Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

The value of going against groupthink

How wrong I was!

With no mobile phone signal, no Internet access, and no visits to human settlements, I was properly cut off from the rest of the world. Upsetting as it was initially, this period off the grid was to prove valuable to my work.

Here is why.

Solo workers vs groups

"Decades of research have consistently shown that brainstorming groups think of far fewer ideas than the same number of people who work alone and later pool their ideas."

This is the conclusion of "Groupthink – the brainstorming myth", a legendary 1958 article from the New Yorker. The article described an experiment performed by researchers at Yale University to analyse brainstorming techniques. 48 undergraduates were divided into 12 groups and given a series of creative tasks to work on, using a popular brainstorming technique. Members of the control group were instructed to work by themselves.

The solo students won hands-down, both in terms of quality and quantity. They not only came up with twice as many solutions, but a panel of judges also deemed their ideas more feasible and effective. The group discussion didn't unleash additional potential, but rather made each individual less creative.

At least under some circumstances, it can be the same with investing.

There are people who can see the truth in spite of prevailing wisdom and make their own investment decisions outside of the influence of others. Through the history of financial markets, some of the world's best traders have been the independent ones, the loners, and the ones willing to discount others' opinions.

One of the most outstanding brave souls of recent times was Michael Burry, who famously shorted the housing market in the mid-2000s. At the time, everyone and their brother believed real estate to increase in value forever. We all know how it ended. Burry's lone journey to success is recorded in the Wall Street classic "The Big Short" by Michael Lewis.

Of course, different things work for different people:

- Some people genuinely thrive by talking through ideas and decisions with colleagues.

- Some problems and challenges are too complex and require a group, a committee, or a network to resolve.

- No human ever lives or works in genuine isolation. For the purpose of this article, the term "isolation" refers to a high percentage of solitary work as part of the overall mix.

Everything has nuances, and no single one approach wins them all. However, the potential financial payoff from individual thinking and decision-making may be higher than ever before.

The age of "permitted opinions"

Groupthink and herd behaviour are something you get to spot in day-to-day life and financial markets in regular intervals – it's not particularly unusual. What's new right now is the societal, practical and even legal pressure to subscribe to some of these views.

If you want a taste of what I am referring to, attend a big-city cocktail party and disagree with other patrons about prevailing wisdom such as:

- "Climate change is set to kill us all, and we immediately need to hand unprecedented power and gigantic resources to career politicians and multinational corporations."

- "Companies that promote women and ethnic minorities based on quotas will perform better than companies that promote staff based on merit."

- "Sex is a social construct, and what determines your sex isn't biology but what you feel like."

Disagreeing with the first example will merely get you ejected from polite society, not going along with the second and third example could make you lose your PayPal account, your job, and quite literally the entire life you've built. "Cancel culture" now runs deep across the entire Western world.

Never before in living memory has there been such a strong movement towards making specific views the only permitted opinion. Increasingly, mechanisms are put in place that are specifically designed to cause tremendous personal costs to anyone who dares to stray from the approved, established narrative.

Notably, what started as a development in the political sphere is increasingly hitting the investment arena. There'll soon be the financial market equivalent of the kind of approved opinions that have crept into everyday life in recent years. If you then continue to subscribe to investment views that are not on the approved list, it could become almost impossible for you to pursue your investment strategy.

It almost got to this stage already. Until the recent (entirely predictable) energy shortages, it had become near impossible to break a cudgel for investing in fossil fuel exploration and production. The situation eased up a bit of late, primarily in light of the extraordinary, hard-to-hide gains that fossil fuel investors have made during 2020/21. Just when the conventional, approved opinion had swung towards calling ALL fossil fuel stocks un-investible stranded assets, did they make a roaring comeback (check back to my Weekly Dispatch "Thungela – 350% quick profit from green insanity"). Still, I am convinced there will soon be an even harder backlash against those who opine that investing in fossil fuels is not just lucrative, but the right thing to do until such time that alternative energy sources are in place in sufficient capacity and with proven reliability.

Read my lips – it's all going to get a LOT worse.

In my estimation, we are only in the first inning of an unprecedented drive to ban certain opinions altogether. Increasingly, this will have direct consequences for your overall investment strategy and your selection of specific investments.

As long ago as 2016, I had warned colleagues in the industry that several subjects would become a victim of enforced groupthink:

- Disagreeing with merits of Modern Monetary Theory: If you have issues with the concept of the "Magic Money Tree" (i.e. the idea that governments can issue as much money as they like without worrying about paying for it with higher taxes or increased borrowing), you could soon be deemed as "upsetting the social order" or some other wishy-washy offence.

Let's get rid of taxes and budgets – the central banks can pay for everything (source: The Conversation, 7 July 2020).

- Choosing to invest in the "wrong" countries: If you want to buy stocks from countries that are deemed unacceptable for one reason or another (such as having the "wrong" government), you could face special fees or taxes, or even see your accounts closed altogether. This used to apply to places like Iran (via sanctions) or Israel (via boycotts movements), but wait for Sweden, the UK, or Poland to be added to the list because their national policies are backing the "wrong" kind of view.

- Portfolio composition not complying with approved values: The government as well as financial institutions could place restrictions on your day-to-day life based on how socially acceptable (or not) they find your investment strategy and your overall portfolio composition. After all, isn't buying airline stocks practically the same as flying excessively?

An exaggerated view, you might think?

We have been moving into this direction ever since, and much of the Western world is probably already much further down that path than you realise. The tools and mechanisms are already being put in place, if they are not even in place already.

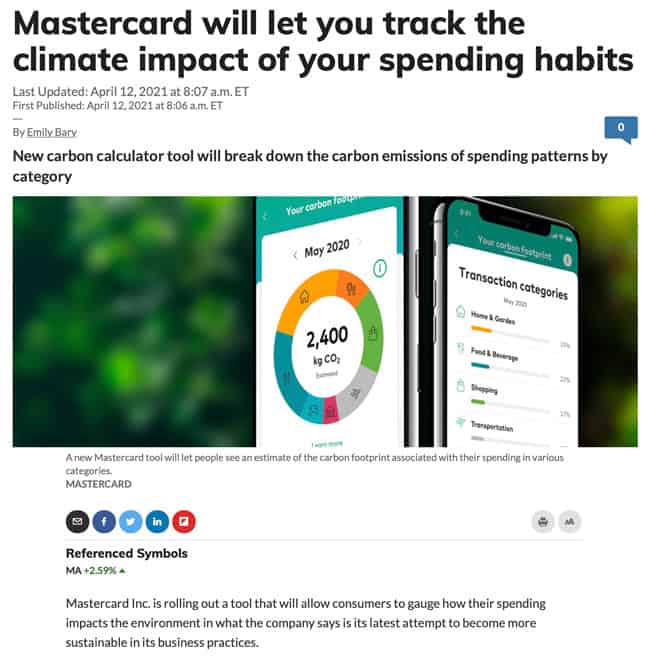

Large credit card companies have already disclosed they are working on automatically adding up the carbon emissions caused by their clients' purchases. Doing something similar for your portfolio stocks is not going to be difficult; the databases to carry out such calculations are already in place. One day in the not-too distant future, you might be allowed to hold fossil fuel-related investments, but as a consequence have fewer social credits for taking airplane trips.

Initially voluntary, eventually it becomes mandatory and linked to social credit databases (source: MarketWatch, 12 April 2021).

These are mere extensions of behaviour-changing measures that have long been pursued in different shapes and forms by governments around the world. E.g., for years the EU has worked towards preventing its citizens from investing in funds that are not issued and administered by EU countries (such as Luxembourg, a country that heavily lobbies in Brussels). If you are an EU-based investor with less than EUR 500,000 to invest, you will have already lost access to certain US-issued ETFs, which limits your choice of investments. Nowadays, bans are often implemented not necessarily through outright prohibition, but through excessive fees, privately enforced "industry standards", and cumbersome withholding taxes (or any combination thereof). It's a new form of government coercion, and a particularly insidious one. An outright ban is visible to anyone, whereas a de facto ban through a range of coordinated, complex steps is easier to conceal and, therefore, harder to criticise.

As to my long-standing favourite point about criticising some aspects of the central bank sector, a ban on that may not be too far down the road either. We have recently witnessed a surprising range of subjects where approved views are already getting enforced in some shape or form. After all, who would have thought it possible two years ago that someone's medical choices could get you into hot water in the way they are doing right now? I have four medical doctors from four countries in my closer network, and all four of them advised me (privately and off the record) that the current coronavirus vaccines should only be taken under specific circumstances. Yet, if I wrote about their line of reasoning, it'd get me banned from popular social media platforms, or worse. It doesn't take much creativity to envision scenarios where central banks will also get special protection against views that go against the core of their interests. If you "misinform" the public about the benefits of the Magic Money Tree, doesn't that upset the social peace and even turn you into a sort of financial terrorist?

Read my lips, central bank policies will be added to the list of subjects where only approved opinions may be distributed. How come? Following the experiences with pesky voters in 2016, the global political establishment needs these institutions more than ever before to pursue its long-term goals without too much direct interference by the public. Central banks now serve as a quasi-treasury for many nations and have become an even bigger hub of political power. They will have to be protected against the public, to prevent something similar to the American public's uproar against central banks in the 1896 presidential election (a subject I'll write about in my upcoming book). Nowadays, if you argue in favour of what until recently was generally accepted basic biology it can get your PayPal account closed down. I fully expect that arguing against central bank orthodoxy will eventually also risk your *bank* accounts getting blocked.

For many investors, the band of approved, acceptable investments that will be practical or even possible to implement is likely to get ever narrower.

Luckily, there is good news. Periods of extraordinary insanity do come to an end eventually, and there is a pot of gold waiting for you at the end of these aberrations.

Michael Burry would be able to confirm this. His insane investment home-run (which made him a cool USD 100m) is something that I am fully determined to make happen for myself (and you, my readers!) another one or two times during my remaining lifetime.

Read on to learn how!

The chicken will come home to roost eventually

The more insane a period of groupthink, the bigger the reward for those who have the guts, the perseverance and the analytical prowess needed for going against the established narrative. Once the current bout of silliness has sucked all oxygen out of the system, there will be a bigger reckoning than ever before. The opportunity to benefit financially from it is what I view as the biggest upshoot of the strange era we currently live in.

Burry was proven right with his view of the housing market, and he became a centimillionaire as a result. He had to withstand ostracising and sidelining for years, but his belief that gravity remained a physical force was eventually proven right. The shock, the surprise!

Personally, I am convinced the current period will not only end one day, but be looked at with ridicule by future generations.

Some of what I am seeing right now does remind me of the financial hocus pocus implemented by the military junta of Burma (today: Myanmar) during the 1960s. The self-proclaimed socialist rulers made their people believe that they could print as much of the national currency as they wanted, provided all bills carried denominations that could be divided by seven. This was going to be spiritually advantageous.

Needless to say, that didn't work for too long and Burma ended up on the list of the world's least developed countries. Even children of kindergarden age would nowadays laugh about this episode, yet the Burmese saw in it the same kind of financial salvation that many now see in Modern Monetary Theory. When someone promises wealth without having to work for it, there will always be a large number of suckers falling for it.

Human nature is littered with such follies, all of which eventually had the laws of nature and common sense catch up with them.

At no point in time would it ever have been a good idea to say:

- "If you have too much debt, simply take on more debt. Whenever that leads to renewed problems, press the repeat button. Continue for all eternity. (Along the way, punish the concept of saving by destroying the concept of interest rates.)"

- "If you are facing an existential problem, give huge stacks of money and nearly unlimited power to career politicians and large corporations. These are the most capable and most trustworthy people into whose hands to place your life."

- "Basic biology doesn't apply to humans anymore."

Yet, here we are!

Friends who lived in the Soviet Union or East Germany tell me that much of what we are witnessing right now reminds them of the dying days of their previous regime. This includes the humour that originated during these periods. Towards the end, Soviet citizens and East Germans cracked jokes about their ruling class and their silly ideas: "What is an 'economic reform'? An injection into an artificial limb."

Indeed, there is a great amount of fun to be had with poking humour about some of what we are seeing today. Ridicule may yet be one of the most potent weapons for dealing with the situation on a day-to-day basis, and with those of your contemporaries who have taken too big a gulp of the Kool-Aid.

The good news is, help is at hand and the rewards for going against groupthink could now be greater than ever before:

- As a result of what we are witnessing right now, entire new business sectors will be created out of nowhere. Emerging sectors that I am currently interested in include:

- Financial mechanisms that can operate outside the realms of political control, which could originate from the crypto-currency / blockchain / De-Fi movement or something else that no one else has thought of yet.

- The concept of "Privacy as a Service", where companies offer entire suites of new products that offer genuine, effective privacy.

- The rush of capital to countries that are refusing to join the insanity, or which may even turn it into a business not to be part of it.

If you missed out on investing in biotech in the 1990s and tech in the 2000s/2010s, there should soon be a whole range of new sectors emerging where you'll get the chance of investing at the ground floor level.

- The more the investment industry piles into a theme, the higher the rewards for those who take the opposing bet once the tide turns. Burry be my witness. Based on that alone, financial instruments and strategies that can be used to be against the consensus view should be given particular attention. What sort of financial instrument does one need to look at? I am planning to look into this question in more detail over the coming months (ideas welcome!), and share the outcome with my Members.

- Ostracism and social isolation are eventually followed by: "He/she was right all along – what a genius!" The housing market crash is now 13 years in the past, but Burry's reputation continues to benefit from the one on-target, brave call he made back then. If you get ONE major call right, you'll continue to benefit from it until the end of your life, and on multiple levels.

Put another way, this period of unprecedented pressure to go along with groupthink and approved narratives also offers unprecedented opportunities for doing things differently in an informed way.

Resist the groupthink

Original thinking and straying from prevailing wisdom were already difficult enough, even without cancel culture and the culture war. Those six days of Internet isolation on the high ocean made me realise that the only things I truly care about are freedom and exploration. There is no threat of punishment that could ever convince me not to explore and write about something that I believe someone should explore and write about.

Without access to the web, I finally had the time to put these thoughts into writing. And I will continue to action this idea from here onwards, now more than ever. Upcoming Weekly Dispatches and in-depth research reports for my Members are going to look into very practical aspects:

- Which sectors and specific stocks are mispriced because of the overall situation? Fossil fuel stocks are obvious ones, but what else is out there that isn't obvious (yet)?

- Which emerging new business sectors should you invest in to benefit from these developments? How can you get in on these sectors before they are more widely discovered?

- How can you ensure that you remain able to invest in anything you like without punishments such as social credits, punitive taxation or societal cancellation?

I do admit that I am somewhat flabbergasted how much of the finance industry has recently given in to this dangerous kind of groupthink. If anything, my industry should be the home of the Navy seals of reason, instead of further promulgating some of the hogwash that is currently peddled everywhere. Then again, as I wrote above, these circumstances simply make the available opportunities even bigger.

Speaking of which, here is an idea you might be interested in…

Crisis investing in Argentina

Who dares to put even a penny into Argentina, one of the world’s most out-of favour stock markets?

Those going against groupthink! Argentina offers some of the world's best investment bargains, and its latest crisis will actually make for a huge opportunity.

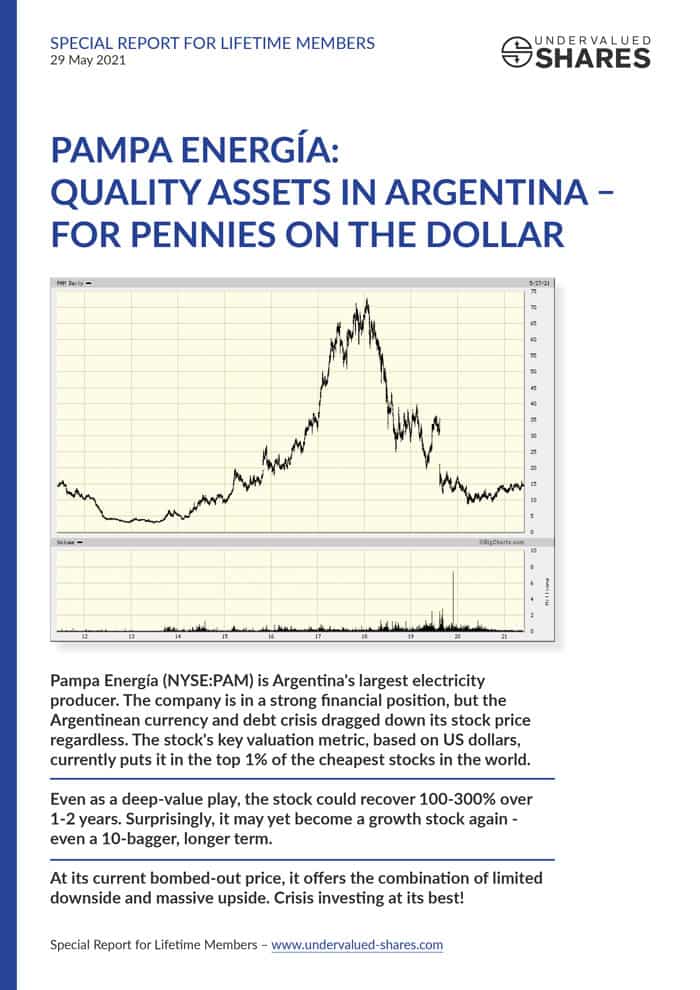

Meet Pampa Energía, a stock that should be a no-brainer investment. If you like buying the dollar for 10 pence, you will love it!

Crisis investing in Argentina

Who dares to put even a penny into Argentina, one of the world’s most out-of favour stock markets?

Those going against groupthink! Argentina offers some of the world's best investment bargains, and its latest crisis will actually make for a huge opportunity.

Meet Pampa Energía, a stock that should be a no-brainer investment. If you like buying the dollar for 10 pence, you will love it!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: