Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Credit Suisse: moment of maximum pessimism?

Image by Judith Linine / Shutterstock.com

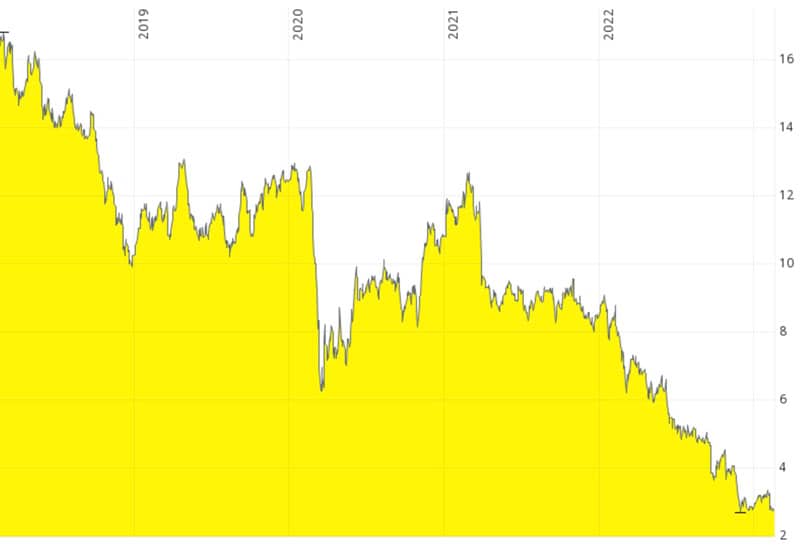

Credit Suisse is currently one of the most hated stocks in Europe.

Since 2008, it has shed an unbelievable 96% of its value. In late 2022, social media rumours nearly caused a run on the bank.

However, Credit Suisse also remains Switzerland's second largest bank, and even after the recent outflow of client money, it is still among the world's ten largest wealth managers.

Has the market overreacted, and is Credit Suisse stock in for a recovery?

Credit Suisse.

Expensive missteps

Credit Suisse (ISIN CH0012138530, CH:CS) has had an unbelievably bad run of late.

Following its multi-billion disasters with Archegos Capital Management, Greensill Capital, and the tuna bonds in Mozambique, the company is widely mocked as "Debit Suisse". As the New York Times put it on 27 October 2022:

"For years, Credit Suisse has stumbled from crisis to crisis, including billions of dollars in losses, costly legal settlements and a series of executive departures — including the ouster of a chief executive, Tidjane Thiam, over the surveillance of employees."

In autumn 2022, the bank had to unveil a quarterly loss of a staggering CHF 4bn. Rumours ran rife that Credit Suisse might no longer be a safe bank to stash away money. There was talk of another bank having to step in to purchase the 167-year-old institution to prevent it from going under altogether.

Credit Suisse then raised CHF 4bn in additional capital from state-owned Saudi National Bank, which helped to stabilise the operation. The bank also unveiled a far-reaching restructuring package to start and work itself out of its predicament.

However, in early 2023, Credit Suisse had to warn the market about another set of disappointing results. During Q1/2023, the bank expects to lose money on both its wealth management division and investment banking division. It also expects to make a loss overall in 2023, and not return to profitability before 2024.

The market had already received an earlier warning about an upcoming CHF 1.5bn quarterly loss, but news that even Credit Suisse's fabled wealth management division was going to suffer a loss pushed investors' nerves over the edge. Management tried to sell the latest update as "strong progress", but the stock market reacted with a 15% plunge. The stock is now trading as low as it did when the possibility of an actual bank run loomed large.

Credit Suisse.

Strong interest from Middle Eastern investors

The deterioration of Credit Suisse is all the more remarkable when put in the context of other European bank stocks.

Long maligned, the stocks of European banks have lately been on a tear:

- On 21 September 2022, I had reported on Bank of Cyprus (ISIN IE00BD5B1Y92, UK:BOCH), which had also long been shunned as one of the less attractive bank stocks listed in Europe. My article drew a fair bit of criticism among colleagues, but the stock is up 76% since then.

Bank of Cyprus.

- I followed up on 14 October 2022 with "European bank stocks – a surprise winner of higher interest rates". The stocks of European banks have since been on fire.

Could Credit Suisse be the laggard stock where you can still get in on the cheap and bet on a recovery over the coming 6-18 months?

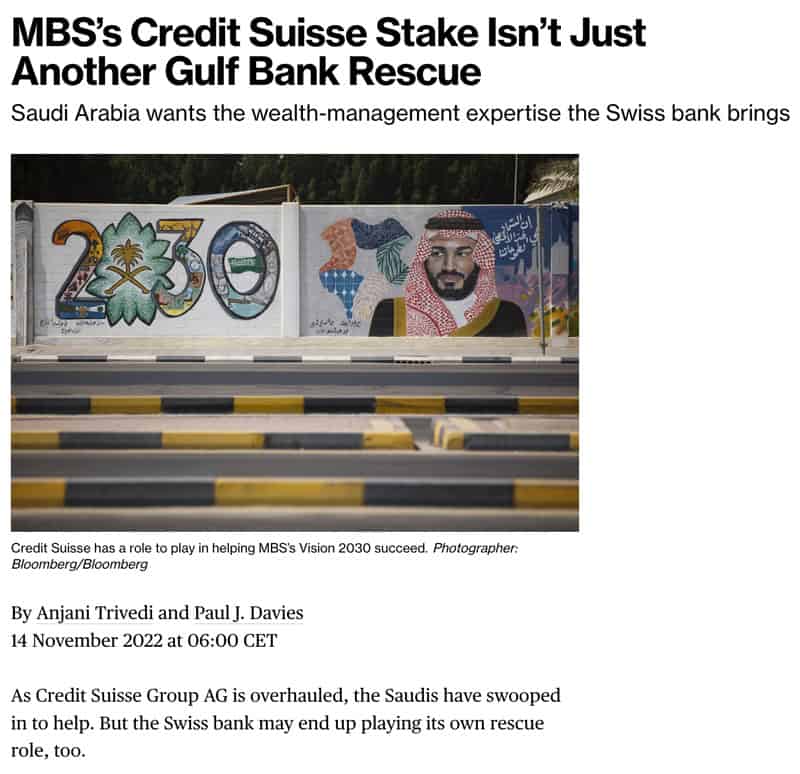

That's what its Saudi investors seem to think. Ammar Alkhudairy, chairman of Saudi National Bank, called the stock "a steal". His firm now owns 9.9% of Credit Suisse, which is the legally permitted maximum before requiring Swiss regulatory approval to increase the stake further.

"We got it at the floor price. I think the bank has been battered. It's trading at less than a quarter of book value, of tangible book value, which is a steal. And it's 160-year-old brand, the brand has a lot of value."

Middle Eastern investors now make up the largest group of shareholders at Credit Suisse. Saudi National Bank, the Saudi Olayan family and the sovereign wealth fund of Qatar own just under 20%. It's quite a change to the 1970s, when large Swiss corporations created poison pills to keep potential interest from Arab investors at bay. Two generations later, it's Middle Eastern institutions that have to bail out one of Switzerland's greatest banking institutions.

Are these ego-driven investments by oil sheiks with more money than sense, or are the bank's new supporters onto something?

Re-establishing strategic clarity

From a fundamental perspective, the situation of Credit Suisse looks complicated and risky, at least in the short term.

The investment banking division added a lot of volatility to earnings, and it all too often produced one-off losses from taking on the wrong kind of client. Even if further missteps were avoided from here on, investment banking is fundamentally different to the more conservative wealth management business with its reliable, recurring revenues.

In its wealth management division, the bank had to stem the outflow of money from worried clients who at one point pulled out 15% of all money in the space of just three months. According to Credit Suisse, it called in all of its important clients to have conversations with them – code for admitting that the bank had to offer these clients lower fees in return for them agreeing to stay onboard. Recent figures indicate that the bank can stop the outflow of client money, albeit at the expense of declining margins.

Credit Suisse also has a large division for so-called structured products, as well as a range of activities that don't fit into any of the existing core divisions.

The bank recently laid out a strategy for the path forward:

- The investment banking division will take new investors onboard; longer term, it could be spun off through an IPO (though it will likely remain consolidated within the group).

- The division for structured products will be sold, as will other non-core divisions.

- "New Credit Suisse" will focus on its roots, i.e. domestic banking market, wealth management, and asset management.

After years of Credit Suisse not delivering on promises, the market has manifold concerns about the plan:

- To sign up a new CEO for its rebranded investment banking division, the bank spent CHF 210m on buying out the firm that the CEO had built. In the eyes of some observers, this seemed like an expensive way to recruit a divisional CEO.

- Once existing wealth management clients are granted lower fees to keep them as clients, how do you ever get them back to paying normalised fees?

- Will the "run-down" (liquidation) of non-core divisions reveal further nasty surprises? Following the past few years, this is a legitimate question to ask.

There are perfectly legitimate arguments for saying that there are better opportunities in the European banking space. Europe offers a plethora of listed banks, so why bother with the problematic case of Credit Suisse?

On the other hand, all of the above is now widely known and likely baked into Credit Suisse's share price already.

Could there be surprises that the market has not yet discounted and which could lead to a recovery of the stock price in the foreseeable future?

There is potential for this to happen. Here are three possibilities to consider.

1. Tailwind from the Middle East (and Asia)

Amidst the seemingly perpetual crisis, it's easy to overlook how strong a brand Credit Suisse remains in wealth management.

Asian clients, in particular, have long liked Credit Suisse and looked up to it as an aspirational brand even. You are not really wealthy unless you have an account with Credit Suisse.

The bank's strength in emerging markets has been given another boost by the investments from Saudi Arabia, in particular.

Investors from the Middle East will be reassured by the involvement of large investors from the region, and Saudi Arabia is said to be pushing for a stronger presence in marketing to potential clients in the region. As the world's fastest-growing major economy in 2022, Saudi Arabia is where a wealth manager wants to have a strong presence.

Investing in Saudi Arabia will be one of the upcoming next hypes, and Western stocks with a strong exposure to Saudi Arabia will become an asset class in itself.

Credit Suisse could become an attractive indirect play on the growth of private wealth in the Middle East and Asia.

Source: Bloomberg, 14 November 2022.

2. Faster progress than expected

Currently, Credit Suisse's management is very much on the defensive. In such a situation, there is a need (and opportunity) for gaining the upper hand through a surprise move.

One possibility for the bank to gain some positive momentum is to advance quickly with selling off non-core assets.

Not many observers noticed that earlier this month, Credit Suisse poached Tom Nyiro, who will head up the unit that will deal with asset sales. Nyiro most recently ran Deutsche Bank's run-down division, with such focus that he was reportedly respected and feared at the same time. He'll come well-prepared to take on this job.

Credit Suisse recently completed the first phase of a deal to sell its securitised products division. Could we now see a quicker sale of the remainder of the division than widely anticipated? What other non-core assets could the bank shed quickly now that markets have overcome their rout and recent concerns about the macro situation?

If I ran Credit Suisse, I'd now seek to achieve one or two such accelerated wins. The bank could gain significant momentum from such an achievement and also start to regain control of the narrative.

Other potential sources of positive surprises could be client outflows stopping quicker than expected or even reversing, and faster than assumed progress with cost-cutting.

Must-read summary of Credit Suisse's trials and tribulations (source: Spear's, 24 January 2023).

3. A bid from another bank

There have been repeated rumours that another bank was going to take over Credit Suisse.

In June 2022, State Street had to publicly deny that it was about to bid for the Swiss bank.

Credit Suisse would not be an easy asset to take over. However, at the end of the restructuring that is currently underway, Credit Suisse will largely have returned to its roots – wealth management, domestic banking, and asset management. These are divisions with traditionally stable income and attractive long-term growth prospects. A banking franchise like Credit Suisse does not become available for sale often. It is now worth a paltry CHF 11bn, and there are many shareholders that would be willing to sell if someone offered them a decent way to end their misery.

If someone had ever considered to have a go at it, now could be the moment.

A mixed, challenging picture – but not without opportunity

I have a bias towards companies that have survived many previous crises, and whose stocks are trading at low valuations. Trawling through recent media reporting and investment bank research, I was left with little doubt that Credit Suisse at its core is a good, proper Swiss bank with a strong domestic business and a massive, global wealth management business.

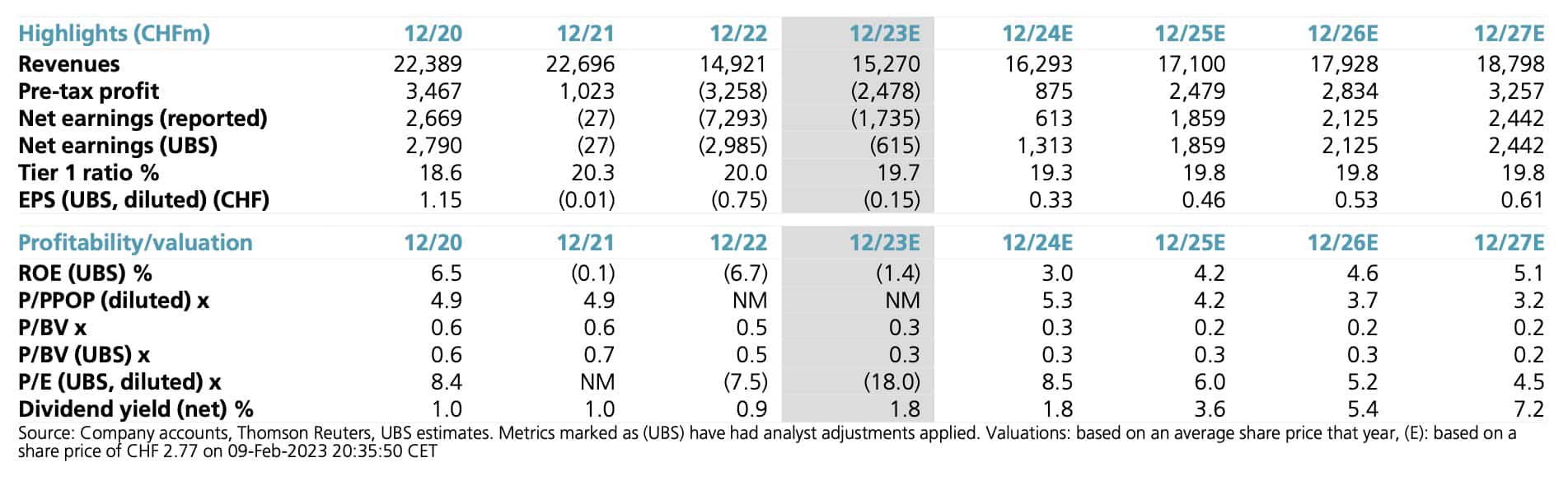

Other European banks used to trade at 0.5x book value until recently, but they are now trading around 0.8x book value following the recent rally. Credit Suisse stock, on the other hand, is still trading at just 0.3x book value (see table below with up-to-date estimates). This could be cheap, but only if Credit Suisse got back to establishing a pathway to an attractive return on equity. Right now, this is still lacking – but if it were visible already, the stock wouldn't trade at this level anymore.

Should you invest into banks at all, given how impenetrable the balance sheets of banks tend to be? As a speculator and public market investor, I believe there is now a higher than 50% chance that Credit Suisse stock will be boosted by some surprise developments during the remainder of the year. The market currently has zero positive expectations for the stock, and Credit Suisse should be at a point where management will be able to pull one or two small rabbits out of the hat without too much effort. In every turnaround situation, there'll be a few unexpected quick wins for management to make use of.

For traders, the stock is worth keeping an eye on, given that it's now trading near its lowest point ever.

Latest stock pick out now

Shortages of minerals and natural resources are going to start to bite in earnest very soon.

This company – owner of one of the world's most valuable mineral resources – is bound to profit from the spiralling demand.

It has all it takes for a multi-bagger penny stock. Beware, though – it is highly speculative, highly controversial, and not for the faint-hearted.

Latest stock pick out now

Shortages of minerals and natural resources are going to start to bite in earnest very soon.

This company – owner of one of the world's most valuable mineral resources – is bound to profit from the spiralling demand.

It has all it takes for a multi-bagger penny stock. Beware, though – it is highly speculative, highly controversial, and not for the faint-hearted.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: