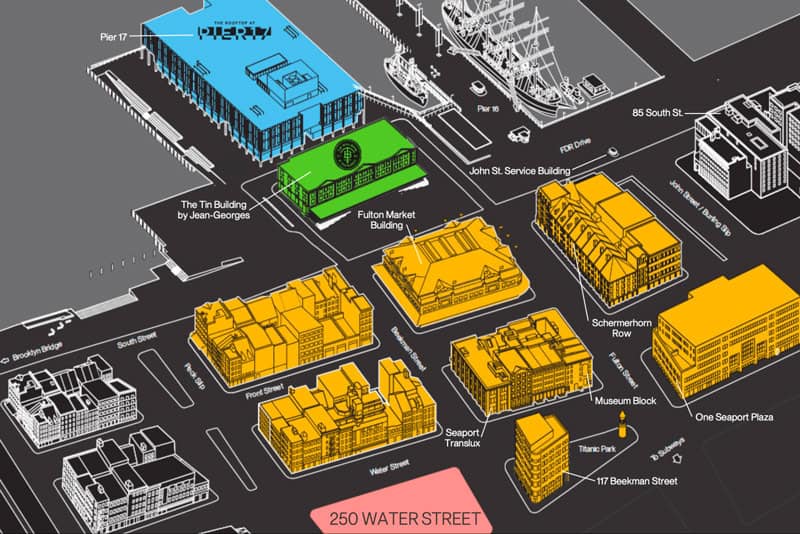

As the name suggests, Seaport Entertainment Group owns much of the South Street Seaport – a district on the East River with views of the Brooklyn Bridge to the east and located about a ten-minute walk from Wall Street.

Think restaurants, retail space, offices, and event space.

Formerly known as "Pier 17", the neighbourhood was rebuilt after suffering extensive damage during Hurricane Sandy in 2012.

Completed in 2018, the development's early operation was disrupted by the pandemic lockdowns. In the years since, the area has struggled with office vacancy rates above 20%. Efforts to transform the former Financial District into a vibrant residential hub have taken longer than expected.

The South Street Seaport also suffers from being slightly out of the way. It's a ten-minute walk from Fulton Street subway station – and it's not on the route to anywhere else. Footfall was a major problem, and the portfolio was initially losing money by the bucketload.

Is there any real prospect of that changing?

During a ten-day stay in New York this August, I once again based myself in FiDi. This time, though, I made a point of visiting the South Street Seaport for seven days in a row, acting as a customer of Seaport Entertainment Group.

What did I find?

My seven-day test

Writing about cities and neighbourhoods is always a controversial, highly subjective business. Large cities are often just collections of villages, and many residents will think of their village as the best.

I'm not even a proper resident, so what could I possibly know?

Granted, what I did was anecdotal at best.

Still, here are my notes on what I found.

1. Footfall

Getting enough people to use its facilities probably remains Seaport Entertainment Group's primary challenge.

On previous visits, it had always been apparent that the small neighbourhood and its facilities did not have enough visitors.

That seems to be changing, at least to some extent.

The company has most recently been run by entertainment executives. Running events in the area was long viewed as the most likely way to succeed in convincing New Yorkers to make the effort and visit. The mix of events for local residents and people coming from further away to attend bigger events seems to address the footfall issue.

My verdict: there is room for further improvement, but the recent uptick indicates that momentum is building.

2. Tin Building

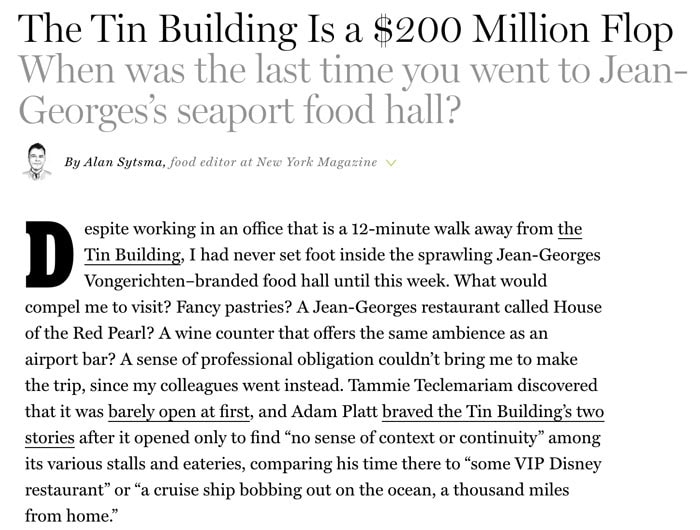

The so-called Tin Building is Seaport Entertainment Group's most infamous asset.

Rented out to restaurateur Jean-Georges, the historic building was turned into a mixture of Harrods Food Halls combined with restaurants and cafes.

It famously loses tens of millions of dollars each year, even now.

Source: Grub Street, 15 January 2025.

The numbers speak a clear language: this space needs a rethink.

The Tin Building's T Café seems to be an ever-busy neighbourhood hub, and it's one of my favourite spots in Lower Manhattan to combine laptop work with a bit of people-watching. Beyond that, though, the rest of the building has never quite come together. Even I found it hard to justify trying the various restaurant options, and as a grocery shopping destination, it is too far out of the way to be convenient.

While there seems to be a modest uptick in footfall, it's palpable that the building's concept remains fundamentally misaligned with market demand.

My verdict: the Tin Building continues to pose a significant challenge. Figuring out what to do with it won't be straightforward – any repurposing could lead to a one-off loss and costly refurbishing.

3. Events

Events can be the kind of unique, compelling reason for people to get on the subway and travel to other parts of the city. Once there, they often spend money on multiple things, such as a pre-event meal or purchases in nearby shops.

The South Street Seaport has "The Rooftop @ Pier 17" as a destination for concerts, fashion shows, and other events. Such spaces are rare in Manhattan, and its riverside location – with views of the New York skyline and the Brooklyn Bridge – is a major strength.

There are obvious additional optionalities in the portfolio – for example, promoting the Seaport Racquet Club for special events during the US Open tennis tournaments.

The South Street Seaport was a popular destination in Lower Manhattan during the 1990s, so its distance from the subway shouldn't be seen as an insurmountable hurdle.

My verdict: Seaport Entertainment Group is making a commendable effort to market events, which must already be impacting footfall. I expect management to continue ramping up these efforts, and to do so successfully.

How about the stock as investment?

When I published an in-depth analysis of Seaport Entertainment Group for Undervalued-Shares.com Lifetime Members in March 2025, the stock was trading at USD 20.20. My subscribers were subsequently able to get in for as low as USD 18.

The share price has since risen to an intraday high of USD 28, and currently sits at USD 25. The days of buying the stock at rock-bottom sell-off prices are probably over for good. When I first wrote about it, New York real estate was largely dismissed by investors, but perceptions have been changing rapidly. As The Wall Street Journal wrote on 17 August 2025: "The New York City office market is recovering from its pandemic debacle faster than any other in the U.S.".

Case in point, Seaport Entertainment Group recently sold a non-core property in the neighbourhood, generating USD 150m in cash. As a result, it now holds a large amount of cash, relative to its market cap.

The company's valuation multiples are (still) almost too good to be true. For the full breakdown of the underlying metrics and my updated assessment, you'll need to become a Lifetime Member.

Or, you can do your own research the way I did it – sift through company reports, talk to knowledgeable analysts who've followed the stock for a while, and make an onsite visit to see the situation firsthand. Beyond trusting my instinct on when to publish these in-depth research reports, I'm really just piecing together publicly available information.

The days of buying Seaport Entertainment Group stock at fire-sale prices are unlikely to return. The real question now is: where does it go from here?

As for me, I am a long-term believer.

FiDi has its challenges, and transforming a neighbourhood from nearly all office space into an attractive residential area inevitably doesn't happen overnight. Still, there is a specific reason why I'm convinved it'll happen eventually.

FiDi is currently a bargain within the New York real estate market. In a city with spiralling costs of living, being able to save 20-30% on rent while enjoying great transport links will attract more residents.

Honestly, if I had a reason to move to New York, I'd probably put down roots somewhere around the area. One Wall Street – the new residential development – would arguably be a suitable address for an investment writer like me. The developer struggled financially with the project, so relatively speaking, I'd be getting a bargain.

As more people move into FiDi, footfall in the South Street Seaport area will naturally increase.

An ongoing recovery of the portfolio could see the share price reach USD 54 by 2027. If FiDi re-rates on a broader scale, the stock could climb to USD 100 by the end of the decade. These figures are explained in more detail in my full report, which also highlights a "forgotten" asset in Las Vegas – a true wild card. Some believe the value of this single asset could eventually exceed the valuation of the entire company.

That said, don't take my word for it, and don't put too much weight on my anecdotal onsite assessment.

The real biggie of the story may be the company's main shareholder: hedge fund billionaire Bill Ackman, who holds a 38% stake.

Who better to follow with an investment than an investment-savvy New Yorker who made his fortune by buying undervalued opportunities?

An asymmetric opportunity

London's AIM market is far from straightforward. Many brokers don't even offer access. Transparency is often lacking. And many stocks go unnoticed.

But that's exactly where the most compelling special situations emerge.

The latest Undervalued Shares report uncovers one such overlooked stock.

With upside of at least 50-100%, it's an asymmetric opportunity you won't want to ignore!

An asymmetric opportunity

London's AIM market is far from straightforward. Many brokers don't even offer access. Transparency is often lacking. And many stocks go unnoticed.

But that's exactly where the most compelling special situations emerge.

The latest Undervalued Shares report uncovers one such overlooked stock.

With upside of at least 50-100%, it's an asymmetric opportunity you won't want to ignore!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: