Image by LayalJebran / Shutterstock.com

Lebanon's recent economic collapse has few equals in history.

The national currency lost 98% of its value.

82% of the country's population now lives in poverty, compared to 26% just four years ago.

Basic public services, such as the supply of power and medications, have partially broken down.

Last week, desperate Lebanese citizens started to put bank branches on fire. It's terrifying when you consider that until 2018, Lebanon was believed to be a relatively prosperous nation!

Is this a place you – or anyone else – should invest in?

Actually, hovering up the country's distressed bonds could be well worth it. Of late, Lebanese debt has been trading at just seven cents on the dollar – the lowest valuation since May 2022.

Distressed Lebanese debt is an opportunity that ultra-contrarian investors should take notice of.

A short primer on Lebanon's crisis

Since winning independence from France in 1943, Lebanon has had extreme ups and downs. Renowned as the "Paris of the Middle East" during the 1960s, the country descended into a devastating civil war from 1975-1990, and made a comeback as a fashionable party destination in the 2000s. Just a few years ago, Lebanon was known as a beacon of free politics and consumerist lifestyles, envied across the Middle East.

The most recent, sad chapter in the nation's history started in spring 2019 when the country's long-running financial strategy stopped working.

Lebanese banks had long offered very high interest rates to attract dollar deposits from both Lebanese living abroad and international investors. At the time, Lebanon's currency was pegged to the US dollar at a fixed rate, and everything seemed to work smoothly for all parties involved. What investors didn't realise was that the private banks deposited all their dollars with the central bank, which in turn used the money to help fund expensive imports, inflated government policies, and the obligatory embezzlement schemes. While holders of dollar deposits in Lebanese banks thought their money was safely stashed in their account, it had actually long been spent on other things. Lebanon ran a giant Ponzi scheme.

It was politicking that eventually brought down the house. In May 2018, parliamentary elections led to a political stalemate. On one side was a strengthened anti-western coalition led by Hezbollah, the Islamist political party and militant group that is backed by Iran. On the other side was Saad Hariri, the pro-western prime minister. The West demanded political reforms in exchange for investment, and Iran made sure that Hezbollah stood firm. For two years, Lebanese politics was stuck in a political impasse. During this time, the economy weakened to a point where the government eventually had no choice but to default on its massive debt. Inflation, currency devaluation and frozen bank accounts followed.

During the first phase of the crisis, Lebanon delivered a case study for what happens when savers lose faith in their national currency and banking system. The Lebanese people fled into real assets, which caused prices for any hard asset available within Lebanon to rise dramatically. As the Wall Street Journal aptly described on 2 June 2020, the well-off Lebanese were "sinking money into Land Rovers, ski chalets and expensive artworks, triggering an unlikely boom at the very top end of the luxury market".

Source: Wall Street Journal, 2 June 2020.

Worse was to come.

On 4 August 2020, an enormous explosion caused by illegally stored explosives in Beirut's harbour destroyed large parts of the capital city. The blast brought down what had remained of the dysfunctional system, and Lebanon has been in a mega-crisis ever since.

The 2020 explosion in Beirut's harbour (image credit: Ali Chehade / Shutterstock.com).

The country has no functioning central power system anymore, basic needs are often met through bartering or smuggling, and anyone who could leave the country will by now have left. In a sign of just how bad things are, the Lebanese Army recently tried to make ends meet by offering joyrides on its military helicopters for USD 150 a head. As if its population hadn't suffered enough already, Lebanon also recently had to deal with an outbreak of cholera.

Over the past four years, the nation's GDP suffered a contraction of 40-50% in real terms. Such a magnitude of economic crisis normally only happens in nations that are involved in a hot war. The crisis is widely viewed as worse as that of Greece in 2008, and more extreme even as that of Argentina in 2001. According to the World Bank, during the last 150 years, only Chile and Spain once experienced a collapse that was even worse, and both of these crises happened nearly a century ago. Chile took 16 years to recover from its 1926 financial collapse, and Spain needed 26 years to get back on its feet after the 1930s civil war. Right now, no one believes that Lebanon will get back on its feet quickly.

It's no surprise, therefore, that the value of Lebanese bonds has collapsed, too.

After trading between 90-100% of their par value in 2018, the bonds fell below 10% in May 2022. After briefly recovering to double-digits, they have spent the past seven months trading between 5-9% – with the current price around 7%. There are dozens of different issues outstanding, each with their own conditions, duration and pricing. During its first 76 years of independence, Lebanon had never suffered a default – not even during its civil war. Today, however, Lebanese debt is held in such low regard that it's almost priced like a total write-off.

Is that justified, though?

Lebanese bonds.

Investing in defaulted sovereign debt

There is a well-established system for dealing with countries that default on their sovereign debt. Ahead of being allowed to return to international financial markets, they have to reach a settlement with their existing creditors. This golden rule of sovereign debt is why, eventually, every nation seeks a settlement with owners of its defaulted debt. The rule held true even for the Soviet Union: following the end of the Communist bloc, Russia settled outstanding pre-1917 Czarist debt. As a result, prices of long-forgotten Paris-listed Czarist bonds rallied from 1% to 100% of face value (as I once described in more detail in a report). Cuba is another such candidate, both for its pre-revolutionary, pre-1959 debt and more recent debt issued by the Castro regime. I last wrote about Cuban debt in September 2022, and on 7 February 2023 we finally saw the Financial Times laying out that "Cuba ministers express willingness to engage with 'legitimate' creditors".

In the end, nation states always get back to the negotiating table with owners of their sovereign debt. Else, they could not tap into foreign funding. Given that government officials are addicted to running up debt, you can trust this system to remain as reliable as it has always been.

It's not a question of if Lebanon wants to settle its debt but when – and how much it will be willing to offer to creditors.

Lebanon's biggest issue right now is that it doesn't have a functioning government capable of tackling the crisis or leading negotiations. Following the elections of May 2022, the country still only has a caretaker government, i.e. it does not have a proper cabinet of ministers in place. The term of the President of the Republic expired last October, and the term of the Governor of Central Bank is also expiring this year. As it stands, Lebanon is facing a triple-power void.

Foremost among the country's challenges is to get the banking sector back on its feet. The local banks have lost about USD 70bn during the crisis, equivalent to three times the banks' capital and four times the country's GDP. Given that Lebanon's government is bust, there is no way for the country to recapitalise the banks. The only way out of this situation will be to force a "bail-in" of depositors, i.e. to convert customer deposits into equity (similar to what happened in Cyprus in 2011). Depositors effectively already lost their money anyway, but to serve them up the inconvenient truth that a bail-in is required is not something that Lebanese politics would have been able to push through just yet. For now, Lebanese bank account holders are merely prevented from accessing their deposits.

In May 2022, the International Monetary Fund (IMF) put a USD 3bn carrot in front of Lebanon's political class, hoping to prompt them into action. Lebanon could pick up these funds if the government dealt with a list of basic tasks, including the restructuring of banks but also an audit of the country's central bank and the parliamentary approval of a government budget.

The IMF's offer was seen as a first step out of the crisis, and Lebanese bonds rallied to ≈15% of their face value. Nearly one year later, Lebanon still has not taken the necessary action to claim these funds. Instead, the market has lost faith in Lebanon's progress, and the bonds are back to trading near their record low.

With distressed debt trading between 5-9% of its par value, Lebanon appears similarly hopeless as Cuba, Venezuela, or North Korea. Does Lebanon deserve to be priced the same way as these eternal "Axis of Evil" countries?

There is no denying that the country's situation is bleak, and dangerous even. Lebanon has reached a point where citizens are taking the law into their own hands. There have been waves of "bank robberies" lately – not by actual bank robbers, but by desperate citizens who simply wanted their own deposits back, often to pay for medical treatments and other emergencies.

Source: The Guardian, 11 August 2022.

There is a non-zero risk of Lebanon descending into a Mad Max-type hyper crisis. The country could even see another civil war.

Then again, there are also some signs of actual improvement. The mainstream media don't generally report about them (yet), and information is hard to come by given that much of the system in Lebanon has stopped working. The market hasn't really taken notice yet – it's in such a chaotic situation that distressed debt investors might find a time-limited opportunity to strike while the bonds are mispriced.

Indicators of a potential recovery

Bank Audi, one of the Lebanese banks caught up in the chaos, recently issued an extensive report on the Lebanese economy (Undervalued-Shares.com, thanks to its network of readers and supporters, procured a copy thereof).

The report stated:

"Following the significant 33% contraction in real GDP in the first two years of the crisis, Lebanon is back to a slightly positive real GDP growth in 2022. Bank du Liban (= Central Bank) and the government announced a 2% real GDP growth for the past year. The analysis of the real sector indicators shows that out of 17 indicators, 11 were up last year. The touristic season was particularly strong in 2022 with 65% more tourists relatively to the year 2021, while flight and hotel reservations were close to full during summer and Christmas holiday. Remittance inflows amounted to USD 6.8bn in 2022, against USD 6.4bn in 2021, growing by 7% year-on-year. In additional, a large number of companies are increasingly paying salaries in fresh dollars which is supporting domestic consumption."

Case in point, the Lebanese stock market (there is one!) rallied 37.2% in local dollar terms, following a 48.1% rally in 2021.

To be clear, one swallow does not make a summer, and Lebanon's problems are far from over. Just recently, the country adjusted the exchange rate of the Lebanese pound from LBP 1,500 per US dollar to now LBP 15,000 – a 90% devaluation in a single day. It is still a far cry from the LBP 80,000 currently paid on the black market, but it's a first step towards adjusting to reality.

Bank Audi estimates that if Lebanon formed a credible and effective new cabinet following the election of a new president, the economy could grow by 5% in 2023.

Without the void in politics being filled, the bank predicts another year of negative GDP growth, hyperinflation in consumer prices, and continued severe socio-economic pressure on the nation's households.

In a scenario that sits somewhere between these two extremes, Lebanon could see real GDP growth of 2% and generally muddle along.

Which way is Lebanon going to go?

No one can really say for sure.

However, it's interesting to analyse how Lebanese bonds are priced right now, and how that compares to historical data about sovereign debt settlements with creditors following defaults and lengthy negotiations involving messed-up situations.

How to assess the opportunity

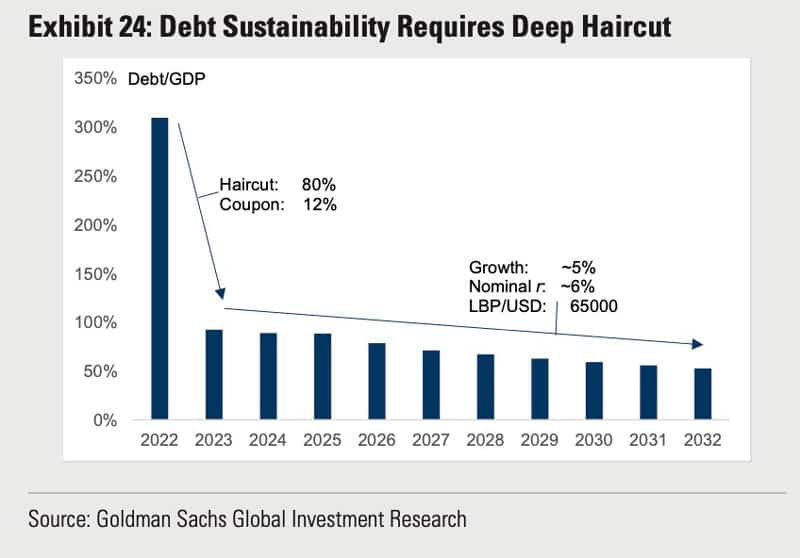

When governments and creditors settle, they agree on a "haircut" – a percentage figure that shows how much of their money the creditors need to write off.

Since the 1970s, the median haircut amounted to 35% (meaning creditors were repaid 65% of the face value). More recent cases (Argentina and Ecuador) involved a haircut closer to 50%.

There is the obvious opportunity cost caused by having to wait for years until a settlement is reached. During such negotiations, governments try to get a deal for repaying both the principal capital and past due interest ("PDI", the accumulated interest since default).

Nearly 50% of all cases get resolved within two to seven years. By year ten, 70% of all defaulted government debt cases are resolved. For reference, on 9 March 2023, Lebanon will enter the fourth year of its default.

In the tug-of-war between defaulted governments and foreign creditors, a deal is usually based around the idea of a country being given a fresh start and creditors getting issued new bonds where they can realistically expect to be repaid.

Where are the chips going to fall for Lebanon?

According to an analysis of sovereign debt experts at Goldman Sachs in December 2022, Lebanon will eventually settle between 16-21% of the bonds' face value. The old bonds would be replaced with new bonds that come with a coupon of >10% p.a. In one case modelled by Goldman Sachs, Lebanese bond holders would get issued new bonds with a 12% coupon and in effect get 21% of their outstanding capital back. With such a solution and taking the country's overall finances into account, Lebanon would be able to get back onto its feet financially and economically. For anyone who buys Lebanese bonds at 7% of their face value, such a settlement would amount to a tripling of their investment. The figure could come out higher if the settlement also involves a payout of some of the PDI in one way or another – which would normally be the case.

Source: Goldman Sachs, December 2022.

Such a deal should be a palpable solution for the owners of the outstanding debt. Much of it is now in the hands of financial investors either experienced or specialised in dealing with this sort of investment.

The fund managers Amundi, Ashmore, BlackRock, BlueBay, Fidelity and T. Rowe Price, as well as a group of smaller hedge funds have bought up over 25% of all outstanding Lebanese debt. They reportedly did so after the crisis hit, often buying debt from local banks that were scrambling for liquidity. These creditors now have a blocking minority, i.e. they will have a serious say in a restructuring of the debt. Notably, the second largest holder of the LEBAN 8.25% 34 issue is Grantham, Mayo, Van Otterloo (GMO), a value investment firm in Canada.

Chances are that over the past months, these investors will have upped their exposure further. With tens of billions of defaulted debt outstanding across various bond issues, there is a relatively liquid market for these securities. They usually trade in denominations of USD 100,000 each, but at 7% of their face value, it is a ticket size of just USD 7,000 to get in.

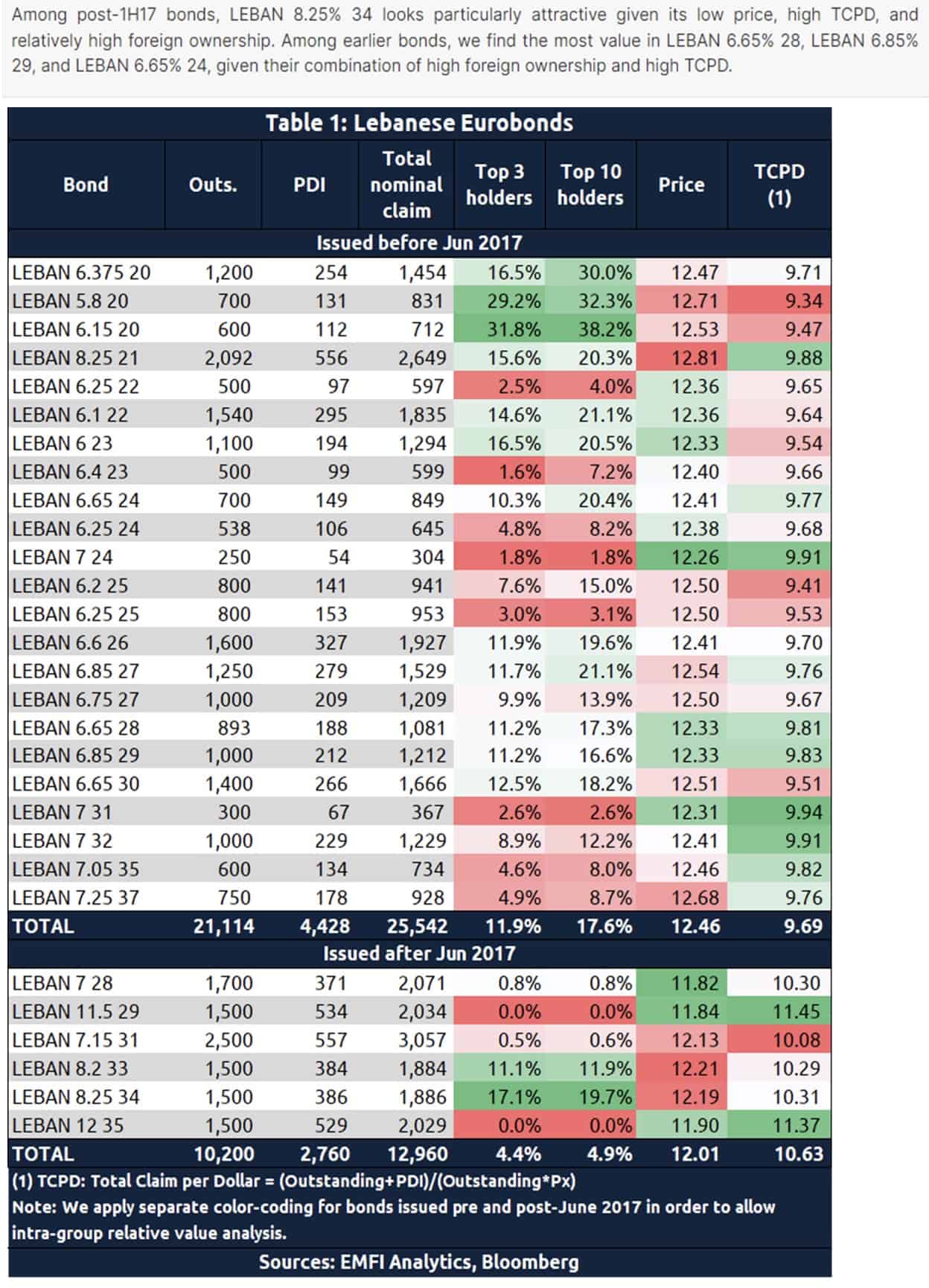

Which issues should investors go for?

Picking the right bond issue is part science, part art – and there is not necessarily a right or wrong, given that no one can foresee the exact conditions for their settlement.

A handy rule of thumb for such investing opportunities involves:

- Buying the issues with the highest interest rates, because the PDI has to be taken into account in the restructuring negotiations.

- Buying the longest-dated issues, because they benefit from the statute of limitation, i.e. any potential expiry of your rights lies further in the future.

- Buying the issues with the highest percentage of foreign ownership, because they are more difficult for the debtor nation to mess with.

Finding out data such as the percentage of foreign ownership of specific bond issues is largely beyond the possibilities of private investors. Occasionally, bits of useful information emerge. In March 2022, EMFI Group, a specialised financial data provider, issued an analysis of Lebanese bonds, singling out the issues LEBAN 8.25% 34, LEBAN 6.65% 28, LEBAN 6.85% 29 and LBAN 6.65 24 as particularly interesting, not the least based on their high percentage foreign ownership.

Source: EMFI Group, March 2022 (not 2023!). Click on image to enlarge.

In the case of Lebanese bonds, one major advantage is that they have a fairly liquid market. While Cuban bonds and North Korean bonds suffer from a lack of liquidity, and trading in Venezuelan bonds is limited by sanctions, Lebanese bonds can easily be bought and sold by anyone with a professional brokerage account – and even at scale. Right now, most of the outstanding issues are largely priced around the same level, which could be justified or a sign that the market does not sufficiently distinguish between interesting and less interesting issues.

Is it time to delve in?

Given how opaque the entire situation is right now, your personal view of Lebanon could well play a significant role in how you assess the opportunity.

Will the Lebanese people pull it off?

Everyone has their personal biases, and mine is a positive inclination towards the Lebanese people.

Twice as many Lebanese live outside of Lebanon than inside, which makes it one of the world's largest diasporas per capita. And it's a commercially successful one, comprising enterprising, often highly educated individuals with a track record for coming back after long crises.

Lebanon is a strategically important country in the Middle East. Would its neighbours and partners further afield want to see it descend into total anarchy? I doubt it. Its diaspora is financially strong enough to fund what is needed to help the country get back on its feet.

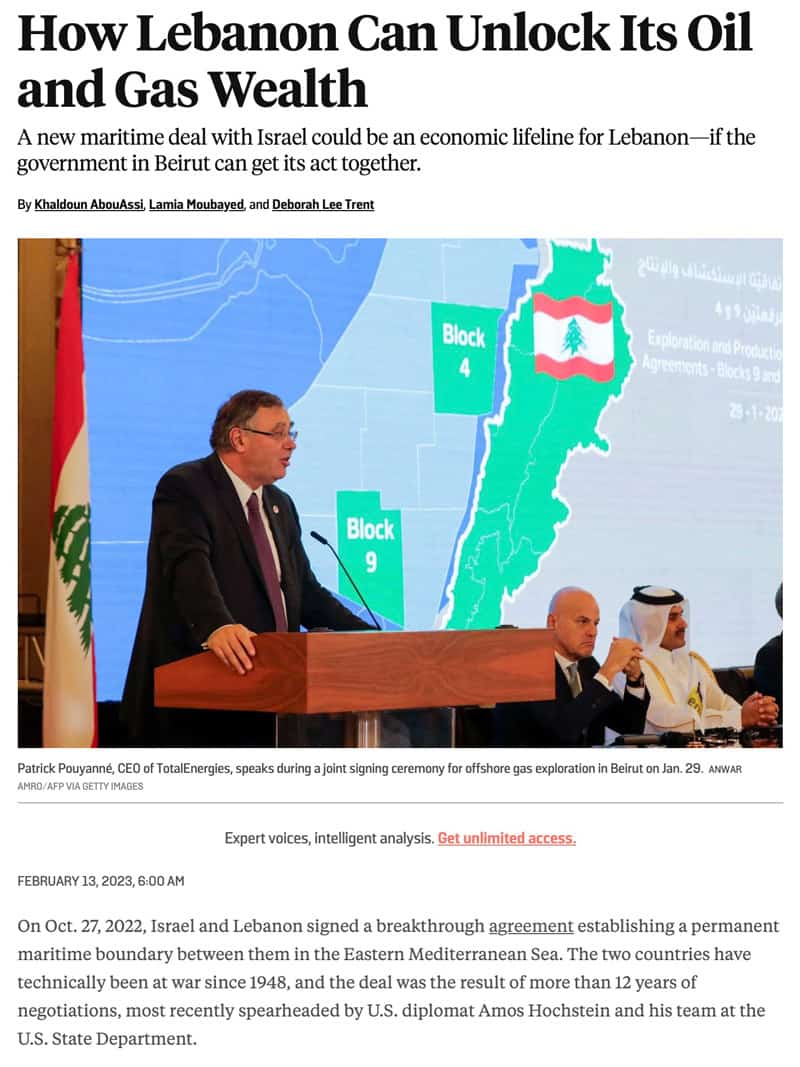

What's more, Lebanon does have veritable assets. It's a major tourist destination, and it recently started to gets its act together for exploiting its offshore gas reserves. The country's central bank reportedly has billions in dollar cash reserves and gold, which could be utilised to facilitate an agreement with creditors. All in all, it appears nonsensical to have Lebanese bonds trade at a similar valuation as those of Cuba – a country that has been in default for 60 years and which has truly run its reserves to zero.

Source: Foreign Policy, 13 February 2023.

My bet would be on Lebanon's tenacious people and its capable, educated diaspora devoted to its homeland. It's true that the country's current crisis is a once-in-a-century economic meltdown, but don't forget that it also managed to pull itself out of the devastation of its 15-year civil war.

At the end of the day, it's all down to how cheap you buy these securities.

If you buy at seven cents on the dollar, how much lower could it actually get?

Just as much, even just the first signs of a potential reversal could see the bonds rally – as they did in May 2022 following the first offer from the IMF. Once the PDI is taken into account and provided Lebanon decided to structure the repayment of outstanding interest in a creative way (as other nations have done), an eventual settlement could even come out between 25-30%.

Investing in distressed debt is not for everyone. However, for those who are interested in this asset class, distressed debt from Lebanon seems like one of the smarter picks right now.

Latest stock pick out now

The world's growing middle class and the electrification of the West will take up tremendous amounts of natural resources, but no one wants to mine for them anymore.

This will change, though, and make this company a very attractive proposition indeed.

It has all it takes for a multi-bagger penny stock. Beware, though – it is highly speculative, highly controversial, and not for the faint-hearted.

Latest stock pick out now

The world's growing middle class and the electrification of the West will take up tremendous amounts of natural resources, but no one wants to mine for them anymore.

This will change, though, and make this company a very attractive proposition indeed.

It has all it takes for a multi-bagger penny stock. Beware, though – it is highly speculative, highly controversial, and not for the faint-hearted.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: