Are we finally witnessing the end of America's dominance and success?

- The BRIC countries are working overtime to get off the US dollar.

- US politics, more than ever, looks like a polarised hellscape.

- Some American cities, such as San Francisco, have become almost unvisitable.

During the past three decades, the US stock market has outperformed the rest of the world by a mile. How is the apparent decline of the US going to affect the valuation and performance of US stocks?

Is there even a crisis and a decline, or is at all a baseless narrative?

My learnings of over 30 years

One of my personal benchmarks for the US is the year 1990. That's the year I went to high school in New Jersey and had my first chance to experience the country firsthand (or at least a tiny corner of it).

"America is going to be a third-world country" – that's what my host family's dad told everyone whenever the conversation went towards American politics and the economy.

It wasn't a particularly great time, as I was able to witness as an impressionable 15-year-old.

New York City was a veritable no-go zone, with a record-high annual murder rate of 27 per 100,000 residents (over 7 murders each day). Even so, I visited New York repeatedly, and vividly remember that it wasn't (in) a good place at all.

Property prices in the Big Apple had taken a massive hit, too. To give you an idea of the magnitude and severity of the decline at the time, it's taken New York prices 15 years to get back to their pre-1990 peak. Outside of New York, you could visit neighbourhoods with rows and rows of empty, newly-built homes.

The education system I was embedded in on the other side of the Hudson River was a mess. Many of my fellow high school students were effectively illiterate – all the more shocking considering that this was a high school in well-off suburban New Jersey.

As to politics nowadays looking like a ship of fools, just watch this throwback video to George W. Bush's bloopers to get a perspective of how it looked like at the time.

Book stores carried countless tomes about "MITI mania", the prevalent hysteria that Japan's Ministry of International Trade and Industry was so economically superior that the US with its laissez-faire approach was inevitably going to fall behind.

The range of "MITI mania" books from the 1990s.

We all know how it ended.

Japan's Nikkei Index wasn't the place to be during the coming decades. Even today, the Nikkei is still not back to its record high reached in December 1989. The peak period for sales of books praising Japan and slamming the US was also the time when you should have sold all your Japanese investments.

The US market subsequently outperformed just about every other major stock market index in the world. Had you bought an S&P 500 index fund at a time when folks feared the US was past its peak, you'd now be set financially. A hundred dollars invested in the index in 1990 would have grown to about USD 2,300 today, compared to just USD 500 had you invested the sum in leading stocks from other rich countries but excluding the US.

Source: The Economist, 13 April 2023.

Much of this came from valuation metrics expanding.

Source: Bloomberg, MSCI, Consensus Economics.

As a result, the US stock market capitalization currently represents 60% of the global stock market capitalization, even though the US GDP makes up only 25% of global GDP.

None of this is to deny that the US has developed all sorts of problems of late, in its economy, national finances, civil society, and financial markets. However, having been through a few cycles gives you a slightly different perspective and makes you question the prevalent media hysteria.

E.g., as a regular visitor to New York, I recently wondered about the dangers I am in now that the city is reportedly in the hands of a "crime wave".

Source: New York Post, 18 July 2022.

A quick check of the underlying data yielded an interesting result. Much as New York's crime is up, even at today's elevated level the city's murder rate is five times lower than that of 1990. New York experienced just 433 murders in 2022, compared to 2,605 in 1990. I was in five times more danger when I visited the Big Apple as a high school student than I am today.

Yours truly in New York in 1990.

America turning into a third-world country? My host family's view of their own country did influence me, and it may have been costly. I also read "The Roaring '80s" at the time, a book that contained a chapter about an investor called Warren Buffett, whose stock was trading at USD 7,500. Buffett's holding company was almost exclusively invested in stocks in his native America but – given that the US was a prospective third-world country – it didn't seem like a stock worth looking at any further. Today, the stock is above USD 500,000.

"Never bet against America", Buffett is known to say.

Is that all in the past, though?

Amid the current hysteria about the US losing to the rest of the world, I decided to look at a few lesser known figures and throw some personal observations into the mix.

More money than God

If you want to book an upmarket Parisian restaurant at short notice, simply call them from an American number and put on your best Texan brawl. I am reliably informed that high-end French restaurants will happily cancel a booking from a European customer if they can replace them with American visitors.

"Americans have money on a different scale", as my friend Ladislas Maurice of The Wandering Investor likes to say.

Not only do they tip more money, but they simply have more money altogether and tend to order more expensive items.

This is of course only anecdotal evidence, but it lines up with real-life evidence that is all too often ignored.

Everyone will have seen countless reports and stats about the rise of China and the relative decline of the US. While stats about China's incredible rise are true, they only reveal a part of the picture.

E.g., it's less talked about how during the past three decades the US has advanced relative to other major economies such as Germany, France, and Japan. In 1990, the US accounted for 40% of the GDP of the G7 nations. Today, it accounts for 58%. Even when adjusting for purchasing power parity (which has its own imperfections), the US still gained on the G7, from 43% in 1990 to 51% today.

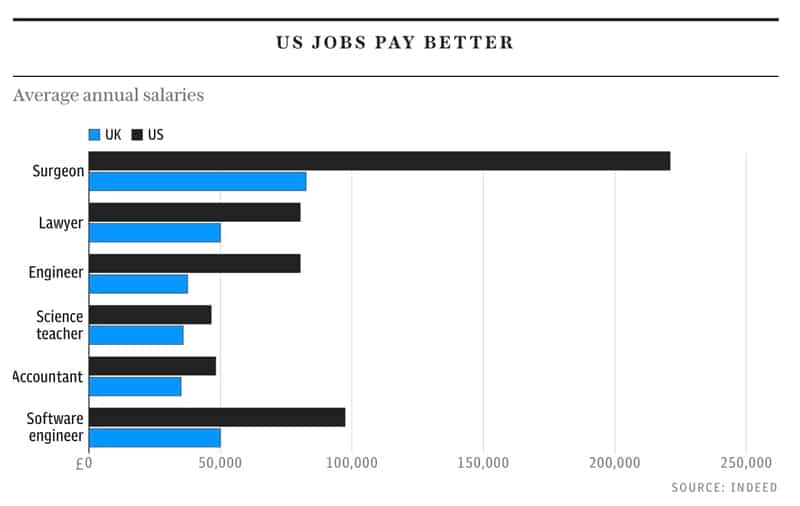

Back when I lived in New Jersey, Americans on average earned 24% more than someone working in Western Europe. Today, the gap is 30%. The US is also ahead in absolute terms. Nowadays only those in uber-rich petrostates like Qatar and financial centres like Luxembourg enjoy a higher income per person than Americans (figures adjusted for purchasing power parity).

Each such statistic has its flaws, and there is the ever-present risk of comparing apples with pears. E.g., in 2022, America's poorest state – Mississippi – allegedly had a higher per capita income than the UK. However, there was an element of exchange rate fluctuations to this, and both the pound sterling and the euro have since regained strength against the US dollar. Still, it's worth noting how Americans simply have more money than anyone else, literally. A truck driver in the Mid-West may well earn more than a doctor in Portugal.

Source: Daily Telegraph, 23 April 2023.

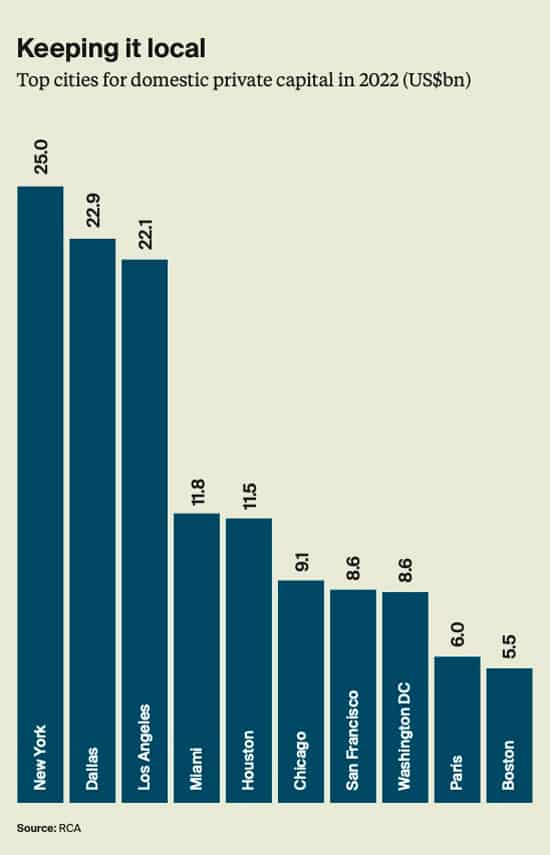

The evidence of Americans once again being the Rich Uncles of the world is overwhelming. If the world's entire financial wealth consisted of USD 100, then USD 30 would sit in the US. China is a distant second with USD 18, while every other nation comes in lower than the tip your typical American would leave from a USD 100 bill. Of the world's 10 richest cities when measured by domestic savings, nine are American (the only non-American city is Paris, ranked #9).

Source: The Wealth Report 2023, Knight Frank.

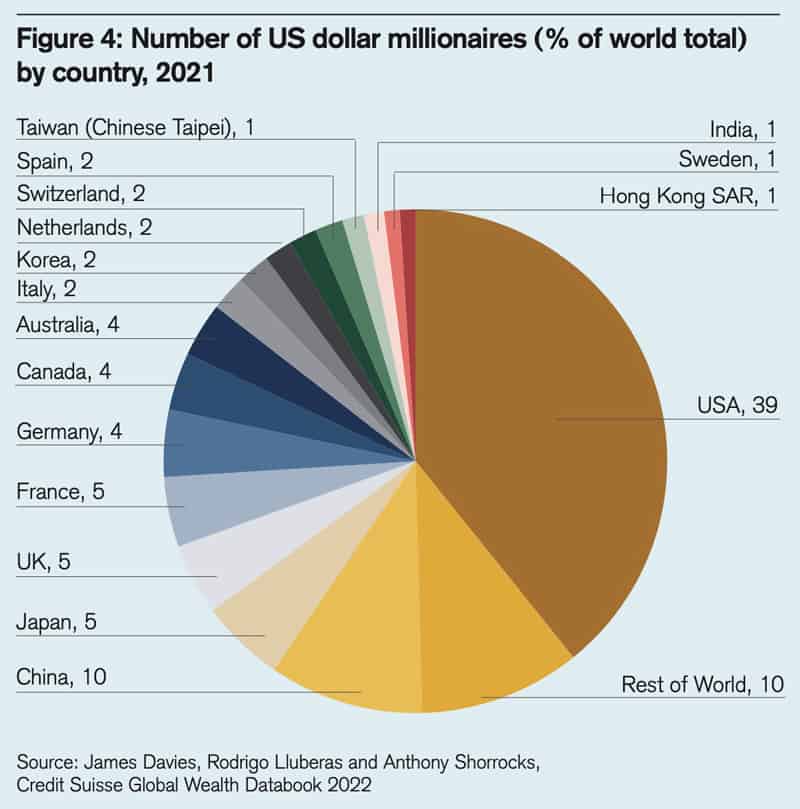

The US has 39% of the world's dollar millionaires, and its wealth per adult is almost three times as high than in Europe. According to Credit Suisse estimates, an incredible 22m Americans are millionaires, up from fewer than 15m in 2014. 83m Americans live in their own house, and they have less mortgage debt than ever before. The percentage of Americans who expect to work beyond 60 because they have enough savings has fallen below the 50% mark for the first time since records began.

The US simply has a lot of scale. As is well known, money goes to money.

Gifted by nature – and its unique people

The US is bestowed with an almost magical combination of natural resources and geographical features.

The Mississippi river system is the largest inland waterway in the world, which provides even a city like Pittsburgh with a direct connection to the ocean. Water-based cargo transport is 10-20 times cheaper than land-based transport, which gives the US economy a huge advantage.

Add to it the Great Lakes to the north, the countless natural harbours along the coast, and how the Barrier Island system protects many of these harbours. The US has three times more coastline than Europe, which is a massive resource that contributes value in countless ways.

Around its river system lies the world's largest contiguous prime farmland area. Canada, Russia and China also have a lot of land, but a high percentage of it is unproductive. The US can produce more food at a cheaper price than anyone else.

Its energy reserves in the form of oil and gas count among the world's biggest. Until 2020, the country was entirely energy independent. If or when its politicians pursue a rational energy policy again, the US can regain this independence, at competitive costs.

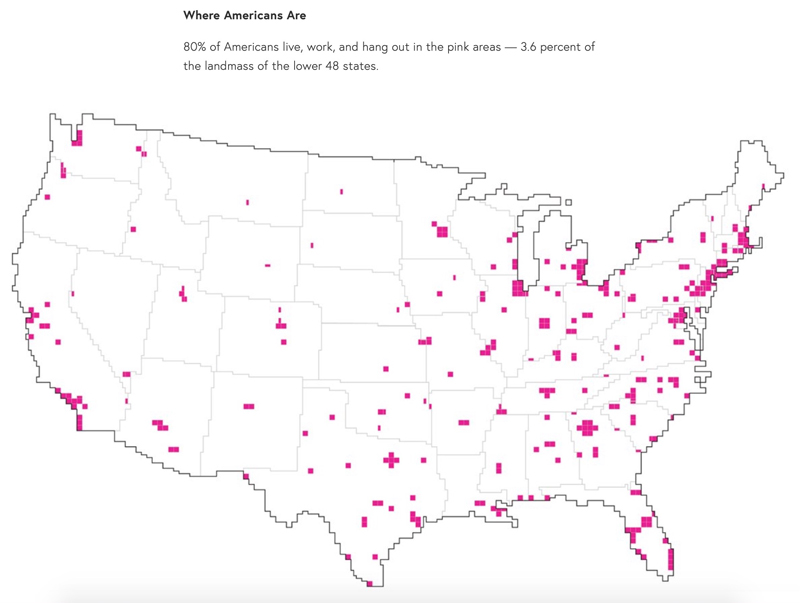

The US also quite simply has space. In fact, even with its current population, the country is sparsely populated: 80% of America's population is concentrated in less than 4% of its land mass.

Source: Wall Street Journal.

All of these factors add further to the long list of reasons why the US is uniquely attractive for the world's best and brightest to emigrate to. A young, ambitious entrepreneur in Europe will have to decide whether to target the relatively small domestic markets of European countries (the biggest one – Germany – has just 83m people), or go to the US where they can tap into a market of 330m with more purchasing power than elsewhere. The EU also has over 300m consumers, but the political experiment steered from Brussels has so far failed to create a unified market in a way that would be comparable to that of the US – never mind different languages separating many of these markets. The scale of the US domestic market is one of the country's biggest attractions and still a pretty unique feature. India has a large domestic population but lacks purchasing power, and while China has unlocked a gargantuan domestic consumer base, its economy is not quite so open to the outside world.

An overwhelming degree of scale is an ever-recurring theme when you look at the US economy:

- American firms own more than one fifth of all patents registered abroad, more than those of Germany and China combined. This is not surprising, given the world's five largest corporate investors in research and development are all American.

- A single US company, Microsoft, can afford to write a USD 10bn cheque for a high-risk investment in artificial intelligence, compared to the German government dedicating USD 3bn to the sector.

- 50% of the world's venture capital gets invested in the US, even though the US makes up less than 5% of the world's population. This is the result of a financial system that has long been geared towards entrepreneurship, in a way that no other economy in the world has managed to even get close to.

Why, then, does the US get so much bad press and predictions of its imminent demise?

Envy drives a lot of criticism

"Europeans are Americans who didn't make it onto a boat."

The US is economically and financially superior in so many ways that I long suspected many were just plain envious and somewhat intimidated by its success and affluence.

Case in point, my late dad.

He had always made it clear that he wasn't a big fan of America, or Americans for that matter. The reasons were all the usual ones you get to hear from middle-class Europeans, who think of their American cousins as uneducated, obese, and crass. Yet, he was drooling when a US headhunting firm rang him with an offer to move to the States and earn three times his salary – which I remember vividly, because I was on the phone translating for him. My mum blocked the idea because she was averse to moving home. My dad was a fine man, but he didn't have it in him to make it in America. He literally didn't make it onto a boat, even when an opportunity was presented to him on a silver plate.

For as long as I can remember, the favourite pastime of many Europeans has been to criticize Americans. In some ways, they have long had many perfectly valid reasons to feel somewhat superior to their American counterparts:

- Healthcare? Universal in Europe!

- Working hours? So much shorter in France, Italy, and Spain.

- Social justice? The social democracies of Europe leave no one behind.

However, of late, their belief system will have had cracks appear, if they even looked.

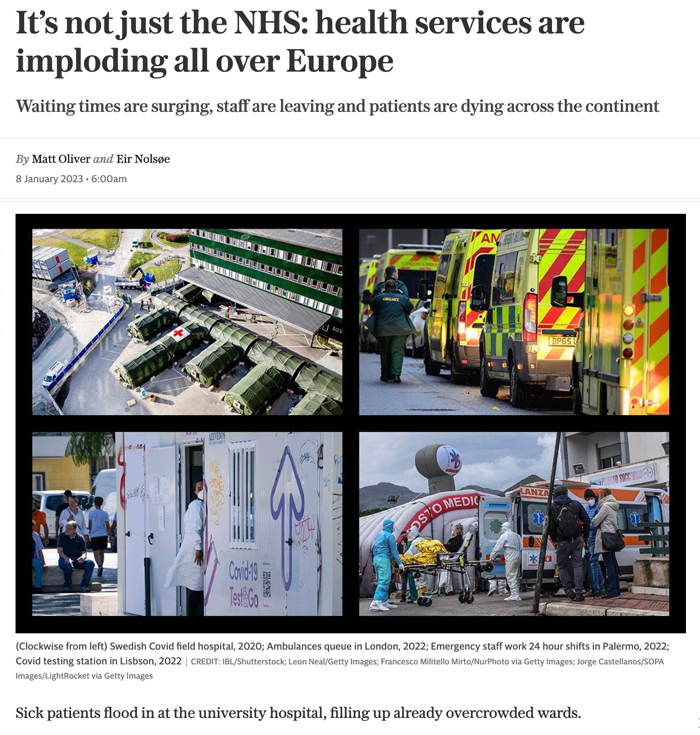

92% of Americans now have health insurance, and of the remaining 8% many have simply made a conscious decision not to partake. While Europe's seemingly superior healthcare systems showed tremendous strain during the pandemic, America's long-standing overinvestment in the sector paid off in the form of a much more resilient system.

Source: Daily Telegraph, 8 January 2023.

Europeans on average still work a lot less than Americans, but stagnating wages and sky-high taxes are forcing a growing number of Europeans into taking a second (or third) job. America's poorest today earn 74% more than in 1990, a much higher increase than across Europe.

Spending on welfare programmes in the US amounted to 14% of GDP in 1990 but has since risen to 18%. That's below Sweden's 25%, but the gap is narrowing and one of the very strengths of the US is that the system nudges people to work rather than to rely on others. The relative harshness in social matters is part of America's recipe, impelling people to strive to get ahead.

As Bloomberg wrote on 25 August 2022, "2022 may be remembered as the year when living standards in the US truly pulled away from those in Western Europe". As I said, try competing with Americans for a table in upmarket Parisian restaurants.

Naturally, there is an awful lot of nuance and diversity to this. Different things work for different people.

Someone with a strong preference for great railway networks will always favour Europe. Thanks to its relative short distances even between countries, it's more viable to maintain a high-quality rail network in Europe. On the other hand, given its high population density and lack of space, Europe also lacks true wilderness and much of its nature has been shaped by millennia of deforestation and overhunting. If you have a knack for wild, untouched nature, you'll find no equal to America's National Park system.

It's all apples and pears, and ultimately down to personal preferences.

What's difficult to argue with, though, is the following: if the US continues to have so many natural and structural advantages, shouldn't Buffett's long-standing principle of never betting against America be right?

MILLIONS continue to flock to the US

Politics and the fashionable crisis du jour always play heavily into peoples' outlooks.

There are many reasons to feel that the Biden presidency marks another low-point for US politics, but it's worth keeping in mind eras such as the Clinton impeachment proceedings in the 1990s or the ballyhoo surrounding George Bush Junior's contested Florida election. US politics has come across as quite the circus for decades – certainly for as long as I can think back, and no matter which one of the two parties was in power.

How much of this really affects the economy, the performance of companies, and the trajectory of the US stock market?

Luckily, post-pandemic I have started to get back to my rhythm of visiting the US fairly frequently. In fact, when this Weekly Dispatch hits the Internet, I'll be roaming the streets of New York, and for the third time this year. Yet again, the Americans that I come across are almost all amiable, upbeat about something in their lives, and with an infectious enthusiasm. The core of what makes America different is still there.

I even struggle to buy into the long-standing claim that American society was more divided than ever. How much of that is down to people with a personal or professional interest in division making it sound worse than it is? Ahead of the 2020 US presidential election, I planned to throw an election night party in New York. The party's angle was to invite a mixture of Republicans, Democrats and Independents, with the aim of showing that we can all have a good time together even when watching a highly contentious election. I could have gotten together a crowd of 50 (from across the spectrum) without even trying and without even living in the city. The gig didn't happen because of the pandemic, and so I lack the ultimate evidence that the evening would have worked.

In the meantime, I believe politics has a lot less influence on the long-term performance of stock markets than the daily headlines make it look like.

For the reasons outlined above, the US economy will probably keep doing what it has done since becoming the world's largest economy in 1890s. Case in point, in 2021, 5.4m new businesses were started in the US, an increase of 53% compared to the pre-pandemic year 2019. Whatever political divisiveness there may be, it certainly doesn't stop Americans from doing what made America great in the first place – setting up businesses, and working hard to make them a success. Thanks to its unique set of circumstances and features, the US should continue to outperform most other major economies of the world.

While the metrics expansion of its stock market cannot continue forever, the market is broad, and different parts of it aren't valued quite so highly. It may even get to attract a security premium again, given the current day and age of geopolitical instability. There is a real risk of a nuclear accident in Ukraine, and both another outbreak of war in the Balkans and a conflict in the Baltic nations involving NATO may be possible. The US, on the other hand, is protected by 2,000 miles of oceans and the world's largest military. It's difficult to predict such matters, but we are now back in a period when diversifying assets into the US is becoming a personal safety priority for many.

Maybe – and that's the optimist in me speaking – we'll even see US politics calm down.

One of the reasons so much reporting about the US looks so ghastly to observers on the outside is the American habit of scrutinising its flaws more deeply than in most other parts of the world. When Lehman Brothers went bust, Americans cleaned up the sector were ready to move on just two years later. In Europe, on the other hand, it's taken well over a decade to gradually work through the issues of the banking sector.

The US is also famous for first trying out everything that doesn't work, before eventually pursuing what does work. The country has fallen for many fallacies and errancies of our age, but it often takes corrective action ahead of everyone else. E.g., Exxon Mobil (ISIN US30231G1022, NYSE:XOM) and Chevron (ISIN US1667641005, NYSE:CVX) recently voted down so-called climate change proposals, and decisively so. If you ever wanted to look for evidence of why US companies deserve their historically higher valuation metrics than European companies, look no further than these energy companies and their European counterparts such as BP (ISIN GB0007980591, UK:BP) and TOTAL Energies (ISIN FR0000120271, FR:TTE).

Source: Financial Times, 31 May 2023.

Add to this the rumours that representatives of the state of Texas had recently been touring Europe to lobby the continent's automakers to move their manufacturing to the US. With some countries currently literally dismantling their industry in a quest for the so-called net zero goal, it's easier to appreciate why the US juggernaut may just continue to move forward in the same fashion that it has done for decades.

The US has all sorts of flaws and problems, but I have seen too many predictions about the demise of the dollar, the US market or the country's entire economy – only to see the juggernaut roaring on after a brief blip.

And many people are buying into it. Since 1990, America's working-age population has risen from 127m to 175m, an increase of 38%. In Western Europe, the working-age population has risen just 9% during that period, from 94m to 102m. With the US population having risen from 240m in the 1980s to just under 340m today, I can imagine it reaching 500m during my lifetime.

And in conclusion?

The Internet has recently been flooded with content of a de-dollarisation of the world economy. Combined with the subject comes the usual plethora of reporting about the end of the US as a superpower, its coming bankruptcy on the back of spiralling debt, and similar predictions.

It reached a point where I asked myself: "Is being short the US dollar such a widely held view that it's worth heading the other way?"

If you have been around for a bit, you'll understand why despite all the well-deserved criticism and the need to be vigilant about a potential change to long-term trends, it's also worth spending a bit more time looking at the counter-arguments.

"A Brief History of Dollar Hatred" is an article worth reading in this regard. Its author Jens Nordvig, one of the world's leading currency experts and a friend of mine whose writings I have long recommended, gives his perspective on the waves of dollar hatred he experienced over the past 20 years, and how he sees things continuing right now. A native Dane, Jens now lives in the US where he has built an amazingly successful business – so he has quite a broad perspective on things.

Ceteris paribus, there are MANY good reasons why the US stock market should continue to trade at a premium to every other stock market in the world.

In fact, if I was in my 20s, I'd probably try to pack up and move to the US. Ignore the noise, and focus on the large set of opportunities there. Given the US is a collection of 50 states that compete with each other, rather than a unitary state, you have many different places to pick from. Don't like woke policies? Florida is waiting for you! Millions have been moving there of late – literally, millions.

Mobility is part of the American culture and enabled by a unified market that EU citizens can only dream about. In fact, there is a specific investment opportunity that relates to Americans' mobility… Watch out for my latest research report presenting this opportunity – going out to Undervalued-Shares.com Members very soon.

Profiting from America's growing population

Americans are a mobile bunch, and one particular company has been making a fortune from helping Americans move house.

It's a brand that most people will have heard of, but few are aware it's also a listed company.

Shareholder-¬friendly policies, a strong balance sheet, and high cashflow come combined with a low valuation.

As the US population grows, so does this business – and then some.

Get all the details in the next report for Undervalued-Shares.com Members – out soon.

Profiting from America's growing population

Americans are a mobile bunch, and one particular company has been making a fortune from helping Americans move house.

It's a brand that most people will have heard of, but few are aware it's also a listed company.

Shareholder-¬friendly policies, a strong balance sheet, and high cashflow come combined with a low valuation.

As the US population grows, so does this business – and then some.

Get all the details in the next report for Undervalued-Shares.com Members – out soon.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: