Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

De La Rue: 130% gain in 24h despite the “end of cash”

It's not often that you see a stock more than double in a single day. Even less so for a company whose core business doesn't seem to have any future.

De La Rue PLC (ISIN GB00B3DGH821) is the world's leading producer of banknotes. One third of the world's circulating money was printed by the 206-year-old British company.

With cash allegedly going out of fashion, why have experienced activist investors bought a sizeable chunk of the company?

How did De La Rue just manage to secure an additional GBP 100m of equity?

Read on to learn about a venerable British company listed on the London Stock Exchange, the long-standing "war against cash", and whether it could provide an opportunity for private investors who have an interest in less liquid small- and mid-caps.

When cash stops flowing

It's impossible to write about De La Rue without looking into the future of cash.

Does cash actually have a future? With each passing year, we seem to be using it less and less often.

The trend to replace cash started with debit cards and now includes paying with your cell phone or even through chips implanted into your skin. The signs are everywhere. Sweden has gone mostly cashless, buses in central London have long stopped accepting cash, and there are now even currencies that exist entirely digitally.

Lesser known to the public are the various steps undertaken by special interest groups to phase out the public's use of cash. These measures constitute what even McKinsey once called "the war on cash":

- Visa offered US merchants rewards of USD 10,000 if they stopped accepting cash and went all digital.

- As long ago as 2009, the electronics payment company, FreedomPay, published a press release that cash gives you the flu: "Human influenza can survive on paper currency for as long as 17 days." Prescient PR, as we now know!

- The Bill & Melinda Gates Foundation donated to the "Better than Cash Alliance", which pushes for the elimination of cash under the pretence of supporting "inclusion".

Governments have been only too happy to play their part:

- EU officials dubbed the 500 euro note the "Bin Laden", insinuating that it was the payment of choice for terrorists. The production of the large-denomination banknote was subsequently stopped in 2015.

- In 2016, India announced that all 500 and 1,000 rupee notes would be withdrawn as legal tender. These two notes jointly made up 85% of India's currency circulation.

- Singapore has phased out the SGD 10,000 note, which at the time was worth USD 7,000.

Add the coronavirus pandemic, which provided the ideal backdrop against which to rally against "dirty cash".

Any company specialising in printing banknotes will look increasingly anachronistic in a world that is going cashless. For a company like De La Rue, surely, these developments will spell the end of the line?

As it turns out, that's far from certain yet. Surprisingly, some investors are now betting GBP 100m (USD 124m) on De La Rue turning the corner. Since its low in May 2020, the stock is up 300%!

De La Rue stock recently gained a lot of ground (UK ticker symbol "DLAR", a play on "dollar").

Decades of mismanagement and demise

De La Rue has had it anything but easy over the past three decades. Since its early 1990s high, the stock price never fully recovered. It is down about 90% compared to 30 years ago.

Its shareholders will look back ruefully to 2010 when De La Rue received a takeover bid. At the time, its family-owned French rival, Oberthur, offered GBP 926m for the company. Confident of its ability to thrive, the company's board rejected the offer. Today, De La Rue is worth just GBP 157m. In May 2020, its value had sunken as low as GBP 40m.

Its gradual demise wasn't just caused by the difficulty of its banknote division, but by seemingly all-round inept management.

- In May 2019, De La Rue suffered a GBP 18m loss because Venezuela wasn't able to pay its bill for printing banknotes. Given that everyone had long known about the country's difficult economic and political position, not having asked for pre-payment was a colossal embarrassment for De La Rue's management.

- In July 2019, the company found itself at the centre of anti-corruption investigations into its currency printing contract with Sudan.

- In June 2020, De La Rue lost its ten-year contract for printing British passports. The blue post-Brexit passport will be produced by a French-Dutch firm, which in turn will use a high-tech printing facility in Poland. Given that De La Rue is a British firm, not winning the job for the iconic new passport hurt not just financially.

- By the end of 2019, the combination of lagging earnings and rising debt had brought the company into a difficult spot. De La Rue had to warn its shareholders of "material uncertainty" about its ability to operate. The world's no. 1 for banknote printing was at risk of running out of cash – leaving it the butt of jokes in British media.

By that time, an activist investor from the Channel Islands had started to push for changes at the top of the company. Guernsey-based Crystal Amber (ISIN GG00B1Z2SL48) is an AIM-listed closed-ended fund that specialises in activist cases and focusses on British small- and mid-caps.

The activist fund had started purchasing De La Rue stock as far back as 2017 when the share price was trading between GBp 500 and GBp 600 (GBp = pence). It's not been a good ride for the fund managers so far. Most of the fund's buying will have occurred in 2019 when it massively upped its stake to 14% to make use of what appeared to be an opportunity to average down. At the time, the stock was trading between GBp 150 and GBp 200. In spring 2020, it fell as low as GBp 37.

Crystal Amber believed there was a lot of value in the company's underlying business, but it suspected that changes were necessary at the top. As the fund's spokesperson put it at the time: "De La Rue’s difficulties are entirely self-inflicted. This is a clueless board and the staff and shareholders deserve better."

At a mid-2019 shareholders meeting, Crystal Amber got almost half of voting shareholders to revolt over director pay (despite the massive Venezuela cock-up, De La Rue's CEO was due a six-figure bonus). The fact that even then just under half of the shareholders revolted goes to show just how difficult shareholder activism is. There is a lot of inertia to be overcome, even among investors who should be motivated to vote in their financial interest.

Following months of campaigning and airing dirty linen in public, De La Rue eventually agreed to replace its Chairman and CEO. Both had been onboard since 2012 and 2014, respectively, making them directly responsible for the company's ongoing misery.

The new Chairman, Kevin Loosemore, may have an unfortunate surname for someone who is supposed to make a company *lose less*. But he does bring along a track record of successful board level work at other British companies, including Cable & Wireless where he once was COO.

De La Rue's newly appointed CEO, Clive Vacher, has a reputation for turning around embattled businesses. There aren't many specifics in the public domain other than his previous positions at firms such as Rolls-Royce, General Dynamics, B/E Aerospace, and the Canadian firm, Dynex Power. However, Vacher does seem to have a reputation as "turnaround guru".

Eight months into the job, he presented the first results of his work as well as his plans for the future. A combination of renewed investor enthusiasm and short-sellers getting squeezed made the stock price leap 130% in a single day in late May 2020.

What's more, investors have now agreed to put an additional GBP 100m of equity into the company.

Is De La Rue finally about to get back to its former glory – and are there more gains to be made?

Future focus on two divisions

De La Rue once operated a sprawling empire of divisions. Over the years, mounting losses have forced the company to gradually sell off various businesses, such as its passport division in late 2019. Frustrating as this may have been for shareholders at the time, it has made the company quite easy to analyse.

The company is now focussed on just two remaining businesses.

- Printing currency: De La Rue is still the world's no. 1 independent producer of banknotes. 85% of the world's currency is printed by central banks and governments, with the remainder split between De La Rue, Oberthur in France, Crane in the US, and Giesecke & Devrient in Germany.

- Authentification technology: the company produces security features for documents, such as tax stamps for use on tobacco products.

De La Rue's products involve a lot of research and development. For example, banknotes are increasingly being printed on polymer rather than paper. As such, De La Rue is not a conventional printing company – it's a high-tech enterprise that also does a bit of printing. The company prints the new British banknotes, such as the GBP 50 notes shown in the cover photo of this article.

It's the company's unique technological capabilities where Crystal Amber spotted value. Their investment thesis finally seems to start bearing fruit.

In late May 2020, Vacher announced that De La Rue was off to a strong start under his leadership. The authentification division had won contracts with a total lifetime value of GBP 100m, compared to the division's most recent annual revenue of GBp 68m. By 2022, De La Rue hopes to generate revenue of GBP 100m in this division alone, and with strong operating margins.

The currency printing division currently makes up nearly 80% of the group's GBP 350m annual revenue, but growth in the authentification division could provide outsized contributions to the group's earnings.

At long last, investors seem to be buying into the idea that De La Rue could turn the corner. In mid-June 2020, De La Rue announced that it had managed to get a capital raise of GBP 100m underwritten by investors. New shares will be issued for a price GBp 110, and the fundraise will be executed in early July 2020.

What were the key factors that convinced investors to dump a cool hundred million into the company at a time when just about everyone believes cash to be a thing of the past?

Interestingly, not everything is quite what it seems in the world of cash payments and banknotes.

Is the tide about to turn in the war against cash?

It has taken the world a long time to wake up to the dangers of the war against cash, but a counter-movement seems to be getting underway.

Over the past three years, a growing number of voices have begun to warn against going all-digital as far as money is concerned.

Going all-digital will not only disproportionally hit the elderly and vulnerable, but also cause a raft of other problems. Who fancies the idea that your first purchase of Playboy magazine at age 15 stays in an electronic database for the rest of your life? Ongoing loss of privacy has been prevalent for years, but the tide may finally be shifting. It's now widely known that China has created a surveillance state where your alcohol purchase in a store feeds into your social credit score, which can lessen your chances to get a mortgage. TV documentaries about China's sinister use of payment technology surveillance, such as "Dataland", have helped to popularise the subject and raise concerns among broader parts of the population. Who wants to live in such a world?

In a context that is more relevant to investors, more and more people realise that banning cash will leave them at the mercy of policy-makers and banks. Going all-digital enables central banks to implement as steep a negative interest rate as they like. Greece recently introduced a measure that forces its citizens to spend 30% of their income electronically – or face a fine of 22% of the shortfall. In an all-digital world, nothing would stop governments from implementing creative measures such as a wealth tax disguised as a negative interest rate. Cash is one of the few measures that give citizens power over governments, central banks, and commercial banks.

Never mind other issues such as digital money relying on functioning power supply. Following the shutdown of entire economies during recent months, I know many people who had previously been blasé about Black Swan risks, but who now worry about being able to access their money digitally. Millions of people will have recently tried to ring their credit card companies to unwind flight bookings that airlines (unlawfully) didn't want to refund. The credit card companies effectively stopped taking calls, which taught everyone a lesson how running your entire life through the Internet and large corporations leaves you hanging when the shit hits the fan.

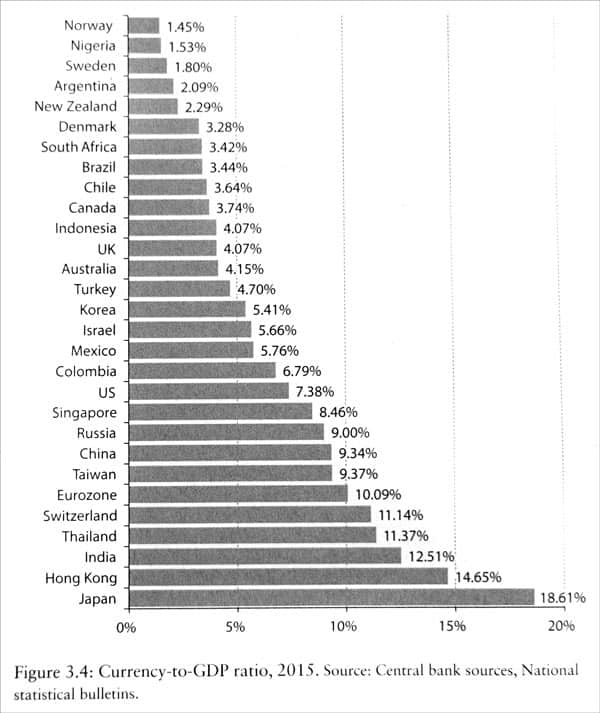

As a result, a growing number of people has now started to look towards Japan, which may well be the world's no. 1 example of a wiser approach to handling money. Relatively speaking, the Japanese economy has more cash outstanding than any other nation on earth – almost USD 27,000 for each Japanese household of four. Just 20% of Japan's payments are done digitally, 80% on the back of cash. Anyone who has ever been to Japan will know that Japanese banknotes tend to be in pristine condition – nothing "dirty" to be found over there. When the Japanese central bank implemented negative interest rates of 0.1% in 2016, it had to exclude ordinary depositors because it knew that even more money would be converted into cash. Given the country's perpetually minuscule crime rate, storing cash at home isn't risky – belying claims that a high rate of cash circulating through the economy fosters crime.

The Japanese love their cash (source: “The Curse of Cash”, by Kenneth S. Rogoff).

Similar wisdom can be found in Switzerland, where the authorities steadfastly refuse to give up the CHF 1,000 note (worth USD 1,055). Obviously, for as long as just one major country keeps issuing large-denomination banknotes, the entire theory that stamping out cash would reduce crime and terrorism will prove useless. The underworld will simply switch to that currency. Switzerland isn't alone. The US, too, had looked into reducing the number of USD 100 bills in circulation, following work of the Clinton and Obama administrations. However, it recently found the idea both impractical and unattractive.

Ample resources have been thrown at the war against cash. "The Curse of Cash" by the well-known establishment economist, Kenneth S. Rogoff, argues in favour of handing all power to bureaucrats and career politicians, and stamping out cash altogether. As ever, the establishment and its special interest organisations found a wilful accomplice in the pink Guardian, aka Financial Times, which published an article about "Curing Japan of its addiction to cash" – as if a preference for using cash was the equivalent of a mental health problem.

But the propaganda doesn't seem to be working anymore. Even the EU had to backtrack a while ago, and it admitted in a report that "restrictions on payments in cash would not significantly prevent terrorism financing".

In March 2019, Philadelphia became the first US city that enacted a law prohibiting stores from going cashless. Similar initiatives have appeared elsewhere in the US, including in Washington, DC.

The UK has just worked on plans that ensure access to cash for anyone who needs it.

Sweden, the nation that pioneered living without cash, has gone a step further even, "urging its citizens to stockpile change in case of power cuts, a cyber-attack or war".

"The War Against Cash" by Ross Clark is the definitive book if you want to inform yourself about the need for cash in our lives (published by Harriman House, who offer an excellent selection of books for investors).

In the US, a recent study found that eliminating cash disproportionally hurts the lower-income part of the population, the majority of whom are non-white. Did the Bill & Melinda Gates Foundation contribute to a cause that is now turning out "racist" and leads to "white privilege"? Will "BLM" soon cause mayhem and destruction at the Gates Foundation headquarter as a peaceful protest against their contribution to the "Better than Cash Alliance"?

Jokes aside, it does appear like rumours of cash's impending death had been greatly appreciated indeed.

It bodes well for De La Rue, and it must have featured in investors backing their current equity raise.

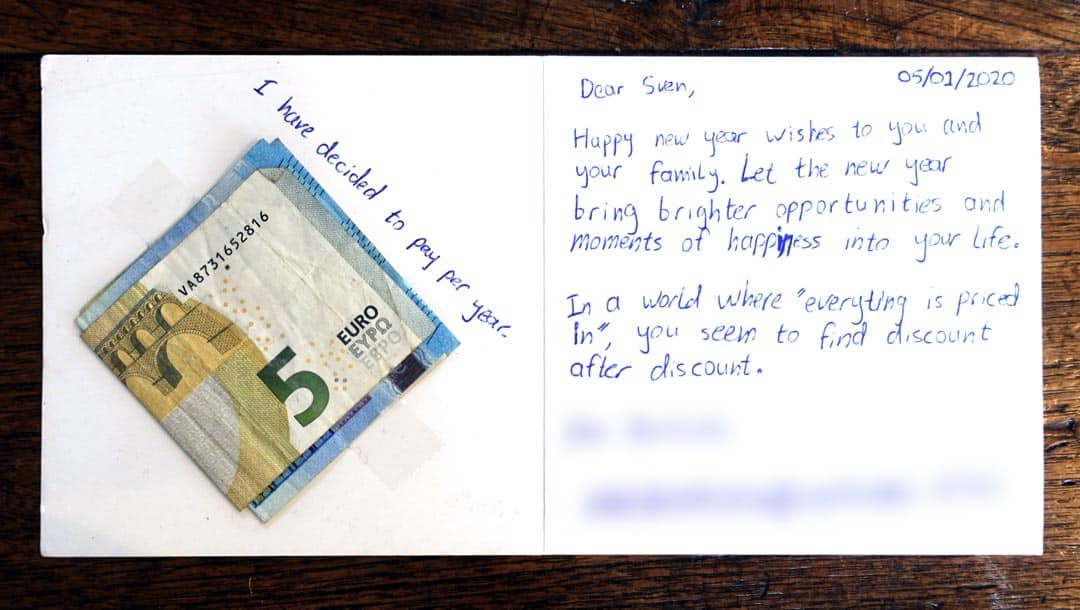

Even some readers of Undervalued-Shares.com have gone back to paying for their Membership in cash.

Plenty of growth potential

As part of its equity raise, De La Rue issued an extensive prospectus, whose fine print makes for fascinating reading.

Somewhat counter-intuitively given years of newspaper headlines about a decreasing use of cash, there seem to be ample opportunities for De La Rue to strengthen its business:

- The world's increasing move towards polymer banknotes. Of the 172bn banknotes currently in circulation worldwide, just 3% are made of polymer. De La Rue, in turn, is one of just two global providers of the innovative, counterfeit-proof polymer notes.

With counterfeiting an ever-increasing problem, De La Rue has its work cut out for replacing paper-based currency with polymer banknotes.

- Given the increasing sophistication of counterfeiters when it comes to conventional banknotes, central banks and governments around the world could decide to outsource the printing of money to firms like De La Rue. With 85% of the world's money still printed by central banks and governments, this would be a vast addressable market. The four independent banknote printers could be in for a windfall if the trend took hold, and it's unlikely that anyone will manage to set up new competitors.

- Surprisingly, cash in circulation worldwide has grown at an annual rate of 3% to 4% since 2014. There still seem to be enough countries that haven't bought into the all-digital fetish just yet.

In authentification, De La Rue has more obvious growth potential:

- Counterfeiting and pirating goods is a global USD 2.2tr market. De La Rue has delivered anti-piracy solutions to Microsoft for over 20 years. With a capable new management team onboard, the company should be able to win over other corporate customers.

- Tax stamps and other track-and-trace products are particularly relevant in the tobacco trade. Of the 59 governments that have signed up to a new convention for regulating the tobacco trade, 40 have yet to implement the agreed global track-and-trace system. De La Rue already has a foot in the door of this market and could grow its revenue significantly from this one initiative alone.

- The company provides government tax revenue protection solutions, which are used in taxing alcohol. Governments around the world have the propensity tax, tax, and tax some more. De Le Rue claims to be the world's second largest provider of solutions for securing tax revenue.

Without a doubt, the company still has a lot of challenges cut out for itself, ranging from closing one of its printing facilities in the UK, to dealing with its large pension liabilities and cutting costs across the board.

However, these are all bog-standard management and turnaround problems. Now that a new management team is on board and based on the restructuring plan that the new CEO presented to shareholders, it could well be the case that brighter times are finally ahead.

De La Rue stock is still far off its historic highs.

An investment – maybe. An exciting case study – definitely!

Given its low market valuation of just GBP 157m (USD 194m), I didn't deem De La Rue large enough to feature in one of my extensive research reports (these are usually reserved for companies with a market cap of at least USD 1bn). Nearly 60% of the company's stock is in the hands of seven institutional investors, including Crystal Amber (19%) and Brandes (12%), the US investment group. Trading is not very liquid, and it's still too early in the turnaround to reliably estimate earnings for the coming years.

The most useful yardstick for assessing the investment right now is the issue price of the new shares. The investors underwriting the GBP 100m equity raise are happy to pay GBp 110 per share. As this article went online, the stock was trading at GBp 149 – signalling that the market has regained some confidence in the company's plans. If markets experienced another turbulent period and the stock fell back closer to GBp 110, it could be worth considering an investment.

I had long wanted to take a look at De La Rue because it had repeatedly crossed my path. In 2015, I approached the company about the possibility of designing and printing a bearer-certificate bond. I had signed up partners to orchestrate a high-profile global bond issue to finance the construction of a world-class museum for the Charles Darwin Foundation (a suggestion that actually got me fired). Also, Thomas de la Rue, the 19th-century founder of the company, hailed from my neighbouring island Guernsey, and I sometimes end up in the Thomas de la Rue pub right on the edge of Guernsey's harbour. De La Rue is a company rich in tradition and history, which makes it a fascinating subject to read up about.

Never mind my personal preference for cash. Following years of fretting about the future of the cash in my wallet, I had recently sensed the first inklings of a change in public perception. Writing today's Weekly Dispatch was also an experiment if I could convince myself that cash was here to stay.

After everything I have learned while researching this article, I'd say it is. Which, if you so will, does indeed bode well for the world's no. 1 currency printing company. It's worth keeping an eye on De La Rue, who should shortly confirm the successful closing of their equity raise.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

5 reasons to invest – Volkswagen and Porsche SE

Volkswagen is probably about to take a giant leap forward as a company. Few people realise that they can buy Volkswagen stock with a 32% discount, by investing in publicly-listed Porsche SE.

A slightly convoluted but fascinating story – one which I'm sharing with my Members only!

My latest report, out today, looks at the 5 reasons to invest in the world's largest carmaker.

Interested?

Sign up for an Annual Membership (just USD 49) and you'll get instant access!