Seaport Entertainment Group is a NYSE-listed play on the revival of New York’s southern tip. I visited the neighbourhood to evaluate the opportunity.

Dubai real estate had a great run – where next?

In July 2021, I published an extensive feature on "The Great Escape" to havens like Dubai.

I pointed my readers towards Emaar Properties (ISIN AE0005802576, AE:EMAAR), widely credited as the company that created modern-day Dubai.

The stock was trading with a 50% discount to its book value and a 73% (!) discount to its net asset value. Speak of an investment thesis being out of favour!

Since then, Emaar Properties' share price has risen from AED 4 to AED 14.

What are the company's further prospects, and which other jurisdictions should hardcore contrarians now look at?

Emaar Properties.

The evolving fortunes of Dubai

Dubai as a place to visit or live in needs no introduction, and its real estate market regularly features in the mainstream news.

When I reported on Dubai in 2021, it had already received a significant boost from its role as a safe haven during the coronavirus pandemic.

Russia's full-scale invasion of Ukraine as well as the crypto bros further fuelled the emirate's population growth. For many years, those struggling with Know Your Customer procedures elsewhere found Dubai to be a bit more "flexible".

However, it wouldn't do Dubai's undoubted achievements justice if it was depicted merely as a place for those wanting to escape challenging circumstances elsewhere. Dubai has become an attractive destination in its own right, with many features that sclerotic Western countries could learn from.

It's a polarising place which some love to hate, but the same can be said about Paris, New York, and just about any other globally renowned city.

For those interested in a deep-dive the subject, I recommend reading "The Future of UAE: Diversify & Transform", a 170-page research report published by Morgan Stanley in January 2025 (contact me if you'd like a copy). As the executive summary puts it:

"Strong economic policy management and the introduction of pro-growth strategies have positioned the UAE well in the post-COVID era. …. The economic boom has seen increased diversification and growth in non-oil GDP (now ~75% of total GDP), new global free trade agreements, deeper foreign investment, a more stable and growing population, a robust capital markets cycle, and the rise of new economic sectors. Government support behind reforms is high, and the runway for continued momentum should extend into the next decade with implications across a range of sectors. Given similarities, we compare the UAE to Hong Kong and Singapore, but conclude the UAE is charting its own path."

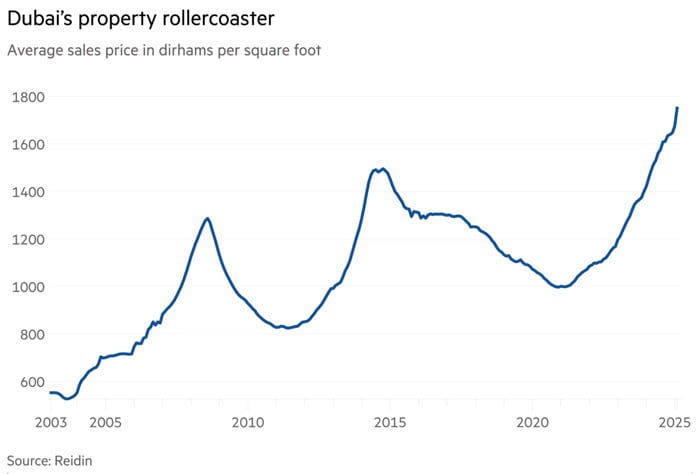

So far, holding stock in Emaar Properties has proven to be an excellent choice to gain exposure. Over the past five years, real estate prices in Dubai have risen by 70%. As I noted in my 2021 article, "historically, Emaar Properties stock offered a 90% correlation to local real estate prices". Since developers are essentially a levered play on rising property prices, it's no surprise that Emaar Properties' share price has increased by 300% over the past few years.

The question is, will it continue?

Source: Financial Times, 13 August 2025.

Boom or bust

It's easy to forget how controversial a bet on Dubai real estate was just a few years ago – and in many ways, it still is. Dubai remains as hated by many as it's loved by others, and these polarised views naturally extend to how investors assess Dubai-centric securities.

What do the numbers say?

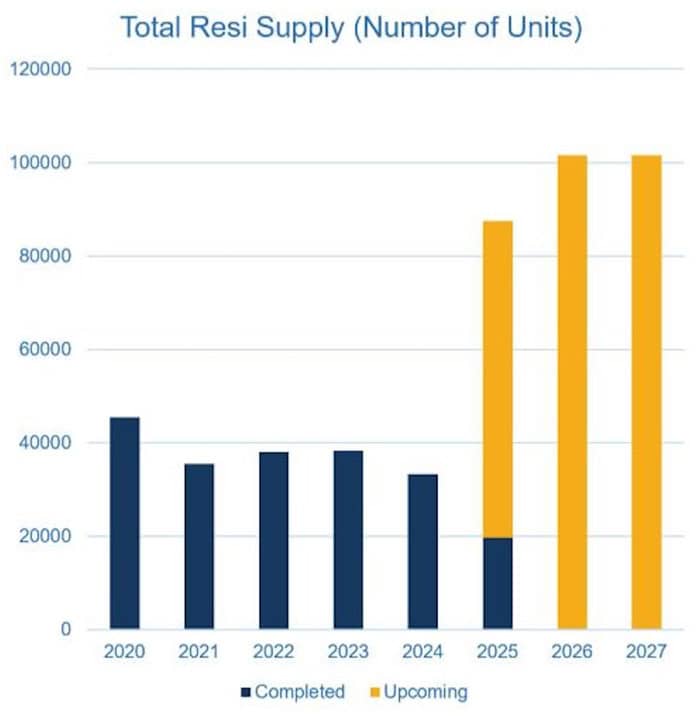

What's notable is just how much new supply is about to hit the Dubai market. With lax planning regulations and ample land, rising demand naturally triggers a wave of new development projects.

Source: Betterhomes, Knight Frank, Property Monitor, Macro Real Estate.

Will this wave of new supply lead to a new price bust?

Those who wonder about the question would do well to read the 12 August 2025 Bloomberg article "Dubai's Housing Boom Is Stoking Fears of Another Crash

On the one hand, foreign professionals continue to pour into Dubai, pushing prices ever higher. Cheerleaders for the emirate are quick to point out that lenders have maintained stringent rules and will only offer mortgages for about 80% of a home's value – a sign that the market and regulation around it are maturing. Plus, developers are required to pay for land in full before construction even starts.

But critics note that the booming property market has lured scores of new developers, with nearly a quarter of a million homes on track for completion in the next few years. That would represent a 30% increase in the supply of housing in Dubai, according to real estate services firm Jones Lang LaSalle Inc."

More optimistic observers argue that Dubai's real estate market (and its broader society) has changed so fundamentally that comparisons to past boom-and-bust cycles no longer hold. As the Financial Times noted in a 12 March 2025 feature:

"One keystone of Dubai's success has been in the more diverse profile of buyers, says Michael Lahyani, founder of PropertyFinder – the local answer to Rightmove or Zillow – largely thanks to the now six-year-old Golden Visa programme. It was introduced specifically to encourage foreigners to treat Dubai as more than just a tax-free pit-stop for a couple of years – and it seems to be working. After the Gulf Cooperation Council buyers came a flurry of Russians and Indians: 'It's for entertainment purposes, a place to go for a weekend,' says Lahyani.

In 2025, though, an increasing number of buyers are coming from Europe and North America. A recent study by migration consultancy Arton Capital, for example, flagged that 37 per cent of Germany's wealthiest are now emigration-prone, with the UAE a prime destination. There is also a rise in American arrivals. Leigh Williamson is a Canadian who moved to Dubai 18 years ago, and has been a Sotheby's agent for 11 of them; she says her client base has 20 per cent more Americans than a decade ago."

Indeed, given the gridlock politics in much of Europe's wealthier parts, it's difficult to envisage an end to the outflow of frustrated, wealthy Europeans. Dubai is one of the few viable places that can accommodate these émigrés at scale.

Speaking as both an investor and a contrarian, it's hard not to wonder whether Emaar Properties' share price has already run its course – at least for now. The company was recently featured in the Financial Times for its struggle to reinvest surplus cash domestically, prompting it to seek acquisition opportunities abroad instead: "Dubai developer Emaar turns to 'big countries' for M&A opportunities

Dubai's leading developer Emaar is considering buying companies in countries such as the US, India and China for the first time as it looks to expand internationally using proceeds from a boom in local property values.

Emaar's financial strength meant that 'a really serious global strategy is something that the board is really debating now,' said Mohamed Alabbar, its founder and managing director.

'Emaar is strong in the [United Arab Emirates], but I think maybe UAE is becoming too small for us, or Dubai is becoming too small for us, to continue this growth story,' said Alabbar, who is one of the most influential businessmen in the region.

He said he wanted Emaar to look at 'big countries' such as the US, India, China and parts of Europe and was flexible about the exact nature of the relationships once it had identified targets.

'Maybe you go and buy a majority stake in a developer and then change the way they do business . . . [Or] maybe they already do good business [and] we learn from them.'"

With so much cash on hand but no clear plan, an expansion into entirely new markets, and a board openly displaying they don't yet have a strategy, there's plenty of cause for concern.

Four years ago, Dubai property and Emaar Properties were as 'out' as they come, with shares trading at an almost unbelievable 73% discount to net asset value.

The stock is currently trading at about 7-9x earnings for 2025-2027, with a dividend yield of 5-6%. For a company that has had an extraordinary cyclical upswing recently, that's not an overly cheap valuation. It's not outrageous either, but it's certainly a far cry from the clear undervaluation the stock suffered when it changed hands at a 73% discount to net asset value.

Not many readers would have taken advantage of that opportunity. At the time, shares of Dubai firms were difficult to trade and often required a local bank account. Some readers did get in, though – and those invested would now be well advised to take at least some money off the table and look elsewhere for the next out-of-favour bargain.

"Where, though?", you will ask.

Other contrarian jurisdictions

Finding contrarian bets that make sense and offer the right risk/reward ratio is easier said than done.

It's all easy to fall into the trap of being contrarian just for the sake of it. As a smart investor, you need to find situations where taking the opposite position of what everyone else believes is backed up by solid evidence and hard data.

Argentina used to be such a destination three years ago, when Undervalued-Shares.com covered the jurisdiction in considerable detail. Today, Argentina is back en vogue with at least a certain subset of investors.

Lebanon was another such place – literally a "bombed out" market. I wasn't referring to real estate, but rather defaulted sovereign bonds. When I covered them in an extensive Weekly Dispatch in February 2023, these bonds were trading in vast quantities at the proverbial pennies on the dollar. Since then, they've surged 300-400%.

Defaulted Lebanese bonds have been on a tear.

What are the next Dubais, Argentinas, and Lebanons for contrarian investors in real estate, securities, and other accessible, liquid assets?

Jason Wong, presenter at this year's Weird Shit Investing conference in London who manages his personal investments in emerging market real estate, believes in Bucharest, Romania, as a down-and-out real estate market. Check Jason's corresponding LinkedIn post, or follow him on X.

Personally, I believe the Ukrainian real estate market is worth a closer look. In fact, I'll be back in Kyiv for an extended research trip from 6-19 October 2025 – watch out for my reporting from there.

We live in a big world, and no one can possible keep an eye on all of the world's countries and territories.

What other opportunities are out there? Please do feel free to send your ideas!

An asymmetric opportunity

London's AIM market is far from straightforward. Many brokers don't even offer access. Transparency is often lacking. And many stocks go unnoticed.

But that's exactly where the most compelling special situations emerge.

The latest Undervalued Shares report uncovers one such overlooked stock.

With upside of at least 50-100%, it's an asymmetric opportunity you won't want to ignore!

An asymmetric opportunity

London's AIM market is far from straightforward. Many brokers don't even offer access. Transparency is often lacking. And many stocks go unnoticed.

But that's exactly where the most compelling special situations emerge.

The latest Undervalued Shares report uncovers one such overlooked stock.

With upside of at least 50-100%, it's an asymmetric opportunity you won't want to ignore!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: