UK real estate stocks are trading at historically low multiples. Will they ever shake off the current doom and gloom?

Allocating to Europe – a new 3-part series

Long viewed as slow and boring, European equities are moving back into the spotlight.

At a recent Goldman Sachs conference focused on investing in European banks, US investor attendance was up 70% year-on-year.

The global investment bank noted afterwards: "There was an eagerness to allocate to Europe that we haven't seen or heard for a very long time."

But where in Europe should you invest, and which opportunities are the most promising?

Undervalued-Shares.com will explore these questions in a 3-part series, looking at specific sectors and companies in Germany and the Mediterranean region.

Today's introductory article sets the broader context.

Why Europe – why now?

Europe is rich in capital, but – paradoxically – it has been underinvesting in its own future. Much of the Old Continent's wealth sits idle in low-yield deposit accounts, and those Europeans who do invest in equity often put their money into US stocks.

Politically, the continent has been known for its incapacity to act and a tendency to kick the can down the road.

However, the times they are a-changin'.

The US administration has made the European Union (EU) face up to some urgent realities. The US is serious about stepping back from its role as the leader in NATO security and from providing a security umbrella for everyone else. If Europe wants to defend itself, it has to step up. The shifting global order under President Trump has created an almost wartime mentality among European leaders.

One of the outcomes is a decision to spend, spend, and spend some more.

Germany's new, more business-friendly government plans to spend the equivalent of 20% of GDP on defence and infrastructure. The country had long taken a conservative fiscal approach, which kept the debt-to-GDP ratio at a relatively low 60% (compared to 100% in the US, 96% in the UK, and 200% in Japan). The German spending package will push this ratio up to 80%, unleashing over a trillion euros of extra spending into the economy. The additional money will go towards German companies that can produce weapons, build bridges, or improve its digital infrastructure.

Think of it what you like, but Germany and the wider EU are about to do what has helped the US drive up economic growth and share prices over the past few years.

While the US economy benefits from structural strengths – like a dynamic tech industry – its recent momentan has also been driven by fiscal policy. During the Biden administration, Washington ran an average budget deficit of about 8% of GDP. This injection of public spending supported faster GDP growth and boosted corporate earnings. Whether such deficits are sustainable (or fair to future generations) is a separate debate. In the short run, it benefited the companies supplying the products and services that absorbed the extra spending. Politics aside, when governments hand out helicopter money, it pays to be out there with a bucket.

The same fiscal playbook will now unfold in Europe. Germany's additional spending is estimated to add over 1% p.a. to its GDP growth for the next 12 years. For a country that has shown an anaemic growth rate of 1.5% over the past 15 years, this represents a 67% increase in the growth rate.

Other European countries don't usually have as strong a balance sheet as Germany, but they are about to embark on similar measures (and will benefit from Germany's spending power as it trickles through to other parts of Europe).

That's trillions of euros changing into different pockets.

Who will stand to benefit from this money – and how can YOU secure your slice of it?

Source: Vanguard, 14 March 2025.

"Alpha rich region"

Europe's equity markets have been overlooked for so long that European stocks now receive less analyst coverage than those in emerging markets – about 25 analysts for each stock, compared to 27 in emerging markets. By contrast, US stocks attract significantly more attention, with a market-cap weighted average of 41 analysts covering each stock.

The same holds true true for media coverage of publicly listed companies. In the US, each stock gets an average of 36 news articles compared to just 14 in Europe.

Information in Europe is generally less abundant, and more fragmented across multiple sources – and that's before you even consider the effect of language barriers. As a result, not all available information is immediately reflected in stock prices. With lower analyst coverage and less media attention, there's less competition among investors to find and act on valuable insights. This makes it easier in Europe to uncover overlooked opportunities, offering active investors a better chance to generate alpha.

As Goldman Sachs put it in a recent note to clients:

"Market inefficiencies and less obvious return relationships between stocks make Europe's equity market a rich alpha environment. … These factors have benefited active investment approaches in the European equity market. Over the past decade, 74% of European investment managers achieved positive excess returns (averaging 1.05% annually) compared to 44% in the US, where the average manager underperformed the market by -0.35% annually."

Which raises the question: what is the best way to invest in Europe?

A plethora of opportunities

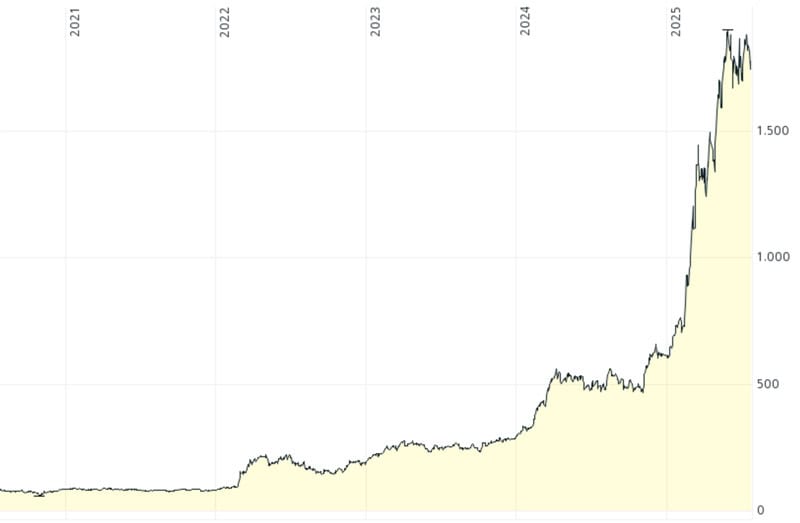

European defence companies have recently enjoyed their moment of glory, fueled by the extra funding for their role in supplying weapons to Ukraine and rearming the continent. The share of Germany's defence firm Rheinmetall (ISIN DE0007030009, DE:RHM) famously soared by 25x over the past four years.

Rheinmetall.

The Rheinmetall story is already widely known, though, so what else is out there?

There are both obvious and less obvious areas to investigate:

- It's often forgotten that Europe is home to eight of the world's top 20 pharmaceutical companies. For example, weight-loss drug Ozempic was developed by the Danish firm Novo Nordisk (ISIN DK0062498333, CPH:B), and its success helped the stock soar by 10x. Healthcare stocks stand to benefit from ageing demographics. Think of Europe what you like, but this is a continent strong in building healthcare companies. Combine it with some of the other factors mentioned above, and you start to appreciate that Europe offers a rich hunting ground to discover the next Novo Nordisk before its stock takes off.

- European telecoms companies sound like an investment designed to put you to sleep, but some stocks in the sector have quietly turned into stellar performers with relatively low risk. For example, Undervalued-Shares.com Lifetime Members received a research report on A1 Telekom Austria Group (ISIN AT0000720008, VI:TKA) in April 2023, when the stock was trading at a spinoff-adjusted EUR 5. Since then, the conservative stock has doubled to EUR 10. Many investors might not realise that the EU's telecoms market is highly fragmented, with over 100 operators (compared to just a handful in the US). I had spotted that the EU was preparing new legislation to finally push through the long-overdue consolidation of the sector, something few had on their radar at the time. Yet, at a recent Goldman Sachs conference, telecoms consolidation was a "hot topic" – another example of how the slower news dissemination in Europe creates opportunities for active investors (and the type of work I am doing for paying Members of Undervalued-Shares.com).

- Investors looking at Germany have recently zeroed in on growth in defence and "hard" infrastructure such as bridges, railway tracks, and tunnels. However, one area that hasn't received much attention yet is Germany's investment in digital infrastructure, both at a company level and in government. Two years ago, Austria Telekom was similarly overlooked but poised for a rising share price. Now, comparable opportunities are emerging within Germany's famed "Mittelstand" companies, often as stocks with limited downside but high upside. Next week's article will look at a few such asymmetric opportunities from my former homeland.

Source: The Market, 1 July 2025.

What's the catalyst?

It has often been reported that European stocks could benefit from their lower valuations, suggesting catch-up potential.

Does the argument hold water, though?

In the long run, valuations ARE the #1 driver of investment performance.

Low valuations can also be a value trap, though. A cheap stock can stay cheap for years, or even decades. Europe's equity markets have been cheap for longer than anyone cares to remember, and you better make sure the latest noises about a turnaround aren't a false signal.

What European markets need are events – or capital flows – to unlock their hidden value.

Which is just what's highly likely to happen over the coming years.

"Large allocators haven't even significantly increased the investment in Europe yet. They'll make these decisions in the fourth quarter and then invest in 2026." That's how one successful American fund manager summarised the state of things when I spoke to him in New York last month.

Indeed, circumstances seem primed for a new long-term cycle for European stocks.

US stocks have outperformed for so long that anyone under 40 won't even remember a time in their professional life when that wasn't the case.

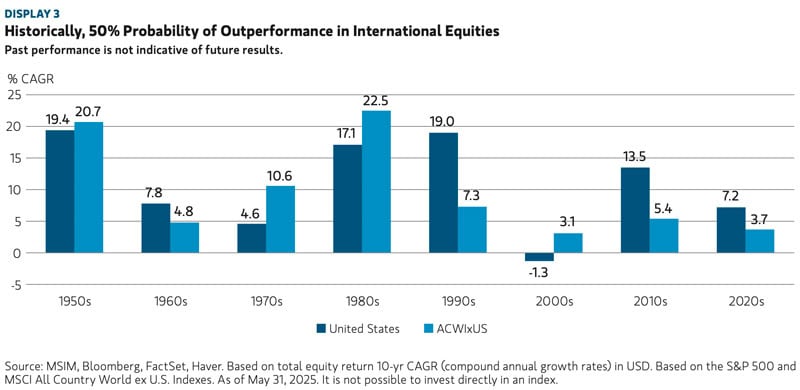

Yet, looking back over the eight decades since the Second World War:

- Four decades saw US stocks outperform (1960s, 1990s, 2010s, 2002s).

- Four decades saw non-US stocks outperform (1950s, 1970s, 1980s, 2000s).

For example, if you were invested in US stocks in the 1970s and 1980s, you would have significantly underperformed the rest of the world for 20 years. This seems incredible nowadays, but it's a clear reminder that a one-sided investment approach can be very risky.

To be clear, I am convinced that American exceptionalism is here to stay, and second Warren Buffett's advice "Never bet against America". The structural advantages of the US economy enjoys are simply too strong to ignore.

However, deploying capital into European markets doesn't have to involve turning your back on the US. It's about recognising key realities around risk management, capital flows, valuations, and also the changing zeitgeist.

Between the 2010s and 2020s, US stocks returned 13% p.a., compared to just 5% p.a. for non-US equities. This has pushed US equities to represent 65% of the MSCI All Country World Index, up from 43% in 2010. Does anyone really believe this trend will continue, with US equities eventually making up 70%, 80% or even 90% of global equity markets?

For risk management and diversification alone, a growing number of US investors are likely to start putting more money into European markets. Apple by itself is now worth about as much as the entire German stock market. Given the sheer amount of wealth in the US these days and how small European markets are in comparison, it would take just 1-2% of American assets to flow to the Old Continent for European markets to soar.

Will they?

Quite likely, for the following reasons:

- Diversification: as the stats above show, there is no guarantee that the US market will always outperform. For risk diversification alone, any US investor should consider investing a percentage of their assets elsewhere – which could be 5% or 20%, depending on an investor's background and goals. Global investing has become easier than ever and the stats are compelling, which is why a growing number of US investors are likely to take it up.

- Weaker US dollar: a significant part of the recent US outperformance was supported by the dollar strength over the last 15 years. The US currency tends to move in cycles: on average, the dollar rises in 10-year cycles and declines in 6.5-year cycles. This time, the rally has lasted an unusually long 14.5 years, and it looks stretched based on long-term metrics such as purchasing power parity. The reality is that today, fiscal and monetary policies are increasingly more favourable outside the US. While currency movements are notoriously difficult to predict, there are reasonable arguments that we could now be entering a multi-year period of dollar weakness. If that happens, you want to have some of your assets in other currencies – and the Eurozone is the world's second-largest currency block (cue the previous point, risk diversification).

- Attractive opportunities: as Goldman Sachs put it, Europe is a fertile hunting ground for opportunities with a great risk/reward ratio and the chance to outperform. If you want to find alpha, come to Europe! The US market is entirely grazed over, while European markets remain relatively unexplored.

None of this will happen overnight, and there'll be pullbacks.

When Rheinmetall was rediscovered following the invasion of Ukraine, the stock quickly tripled from its low base. At the time, many believed that was the end of the story. However, the reallocation of funds toward European defence turned out to be a long-term trend, and the stock went on to deliver another 8x gain even from its already elevated level. In this case, the trend really was your friend.

European stocks as a whole had a strong run earlier this year, and it's likely we'll see another surge in 2026 as US and global allocators work to increase their exposure to Europe:

- Apollo Global US announced that it could invest as much as USD 100bn in Germany – though this would be spread out over the course of a decade.

- Aware Super, one of Australia's largest pension funds, recently cited "significant opportunities in Europe". It plans to invest billions in the UK and across Continental Europe – though this is expected to take place over a five-year period.

- Blackstone announced plans to invest as much as USD 500bn in Europe. According to CEO Steve Schwarzman, "They are starting to change their approach here, which we think will result in higher growth rates". The world's largest alternative asset manager intends to spread out this capital over the next ten years.

Source: Bloomberg, 10 June 2025.

The message is loud and clear: we are likely to see sustained, large-scale reallocation of capital into European equity markets. This will not play out overnight, and it's not over just because markets have already seen a rally.

Just to be clear, asset allocators won't be abandoning their US exposure anytime soon. However, many are currently overexposed to the US market and will likely seek to rebalance their portfolio, both to manage risk and to position themselves for the next leg of the economic cycle. Non-US, and in particular European equities, are the most attractive underpriced call option currently available in global equities markets. US investors who haven't yet diversified globally have already missed out, given how weak the US dollar has been of late. This is likely to encourage others to join the trend.

A decade-long European bull market?

Roughly every decade or so, financial markets fall in love with a new narrative – and these narratives often shift just when everyone has gotten comfortable with them. History shows that the next 10-15 years are unlikely to simply mirror the last.

Given the announcements highlighted above, it's clear that allocators are going to change capital flows. We could be entering a new cycle marked by a weaker dollar, better international equity returns, and – as a result – a flywheel of capital outflows from the US.

How should you position yourself for all of this?

As touched on above, to find alpha in European markets you need to understand the continent's peculiarities and find your way around the lesser-trodden paths.

In part 1 of this series, I will dive into the German market. Stay tuned for a 33,000-foot overview of Europe's largest economy's equity market, along with some pointers toward a few opportunities you probably haven't yet considered.

Out now: Taking Europe's finest to the US

Look no further than Europe!

The stock featured in the latest Undervalued Shares report – out this week – offers one such opportunity from the Old Continent: a #1 UK brand, which is now scaling its operations across the Atlantic.

Early US sales are already surpassing its home market – and a major US investor has just acquired a stake to support the expansion.

With US growth just beginning, this stock could offer 3x upside – and even more longer term.

Out now: Taking Europe's finest to the US

Look no further than Europe!

The stock featured in the latest Undervalued Shares report – out this week – offers one such opportunity from the Old Continent: a #1 UK brand, which is now scaling its operations across the Atlantic.

Early US sales are already surpassing its home market – and a major US investor has just acquired a stake to support the expansion.

With US growth just beginning, this stock could offer 3x upside – and even more longer term.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: