Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Bank of Cyprus – imminent bidding battle?

Image by Paul Cowan / Shutterstock.com

Cyprus is not exactly a famed banking destination, and that's being polite.

In 2013, a financial crisis forced the country to confiscate bank deposits. Anyone with more than EUR 100,000 in their bank account had 47.5% of their assets confiscated to save the local banking sector from going under.

Cyprus' banking system has also long been known as a financial haven favoured by questionable Russian investors.

There is one Cypriot bank, however, that is currently attracting serious attention from abroad. It could receive one or even several lucrative bids, and the first one could come in before the end of this month.

Given the urgency of this particular opportunity, I decided to publish this Weekly Dispatch two days earlier than usual.

Here is the story of Bank of Cyprus (ISIN IE00BD5B1Y92, UK:BOCH), a market-leading, London-listed bank with a GBP 526m (EUR 602m) market cap.

A Western European banking duopoly

The last time Cyprus' banking sector made international headlines was in March 2022, when RCB Bank, one of its local banks, decided to close doors.

Controlled by VTB Bank, a sanctioned Russian bank, RCB Bank decided to voluntarily wind down its banking operation in Cyprus as a result of the war in Ukraine and the subsequent actions against Russian institutions. This was no small matter, given that up to this point, RCB Bank had been the island nation's fourth largest bank.

RCB Bank's closure turned Cyprus into a banking jurisdiction where the two leading banks – including Bank of Cyprus – now control 70% of the local market. Experience shows that in countries with such a banking duopoly, shareholders can expect to earn a double-digit return on their equity.

One large investor decided to get involved. Lone Star, an American private equity firm with USD 85bn in client assets, has been making overtures with regards to a potential cash bid for Bank of Cyprus.

In May 2022, Lone Star made a first non-binding offer of EUR 1.25 per share.

That same month, the Americans upped their tentative offer to EUR 1.38 per share.

In August 2022, they made a renewed attempt by making a non-binding offer of EUR 1.51 per share.

Each time, the board of Bank of Cyprus rebuffed the approach because the price was deemed to be too low. After a careful consideration of the third proposal, the board "concluded that it fundamentally undervalues the company and its future prospects". There was also an underlying message that American private equity companies are simply not welcome to purchase Cyprus' #1 systemic financial institution.

Under takeover rules, Lone Star now has until 30 September 2022 to make a binding offer for Bank of Cyprus or walk away from the deal.

Will they? Won't they?

This question is currently whipping up strong feelings in Cyprus and among value investors, as I just witnessed myself at the Cyprus Value Investor Conference, my favourite annual event in this sector. When one participant at this year's conference introduced his thoughts on Bank of Cyprus, it was the presentation that caused the liveliest Q&A session. Participants were divided in their take of the company, with views ranging from this being a superb arbitrage opportunity to the bank being a worthless legacy operation.

The details of what gets discussed at this conference are strictly "off the record", i.e. the event presentations are not for publication. However, the author of the Bank of Cyprus presentation gave me his explicit permit to speak about the stock on Undervalued-Shares.com.

I found the story so compelling that I sat down as soon as the conference ended to send you this heads-up about a potential bidding battle.

Bank of Cyprus.

Successful turnaround or lame laggard?

The situation of Bank of Cyprus is much better than is widely known.

- Russian money? Just 2% of the bank's loan portfolio is with Russian clients.

- Bloated staff? The bank just paid off 16% of its employees to make them go into voluntary retirement.

- Non-performing loans? These were reduced from 30% in 2019 to 5.7% in 2022.

If you take a longer-term perspective, the Bank of Cyprus of 2022 is very different from what many remember from the past. Since the peak of non-performing loans in 2014, the bank has achieved a cumulative reduction of non-performing loans by 96%. As a result, on 8 September 2022, S&P upgraded the bank's credit rating.

During the past years, whenever American private equity companies bought into European banks, it was usually a rescue deal to meet European Union privatisation deadlines after bad-debt pile-ups and state bailouts.

Lone Star's interest in Bank of Cyprus is a different situation altogether.

This is a financial investor chasing an asset that is currently trading at too low a share price, which is what made my ears perk up.

Benefitting from rising interest rates

A key figure for valuing a bank is the Net Interest Income (NII), i.e. the difference between the interest income a bank earns from its lending activities and the interest it pays to depositors.

During the past decade of zero or negative interest rates, banks couldn't earn much from the interest rate spread. Now that interest rates have gone up, the entire European banking sector is experiencing a resurgent NII.

A 1% increase in interest rates leads to Bank of Cyprus earning an additional ≈EUR 100m. That's an improvement in earnings per share of EUR 0.23.

Bank of Cyprus has a long history of one-off impairments weighing on earnings, and critics were right to point to its excessive costs. However, following the 2019 appointment of its current CEO, it appears that the bank has finally addressed long-standing issues with its bloated cost base. Besides reducing its staffing by 16%, it also managed to reduce its branch network by 39%. There are probably further staff pay-offs in the pipeline, and the bank is working to digitise its outdated operation.

During the first half of 2022, Bank of Cyprus posted a profit after tax of EUR 50m, compared to a loss of EUR 1m for the first half of 2021. The 2022 results will have a one-off cost of EUR 99m weighing on them, which were the payments needed to send staff members into early retirement. Still, this will save costs of EUR 37m from 2023 onwards and improve profits in future years.

Without a doubt, there is a lot that remains to be desired at Bank of Cyprus. Local customers told me various horror stories about dealing with the bank. In fairness, though, these complaints sound not all that different from dealing with any of the other European legacy banks. The banking sector as a whole still has its problems, and it's facing competition from a new generation of fintech banks. However, if these operations were perfect already, they'd be priced differently altogether, and there wouldn't be a reason for private equity to get involved.

It's the new situation around Cyprus' banking duopoly that must be so compelling for Lone Star. Bank of Cyprus now has a 40% market share in a jurisdiction that is currently experiencing a booming economy. Unlike much of the rest of Western Europe, Cyprus even has attractive demographics, due to the ongoing influx of new residents from Northern Europe, Ukraine, and Russia. This is a small, but attractive jurisdiction where to own a banking operation – and buying Bank of Cyprus is a way to get macro exposure.

Limassol is booming because of a large influx of new residents.

In 2016, the company reincorporated in Ireland to be able to gain a listing on the London stock exchange (in addition to the Cyprus stock exchange). The London listing is in pounds, which can be confusing since all other key figures coming from the bank are in euros.

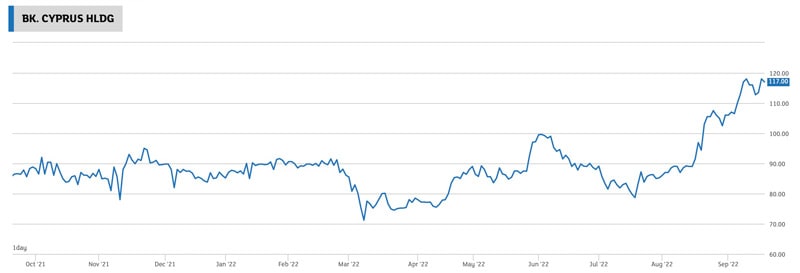

Due to the one-off costs for staff reductions, the 2022 earnings will probably come out at around zero, rather than the EUR 100m profit (EUR 0.20 per share) that Bank of Cyprus would have earned without this extraordinary effect. For 2023, the bank's management is guiding for EUR 200m in net profit, which equates to earnings of EUR 0.40 per share. The current share of 117 pence (GBP 1.17) equates to EUR 1.34. The 2023 dividend could come out at EUR 0.10 per share. This gives the company a price/earnings ratio of 3.35 and a potential dividend yield of 7.4%.

What will shareholders think of Lone Star's overtures, and why could there even be a bidding battle?

There is a lot to the story of this small bank, and it does make for an exciting constellation.

Engaging key shareholders

Bank of Cyprus' largest shareholder is a sanctioned Russian, Viktor Vekselberg. The oligarch involuntarily got to own 9.27% of the bank when his deposits were forcibly confiscated in the 2014 bail-in.

The second largest shareholder with 9.07% is CarVal, a London-based alternative investment manager focused on distressed assets.

Senvest Management in New York owns 7.11% of the bank. This is a contrarian, value-based investment manager with USD 3bn in assets under management.

Notably, both CarVal and Senvest increased their stakes in late August 2022 after Bank of Cyprus confirmed it had received and rejected three initial bids from Lone Star. These two shareholders will have a clearer idea of what is going on behind the scenes, and their additional share purchases should probably tell us something.

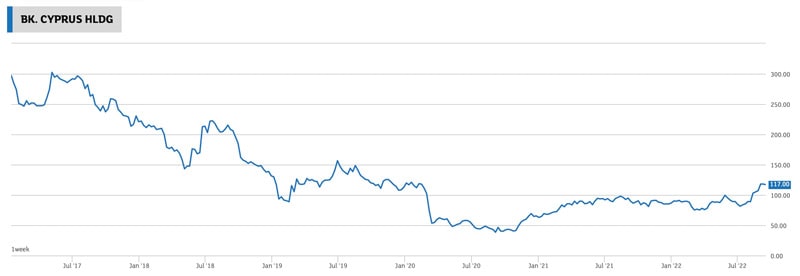

The seven largest shareholders own just under 40% of the bank. The remaining ≈60% are widely dispersed. Without a dominant shareholder, Bank of Cyprus is naturally vulnerable to a bid – all the more so since its shareholders have long suffered under the stock's dire performance. Following the listing in London, the share price declined from 300 pence in 2017 to as low as 40 pence in September 2020.

Before Lone Star's interest became public, the stock price traded in a range of 75-100 pence. Only thanks to Lone Star's interest did the stock recently break through the 100 pence barrier – reaching 123 pence at its highest point. Lone Star's last tentative bid indication of EUR 1.51 per share would translate into 131 pence at the current GBP/EUR exchange rate.

Bank of Cyprus.

On the one hand, Bank of Cyprus has some shareholders that are likely to sell if a tempting offer was made. Vekselberg probably simply wants to get rid of his shares, and the two other large holders are purely financial investors looking to make a buck.

On the other hand, Lone Star's recent tentative offer of EUR 1.51 per share does not seem to reflect the bank's much-improved outlook. It'd be hard to see an offer succeed if it didn't at least reach EUR 1.75, or potentially even EUR 2 per share. Analysts at Woods & Co. recently concluded the stock was worth EUR 2.50 based on the bank's improved fundamentals. The likes of Lone Star would only buy into this if there was a valuation differential to exploit, but at EUR 1.51 per share, it'd probably be better for shareholders to simply hold on to the stock and collect dividends.

Never mind Cyprus potentially getting politics involved, and what this could do to the overall constellation.

Counter-bid from Greece?

Protectionism and industrial nationalism run deep in the DNA of Continental Europe. As was to be expected, Cypriot politics got all defensive about the prospect of an American private equity buying control of its #1 domestic bank, whose balance sheet of EUR 26bn is bigger than the country's GDP.

There are measures underway to declare Bank of Cyprus a "strategic asset" and ban non-European bidders from getting involved. As Cyprus' Financial Mirror reported on 23 August 2022: "The Ministry of Finance is preparing to submit a bill to the Parliament on the establishment of a framework for the control of foreign direct investments."

Such behaviour is really bad style, and it will hurt Cyprus' attractiveness to foreign investment at a time when its economy is finally taking off again. A more elegant solution could be to get Greek banks involved in the bidding.

The Greek part of the divided island is politically close to Greece, and having a Greek bank take over Bank of Cyprus could be a way out of the conundrum. National Bank of Greece (ISIN GRS003003035, ETE:ATH) is rumoured to be interested in Bank of Cyprus, and other Greek banks would also be in a position to bid now that the Greek banking sector has regained its footing.

For shareholders, a bidding war would be the best scenario.

Lights, camera, action!

Just how it all unfolds will become clear over the coming weeks – or potentially even days. Lone Star has until 30 September 2022 to "put up or shut up" under British takeover rules. If you are looking for an investment with some likely action, the stock of Bank of Cyprus is one to take a closer look at.

Will Lone Star make a firm, attractive cash offer?

I'd place the likelihood for that to happen at well above 50%. Lone Star will have known that its low indicative offer price and the bank's prominent local position were likely to create some resistance. Rumour has it that Lone Star floated these indicative bids to be able to directly approach large shareholders and take their temperature – ahead of making a firm bid that was fine-tuned towards bringing key shareholders over the line. We are now going to see the decisive phase of this situation.

Not surprisingly, the Financial Times has just started to chime: on 20 September 2022, its paywalled LEX column reported about Bank of Cyprus. A week earlier, Euromoney, the specialist banking publication, had explained the entire situation with its article "Why is Lone Star chasing Bank of Cyprus?". Whatever the next move, it will likely gain significant media attention.

The worst-case scenario is Cyprus blocking any takeover attempt. In that case, you'd be stuck with a cheap stock that is likely going to pay a dividend yield of 7.4% from next year (and rising). There'd be worse investments to hold for a few years, given how Cyprus as a whole is on the up again.

The best-case scenario is a bidding war that sees a winning bid drive the price to EUR 2 per share. I'd expect EUR 2 per share to turn out a real hurdle. If the price went beyond that, a buyer would struggle to justify the transaction. However, existing shareholders will know as much, which will make a bid around this price supremely tempting to them. There will also be a point where the bank's board is going to struggle to withhold its endorsement of an offer. With board endorsement, a bid would be more likely to overcome political and regulatory hurdles, too.

Just what will unfold – if anything – is subject to heated debate among investors, as I witnessed in Cyprus.

Given how strongly interest rates (and the resulting NII) play into the valuation, investors also need to have an opinion about the macro environment.

That all said, it's a rather tempting situation altogether.

No bid happening at all would probably see the share price fall back temporarily before creeping back up given the improving fundamentals.

A bid – or multiple bids – could lead to a quick gain of up to 49%, if the bid falls near the mark of EUR 2 per share (175 pence).

I doubt Lone Star will simply back off from this opportunity, and the resulting actions are going to make some hefty waves land on the shores of this sunny Mediterranean island.

Most likely, you'll soon get to read more about this situation in the Financial Times, Euromoney, and other financial publications of choice.

How to own a (tiny) piece of Monaco

Monaco continues to be the world's most expensive real estate location.

Over the past ten years, prices have risen 75%; the rich and famous now have to fork out between EUR 20,000-115,000 per square metre for residential real estate.

If you ever wanted to buy yourself a tiny slice in the Principality, SBM remains the only publicly listed vehicle to do so.

It's also one of Europe's most mysterious (and fascinating) companies – and it's never been analysed in as much detail as in this in-depth report.

How to own a (tiny) piece of Monaco

Monaco continues to be the world's most expensive real estate location.

Over the past ten years, prices have risen 75%; the rich and famous now have to fork out between EUR 20,000-115,000 per square metre for residential real estate.

If you ever wanted to buy yourself a tiny slice in the Principality, SBM remains the only publicly listed vehicle to do so.

It's also one of Europe's most mysterious (and fascinating) companies – and it's never been analysed in as much detail as in this in-depth report.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: