Back in 2004, I published a 142-page report about the little-known oil resources of the Falkland Islands. My research pointed to a century-old colonial company listed on the London Stock Exchange, which back then was the only way to get Falkland oil exposure for your portfolio.

The islands have since seen an oil exploration boom, and exploitable oil reserves were found in 2010. Sadly, the oil price fell off a cliff in 2014, which killed the prospect of actually producing oil in the Falklands. The share prices of the fledgling Falkland oil companies all fell over 90%, many went under altogether.

Given the new energy situation, are we going to see a "Falkland Islands Oil Boom 2.0"?

This Weekly Dispatch will give you valuable pointers, and revisit the stock of the colonial company listed in London.

Ready for a short trip to a group of remote islands?

A century-old colonial outpost

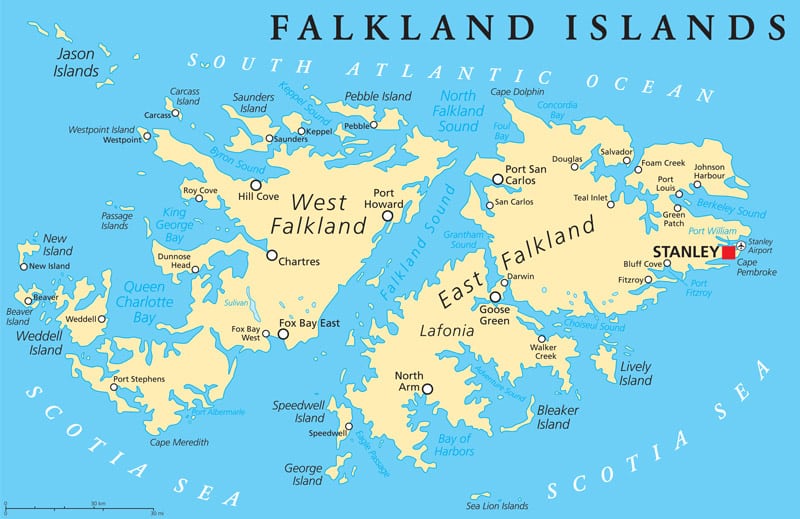

The Falkland Islands are a self-governing British Overseas Territory located about 480 kilometres (300 miles) to the east of Argentina. They count as one of the world's most remote places and currently have a population of about 3,600. As a British Overseas Territory, they have outsourced defence and foreign policy to Britain, but are otherwise like a country of their own.

Nowadays, most people only know the Falkland Islands from the context of the Falklands War of 1982. Following the invasion of the islands by 10,000 Argentinean soldiers, Margaret Thatcher's government dispatched a naval task force to engage the Argentinean navy and air force. The subsequent British mobilisation represented the country's largest military deployment since the Korean War and became a major international episode. 900 soldiers died on both sides, a steep price to settle a dispute over a territory with then just 1,800 residents. At one time, the British even threatened to nuke Cordoba, Argentina's second largest city with 1m residents.

Ultimately, Britain won the Falklands War, and it has had a much bigger military presence on the islands ever since. In terms of military spend per capita, the Falkland Islands have since been one of the best-protected places on Earth – further aided by their extreme remoteness and hostile environment. Billions were spent to make sure the islands would never see another Argentinean soldier set foot on them.

It begs the question, why was Britain so keen to keep the remote outpost? Doesn't it all seem a bit out of proportion?

As you probably suspect by now, oil played a role in it.

The oil issue pre-dated the war

"Declassified documents show that Britain has long been interested in oil around the Falkland Islands. In 1975, an energy department official wrote: 'Our ministers are very interested in the possibility of exploiting offshore oil around the Falkland Islands.'"

In retrospective, it all makes a lot of sense. (And my readers were 18 years ahead of The Guardian.)

The Argentineans got wind of the Falklands' oil potential, and they started to undertake offshore seismic explorations in the islands' continental shelf as early as 1977. Behind the scenes, the conflict started brewing years before the actual invasion.

Cynics would say the entire war was about oil. There is probably a significant element of truth to it, although a whole number of interesting economic factors were at work.

The Argentineans even once tried to buy "Las Malvinas", as they call the islands. In the mid-1980s, they considered offering each resident of the islands the princely sum of USD 1.5m in cash if they voted in a referendum to join Argentina. Some reports suggested that Argentina was even willing to pay up to USD 4m to each resident. Based on the population figures of the time, this would have added up to USD 3-8bn. However, an informal survey yielded that 87% of the "Kelpers" (as the islanders are called) would have voted "no" in such a referendum.

Why would Argentina offer so much money for these islands, and why would the residents turn down an offer to receive more money than they'd ever have a chance to earn in a lifetime of working?

Leaving aside the bad will created by the invasion, it was financially rational to keep clear of Argentina's offer. The residents of the Falklands are fully aware that they are sitting on a proverbial gold mine. It's not just oil that could make these islands fabulously wealthy, but also other resources – notably, fish and squid. Ridiculously inflated as the Argentinean offer appeared on the surface, it would have undervalued the islands because of their sheer amounts of natural resources.

The ocean in this part of the world is extraordinarily rich, and squid, in particular, is almost ridiculously abundant. The Falklands calamari or "Loligo gahi" meets about 10% of the world's squid demand. The islanders benefit financially even if it's foreign vessels that catch the squid, because their government is selling fishing rights to vessels from abroad (and relies on the British navy to keep everyone else out).

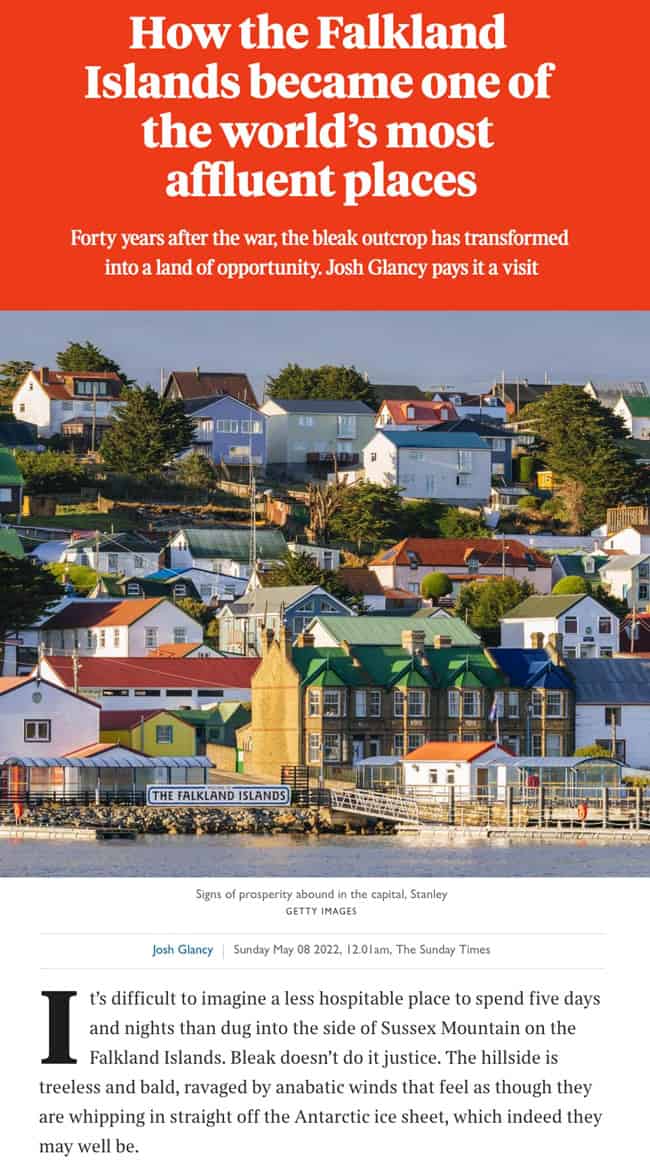

Thanks in no small part to these fishing rights, the residents of the Falkland Islands have been able to create a sovereign wealth fund, which currently has about USD 250m in reserves, equal to about USD 65,000 per resident. The islands' government has no debt. Given that no oil has been pumped yet, this is an extraordinary economic success story. As The Times reported on 8 May 2022, today the Falklanders are "the fifth or sixth richest people in the world per capita, right up with Luxembourg and Qatar. This is nearly double the UK's average wealth."

Which company benefits most from these developments? For a start, it's worth taking a look at the same colonial company that I had featured in my 2004 report.

Source: The Times, 8 May 2022.

Introducing: FIH Group

When I first reported about this company, it was called Falkland Islands Holdings. Among other assets, it owned 100% of The Falkland Islands Company (FIC), which was granted its Royal Charter in 1852 to settle, develop and exploit the Falkland Islands. Since I first reported about Falkland Islands Holdings, the company broadened its portfolio and changed its name to FIH Group (ISIN GB00BD0CWJ91, UK:FIH).

Then and now, the company operates the backbone of the Falkland Islands' economy. As its website explains:

"From its early days as a major landowner and sheep farmer, … the Company has steadily widened its activities to provide a broad range of essential services to the people of the Falklands.

The Company's main areas of activity embrace:

- Retailing (including food, clothing, electrical goods, home furnishings, gifts and DIY);

- Residential and commercial property;

- The sale and hire of 4x4 vehicles;

- Travel services including flight bookings;

- Airport transfers and luxury coach and walking tours for tourists;

- Insurance;

- Agency services for cruise ships and fishing vessels;

- and the provision of freight and shipping services to and from the Islands."

In short, residents and tourists alike will struggle not to spend some money with FIH Group while on the islands.

Port Stanley, capital of the Falkland Islands (image credit: Vintagepix / Shutterstock.com).

In a way, FIH Group is not too dissimilar from Société des Bains de Mer/SBM (ISIN MC0000031187, Euronext:BAIN), the company that controls large parts of the economy of Monaco and which I had last featured in my Weekly Dispatch on 16 September 2022. It's a bit less glamourous, though. Whereas Monaco is about Ferraris and Louboutins, the Falklands are about Wellies and Land Rovers.

With a market cap of GBP 28.5m (USD 32m), FIH Group is a minnow of a company. However, it's profitable and stable.

In 2022, the company achieved turnover of GBP 40.3m and a net profit of GBP 2.0m. The earnings per share amounted to 9.5 pence per share. At a share price of currently 228 pence, the company is trading at a price/earnings ratio of 24. It paid a dividend of 3 pence.

Unfortunately, in previous years, FIH Group's management gave in to the siren calls of diversification. In 2008, GBP 10.3m were spent to purchase 100% of Momart, the London-based specialist for transporting precious works of art. Prior to that, FIH Group had already spent GBP 7.5m to buy the Portsmouth Harbour Ferry Company on England's south coast.

Following these acquisitions, it's been rather difficult to say why anyone would want to invest in shares of FIH Group. The company is a ferry business in the UK, an art transport specialist, and a remote islands allrounder all wrapped into one. It's no big surprise – at least from my perspective – that the stock never gained much traction. FIH Group is a classic case of "diworsification", at least as far as the company's narrative and public perception are concerned. About 80% of the group's profits are still from the Falklands, meaning the other two divisions are truly a mere distraction.

FIH Group also once owned an asset that could have propelled its share price to new heights – which was the reason why I wrote about the company in the first place. What was then Falkland Islands Holdings set up Falkland Oil and Gas Limited, one of the first exploration companies operating in the Falklands. "FOGL", as the company was usually referred to, landed a contract to explore a massive exploration acreage in the south basin of the islands.

FOGL eventually went public and briefly reached a market cap of GBP 900m. In that sense, my research from 2004 was right on the money.

Unfortunately, the first round of drilling carried out by FOGL turned up dry, and then the oil price collapsed. In 2015, what was left of FOGL was taken over for a paltry GBP 57m by another exploration firm.

If or when the Falkland Islands' oil potential is rediscovered, FIH Group is not going to benefit directly. It no longer owns a stake in any oil exploration company, and probably won't ever get back into it.

However, another of its assets could yet prove very valuable and lead to a revaluation of FIH Group stock.

Land. Lots of land.

Port Stanley from the air – where FIH Group is a major land owner.

A massive hidden reserve

The Falkland Islands Company once owned about half of the entire archipelago, but it sold most of the land to the Falkland Islands' government in 1991.

It did keep 400 acres of land, though, and much of it with serious development potential now that the islands are coming into their own economically.

Over the past 20 years, the population of the islands has doubled to 3,600. As The Times once quoted a resident, the islands are "developing at a rate that's unreal". Most residents live in or near Port Stanley, the capital. That's where FIH Group, through its 100% ownership of The Falkland Islands Company, owns much of its land.

The company already owns 83 properties with an estimated market value of GBP 10.1m. It can offer construction of residential, office and industrial real estate to third parties, but also develop its own land. If or when there is a new oil exploration boom, visiting oil workers and new residents need to be housed somewhere.

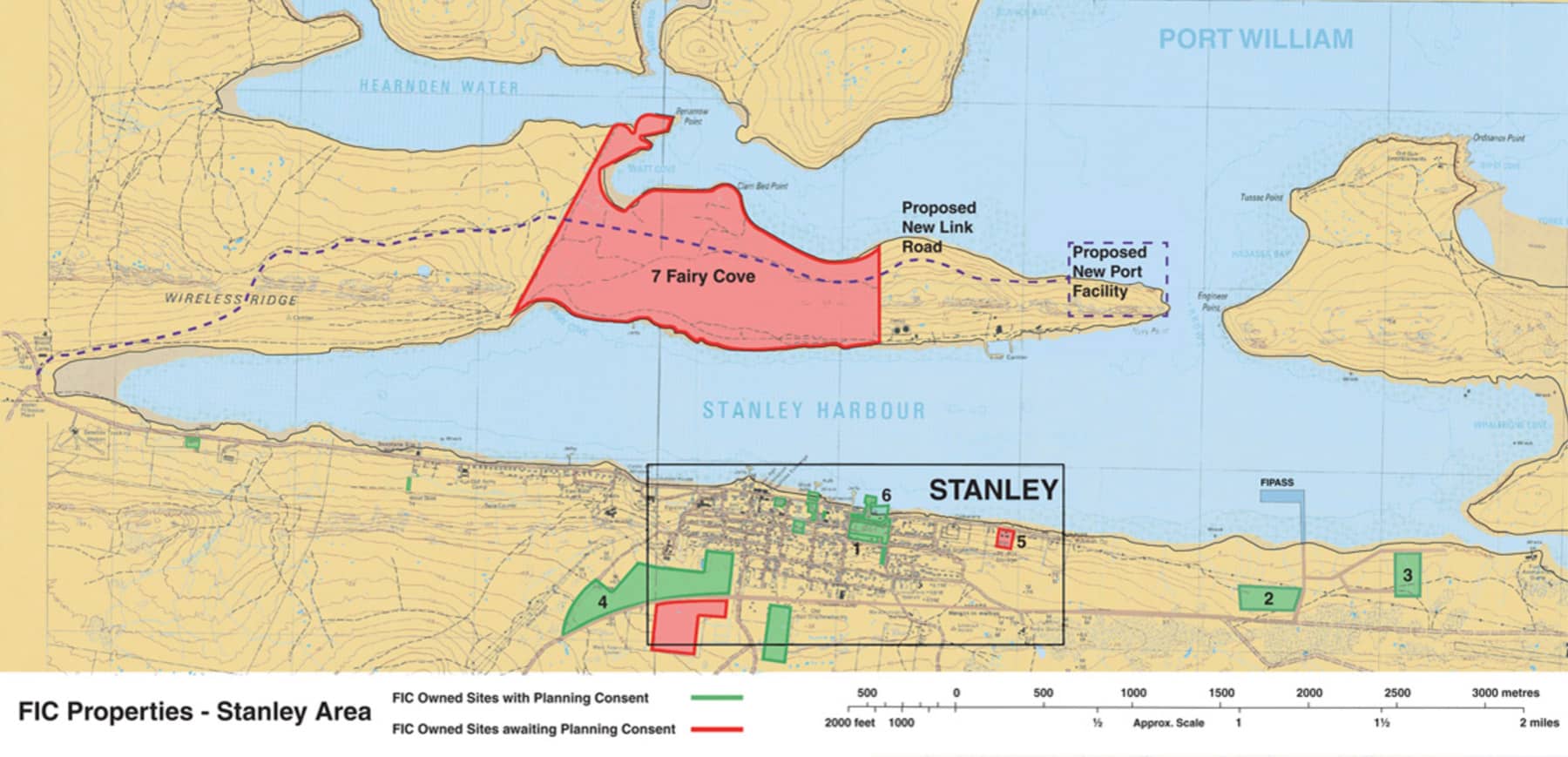

The following map shows where FIH Group owns land in Port Stanley. The green areas already have planning consent, the red areas are awaiting planning consent.

Click on map to enlarge.

FIH Group also owns one large parcel of land on a peninsula opposite the capital. This will likely be the location of a new harbour facility, which would significantly increase the value of the nearby land. Here, FIH Group is also awaiting planning consent.

Click on map to enlarge.

What's the land worth at going prices?

God only knows, especially in the case of the large piece of land that would be on the way to the new harbour facility. However, it doesn't take much to figure out that there is quite a bit of potential to this land as far as FIH Group's share price is concerned. 400 acres translates to 1,618,742 square metres. FIH Group currently has 12,519,900 shares outstanding. This makes for land reserves of about 0.1292 square metre of land per share. Looked at it another way, if you purchased 31,323 shares, you'd indirectly own an acre of land in the Falkland Islands. The shares are trading at 228 pence and the existing operative businesses seem to largely cover the current valuation. What's the current value and the upside? Well, it's anyone's guess what a piece of land will be worth in ten or twenty years in what seems set to become one of the world's most affluent communities. The population and the level of industrial activity of the islands could experience explosive growth, and the level of wealth could go through the roof. Chances are that land prices in the Falkland Islands would have a lot further to run if a second, sustained oil boom happened.

FIH Group PLC.

For anyone looking to benefit from a renewed oil exploration boom in the Falkland Islands, buying stock in FIH Group may not be a bad long-term idea. In quite a few indirect ways, the company stands to benefit from such renewed interest, and it wouldn't be quite as risky as an oil exploration company. In a way, the land is currently thrown in for a song – if not even for free.

It all begs the question, is a Falkland Islands Oil Boom 2.0 in the works?

With all likelihood, we are on the cusp of seeing just that.

Another "stranded asset" to see a potential resurgence

The first wave of oil exploration in the Falklands around 2010 wasn't without success.

Oil was found, and in exploitable quantities. However, just when it all started to get interesting did the collapse of the oil price bring everything to a halt.

The oil price fell from USD 131 per barrel in June 2014 to just USD 42 in February 2016. Producing oil in the Falklands is generally only viable at an oil price of USD 45 or higher, and the sustained collapse in price effectively killed off most of these projects.

Given that oil is now back in demand and likely to remain so, oil investors have started to sniff around again. If the interest keeps growing, it will make for quite a reversal of fortunes.

As recently as 17 August 2020, Bloomberg had reported:

"The Falkland Islands were once at the forefront of a new era for the oil industry as companies scoured the planet for resources. Rather than the next frontier, the project to extract energy risks being added to a list of what companies call 'stranded assets' that could cost them huge sums to mothball."

Obviously, the world has changed rapidly since then. Russia started a military conflict with Ukraine, and we all know what has since been happening in energy markets.

Will there be a revival of the Falkland Islands oil story?

Quite a few indicators point in that direction.

Source: The Times, 23 July 2022.

Keep in mind, this is no longer a story about the Falklands possibly having some oil. Oil has been found in exploitable quantities already, and many tens or even hundreds of millions have already been spent on planning the engineering aspects of getting the oil to the surface. Oil firms can now step in and build on all the work that has already been done during the busy period from 2005-2014. The Falkland Islands are now a sitting duck when it comes to utilising their oil potential – making this a very different proposition than in 2004. There are many reasons why this is now an oil play that companies would love to get their teeth into.

The new UK government under Liz Truss has put energy independence on the agenda:

- Fracking will once again be allowed in the UK.

- The remaining North Sea oil reserves have become a new strategic priority, and will soon see a resurgence of activity.

- The "British energy security strategy", updated in April 2022, calls for "a power supply that's made in Britain, for Britain".

In my estimation, this new lease of life for fossil fuel exploration is going to extend to the British Overseas Territory of the Falkland Islands, too. It's just too obvious a potential energy resource not to make use of it. Never mind the fact that Britain also pays for military protection of the area and could now finally get a financial return for its military expenses of the past four decades. Also, you are not going to have any Greenpeace activists glue themselves to oil platforms in the Atlantic. The Falklands are one of the most obvious and also safest options for dealing with the new energy situation.

Might there be a way to gain more direct investment exposure to the Falkland Islands and their oil potential?

Most Falkland Islands' oil exploration companies have fallen into a state of despair since 2014. There is, however, one good option to benefit from a potential resurgence of interest in the islands' oil potential. It's a unique and unusual investment idea, and one that has limited liquidity (as always with such less liquid investment opportunities, this idea is reserved for Undervalued-Shares.com Lifetime Members).

A multi-bagger from the Falkland Islands?

It's now only a matter of time before the investing public once again wakes up to the long-dormant subject of the Falkland Islands' oil reserves.

One company, in particular, is set to benefit. It is the only Falkland focussed firm that I believe is currently worth investing in in the short term. It comes with some incredible fundamentals, and a potential multi-bagger return.

Quite likely, this will be one of the more unusual investment cases you will have read about in recent times.

A multi-bagger from the Falkland Islands?

It's now only a matter of time before the investing public once again wakes up to the long-dormant subject of the Falkland Islands' oil reserves.

One company, in particular, is set to benefit. It is the only Falkland focussed firm that I believe is currently worth investing in in the short term. It comes with some incredible fundamentals, and a potential multi-bagger return.

Quite likely, this will be one of the more unusual investment cases you will have read about in recent times.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: