Emaar Properties’ stock has already multiplied several times. What potential remains, and which other contrarian investments merit attention?

UK real estate stocks – so ‘dead’ it’s time to invest?

Image by Andrei Antipov / Shutterstock.com

Brits are said to be born with a brick in their stomach.

But today, the long-held belief that property is a one-way bet is being shattered.

Could this be the moment of maximum pessimism – and a time to take a closer look at Britain's listed real estate groups?

Brits feeling gloomy

You know sentiment is dire when one of the country's leading real estate media personalities publicly declares: "The property market is dead."

So said Kirstie Allsopp, longtime TV presenter of "Location Location Location".

As The Telegraph reported on 24 September 2025:

"Last month, a raft of proposals around property taxes were revealed, which Allsopp said has led to stagnation. 'The market has stopped. It's dead... Nobody is moving. Everyone is waiting. Rachel Reeves threw a whole load of kites, leading to paralysis. I've never seen the market like it.'”

Allsopp was primarily referring to private residential property owners, who are now facing the delayed reality of higher interest rates. Millions of heavily indebted households took out cheap, fixed-rate mortgages when borrowing costs were at rock bottom. These deals are now expiring. Borrowers who locked in mortgage rates below 2% must now refinance at levels north of 4%.

To make matters worse, real estate owners were facing ever-increasing tax burdens across the board, along with the introduction of a new renters' rights bill.

As a result, a slow-motion car crash is unfolding across Britain's housing market.

It sounds bad, and the sentiment on the ground is truly terrible.

This extends to owners of commercial real estate. British Land, which owns and manages some of the UK's most prominent real estate assets, has sounded the alarm. Its CEO, Simon Carter, recently warned that the Labour government's policies were eroding investor confidence in the UK.

If you follow the media or talk to landlords in Britain, the vibes you pick up are icy.

Contrarian investors will intuitively ask if now is the time to take a closer look at UK real estate and invest via publicly listed stocks.

One man's gloom is another man's bargain

The pain in Britain's real estate market is already becoming someone else's gain.

As the Financial Times put it on 25 August 2025: "Wealthy UAE residents look to snap up prime London property

A depressed prime property market …. has made buying in London more attractive to wealthy United Arab Emirates residents over the past year, according to their advisers. Property agents and tax lawyers told the Financial Times that purchasers included UAE nationals and long-term UK expats, with some looking to relocate and others wanting a foothold in London at decade-low prices."

There is an old truism: "In London, there is always someone looking to get in." At one point, it's wealthy Arab buyers. At another, it's the Chinese or the Russians.

Right now, in commercial real estate, it's the Americans.

Somewhat surprisingly amid the current general doom and gloom surrounding the UK, The Wall Street Journal reported on 14 September 2025: "Apple and Citadel Fuel London Office Boom

Tech and finance companies, many from the U.S., are filling the swankiest spaces in the ancient commercial quarter known as the City

Larry Fink complains BlackRock is running out of desks. HSBC's new tower turned out to be too small. Ken Griffin's hedge fund, Citadel, signed a lease on a building three years ahead of time. The office market in London's ancient commercial quarter – known simply as the City – is booming, fueled by an influx of American law and finance firms, a growing tech scene and demand for the swankiest spaces to lure workers back to their desks.

The boom shows Britain's finance industry has defied fears of a post-Brexit exodus. Despite losing some business and financiers after the U.K. left the European Union, London still hosts by far the biggest banking and capital markets in Europe.

The buoyant market also reflects the district's broadening appeal. For decades the area was a bastion of finance and insurance. Now tech companies – including Apple, TikTok and several thousand smaller firms – vie for space, drawn in part by the prospect of easy access to potential investors.

'London, as a location for international businesses, seems to have really proven its resilience,' said Martin Towns, who runs M&G's $43 billion real-estate business. 'The City has a renewed level of vibrancy.'"

Do any of these developments show up in the prices of listed real estate stocks yet?

Barely!

What's there to invest in?

Among the better known London-listed real estate stocks are:

- British Land (ISIN GB0001367019, UK:BLND)

- Derwent London (ISIN GB0002652740, UK:DLN)

- Great Portland Estates (ISIN GB00BF5H9P87, UK:GPE)

- Hammerson (ISIN GB00BRJQ8J25, UK:HMSO)

- Land Securities (ISIN GB00BYW0PQ60, UK:LAND)

- Segro (ISIN GB00B5ZN1N88, UK:SGRO)

- Shaftesbury Capital (ISIN GB00B62G9D36, UK:SHC)

To name just a few...

Their charts look broadly similar. The ten-year chart below for British Land pretty much sums up where the sector stands.

What could end their decade-long malaise?

Potential catalysts

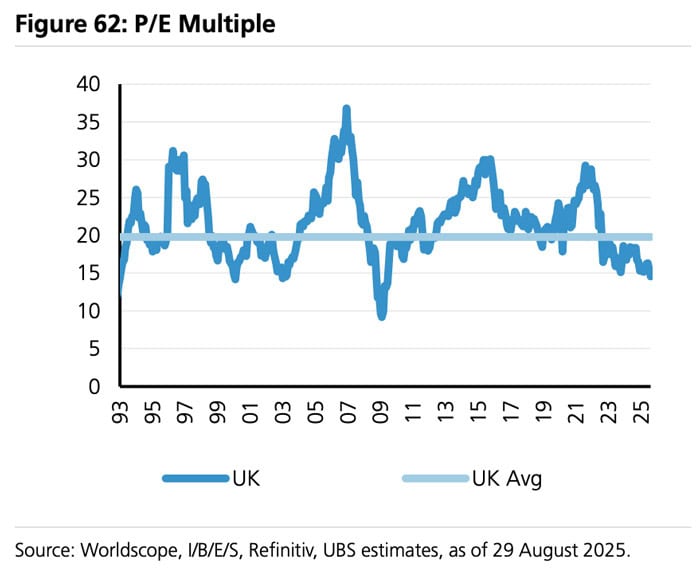

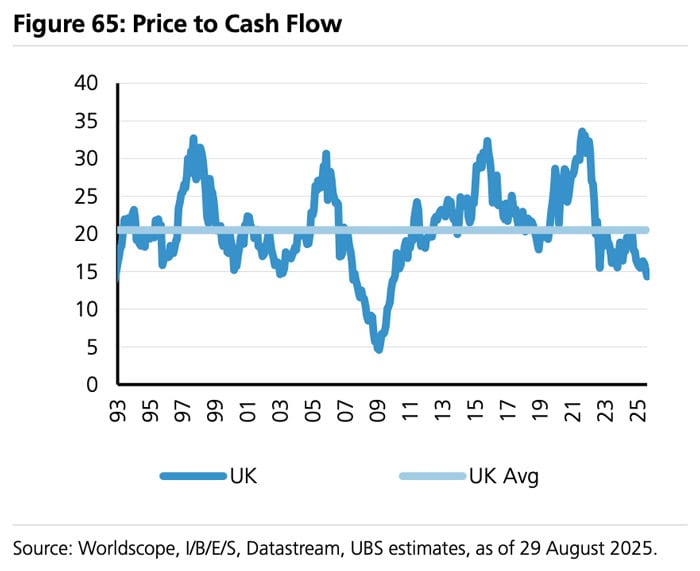

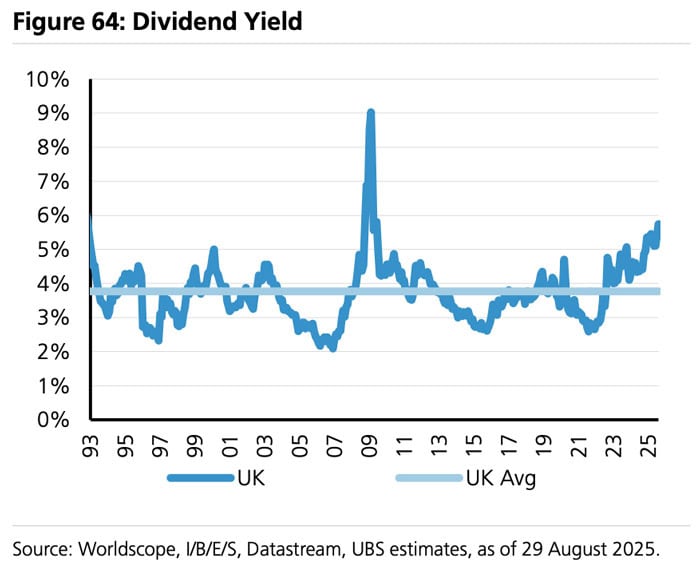

By many measures, British real estate stocks are currently fundamentally cheap. Below are the sector's valuation metrics as of 8 September 2025.

The obvious catalyst could be political change in the UK. This might involve a Labour government changing its leader and following the path Gerhard Schroeder took in Germany in the early 2000s, or an outright change of government. For better or worse, betting markets currently predict Nigel Farage as the next Prime Minister.

Falling interest rates could also trigger a re-rating of British real estate stocks. For a non-consensus view on this possibility, see the recent commentary "Are UK government bonds a generational buying opportunity?" by Marco Pabst, CIO of ARBION, a boutique wealth manager serving a global clientele. Historically, falling interest rates tend to have a strong effect on real estate stocks.

Britain currently offers one of the most attractively valued stock markets globally, especially considering its sophisticated, open capital markets and secure rule of law.

Out now: rebound play

Sky-high debt.

Losses larger than annual revenue.

A "premium" product so unwanted, you couldn't even give it away for free.

The company featured in the latest Undervalued Shares report – out today – has seen some WILD swings.

Just two years earlier, people were falling over themselves to become customers. A dramatic rise – followed by an even more dramatic fall.

Now is the time to take a closer look, though.

The stock could be gearing up for a quick 20-30% gain, with 3-4x potential over the next two years.

A short-term trading opportunity AND a longer-term recovery play!

Out now: rebound play

Sky-high debt.

Losses larger than annual revenue.

A "premium" product so unwanted, you couldn't even give it away for free.

The company featured in the latest Undervalued Shares report – out today – has seen some WILD swings.

Just two years earlier, people were falling over themselves to become customers. A dramatic rise – followed by an even more dramatic fall.

Now is the time to take a closer look, though.

The stock could be gearing up for a quick 20-30% gain, with 3-4x potential over the next two years.

A short-term trading opportunity AND a longer-term recovery play!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: