UK real estate stocks are trading at historically low multiples. Will they ever shake off the current doom and gloom?

Understanding (and exploring) preferred stocks

Preferred stocks can offer attractive returns and may deliver other benefits, such as reduced volatility.

However, the sector is opaque and complex.

What are preferred stocks, what makes them interesting, and what are some sources for specific investment ideas?

A resource by my readers for my readers

"Do you have any examples or case studies of weird preferred stock structures? I am trying to get a better sense of what is feasible in the sector, and what is normal."

Upon receiving this email from a long-time reader, I realised that I knew too little about this particular niche subject of financial markets.

Using my network, I started to gather more information. Today's Weekly Dispatch shares the best of my sector research.

If you have any further interesting intel, please do get in touch. It might lead to a follow-up article (or even a research report for Undervalued-Shares.com Members).

Born out of financial embarrassment

Tellingly, only a small amount of literature exists on the historic origin of preference shares.

However, what is known about their history does make for interesting context.

Some early, scattered examples of preference shares popped up in the late 17th and early 18th century. It was not until about 1800, though, that they gained in visibility. By 1850, over 100 different preference shares were available among British railroad and infrastructure companies alone.

What had led to the booming demand for a new type of stock?

Most of the preference shares came into being due to the financial travails of early transportation companies. Large projects in building railway lines, stations, canals and other infrastructure were often started without adequate understanding of the engineering challenges, making the construction cost exceed expectations.

Enticing investors to provide the additional money needed to finish projects wasn't easy. Many of these projects had already borrowed money to the then legally permissible limit, their shares prices had collapsed, and too many such companies were looking for new investors.

The situation called for a new type of security. Preference shares came with a preferential dividend, which was often initially paid out of the company's capital to offer some kind of attractive "return" until the project was completed, before switching to paying dividends from income. In a way, it was a financial instrument designed to offer investors to have their cake and eat it.

Such placements were often aimed at investors with relatively small means and limited experience with such investments. Selling a "return" that is based on paying out the capital paid in by investors is an obvious contradiction, but many investors were only too happy to ignore it as they felt smart for having found an innovative investment that offered an ongoing return and the upside of a new venture. There was a fair amount of controversy among learned observers and the more informed investors as to whether the issuers of preference shares were, in fact, misleading investors.

An English court spoke: "The expression 'preference shareholder' is ambiguous. The term by no means indicates what are the rights of those to whom it applies." while another critic of the sector said that "preference shareholders are cheated, cajoled and elbowed out of their legal rights."

Some said that issuing preference shares was discriminatory against investors, if not an outright fraud. There were repeated calls for banning them altogether. One excellent book looking at this is the one depicted below, and geared towards the early examples from Britain. Another outstanding historical study is "Preference Shares and Company Finance", published by Dr. L. C. Gupta in 1975 and geared towards the Indian market.

Available as a reprint on AbeBooks.

Many of the more innovative preference share structures offered at the time were dreamt up by desperate entrepreneurs operating in a legal vacuum. The UK's parliament eventually stepped in and, over the course of a few decades, regulated the types of preference shares companies were allowed to offer. Clear legal structure for these types of shares started to emerge, which made them yet more popular.

By 1850, about a fifth of all outstanding share capital of British infrastructure companies was in the form of preference shares. Given that they had been introduced as a device of emergency finance, preference shares did very well with the investing public.

Today, preference shares are an asset class with over one trillion US dollars invested in them.

However, just what they are – and how they function – remains difficult to explain.

Understanding preferred stocks

Preferred stocks occupy a unique space between debt and equity. They carry attributes of both of these asset classes, which makes them so interesting but also difficult to nail down what exactly they are.

Features associated with preferred stocks *typically* include:

- Preference in dividend payments.

- Preference in getting capital returned in the event of a liquidation.

- No voting rights.

However, there are few fixed rules, e.g. some preference shares are given voting rights under specific circumstances.

Why would investors be interested in them? Reasons include:

- Higher dividend yields compared to bonds issued by the same company.

- Dividend safety, because preferred dividends are usually cumulative, which means that skipped payments accrue and need to be paid in full before any distributions are made to common shareholders.

- Diversification benefits, e.g. preferred stocks will have different volatility characteristics than bonds and equities.

Last but not least, why do issuers like them?

- Flexibility in payments: preferred dividends can be suspended without the risk of default, unlike bond interest payments.

- Non-dilution: issuing preferred shares can raise equity financing without diluting existing shareholders (if structured with that aim in mind).

- Regulatory capital: preferred stocks count toward regulatory capital requirements when issued by banks or insurance companies.

As you can easily guess, all of this has led to a tremendous diversity in how preferred stocks are structured today.

On the one hand, it's this flexibility that has made them a successful asset class. On the other hand, it requires specialised knowledge to analyse the sector (as The Wall Street Journal once put it, "Investors don't understand preferred stock.").

Obviously, if there is an asset class that is relatively liquid but complex and understood by only some investors, my ears immediately perk up.

How to learn about this sector?

My archive contains a number of resources, such as:

- "Primer on preferred securities", issued by Bank of America in 2016: although dated, this 24-page document still provides incredibly useful background information to help understand this sector.

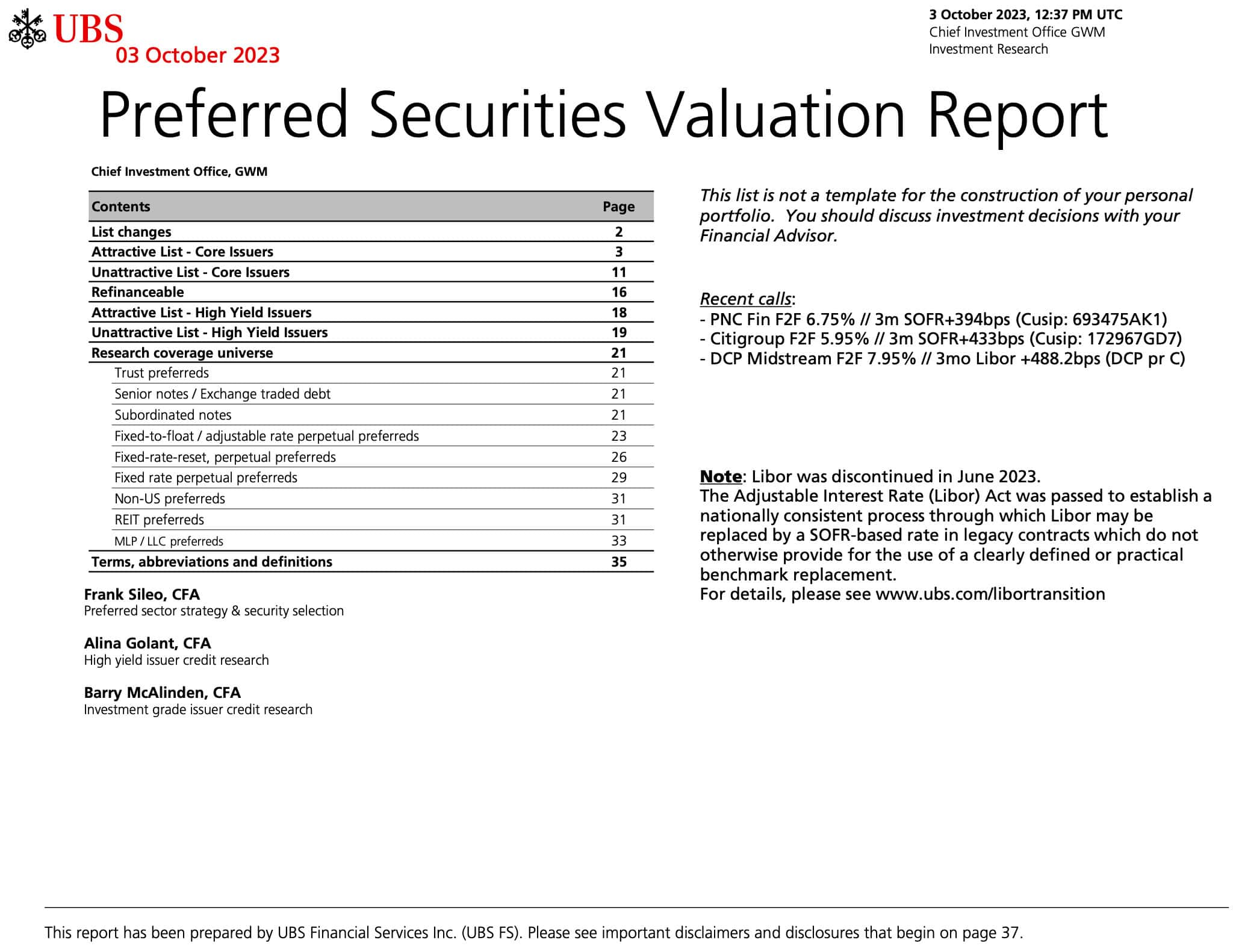

- "Preferreds", issued by UBS in 2024: a 5-page overview of the asset class, which also points out that preferreds are a big thing in the US whereas Europeans like so-called corporate hybrids and AT1 bonds (see table below). Cynics would say it's a case of potato, potahto.

Click on image to enlarge.

If you'd like a copy of these two documents, please get in touch.

For those who want to go really deep, the following specialist books might be helpful:

- "Contingent Convertible Bonds, Corporate Hybrid Securities and Preferred Shares: Instruments, Regulation, Management", published in 2019 by Marcin Liberadzki and Kamil Liberadzki.

- "The Handbook of Hybrid Securities: Convertible Bonds, CoCo Bonds, and Bail-In", authored in 2014 by Jan De Spiegeleer, Wim Schoutens, and Cynthia Van Hulle.

- "The Handbook of Convertible Bonds: Pricing, Strategies and Risk Management", published in 2011 by Jan De Spiegeleer and Wim Schoutens (with a foreword by Philippe Jabre).

Younger readers might have an opportunity to carve out a career for themselves, as preferred stocks are not something that many young finance graduates would naturally go for. Just as in investing, a niche might await those looking to get an edge.

It's also worth noting that preferreds are commonly used by venture start-ups. Many investments in such start-ups are structured as preferred stock that has a liquidation preference and converts into common only upon an exit of the company. This is how venture investors protect their downside risk and maintain equity upside, while also getting more governance rights over the company. In the venture capital context, this is sometimes called "structured equity" or "structuring." It is also why the headline valuation for many venture-backed start-ups don't really represent the value of the company. All of the structure gives the investor much more protection than if they were investing in common shares. The headline valuations are often double what the common would really be worth.

With all these fundamental aspects out of the way, the obvious question remains: how can you actually invest and make money?

Digging for investment ideas

The bad news first, there is no silver bullet solution for anyone looking to invest in preferred stocks.

Difficulties include the differing tax treatment of these securities, depending on which jurisdiction you are based in. E.g., if you are a non-US resident and purchase US preferred stocks, a 30% dividend withholding tax will apply. An entire sub-subject exists on why certain listed (!) US preferreds are primarily held by other companies – they get more optimal tax treatment for dividends paid by preferreds, which makes them a more tax-advantaged owner than an individual investor.

If the complexity of the subject has not yet totally put you off, there are some resources that you can use to invest in the sector:

- Preferred Stock Channel.

- Value Investors Club, with an entire section covering preferred stock.

- Investment bank research (e.g. a comprehensive overview of preferred securities, including valuations and grading the securities, by UBS).

Click on image to enlarge.

- "Preferred stocks explained: what they are and why you should care", by Saxo Bank. For clients, the article contains a link to such securities that can be traded on the bank's brokerage platform.

- "The Best ETFs to Buy Now", by Kiplinger.

- An article on MicroStrategy (ISIN US5949724083, Nasdaq:MSTR) by Barron's, which highlights how three of the company's executives snapped up stock in the recent issue of preferred shares even though they previously shunned the common stock.

This is not an easy sector to invest in – but, as set out initially, it could be all the more interesting for that reason.

196 years after the UK's parliament first granted formal permission to issue preference shares, the sector clearly has come a long way. It's no longer a botched-together emergency funding instrument, but a highly sophisticated, diverse asset class.

If you are willing to put in the work, preferred stocks are an interesting rabbit hole to go down.

P/E of 2.5 and >20% dividend yield with this coal stock

Looking for a deeply contrarian, deep value investment with high payouts and buybacks?

The latest Undervalued Shares research report has one such stock in store for you. It's a coal stock, and it's currently trading at a bargain price.

In fact, it's the second time this stock is trading at such low valuation multiples. It was similarly cheap in 2021 and then soared by 15x.

It's unlikely that you'll see this stock do 15x again, but it should be a relatively low-risk 2-3x when the situation normalises – and you'll get plenty of dividends while you wait.

P/E of 2.5 and >20% dividend yield with this coal stock

Looking for a deeply contrarian, deep value investment with high payouts and buybacks?

The latest Undervalued Shares research report has one such stock in store for you. It's a coal stock, and it's currently trading at a bargain price.

In fact, it's the second time this stock is trading at such low valuation multiples. It was similarly cheap in 2021 and then soared by 15x.

It's unlikely that you'll see this stock do 15x again, but it should be a relatively low-risk 2-3x when the situation normalises – and you'll get plenty of dividends while you wait.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: