Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

How to benefit from PayPal’s censorship policy

Censorship, cancelling, shadow-banning and similar measures of suppression of wrongspeak were long considered a niche issue by most. This is what happens to fringe characters and lunatics only, right?

The PayPal incident might one day be looked at as the point where many realised that this can hit them as well – and just about anyone else, for any reason, at any time. Who is naïve to believe such a policy would get announced without the explicit approval from the company's CEO? The issue has now received a lot of attention globally; if you missed the story at the time you can get a quick overview from this 16 October 2022 Daily Telegraph article: "How PayPal became the centre of Silicon Valley's culture wars".

Another infamous, high-profile case surrounding PayPal involved Britain's Free Speech Union. Without warning and without giving a specific reason, PayPal closed down the account of the charitable organisation. 40 UK Members of Parliament stepped into the subsequent public debate. The case made significant waves both domestically and internationally, and led to PayPal backtracking on its decision.

Following the day of its "error", PayPal stock plunged 6%. Financial markets, too, have started to pay attention. Suddenly, the issue is costing shareholders billions in lost value. After all, those who deleted their PayPal account will be looking for alternatives to process payments.

Leaving the politics of this aside, how can we make money from these developments?

It's a serious question, and one that I have done quite some work on. I recently even brought together a brainpool of fellow investors for a focussed lunch discussion in London.

The conclusion we derived at surprised even myself.

Source: Daily Telegraph, 27 September 2022.

The uncomfortable dependence on existing payment providers

Censorship is something I have long felt strongly about, and I acted on it long before the subject became somewhat fashionable.

As far back as 2016, I warned financial writers against using popular online platforms for publishing their content. "One day", I warned them, "they'll consider it hate speech if you criticise central bank policies." If you rely on social media platforms such as Twitter or content platforms like Substack, you put yourself at the mercy of a growing trend of large corporations telling you what you can and cannot say – which, ultimately, means limiting what thoughts you are supposed to have.

PayPal is just the latest example of how the enforcement of what can be said nowadays is no longer influenced primarily by governments but transnational corporations. Of the world's 200 largest payment providers, 99% have provided public commentary on issues such as "social justice". Increasingly, these companies are making efforts to influence what their customers are allowed to say in public.

Undervalued-Shares.com, too, is reliant on such payment providers. If PayPal cancelled my account, I'd lose about half of my subscribers. Combining the purposefully vague concept of "misinformation" with my loose mouth is a dangerous thing, and I expect that my head will end up on PayPal's chopping block eventually. After all, even if you said that "men are not women" (which I would never do), you already commit a hate speech offence under some corporate regulation.

I repeatedly ask my tech staff for any alternative payment options that Undervalued-Shares.com should offer to reduce this dangerous dependence. I don't want to have happen to me what the Free Speech Union went through, or at least, minimise the impact when it happens.

So far, no viable alternative was available.

"Why don't you accept crypto?", will be the first question I get.

Crypto platforms don't allow you to use an auto-renew mechanism. If you run a publishing organisation where 97% of readers extend their subscription to the following year, not having an auto-renew function is an inconvenience for customers, and it decreases the value of your business (e.g., if I ever wanted to securitise Undervalued-Shares.com's recurring subscription income).

The devil is in the detail when it comes to these issues. But as always, every problem also represents an opportunity.

Might this make for an opportunity for a new generation of payment service entrepreneurs?

At my lunch in London, we discussed the question whether we were "in the early stage of a formation of competitors to PayPal".

If this were the case and a new competitor arose out of this entire situation, someone would stand to make an absolute fortune. (And existing shareholders of companies like PayPal should also pay attention!)

Even PayPal was once sneered at

It's easy to forget that PayPal was once an obscure service provider that appeared to be geared toward a niche problem.

In the late 1990s, it was perfectly normal for consumers to send money orders, cheques or even cash by post to make payments. At the time, I was hoovering up old Cuban bonds on platforms such as eBay. I thought nothing of sticking American Express Money Orders into the post to pay for them. It worked, and it was safe.

PayPal launched a service that tried to convince customers to share their emails, banking and credit card information in return for fast, low-cost payments online. The market didn't perceive the idea behind PayPal to be an earth-shattering innovation. When the company went public in 2002, it was not even worth USD 1bn.

As it turned out, there was a lot more consumer demand for this service than initially anticipated. By July 2021, PayPal was worth USD 362bn. Following the tech stock crash of the past 15 months, it is still worth USD 98bn.

PayPal.

Not bad for a company that – in a way – the world could actually do without. PayPal is primarily a middleman, i.e. its service could easily be replaced through other ways of electronic payment if there was strong desire among consumers. For now, though, its service is much in demand, and there is a whole industry of such payment providers. Because of convenience and habit, PayPal has a powerful position in the lives of millions of people.

Besides PayPal, there is Stripe. The privately held Irish company processes about half the amounts of payments as PayPal, and it was last valued at an eye-watering USD 95bn. The company has only been in existence for 12 years.

The competitors Block (ISIN US8522341036, NYSE:SQ) and Adyen are both worth around USD 35bn. They all have different business models and operate across multiple parts of the payments industry, but represent a sector of their own.

Fortunes were made in this sector. Processing payments electronically comes with enormous economies of scale, which has enabled some of these companies to become veritable cash cows.

It all seems terrifically obvious in hindsight. However, these opportunities are never quite as clear during their outset. Today, we are facing other propositions that will seem irrelevant or preposterous in the eyes of many.

Making yourself independent from large payment providers? Bullet-proofing your business against the censorious tendencies of transnational companies?

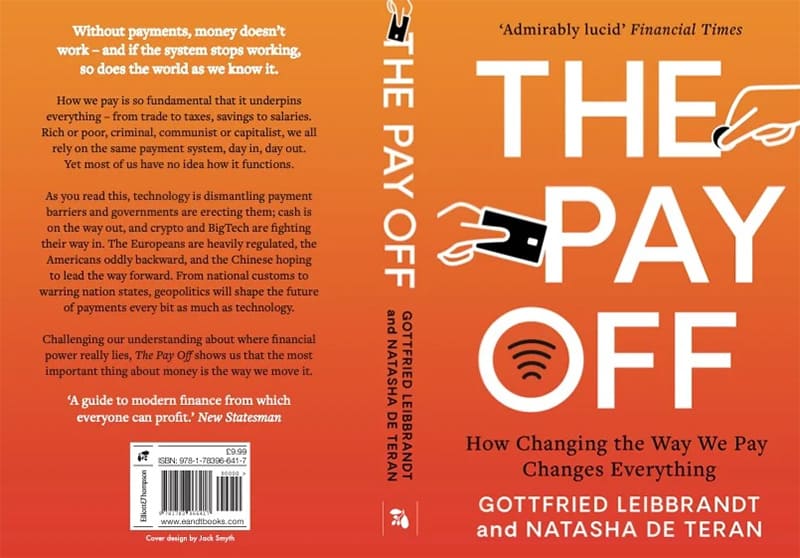

It's also an area of almost absurd complexity. If you wanted to get your head around the global payments industry, I recommend "The Pay Off: How Changing the Way We Pay Changes Everything", published by Gottfried Leibbrandt and Natasha de Terán in 2021. This book literally changed the way I see the world. However, it also made me realise that I'll never have a chance to truly understand the changes of this industry if I don't tap the brains of people who are actually on the inside and can keep me updated about the stuff that is not yet in the public domain.

Which is why I invited a speaker to my lunch who has been at the forefront of this trend, and who was even granted a government license for a major Western European country to operate an alternative system.

Ignore the following market intel about this sector at your peril.

A must-read for anyone interested in payment services.

The quest for better options

Big problems promise a big payoff if you resolve them for consumers.

The current generation of payment providers don't just cause problems through censorship policies. They are also darn expensive, which is a problem that other entrepreneurs may be able to make use of to succeed in establishing alternatives.

The convenience offered by today's electronic payment providers has made most people forget just how expensive these platforms are. First of all, their fees are often hidden. For a service like PayPal, the fees of 1.9-3.5% of the transaction value are shown openly, but most consumers have accepted them as a price for convenience. There are also crossover areas such as Zettle, the point-of-sale credit card processing service offered by PayPal. When you use a credit card on a small business' Zettle point-of-sale, you are not notified that you are paying fees.

The folks who do know how much these services cost are the business owners who use them to charge consumers. Their accounting includes an annual overview of just how much of their money goes to these service providers. There are many reasons to be unhappy with these service providers, and the fees are the most powerful among them.

"I accept cards, but prefer cash. Thank you!", was a sign I spotted in the back of a London cab recently. As someone who pays cash on most occasions (where still possible), I couldn't resist but speak to the driver about it.

"In a single year, I pay between GBP 1,500 and GBP 2,000 for card processing. That's another holiday with the family. And they keep me waiting for my money!"

If you speak to just about any London cabbie, the view they'll share with you about PayPal's Zettle and similar services will not be a good one. If someone gave them a viable, better alternative, they'd probably change in a heartbeat.

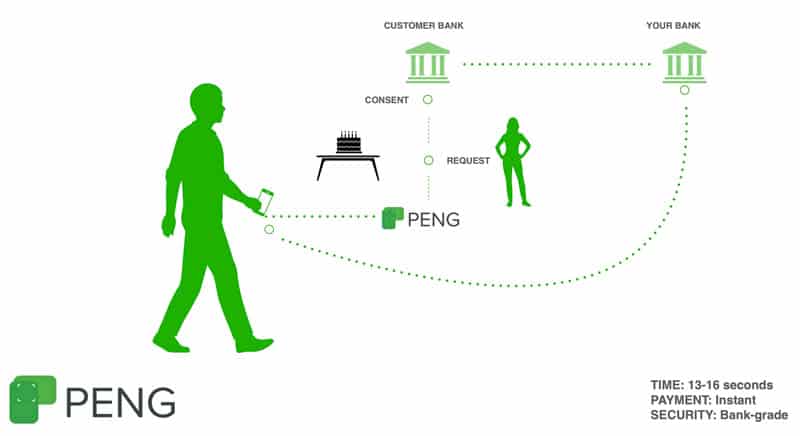

Someone who has spent years telling business owners how much they end up paying for these services is Simon Reader. Simon is the founder and CEO of PENG, a UK-based company that has created a payment system which could eventually offer an alternative to the PayPals of this world.

His platform, Simon claims, offers businesses up to a 99% saving compared to the processing fees of PayPal's Zettle and Square. As an example that is included in PENG's corporate documents, a client who'd pay GBP 14,500 to PayPal's Zettle and GBP 15,230 to Square would pay just GBP 240 to get the same payments processed through PENG.

How is that possible?

Simon found an opportunity in the new "open banking" legislation that the UK introduced in the aftermath of the 2008 financial crisis. In order to force banks to become more competitive and substantiate their fees, the UK government mandated banks to allow customers to use third parties to make payments directly from their own accounts.

In layman's terms, by using the open banking concept, you can conveniently and quickly make payments directly from your bank account to someone else's bank account. If you use a free bank account, such as the ones provided by so-called challenger banks like Revolut and Monzo, then your payments are effectively for free.

Obviously, no one wants to bother with typing account numbers or IBAN codes into a machine to make a payment. The missing link had so far been a platform where businesses and consumers could easily send and receive payments using open banking.

PENG solved the problem by providing an app that is connected to your bank account and which you can use to send out payment requests. Your customers then receive a text, WhatsApp email or even direct phone-to-phone QR code, which they scan. That's the payment done! It's a short, bank-grade safe journey. Unlike with credit cards, you don't have to wait for your money – the transfer is instant.

Source: PENG.

Few would have heard of this payment option enabled through open banking, but it already found its first at-scale use case. The UK's tax authority now allows tax payers to pay VAT (sales tax) and PAYE (pay-as-you-earn tax) through an open banking payment system. The system used by HM Revenue & Customs has the same technology backbone as PENG: Ecospend, an open finance infrastructure. Any company that has received an open banking license from the UK's financial regulator (the FCA) can operate a payment system using Ecospend's architecture. Since February 2021, Ecospend has processed over GBP 8bn in payments, and the company says it has not yet had a single customer transaction issue. PENG operates with a tried-and-tested technology.

Does this make PENG a viable alternative to PayPal, and should investors rush to try and become investors in Simon's privately held company before it takes off?

As Simon is the first to admit, his company is in the early stage of a long journey to provide an all-encompassing solution:

- Unlike with credit card payments, PENG does not yet offer a solution for cases where payments have to be returned because of fraud or similar issues. In fairness, the ability to reverse payments is one of the reasons why credit card companies have a justified case for charging higher fees.

- So far, only UK customers have truly embraced open banking.

However, things are evolving.

Originally, open banking arrived on the scene thanks to an October 2015 initiative by the European Parliament, which adopted the revised Payment Services Directive, also known as "PSD 2". These new regulations aimed to promote the use of innovative online payments through open banking.

Open banking is possible across the EU, but it was the UK that turned into the frontrunner of this trend. After Brexit, the UK used its newfound sovereignty to make some amendments to the PSD 2 regulations, mandating that the nine biggest UK banks allow licensed start-ups direct access to their customers' data. Earlier this year, 5m Britons were already making use of open banking services, equivalent to over 10% of the population. Acceptance continues to rise fast.

The US also has open banking, but it's not mandated by law, and adoption by banks has been slow. Hong Kong has adopted it, and Australia is working to become another frontrunner. Japan, Singapore, and South Korea do not currently have formal or compulsory open banking regimes, but their policymakers are introducing a range of measures to promote and accelerate the take-up of data sharing frameworks in banking. It's a slow-moving process, but the concept of open banking is on the march globally.

Further significant changes could come as legislation evolves. Within the next three to five years, there will likely be a PSD 3 directive. Some expect that PSD 3 will leave considerable room for blockchain features. Where Simon believes the opportunity lies, is that if you can fit all payments into a blockchain feature that banks are, by law, forced to offer customers, then not only would you be able to ensure payment integrity and security, but also reduce the prospect of the bank itself terminating service. What exactly is going to happen in this area is still entirely unclear, but it's one to watch. Simon: "As I speak, we have people trying to figure this out. I'm hopeful that a system emerges."

Will PENG grow to be another PayPal, and will systems such as these free us from censorious payment company overlords?

Open banking, and the payment options it could offer further down the road, are not a subject that I've previously had on my radar. As far as I can tell, though, if this system evolves further and spreads across the globe, it could eventually make for a viable competitor to the likes of PayPal or even Visa and Mastercard. There are even already the first possibilities to set up a type of auto-renewal payments using these systems. PENG offers a recurring payments function which doubles as auto-renew. Trustly, a Swedish open banking payment company, also offers a recurring subscription payment model – albeit currently limited to Sweden. Trustly purchased Ecospend, and there is a lot of movement in this industry. There seems to be a real opportunity for entrepreneurs and investors, as shown by the frustrations of both London cabbies and yours truly.

Quite a few, including Jordan B. Peterson, have already tried to create such alternatives. No one has succeeded at scale yet, even though some who tried had access to serious resources. We may also simply have to be content that building solutions will be about incremental solutions, rather than achieving a massive leap forward. Even Simon admits that with his system, too, users are exposed to the politicking of large corporations. Ultimately, to utilise PENG, you need to have a bank account. Just as large tech firms can cancel you for any reason they like, so banks, too, can kick you out for pretty much any reason. Large banks have so far been less prone to cancelling customers, and there may eventually be legislation to ensure that everyone can have at least one bank account in their country of residence. But losing access to banking is a non-zero risk in today's world.

Which leads right over to the conclusion that our lunch discussion derived at, and which any private investor can easily take part in.

DeFi seems the only safe option

So far, I had not been overly involved in the crypto space. While it's a fascinating subject, I have primarily been married to public equities.

Given the world that we now live in, I don't see any other way but for everyone to build themselves a second financial life in a system that is entirely outside of the realm of government and transnational corporations. What governments across the Western world have been doing over the past years is too scary not to look into alternatives and "Plan B" options that you can utilise. Decentralised money and decentralised finance are, at this stage, the only options that I can imagine will provide us with a reliable protection against getting cancelled financially.

PayPal has just provided us with a call to action to allocate some money to crypto, and to educate yourself about decentralised money and finance.

Crypto isn't convenient yet. Its use case and day-to-day handling still require you some rocket science, or at least that's how it feels to me. However, after years of looking for an alternative, I am ready to conclude that there is no other way forward. There are easy ways to get some exposure, e.g. through purchasing stock in MicroStrategy (ISIN US5949724083, Nasdaq:MSTR), a company that owns a large amount of Bitcoin. The other alternative is, of course, to allocate some money directly to Bitcoin, Ethereum and possibly a selection of stable coins.

Seeing how everyone is completely at the mercy of payment service providers that want to play politics, the current crypto winter will prove a temporary occurrence yet again. Eventually, a larger than ever number of participants will take this entire industry to new heights in terms of breadth and valuations.

There is a chance that PENG will eventually incorporate a blockchain-based, DeFi-type solution. As Simon put it: "I had zero desire to position my company as 'resistance', but I'm afraid that's what we have become given recent actions by PayPal and others."

As far as being part of the resistance and not letting corporations tell me what I am allowed to say, please count me in. We are now at a stage where those who don't actively resist and support building solutions have to be considered a part of the problem.

What do you think? Do you agree or disagree with the arguments laid out above? Are there any alternatives that would solve this problem but which I haven't found yet? All feedback is greatly appreciated.

PENG: Experienced VCs who find this subject interesting can contact Simon on [email protected].

Correction (23 October 2022):

An earlier version of this article referred incorrectly to the use of the PENG app. Only merchants need to have this app installed, not customers.

A multi-bagger from the Falkland Islands?

It's now only a matter of time before the investing public once again wakes up to the long-dormant subject of the Falkland Islands' oil reserves.

One company, in particular, is set to benefit. It is the only Falkland focussed firm that I believe is currently worth investing in in the short term. It comes with some incredible fundamentals, and a potential multi-bagger return.

Quite likely, this will be one of the more unusual investment cases you will have read about in recent times.

A multi-bagger from the Falkland Islands?

It's now only a matter of time before the investing public once again wakes up to the long-dormant subject of the Falkland Islands' oil reserves.

One company, in particular, is set to benefit. It is the only Falkland focussed firm that I believe is currently worth investing in in the short term. It comes with some incredible fundamentals, and a potential multi-bagger return.

Quite likely, this will be one of the more unusual investment cases you will have read about in recent times.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: