INVESTMENT REPORTS

Gazprom

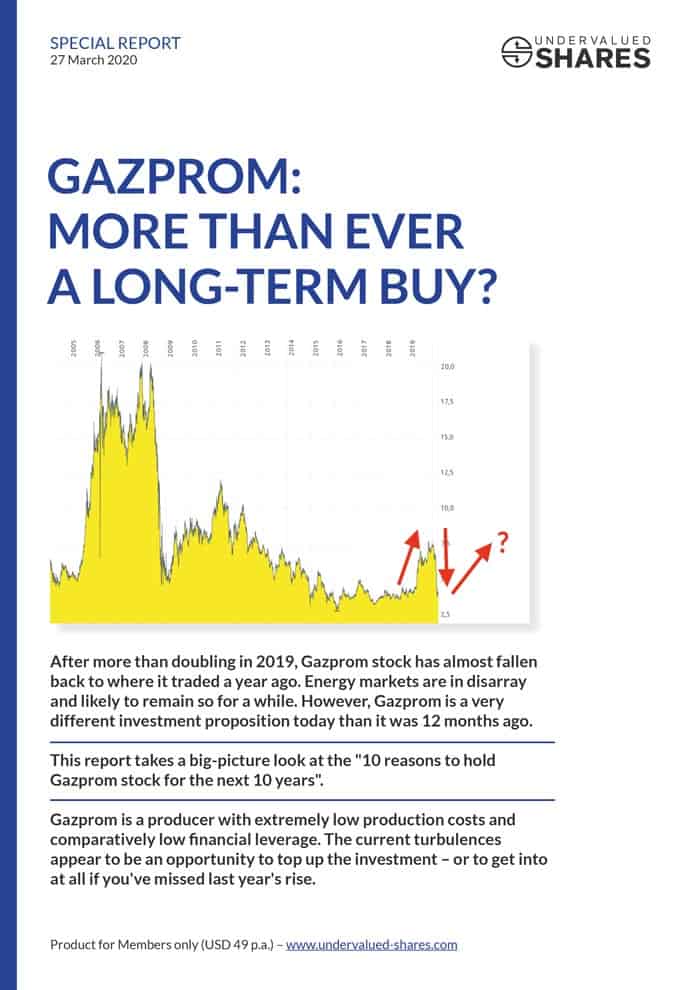

Gazprom: more than ever a long-term buy?

27 March 2020

The stock of Gazprom rose 128% after my December 2018 report, but has since lost most of its gains due to the double-whammy of the coronavirus crisis and oil price crash.

Is now a second opportunity to get onboard at fire-sale prices?

This report provides you with a very different perspective to the one shared by conventional investment media. It spells out the "10 reasons to be invested in Gazprom for the next 10 years".

Short term, the company probably offers a double-digit (!) dividend yield.

Long term, it's one of the most compelling corporate restructuring stories you can find on the world's stock exchanges. If Putin plays his cards right (as he has done recently), Gazprom shareholders could earn hundreds of billions of dollars between now and 2030. If you missed the FAANG stocks in the 2010s, you might want to consider owning Gazprom for the 2020s.

This report is both an update to my December 2018 report and a standalone piece that you can read without prior knowledge of the company.

Bonus Report: The Coming End of Gazprom's Pipeline Export Monopoly?

23 May 2019

Vladimir Putin enjoys making unexpected moves, and one such upcoming move could be the end of Gazprom's monopoly right to export gas in a gaseous state through pipelines.

Gazprom did already surprise the market recently, by announcing a doubling of its dividend payment for 2018. This led to the share price making a bigger one-day leap than on any other day during the past decade. Also, it catapulted the dividend yield for my readers to a staggering 13% p.a.

Are more surprises coming the way of Gazprom shareholders?

This bonus report, which adds to my 91-page research piece issued on 28 December 2018, takes an initial look at the currently available evidence.

Gazprom

28 December 2018

Once celebrated by Western media as likely to become the world's first trillion dollar company, Gazprom fell out of favour and has seen its market value plunge from USD 367bn in 2008 to now USD 50bn.

Few companies are as polarizing as Gazprom.

This report is looking at a range of lesser-known changes that the company has recently undergone. Its main thesis is that Putin's self-interest is tipping from utilising Gazprom as a political tool to turning the government's 51% stake into a valuable financial asset. He will work to re-establish Gazprom on international equity markets, aiming to create an additional >USD 1tr in Gazprom shareholder value.

If this report's controversial thesis is proven right, the share price is likely to rise by a factor of 5 during the next few years; and possibly by a factor of 20 in the long run.