My network of readers has become an invaluable source of investment ideas. Even if you don’t attend my reader events, you can still benefit from their insights.

Metals Exploration – when patience and perseverance pay off

In 2021, I wrote about Condor Gold when its share was trading at 46 pence. My research report highlighted the London-listed gold exploration and development company as a potential takeover target with 3x upside.

Instead, the stock dropped by two-thirds due to US sanctions on Nicaragua and concerns the project couldn't be financed. No bid emerged.

I stuck to my guns, and in late 2023 called to aggressively average down. At the time, the share price was trading between 15-22 pence.

Fast-forward to late 2024, and a takeover bid by Metals Exploration changed the story. Shares of the newly merged company are now trading at an equivalent price of 85 pence for Condor Gold, a 4-bagger from my 2023 recommendation.

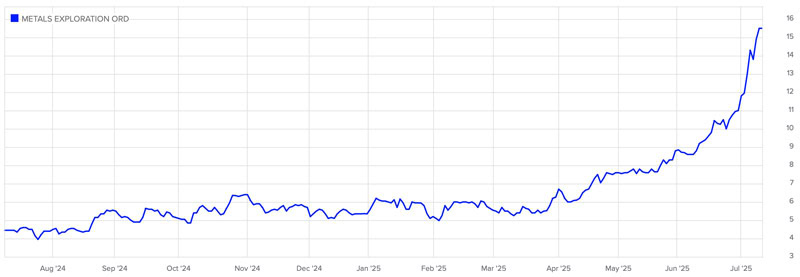

It's remarkable how quickly the share price took off.

Why did it go vertical? Could there be more gains to come – and which other stocks might also prove to be lucrative late bloomers?

Metals Exploration.

The saga of Condor Gold

In the history of Undervalued-Shares.com, there are a few research reports where you could say I was stubborn.

Eventually, your name gets closely associated with a company – for better or worse!

In the case of Condor Gold, I did go in rather deep. It wasn't so much stubbornness but what I perceived to be a fact-based analysis and solid reasons to stay invested even at times when the market did not agree with me.

Condor Gold was working to develop a gold resource in Nicaragua. I had been following the company since the late 2000s, and been to the country several times.

Additionally, its CEO happened to be one of my neighbours in Sark. We have joint friends, and I even know some of his family.

This long-standing, broad exposure to the subject matter gave me confidence. Everything seemed aligned for me to make an informed call on the company's fortunes.

However, as happens, the stock market did not initially agree. The share was trading at 46 pence when I published my in-depth research report for Undervalued-Shares.com Lifetime Members in January 2021. It subsequently went up to 63 pence but then trended lower, eventually at 15 pence due to an open offer to all shareholders, allowing them to participate in a financing at a low share price.

In December 2023, I made no secret of my belief that it was the right time to double down (or even triple down).

The takeover saga then dragged on AGAIN, because an expected bid from a Canadian mining company did not materialise.

Instead, another London-listed junior miner spotted its opportunity to make a move: Metals Exploration (ISIN GB00B0394F60, UK:MTL) launched a bid that offered 9.9 pence of cash, 4.0526 shares of Metals Exploration, and up to 11 pence in additional cash subject to certain key performance indicators being met by the newly merged company ("contingent value rights", CVRs). At the time, this added up to 44 pence per share of Condor Gold.

Not bad, but it was merely the price at which I initially wrote about Condor Gold. It did not yet include a payoff for the time investors had waited, and I felt strongly that it didn't reflect the potential cash flow from exploiting the gold reserve/resource in Nicaragua.

Last but not least, the shares of Metals Exploration seemed cheap relative to the cash flow that the company was generating from its existing mine in the Philippines.

"Why sell now?", I thought – and told everyone to stick to their guns.

I am so glad I did.

The share price of Metals Exploration recently soared in a way that is remarkable, even when compared to the increased gold price. Trading volume has been notably heavy, indicating something may be afoot.

Why did the share take off in quite such a way, and could there be more gains to come?

Adding to its potential – and then some

When Metals Exploration made a move on Condor Gold, it did seem a bit like an act of desperation.

The company had turned around the Runruno gold mine in the Philippines, but that mine's gold reserves were about to run out in 2027.

To stay in business, Metals Exploration needed a new resource.

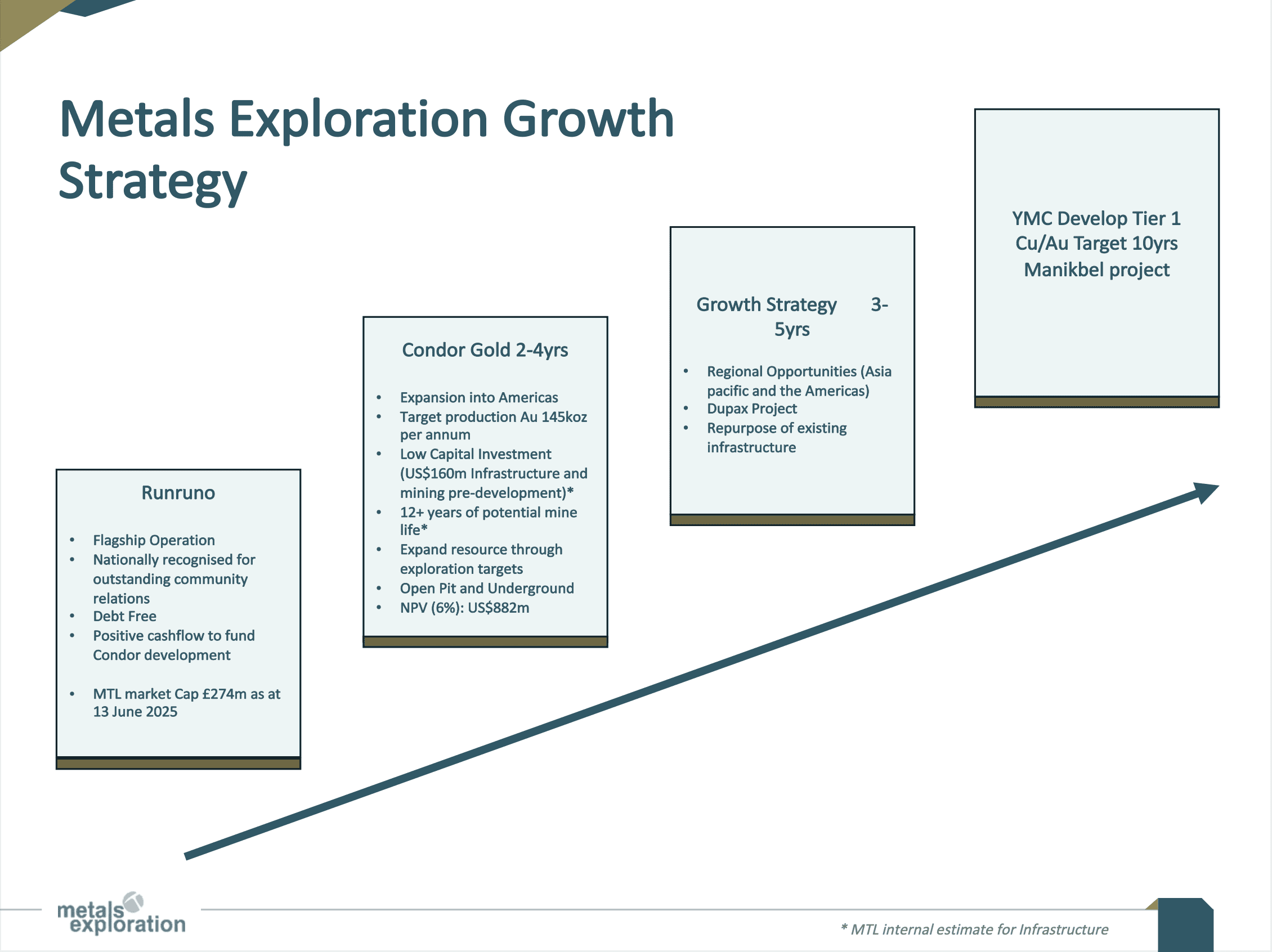

With Condor Gold, it purchased a gold district in Nicaragua that had a reserve of 2.4m ounces of gold and an initial production target of 145,000 ounces of gold annually. Its reserve could increase further if additional exploration work turned out successful.

Condor Gold, in turn, had spent years not only exploring this resource but also engaging the local community, securing permits to construct and operate the mine, acquiring land, and completing a bankable feasibility study. What it lacked was the funding or the experience to bring it into production.

Joining forces with Metals Exploration intuitively appeared to be the right decision. Condor Gold's CEO had negotiated a deal that yielded a bid at a 70% premium to the 20-day volume weighted average price of the company's share price prior to the announcement in late 2024. The upfront consideration was approximately GBP 70m. Condor Gold shareholders received 30% in cash immediately and 70% in shares of Metals Exploration, i.e. 34% of the combined company. In addition, the CVRs payment totals up to GBP 22m payable on gold production and for the discovery of additional ounces of gold, providing Condor Gold shareholders with exposure to the project's upside.

After combining the businesses, Metals Exploration gave a convincing presentation to shareholders. The beauty of the deal was that Metals Exploration had no debt, produced 80,000 ounces of gold p.a. in 2024, forecast USD 220-250m in EBITDA for the next two years and could finance the upfront capital costs of a new mine at La India without shareholder dilution. The market took note, a new mine was fully funded.

The current investor presentation of Metals Exploration (click on image to enlarge).

Bringing the La India gold district in Nicaragua to a "shovel-ready" stage had taken years, and now Metals Exploration provided the capital and expertise to fast-track the first production to 2027. A January 2025 research report by Hannam & Partners set a 13 pence price target for Metals Exploration shares post-merger, while the stock was trading at around 5 pence.

The velocity with which the share price subsequently shot past this initial target is remarkable, given that the gold price was only trending sideways.

The Metals Exploration team didn't just advance the existing plans as promised, but they added a further twist to the investment case by acquiring another exploration licence in the Philippines.

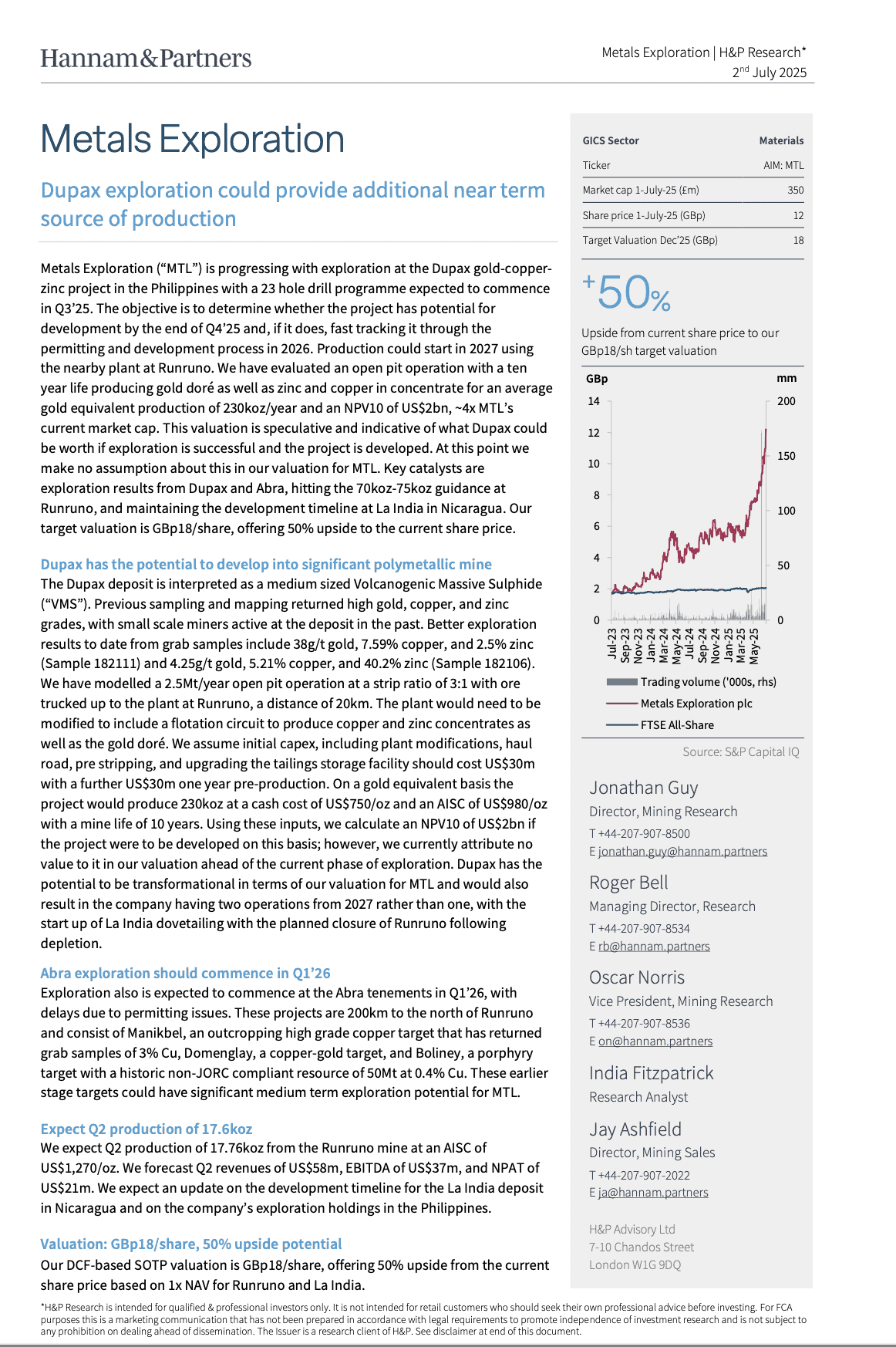

A February 2025 research note by Hannam & Partners described the exploration target in more detail:

"Metals Exploration ('MTL') has identified an exploration target called Dupax within a 3,101ha tenement, located ~20km SW of the Runruno mine site in the Philippines. With an internal estimate of 10Mt to 20Mt, this could extend Runruno operations by several years beyond the currently modelled depletion of the existing Runruno mine in 2027. The proximity of Dupax to Runruno should facilitate development, with ore processed using the existing Runruno infrastructure, while its location within an established mining region could streamline the permitting process. If exploration is successful, the Runruno plant would require re-configuration to process ore. …. The Dupax licence covers 3,101ha and hosts a Volcanogenic Massive Sulphide ('VMS') system, with historical rock sample grades of up to 15.47 g/t Au and 7% Cu."

If successful, Metals Exploration could truck ore from Dupax to a refitted plan in Runruno.

As time progressed, some investors seemed to grow increasingly excited about the possibility of the Philippine operation not ceasing production in 2027 after all. Hannam & Partners produced another research note in July 2025. The Dupax could produce 230,000 ounces of gold p.a for ten years, all-in sustaining cost is assumingly less than USD 1,000 per ounce, and capital expenditure requirements to expand and refit the existing Runruno plan USD 60m. At a gold price of USD 3,000, this operation could add USD 460m in EBITDA p.a., a net present value of USD 2bn when using a 10% discount rate.

While the Nicaraguan projects would have sustained Metals Exploration, Dupax could prove transformative. The combination of the La India project in Nicaragua and operations in the Philippines now charts a path for Metals Exploration to achieve approximately 400,000 ounces of gold p.a., an annual EBITDA of USD 800m from 2028, based on a gold margin of USD 2,000 per ounce. Currently, the company's market cap stands at GBP 450m (USD 600m).

Source: Hannam & Partners, 2 July 2025 (email me for a copy). Click on image to enlarge.

Backed up by such potential, Metals Exploration's share price naturally re-rated to reflect the company's long-term potential.

Of course, when everything looks really good, it might be the perfect moment to sell.

To maintain a contrarian perspective, could this wave of euphoria and the near-vertical rise in the share price make for a good opportunity to take profits?

What does the mysterious Jersey investor know?

To be clear, Dupax is an early-stage project.

There has been no drilling yet, no preliminary economic assessment, no pre-feasibility study, no feasibility study, no permit to actually operate a mine, and no assessment of the findings based on the JORC Code.

There is a very real risk that Dupax could yet get delayed, or even prove a mirage altogether.

That said, other promising indicators warrant attention.

On 9 July 2025, Jersey-based investment holding Drachs Investments No3 Limited announced that it had increased its stake to 20.37%, up from 19.65%.

In fact, despite the rise in share price, Drachs has been upping its stake considerably over the past year mainly by buying shares in the market. In July 2024, the company owned 317m shares representing 18.4% of the share capital (a stake worth GBP 14m at the time). It now owns 594m shares or 20.37% of the enlarged share capital (a stake worth GBP 92m).

Piecing together the few available data points paints an interesting picture. Drachs seems to have deployed GBP 25m in cash since January 2025 – not exactly pocket change!

What does Drachs know to inspire such confidence?

It's a question only insiders can answer.

No one even seems to know who Drachs represents. There are no public records disclosing the ultimate beneficial owner of the entity. Clearly, someone is deliberately staying in the shadows, which only the speculation more intriguing. Presumably, anyone placing such a punchy, illiquid bet on a mining operation must have deep industry experience.

Based on Drachs' representative on the board of Metals Exploration, the investment holding is likely linked to Evans Property Group, a privately-owned, privacy-minded American real estate firm that prides itself as "delivering iconic public and private sector projects, on time and on budget". Presumably, such an investor would have solid understanding of the challenges such as constructing a mine operation, or leasing and operating a large fleet of trucks.

It's reasonable to suspect that a large holder like Drachs, with a representative on Metals Exploration's board, has a clearer view on what the future may hold for the fast-growing company. Given the significant amount of money they've been deploying over months and even at current prices, it's likely they know more that what's publicly available.

From that perspective, the share price should have further to run.

What's an investor to do?

Anyone who bought into this early on should probably pull out their original investment by selling some of their holdings – and then retain the remainder "for free".

Metals Exploration will soon commence drilling in Dupax, and it's worth waiting for these results. If Metals Exploration re-rated as a producer of a future 400,000 ounces of gold per year, the share price could feasibly do another 3x and take the company's market capitalisation to GBP 1.5bn. If this scenario would come to pass, it'd be an equivalent Condor Gold price of more than 200 pence per share.

If gold rises to USD 4,000 or 5,000 per ounce, as some believe it will, all estimates will need to be upped further.

It's worth keeping some of this stock in the portfolio – or look at some other companies that could become late bloomers.

The following comprise some noteworthy cases that could turn out similar to Condor Gold. A long lead time, with a wildly fluctuating price, before things finally work out as expected:

- Burford Capital (ISIN GG00BMGYLN96, UK:BUR) is a litigation finance provider with a gigantic legal claim against Argentina. Following my initial research report in March 2022, matters now seem to finally progress towards a resolution. That share price could 2x or 3x if (or when) this legal claim is settled.

- Company X, an unnamed Belgian enterprise with a world-leading technology for cancer treatment, is on the cusp of expanding into a different area of cancer care. This company has already proven that it can create and market a world-leading product in its space, and it may now do so again. Since my research report in October 2024, the share price hasn't moved much yet. However, this story should eventually catch on and could have massive upside.

- Company Y stands to benefit from the reconstruction of Ukraine. After I featured it in November 2024, the stock quickly doubled. It has since fallen back to its initial price. Will there be a repeat? Every conflict ends eventually, and this may be the smartest way to bet on a recovery of Ukraine backed by a Marshall Plan II. If (or when) it happens, this London-listed stock could turn out to be a multi-bagger.

Timing, timing, timing

Finding interesting investment cases is one thing. Getting the timing right for deploying money and waiting for the outcome is an entirely different matter.

In investing, having a bit of patience is a virtue – provided, of course, it's backed up by research and facts.

For research and facts, you can rely on Undervalued-Shares.com to do the work for you. As for patience, this is something only you can bring to the table.

A P/E of 2.1 and a 43% dividend yield…

… that's what recent analyst estimates assign to a little-known coal miner.

The company's shockingly low valuation levels were already highlighted by Undervalued Shares back in April 2025.

The opportunity featured then is as relevant today. Now is a good time to take a(nother) look!

Even at a P/E of 3 and a 20% dividend yield, this is an insanely cheap stock with decades of profitable production ahead.

If you like a deep-value, high-yield, contrarian opportunity, this one's for you.

A P/E of 2.1 and a 43% dividend yield…

… that's what recent analyst estimates assign to a little-known coal miner.

The company's shockingly low valuation levels were already highlighted by Undervalued Shares back in April 2025.

The opportunity featured then is as relevant today. Now is a good time to take a(nother) look!

Even at a P/E of 3 and a 20% dividend yield, this is an insanely cheap stock with decades of profitable production ahead.

If you like a deep-value, high-yield, contrarian opportunity, this one's for you.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: