On the surface of it, now does not seem to be a good time to invest in European banks. GDP growth has slowed in much of Europe, a potential recession increases credit risks, and the energy crisis creates additional tail risks.

Many investors are currently wondering if the 2020s will be similar to the difficult 1970s. Not many people realise that banks and other financial services companies actually did quite well during much of this inflationary, high interest rate period.

History doesn't repeat itself, but it rhymes. There are plenty of reasons why large-cap bank stocks from Europe could be in for a few good years – and there are some attractive candidates in some very different European economies.

Source: J.P. Morgan, 3 October 2022.

Spanish banks benefit from an outlier status

It's widely known that you shouldn't own bank stocks when the economy weakens, no matter how strong their balance sheet. A weaker economy means higher credit losses because of creditors going belly-up, which in turn hurts a bank's earnings.

This time, it could be different. When interest rates rise, banks can pass them on to their credit clients. The key question is, which of the two factors will dominate – increasing credit losses, or higher income from rising interest rates?

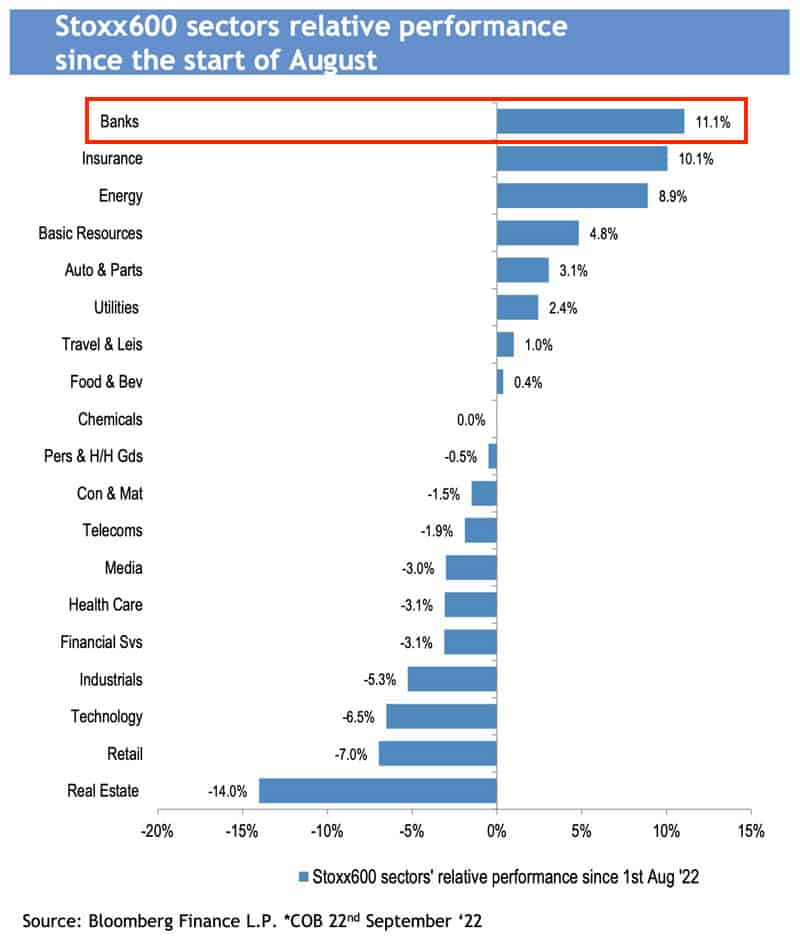

Spain makes for an interesting case study right now. The stocks of Spanish banks that focus on the domestic market have shown a very strong performance this year, both on an absolute and relative basis. Stocks in the banking sector are up 25% year-to-date, outperforming just about everything except energy stocks.

However, there are also significant differences, which demonstrate how investors need to differentiate between individual banks.

CaixaBank (ISIN ES0140609019, ES:CABK) is the biggest outperformer, with its stock up 40% this year. The bank's loan book and balance sheet are the most geared towards benefitting from rising interest rates, which is why Spanish investors have tried to get a piece of it.

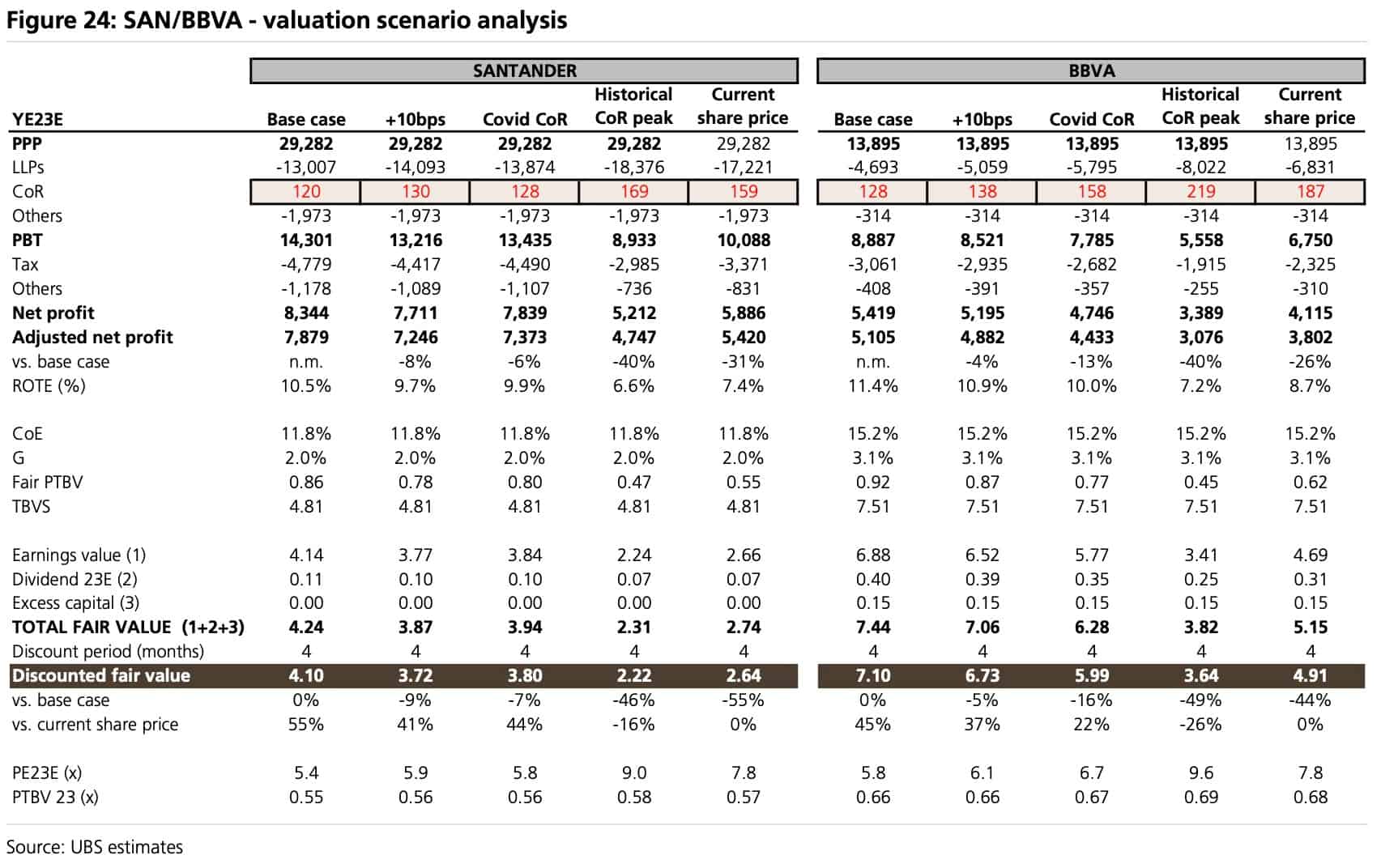

On the other hand, you have Banco Santander (ISIN ES0113900J37, ES:SAN) and BBVA Banco Bilbao Vizcaya Argentaria (ISIN ES0113211835, ES:BBVA). Both bank have exposure in countries like Turkey and Brazil, which the market is wary of. BBVA is up just 10%, and Banco Santander is the laggard of the sector with a year-to-date performance of -17%.

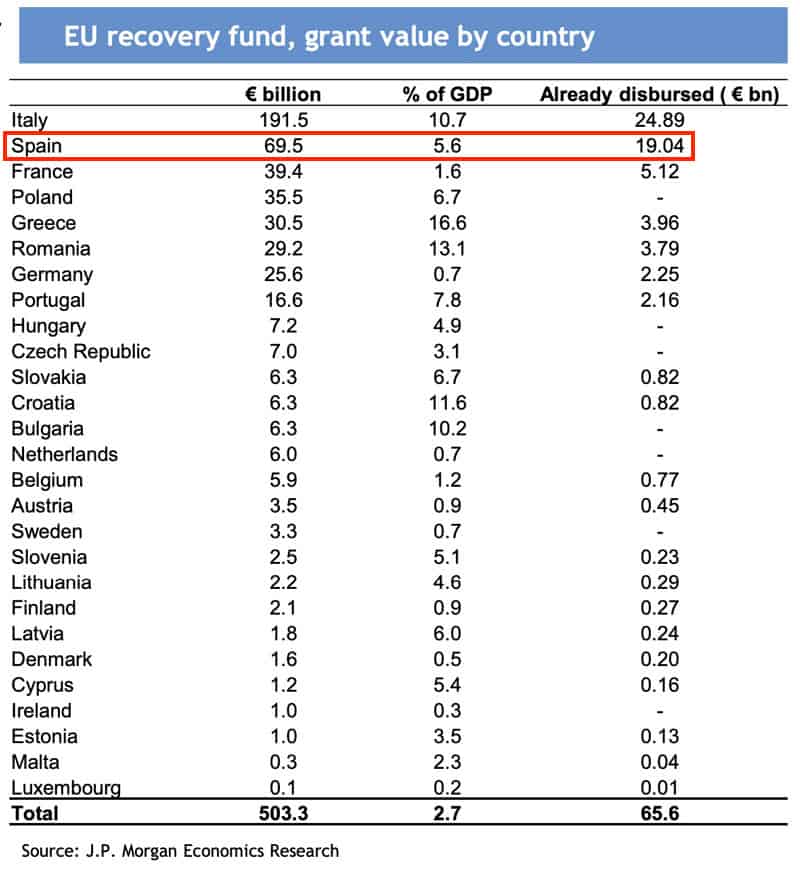

Similar differences and idiosyncracies need to be taken into account when looking at bank stocks across different countries. It looks like Spain will be the only major European country to avoid a recession in the coming quarters. Between 40-60% of the loan books of domestically focussed Spanish banks consist of residential mortgages, which are secured against property and thus quite safe. Last but not least, Spain, as part of the Southern periphery, benefits disproportionately from the European Union's redistribution policies. The country is the second biggest beneficiary of the EU recovery fund, receiving a staggering 5.6% of GDP in support from countries such as Germany.

Depending on an investor's personal views and preferences, there are different ways to play this theme. E.g., it could now even pay to place some bets on the more internationally exposed Spanish banks. Much as their fundamentals are less attractive for the reasons stated, they currently trade on heavily discounted multiples. Their price/earnings ratios are between 5-6 for 2023, and the stocks are trading 20-25% below the average of the European banking sector. Relative to the risk that comes from their international business, the market seems to have taken an excessively conservative view on both Banco Santander and BBVA Banco Bilbao Vizcaya Argentaria. At least, that's a potential investment thesis that'd be worthy of further investigation. The fact that Spain currently features among the cheapest markets globally is thrown in as a bonus.

Source: UBS, 21 September 2022. Click on image to enlarge.

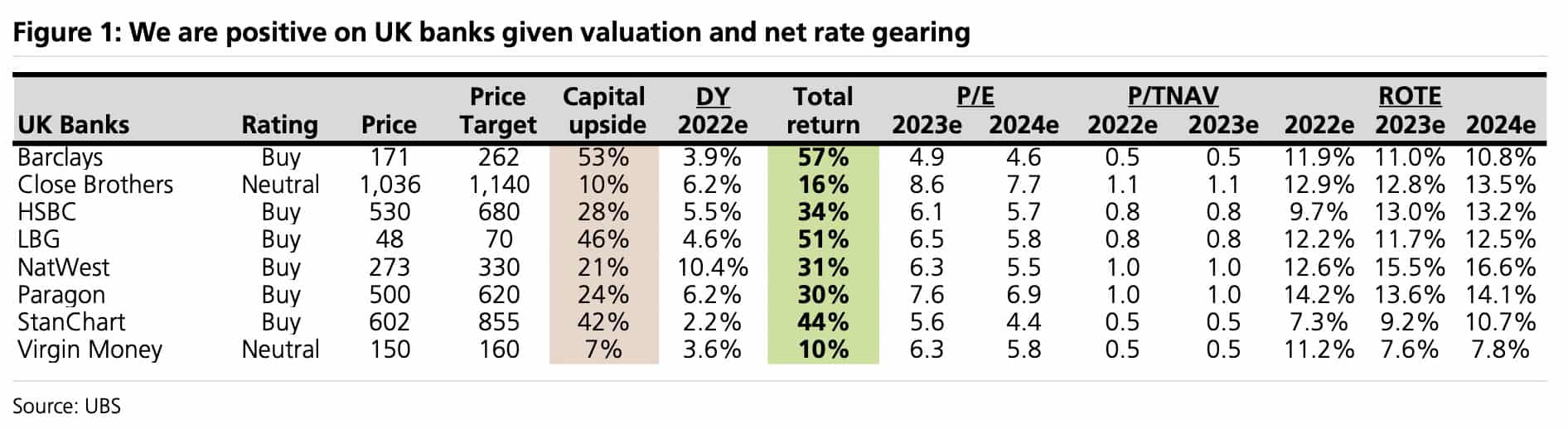

Are British banks a safe bet?

The UK market offers a compelling case for bank stocks. Approximately 70% of the rise in interest rates is kept by banks, which are also far less exposed to the risk of recessions. Following a decade of regulation such as Basel III, IFRS 9, regular stress tests and the end of self-certification mortgages, British banks are generally quite secured against economic turbulence. According to a recent estimate by Credit Suisse, even in the case of a severe recession, Britain's banking sector would only experience a 25% downgrade to earnings per share.

British banks are currently trading at just 6-7 times "normalised" earnings (= applying loan losses at cycle averages), and the leading banks' figures for Q2/2022 were reassuring: 95% of British lenders reported lower loan losses than expected by analysts (with losses falling below the pre-pandemic level), and reserves to cover potential loan losses are now 40% higher than in 2019. The GBP 2,500 household energy cap introduced by the Truss government helps with reducing retail credit risk, and while the GBP 40bn business intervention is more difficult to gauge in terms of its precise effects on banks, it also provides support that lending institutions benefit from.

Here, too, significant differences need to be taken into consideration. E.g., a weaker exchange rate of the pound sterling benefits Barclays (ISIN GB0031348658, UK:BARC) but provides headwind for HSBC (ISIN GB0005405286, UK:HSBA). The pound's future is a polarising subject, so take your pick!

If you are looking for a domestically focussed bank with a very high gearing towards benefitting from increasing interest rates, then NatWest Group (ISIN GB00BM8PJY71, UK:NWG) is for you.

Source: UBS, 20 September 2022. Click on image to enlarge.

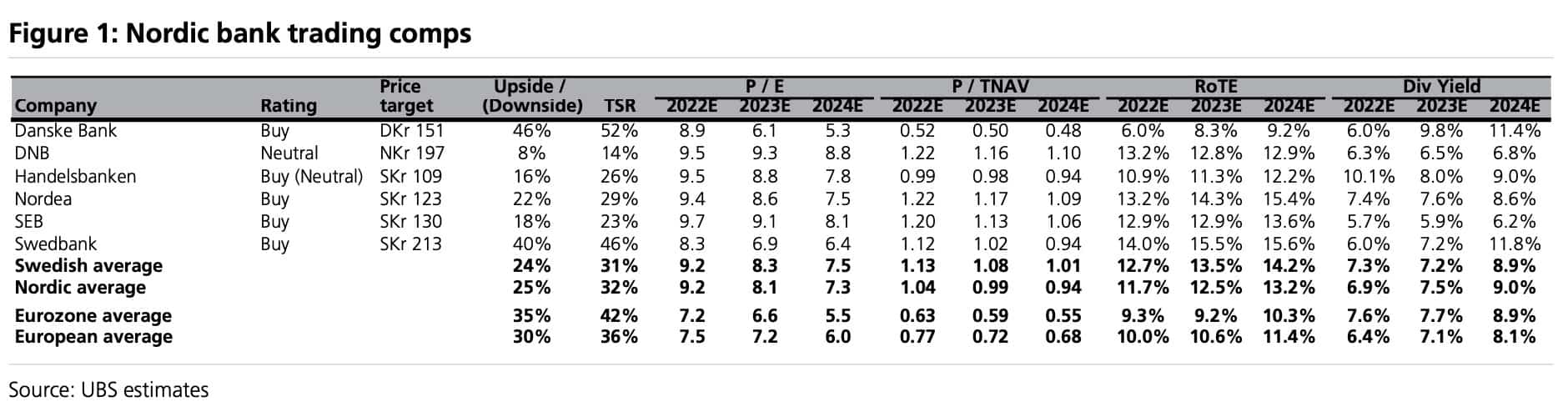

Nordic banks are a class of their own

There is little doubt that the Nordic region is heading into a recession. Historically, though, Nordic banks have performed relatively well in a more challenging economic climate. Keeping a defensive balance sheet is baked into the local culture, and for this reason the area's banks have long had an above-average through-the-cycle profitability.

Because of the oncoming recession, Nordic banks are likely to experience a year or two of lower activity levels, higher cost inflation and higher credit losses. However, it seems very likely that increasing earnings from higher short-term interest rates will more than offset these headwinds. What's more, it's entirely reasonable to argue that we are now facing a very low risk of going back to a zero interest rate world, which means that the price/earnings ratios of bank stocks should generally increase. Nordic banks are still trading on an average price/earnings ratio of below 8, which is 25% below their historic average. The sector could yet see multiple expansion.

One of the stocks that'd be worth favouring is Swedbank (ISIN SE0000242455, STO: SWED). It is the most geared towards benefitting from rate increases, but is currently trading at significantly lower valuation multiples than its peers (see table).

Source: UBS, 21 September 2022. Click on image to enlarge.

Rising rates do bring opportunities

The idea that a permanent goodbye to zero interest rates could lead to multiple expansion for European banks is a powerful one.

Not only is it interesting in its own right. It also goes to show that there is money to be made from our changing circumstances. However, more than ever, this is easier said than done. Given that almost no one has spent any thought on following or analysing European bank stocks during the last decade, we all need to invest some time into getting up to speed on those neglected sectors.

Which other sectors, themes and ideas are likely to benefit from (or at least protect yourself against) rising rates and higher inflation?

Feedback of any kind is welcome, as always.

Also, I'll be meeting with a group of readers and like-minded investors in London to discuss this subject further. This will be a dinner discussion on Tuesday, 18 October in Central London – you can find details here. We still have a few spaces if you'd like to join, and you'll inevitably find some of the results of these discussions on this website.

In the meantime, you could do worse than taking a glance at European large-cap bank stocks. The sector is trading at a price/earnings ratio of ≈7, comes with a dividend yield of 6.8%, and its year-to-date outperformance should probably tell us something. It's a large, diverse sector and this article can only provide a brief introduction – but it's definitely a sector that promises opportunities for stock pickers.

Latest stock pick out now

Given the new world's energy situation, are we soon going to see a "Falkland Islands Oil Boom 2.0"?

Quite likely!

When the investing public once again wakes up to the long-dormant subject of the Falklands' oil reserves, you want to be prepared.

Here's one company that gives you immediate investment exposure.

I've been following this opportunity for years. Now is the time to present it to you.

Latest stock pick out now

Given the new world's energy situation, are we soon going to see a "Falkland Islands Oil Boom 2.0"?

Quite likely!

When the investing public once again wakes up to the long-dormant subject of the Falklands' oil reserves, you want to be prepared.

Here's one company that gives you immediate investment exposure.

I've been following this opportunity for years. Now is the time to present it to you.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: