Britain offers many unloved, undervalued stocks. Opportunities come from takeover candidates, changing politics, and special situations.

Dead newsletter authors you can learn from

I recently published an article about 50 things I learned during my first 50 years.

It proved phenomenally popular, and had many readers reach out to me.

One reader wrote: "Thanks for emphasising the value of reading old books. In my view, it is THE biggest life hack of them all."

I couldn't agree more – that insight was actually #10 on my list.

Indeed, I have long made it a regular practice to look for inspiration in out-of-print books by long-deceased authors.

Among those that are worth reading are a few of my late colleagues from the investment newsletter industry.

Here are three such voices worth revisiting.

Gerhard Kurtz – 1934 to early 2020s

Many of my older German readers will remember Gerhard Kurtz as the absolute enfant terrible of the newsletter industry – both at home and even globally.

Kurtz didn't just write about investing, although it was a big part of his early career. In the 1960s and 1970s, he wrote for a prominent investment newsletter published from Hamburg and authored books with titles such as:

- "How to make big gains on the stock market with small bets" (1966)

- "How to get to wealth" (1967)

- "How to protect savings against crisis?" (1970)

(All titles translated from German.)

Later, Kurtz created "Geldbrief", literally "Money Letter". This publication changed ownership and remains in publication today from its base in Liechtenstein.

However, the niche publishing company that Kurtz eventually built went far beyond the subject of investing, covering anything and everything that was useful, controversial, or outrageous. Kurtz fancied himself as a rogue journalist on the run from governments who wanted to shut him down and lock him up. To some extent, this was true. In 1993, Germany's powerful SPIEGEL magazine called him an "underground author" (in an article authored by a lady who later became my girlfriend – but I swear all of this was entirely coincidental!).

The 1990 book "218 Tax Havens of the World" is possibly his most impressive, brilliant, and laborious work. I first bought the 194-page book in the late 1990s, and it was as hilarious a read as it was informative. How Kurtz managed to procure all the obscure information contained in this book before the Internet age is quite unimaginable. The only possible answer is that Kurtz travelled SO much that he picked up lots of local intel along the way.

This book is no longer available commercially, and over the years it has become extremely difficult to obtain copies. It deserves to not be forgotten, though, and it's hugely enjoyable if you like the obscure. I thus decided to sacrifice my own copy to have it scanned and turned into a pdf. Drop me a message if you'd like a copy.

Kurtz's genius work (click on image to enlarge).

Kurtz died in the early 2020s. His family tried to keep this private at the time, and (to the best of my knowledge) no formal announcement was made. However, it's now common knowledge in the industry that the "Meister" (as he was known) has hung up his typewriter for good.

This is how Kurtz viewed his work.

I've never met him in person, but we've had a number of friendly phone conversations. Kurtz liked giving me a call, knowing full-well that he was calling me on a landline in... Sark!

The island I still live on is one that Kurtz himself had a fair share of history with. As far back as the 1980s, he advised people to move to Sark and live an anarcho-capitalist lifestyle. It's fair to say that Kurtz truly put Sark on the map.

Who knows, maybe calling a colleague on Sark made him feel like he was talking to his younger self? After all, we both grew up in the same German state, Hesse. Kurtz started his career writing the "Hanseatischer Börsendienst" (= "Hanseatic Stock Market Letter") in the 1960s, a publication that I became the editor of in the 1990s.

Gerhard Kurtz meeting the previous Seigneur of Sark (photo from 1980s).

Those who remember Kurtz today are more likely to associate him with tax havens, buying passports and aristocratic titles (real or fake), and a never-ending quest to find loopholes for almost any aspect of life (such as healthcare).

Kurtz lived out his days in Tenerife, where he could be seen driving around in his Morgan classic car.

What can a private investor learn from him?

The #1 learning from his career probably is that you have to have the courage to venture off the beaten path and swim against the tide.

Case in point, my shared history with Kurtz in publishing a tip on a stock that went up 50fold.

In the early 2000s, I wanted to write about a tiny London-listed company that had positioned itself to do business in the oil industry of Iraq as soon as Saddam Hussein was gone. This was going to require another war in Iraq.

I approached a few publishers in Germany who unisono said: "Quirky story, but too controversial. 'No war for oil' and all that."

In the end, Kurtz published my story in a special report about investing. When the stock went up 50fold, other publications started to cover it after all.

Kurtz never shied away from a controversial idea – indeed, he was drawn to it.

Check back to the story of Adolf Lundin to learn why the ability to invest into extreme situations can be the right investment style for some (though not everyone).

Unlike Lundin, Kurtz wasn't a full-time investor. Instead, his publishing company was his life.

Still, his ability to leave the designated lane and go truly off-road is something that I believe more investors should take to heart.

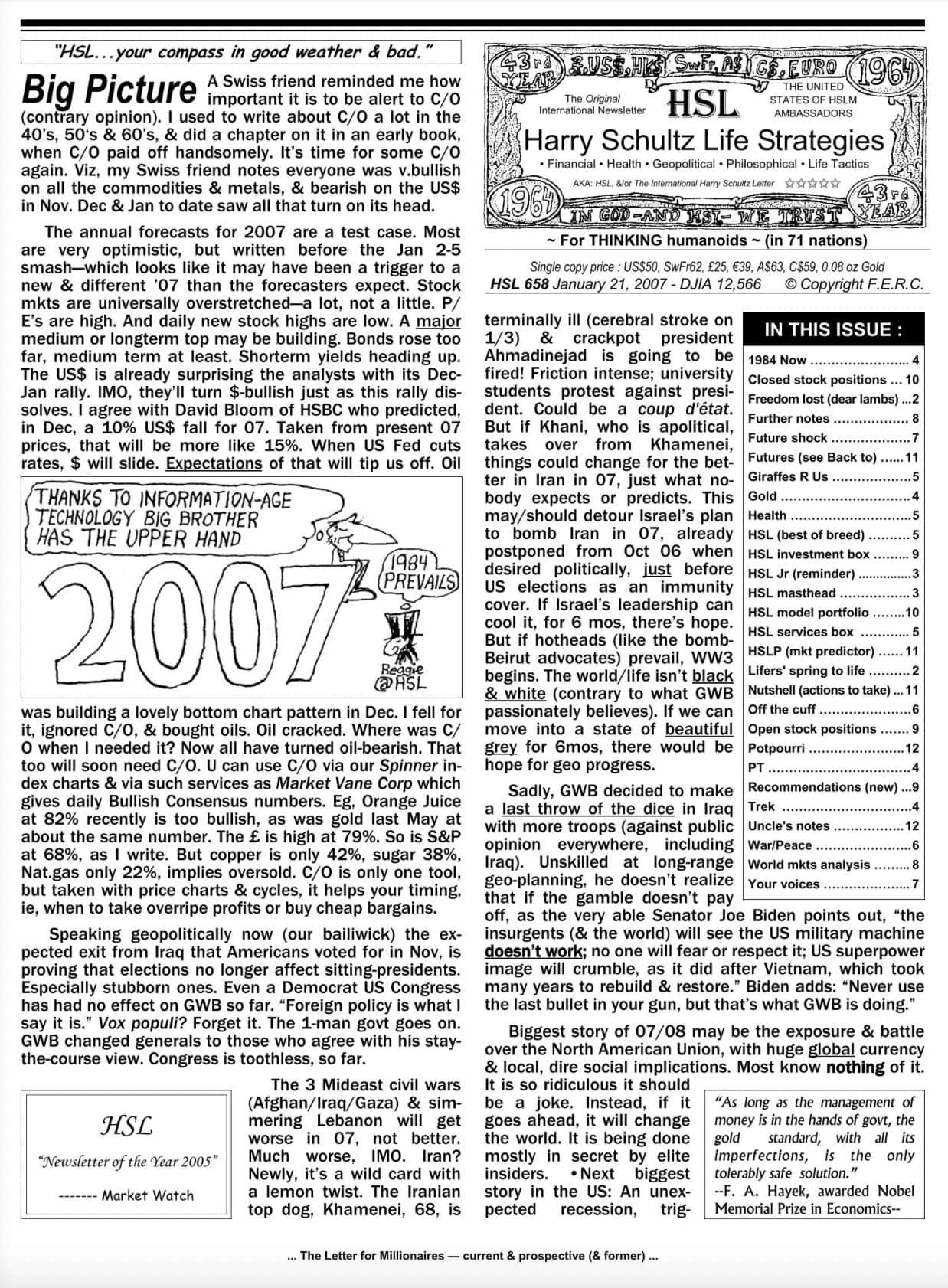

Harry D. Schultz – 1923-2023

If you believed his claim, the late Harry D. Schultz was the world's highest-paid financial consultant. He charged USD 2,000 per hour at a time when such a sum would have bought you a lot more than today. The Guinness Book of Records agreed to list him for this achievement.

Harry D. Schultz (1997).

How had a kid from Wisconsin risen to such global fame?

Serving in the US military during the Second World War and stationed in Asia, Schultz bought and sold shares on the Shanghai stock exchange. This taught him that you could find investment opportunities in foreign, exotic and often crisis-ridden countries.

Upon returning to the US, Schultz used his gains from stock trading to buy a local newspaper. Buying small newspapers, improving their operation and selling them again turned into a real career for Schultz – he did it 13 times!

Since he had to invest and protect his wealth, launching an investment newsletter probably came quite natural to Schultz. In 1963, he published the first issue of The International Harry Schultz Letter, commonly referred to as "HSL".

I first read it while still in high school. The publication ceased in 2011 after 45 years in publication, and only a handful of old issues are available on Yumpu (free download; enter "Harry Schultz Letter" as search term).

Every month, Schultz produced a dense, far-ranging issue covering stocks, gold, commodities, currencies, interest rates, and other topics.

The International Harry Schultz Letter (HSL) (click on image to enlarge).

He also published several books, including:

- "Bear markets: how to survive and make money in them" (1964)

- "Treasury of Wall Street Wisdom" (1966)

- "Handbook for Using & Understanding Swiss Banks" (1970)

- "Panics & crashes and how you can make money out of them" (1972)

- "Financial Tactics and Terms for the Sophisticated International Investor" (1974)

- "Bear market investing strategies" (2002)

For the most part, these publications provide a view into a world that (from today's perspective) seemed simpler and slower.

One of his books, however, proves my point about the value of sifting through old books to discover ideas that will make a comeback – such as the subject of creating new nations, free cities, and sovereign entities which has become quite fashionable again. Folks like Balaji Srinivasen make it appear like they came up with an amazing new concept, when in reality they merely took an old idea and extended it using today's possibilities.

Schultz was already all over the subject decades ago. He funded an effort to establish small libertarian states in the 1970s, and subsequently proposed to dramatically reduce large nations in size because smaller states were better for the people that inhabit them (check back to "On Re-making the World: Cut Nations Down to Size" from 1991).

There really is nothing new under the sun…

Schultz is also the godfather of the legendary "PT" concept, that of being a "Perpetual Tourist" who only ever passes through countries but doesn't have other ties. The idea, originally, was to spend no more than three months in a country so that you were treated as a tourist and not liable for tax.

This later became known as the "five flags" concept:

- Flag One: Where you lived

- Flag Two: Your country of residency (i.e. which passport(s) you held)

- Flag Three: Where your businesses were based

- Flag Four: Where your assets were based

- Flag Five: "Playgrounds"

What's an investor to take home as a learning from Schultz?

The answer is printed at the top of each page of HSL.

HSL wasn't aimed at investing but "Life Strategies".

"Uncle Harry", as Schultz was affectionately known, was the ultimate renaissance man. He didn't just research investments but tried to educate himself about any and all aspects of living a successful, happy life. His readers fuelled his work, and Schultz took them along for the journey.

He wrote about health, avoiding bureaucracy, and how to keep good relations with family – all of which he believed were vital for maximising the returns you can achieve on your investments and also for protecting your wealth.

Given how many people I meet in finance who have an extreme niche talent and don't pay much attention to other areas, I'd say it's a point worth bringing up.

Schultz also wanted people of lesser wealth to read his work and be inspired. At the bottom of each issue, he put: "The Letter for Millionaires - current & prospective (& former)..."

All of this seemingly has gotten Uncle Harry through live rather well.

Schultz married a Princess (or so he claimed.)

According to mainstream media publications like The Times, his subscribers included Richard Nixon, Margaret Thatcher, and the Saudi Arabian oil minister, Ahmed Zaki Yamani. Speak of a two-legged publishing operation creating a must-read!

Schultz could afford to live in Monaco, a place whose climate and overall vibes must have contributed to his longevity.

He made it to 99 ½ – just short of the 100 years that many of his readers had wanted him to achieve, but he had a great run in any case!

There is an obituary where you can read more about him.

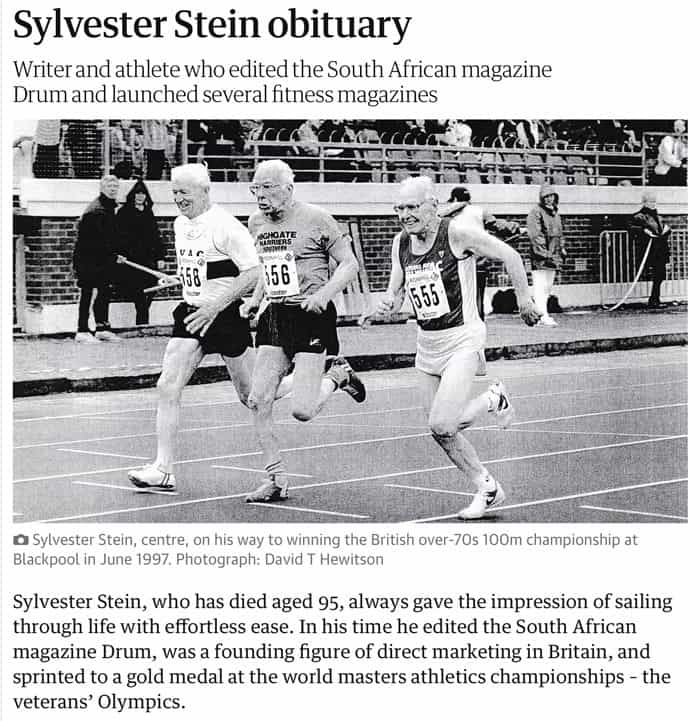

Sylvester Stein – 1920-2015

Of the three gentlemen featured herein, Sylvester Stein will be the least known.

Stein's work in investment newsletters goes back to the early 1960s and involves real estate rather than stocks. Stein didn't just create the first newsletter about investing in real estate, he literally created the newsletter industry in the UK. The concept of subscribers auto-extending through a direct debit mandate with their bank was 'invented' by Stein, as far as the UK market was concerned.

Selling his publication and reinvesting the money into new ones, Stein got wealthy.

When I met him, he was already in his 80s but still involved with a newly created newsletter business. It was affiliated with the UK's Fleet Street Publications, to this day the country's leading publisher of investment newsletters.

Stein and I shared a few glasses of his beloved port wine in his mansion in Belgravia.

The biggest learning we can take from him?

Like the other two gentlemen, Stein lived to a ripe old age – something he actively aimed at and worked for. Aged 67, he authored "99 ways to reach 100 – step-by-step advice for a long, healthy and happy life".

With such out-of-print works, parts are inevitably outdated. In other aspects, they can offer a refreshingly different perspective. Stein's 1987 book warned of the danger of driving, citing that by the year 2000, more people would have been killed in car accidents than during the Second World War. His prediction of 45m dead turned out too low, as the total tally is 60m according to online sources. Yet, no one is afraid of going on the road – except yours truly, who doesn't have a driving license.

Stein believed that running after the age of 35 was the best recipe for longevity. He himself kept running in international races to a very old age. In 2003, at the age of 82, he won two gold medals in the British Masters Championships. At the age of 89, he had a pulse rate of 52, 20 points below the national average.

In his words: "Running is the surest, safest, cheapest, best way to fitness."

In this day and age of Hot Yoga, Hula Hooping and Pole Dance, old-fashioned running may seem unsophisticated, but it did work for Stein. He lived to the age of 95.

Source: The Guardian, 3 January 2016.

As someone who recently turned 50, I might take him up on that advice!

P/E of 2.5 and >20% dividend yield with this coal stock

Looking for a deeply contrarian, deep value investment with high payouts and buybacks?

The latest Undervalued Shares research report has one such stock in store for you. It's a coal stock, and it's currently trading at a bargain price.

In fact, it's the second time this stock is trading at such low valuation multiples. It was similarly cheap in 2021 and then soared by 15x.

It's unlikely that you'll see this stock do 15x again, but it should be a relatively low-risk 2-3x when the situation normalises – and you'll get plenty of dividends while you wait.

P/E of 2.5 and >20% dividend yield with this coal stock

Looking for a deeply contrarian, deep value investment with high payouts and buybacks?

The latest Undervalued Shares research report has one such stock in store for you. It's a coal stock, and it's currently trading at a bargain price.

In fact, it's the second time this stock is trading at such low valuation multiples. It was similarly cheap in 2021 and then soared by 15x.

It's unlikely that you'll see this stock do 15x again, but it should be a relatively low-risk 2-3x when the situation normalises – and you'll get plenty of dividends while you wait.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: