Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Butterfield – a “Plan B” bank option that you can invest in

- The treatment of Russian ADRs held by Western investors has shown that property rights are not secure anymore – not even in Europe and the US.

- We now live in an era where freedom of movement is no longer guaranteed, which in turn throws up questions surrounding access to your property.

- Even the potential bankruptcy of central banks has become a subject of public debate of late.

In such an environment, should you keep all of your assets in one currency, country, or political block?

It's no wonder that more and more investors are looking to diversify, searching for a "Plan B". However, this is easier said than done.

Have you recently tried to open a non-resident account with a bank abroad? It has become nigh on impossible to get a bank account in a country that you don't live in, unless you are willing to entrust your money to banks in countries that have their own set of risks, or unless you have millions to invest.

Fear not, Undervalued-Shares.com has found a potential solution.

Butterfield Bank (Guernsey) Limited offers, under certain conditions, the option to open accounts for non-residents on a remote basis, for a minimum deposit of just EUR 250,000 (2-8 times less than most comparable banks request).

Few people would have heard of the bank, and even fewer know that for the past six years, its stock has also been listed on the New York Stock Exchange (NYSE:NTB).

No banking presence in the EU, US or UK

The Bank of N. T. Butterfield & Son Limited's roots go back to 1784 when one Nathaniel Butterfield founded a trading company in Bermuda, which eventually became a full-fledged bank. It was Bermuda's first bank, and today sits among just four banks that are operating in the British Overseas Territory.

Bermuda is 1.5h flight time from New York and 7h from London.

Given the limited size of its domestic market, Butterfield started to expand abroad many years ago. During the 1960s, it opened branches in the Cayman Islands, which subsequently became one of the world's leaders in fund domiciliation. Today, the bank holds client deposits of USD 13.1bn. It has a loan portfolio of about USD 5bn, USD 3.6bn of which are residential mortgage loans and USD 1.4bn commercial loans.

What makes the bank so interesting today is that it does not have any bank branches in the major welfare states of the West. Butterfield exclusively offers its banking services in:

- Bermuda

- Guernsey (Channel Islands)

- Jersey (Channel Islands)

- Cayman Islands

Additionally, it offers fiduciary and administrative services in:

- Singapore

- Switzerland

- The Bahamas

While Butterfield does have outposts in the UK, Canada and Mauritius, these are not bank branches but merely service centres for providing mortgages and a few ancillary services.

The bank's home base is in itself a safe haven. Bermuda is effectively neutral politically, and protected by its remote geography and fiscal conservatism. Finance makes up the biggest part of Bermuda's economy, but the jurisdiction does not have a central bank. The government keeps a very close eye on its domestic banks because there'd be no one to bail them out with helicopter money. Outside of Bermuda, Butterfield only operates in jurisdictions that are similarly safe.

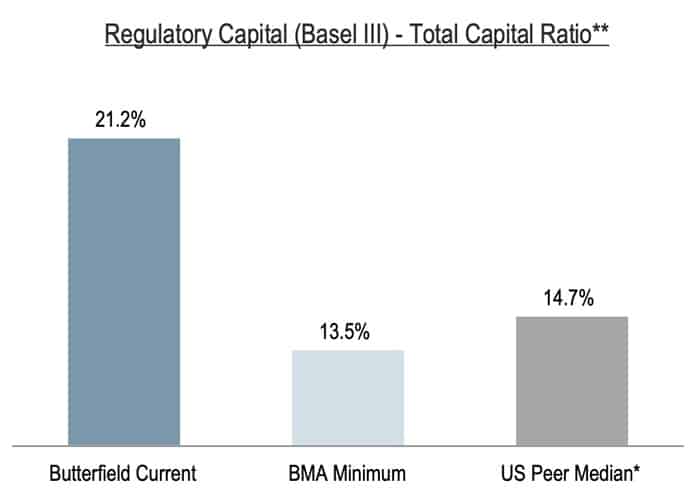

In its efforts to market itself as a safe institution for storing wealth, Butterfield's corporate presentation points towards:

- A regulatory capital ratio that is higher than that of US banks.

- A loan-to-deposit ratio that is lower than that of Nordic banks, which in turn are known to be among the most conservative.

- A plethora of strong balance sheet metrics (see Butterfield's most recent earnings presentation for details).

For international clients, Butterfield is a private bank aimed at high-net-worth individuals. In its domestic markets, however, Butterfield considers itself a bank for everybody, offering both personal and corporate services. Residents of the jurisdictions where the bank operates can open accounts with similar minimum amounts as they'd be required at high street brands. E.g., as a resident of the Bailiwick of Guernsey, you can open a savings account with just GBP 25,000.

Still, the bulk of Butterfield's deposits and business comes from high-net-worth and ultra-high-net-worth individuals, who have already discovered that the bank makes for a potential pillar in their "Plan B".

Keeping a stash of money in the British Isles

A growing number of those wealthy investors (and even some who have only 'ordinary' savings) are now facing the danger of capital controls, i.e. restrictions on where you can send your money and – by extension – what you are allowed to do with your money.

I had already warned about this danger in my 6 May 2022 Weekly Dispatch "Capital controls – a return to the 1970s?", and this seemingly arcane subject got another boost in the public's attention last week, thanks to an interview that went viral.

Here's an excerpt from the interview that market strategist and historian Russell Napier gave to Neue Zürcher Zeitung:

"Sooner or later, Switzerland will have to bring back some forms of capital controls. That will be a feature worldwide. We have gotten used to sitting in Zurich or London and investing money in the US, in China, in Malaysia or Mexico. There are some emerging markets that are attractive today, as they have low levels of debt. But in a world where large parts of the global economy are in a system of financial repression, there will be all sorts of capital controls."

The issue goes well beyond spending your retirement savings. As one reader pointed out to me in an email last week, having restrictions on what you can do with your money decreases the very value of the money itself. Capital controls are wealth destruction, plain and simple. If you want to be free to invest your wealth anywhere you like, then you need to keep it in a place that will allow you access to assets worldwide.

The European Union is a region well-known for its ever-growing wealth redistribution, utilising opaque and complex mechanisms. Will the EU continue to permit a free flow of capital beyond its borders? I don't know, but many have their doubts.

The US, too, could implement capital controls for a raft of reasons, be they financial or purely political.

Which jurisdictions are the right ones for you? The answer is complex and involves many subjective factors.

It'd be reasonable to argue that the UK is a good choice for many, because:

- London is one of the world's premier financial centres.

- The UK traditionally has a strong focus on property rights.

- The country has sovereignty over its own currency.

On the other hand, opening a non-resident account in the UK has become truly difficult. Unless you bring GBP 2m in assets to the table, you'll struggle to find a British bank that will take you on as a non-resident. If you do find such a bank, be prepared for an account opening process that is likely to take 3-6 months.

Butterfield's operation in Guernsey is located in a jurisdiction that ticks many boxes:

- Guernsey is a small but globally connected financial centre.

- Private property has been secure in the Channel Islands for over 800 years.

- Guernsey has a currency union with the UK and uses the pound sterling.

Crucially, Guernsey doesn't have the same kind of political issues as the UK. There is no bloated welfare state, the government's expenditure as a percentage of GDP is a lot lower than in much of Europe, and the island is fiercely protective of its finance sector.

With 34 banks based in Guernsey, which banks are worth considering?

If you face the hurdle of being a non-resident of Guernsey, I'd say Butterfield is now worth a closer look.

A new and revised offer for non-residents

Butterfield in Guernsey used to require non-resident clients to bring EUR 500,000 for the door to open, and a personal visit was obligatory.

The bank has now made it easier for non-residents to open an account:

- Non-resident accounts only require a EUR 250,000 deposit or safe custody assets. To open a non-resident account, the local financial regulator, the Guernsey Financial Services Commission (GFSC), requires you to have a so-called "local connection". This refers to the fact that if a client chooses Guernsey as a jurisdiction over another, there must be a clear reason and rationale. In my observation, this often includes that someone feels attracted to the proven stability of the jurisdiction; its ranking for the highest regulatory standard of 49 jurisdictions (offshore and onshore) assessed by Financial Action Task Force (FATF) in a 2016 global survey, and the fact that I wrote about Guernsey repeatedly (see here, here and here). However, this boils down to each individual and can consist of other rationale, too.

- The procedure can be done remotely.

- If the client's paperwork is in order, the bank commits to open the account in ten working days.

The available service package includes online banking, lending, and access to most stock exchanges.

There are a range of additional details to this, e.g. special requirements for anyone who has a significant part of their wealth derived from cryptocurrency. Like any bank, Butterfield has specific risk issues that it feels more strongly about. Also, if you believe you can be with a private bank without paying private bank prices, you are mistaken - this is a premium price option. Still, Butterfield in Guernsey is now an option that I believe quite a few of my readers could consider.

(For full disclosure, I am currently in the process of opening a business account with Butterfield myself. I do not, however, have a marketing agreement of any kind with the bank.)

Normally, I shy away from recommending individual service providers. Why this exception? Among other aspects, it's because Butterfield is not just some small "island bank", but a NYSE-listed corporation with a USD 1.6bn market cap.

The investment case behind its publicly listed stock is a story where I recently had a colleague steal my thunder. As a result, you are now in for a freebie research report.

Interesting investment case

The stock of Butterfield has been on my watch list for years.

A few weeks ago, I received an email from a colleague in the blogosphere: "Attached is the draft of a research report about a bank that you will probably like. It's right up your street – literally!"

Alan Galecki used to manage EUR 300m in client assets across several investment funds, but he recently focussed on his new investment blog, Financial Engineering. Alan and I have known each other for years, and Alan also joined my 2020 investor trip to Poland. Being the clever truffle hound that he is, he had come up with the idea for Butterfield as well, partly inspired by "Tax havens are toast", an article that I had co-authored earlier this year.

The article clarified why there is no such thing as "offshore tax havens" anymore. The majority of people still live in the outdated belief that a place like Bermuda or the Cayman Islands can be used to hide money. Since the introduction of global tax information exchange treaties in 2009, just about any major financial jurisdiction will automatically report your assets and income to your home authorities. Bermuda, as Butterfield's home base, is in that camp. Its financial industry was last evaluated by FATF (the international supervisory body) in 2020, whose publicly available evaluation report concluded that Bermuda was on top of such regulatory issues. Guernsey is very much in the same camp. It was included on the first OECD White List for the exchange of tax information in 2009.

Instead of duplicating work that someone else has already done, I convinced Alan to provide his research report on Butterfield as a freebie for my readers. Alan's reports are usually behind a EUR 99 p.a. paywall, but you can download the Butterfield report for free using this link.

As the report points out, thanks to rising interest rates, banks are once again earning a decent interest margin, and Butterfield is very much a beneficiary of it. The bank takes on deposits, and it selectively does some lending, predominately on prime residential property.

According to Alan's estimates, Butterfield will earn net income of USD 227.5-245m in 2022. There'll be an impairment charge on the bank's long-term bond investments because of higher interest rates, but these will only be an accounting figure, not representing any cash outflow from the business. The earnings per share are estimated to increase to USD 4.20-4.50 in 2022, compared to USD 3.28 in 2021. Butterfield shouldn't find it difficult to continue paying a dividend of at least USD 1.87 per share, which makes for a yield of 5%. The company will likely buy back around 4% of its outstanding stock during the current year.

As I recently pointed out in my Weekly Dispatch on European bank stocks, the long-neglected bank sector is currently experiencing a lot of new interest. There is a credible case to be made for bank stocks being in for a period of multiple expansion. In other words, even without growing earnings, bank stocks could rise because investors are willing to pay a higher multiple. Throw in growing earnings, and you have a double booster for these stock prices.

Will Butterfield stock also benefit from these developments?

A decade of growth could lie ahead

Butterfield only got listed in 2016, and the company has yet to make itself better known among equity investors. As a bank that falls outside the usual schemata of publicly listed banks, Butterfield will face a bit of an uphill battle to get investors interested in its stock.

Nevertheless, since its IPO, Butterfield stock has advanced from USD 23.50 to now USD 35. With a price/earnings ratio of currently ≈8, it is neither expensive nor screaming cheap. It competes with many European bank stocks that are trading for 4-4.5 times earnings (although some would say it's better comparable with conservative Nordic bank stocks, which trade at the same price/earnings ratio).

Does Butterfield stock have further to advance?

Butterfield's investor relations comes across as fairly old school, and there are a number of unanswered questions for shareholders:

- The trust business that Butterfield acquired from Credit Suisse is likely to be somewhat toxic. What kind of indemnities did Credit Suisse give?

- While focussing the loan book on mortgages is a plus, is there more information about the geographic focus and the average loan-to-value?

- The bank's 30% market share in deposits in Bermuda is good, but what about the deposit Beta, i.e. the percentage of changes in market interest rates that banks have to pass onto their customers? Having this information for the 2018 rate-hiking period, as well as more granularity on the deposits, would be useful (this also in the context of Butterfield's net interest margin not being very impressive yet).

Having such room for improvement can be part of an investment case. Butterfield has an opportunity to up its game in investor relations, which could tie in with a number of other current opportunities:

- As concerns grow about the safety of assets in regions like the EU or the US, Butterfield will attract new clients who are looking for a safe haven and diversification. This could even extend to UK investors who might prefer to move assets to Guernsey, since this keeps it clear of the UK mainland's political and financial turmoil.

- Butterfield has a long history of successfully consolidating its home markets. In Guernsey, Butterfield has bought no less than five other banks and financial operations over the past 21 years. There are usually few takers for these small acquisition targets, which is why they tend to be available at an attractive price.

- At a time when many high street banks are working hard to keep away (and repulse) clients, there is a massive opportunity for a bank that makes a visible effort to be more agile and friendly towards new clients – such as Butterfield has just demonstrated with its new offer for resident and non-resident clients.

Going public will have been a significant change for the conservative, 238-year-old bank. Given how it recently changed its conditions for non-resident account holders, I suspect that Butterfield wants to continue to modernise itself.

The bank could also quite simply get a bit lucky. A potential wave of assets fleeing the EU and the US in particular, looking for safe-haven jurisdictions and institutions, could significantly boost the growth of Butterfield. The resulting growth could put the bank's annual growth rates well ahead of other banking operations, and the assets of high-net-worths are usually very sticky, all of which should be rewarded by the market with significantly higher valuation multiples. Throw in a more attractive interest rate environment, and this could turn into an attractive long-term investment for the remainder of the probably tumultuous 2020s.

What's safe to say is that anyone looking to diversify their assets geographically now has a viable further option to look at.

Ahead of changing banks (and just as with any investment decision), you should always consult a licensed professional advisor of your choice. For an initial overview of the bank and for contact details, please take a look at its corporate website.

How to Invest Internationally for Higher Returns and Risk Reduction

There are 100,000 (!) publicly-listed companies around the world, so why limit yourself to your home market?

Learn everything there is to know about international investing, at this year's Expat Money Summit.

Join my 30-minute webinar on 9 November 2022 (9.30pm CET | 3.30pm Eastern) – entirely for free!

How to Invest Internationally for Higher Returns and Risk Reduction

There are 100,000 (!) publicly-listed companies around the world, so why limit yourself to your home market?

Learn everything there is to know about international investing, at this year's Expat Money Summit.

Join my 30-minute webinar on 9 November 2022 (9.30pm CET | 3.30pm Eastern) – entirely for free!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: