Seaport Entertainment Group is a NYSE-listed play on the revival of New York’s southern tip. I visited the neighbourhood to evaluate the opportunity.

“The International Stock Exchange” is about to take off – catch it while you can

Is there anyone who doubts that the world is about to undergo seismic changes?

One likely winner are micro-jurisdictions – countries such as Singapore, Monaco, or Liechtenstein. These small countries tend to be faster at political decision-making, and during times of crisis they often benefit from a higher degree of societal cohesion. Their agility and stability will prove an asset during the coming years of rapid change and potentially unprecedented turmoil.

Case in point, Guernsey, one of the self-governing Channel Islands. While much of the world is currently struggling with the shockwaves caused by the pandemic as well as the onset of long-standing structural issues, Guernsey appears like a jurisdiction of blissful stability. Not only did the island avoid the worst of lockdowns and infections (life has mostly been normal, i.e. no masks and restaurants open), it's also experiencing an unusual economic boom:

- Lawyers are telling me "the phone is ringing off the hook" with enquiries from people who want to move there.

- Real estate agents are reporting that British investors were buying multi-million-pound properties over the phone without as much as a viewing. As one local story claims: "One buyer purchased three properties worth a total of GBP 11m without even going to Guernsey to view them."

- A well-placed consultant in the financial industry told me that he was currently experiencing an "unprecedented business flow coming from every angle".

What is going on there and how can investors play this trend?

The stock featured in today's Weekly Dispatch is probably a no-brainer investment for anyone seeking to benefit from the rise of micro-jurisdictions - provided you can overcome the (currently quite formidable) hurdle of trading it. For everyone else, it's at the very least a case study of the kind of hidden gem you can find on European stock exchanges. Europe remains a fragmented, opaque market where exciting equity stories and undervalued gems keep hiding in plain sight, if you have the analytical skills and tools needed to locate and research them.

A booming jurisdiction

This article is a follow-up to my 31 January 2020 Weekly Dispatch: "The (not so) secret Channel Islands stock exchange"

If you aren't familiar with last year's article, do read it. It delivers an all-round overview of the island of Guernsey and its unique legal situation as a self-governing Crown dependency and financial centre.

Saint Peter Port, Guernsey's capital and financial hub

There are countless details to it, but just to recap the key points:

- Guernsey's public finances are in relatively fine shape, with a debt to GDP ratio of just 18% (US 100%, UK 85%, Switzerland 40%). Solid government finances are an exceedingly rare exception in a world that is awash in debt. It gives the island strong control over its destiny.

- Societal ills such as unemployment, crime or uncontrolled third world immigration hardly exist in Guernsey. Many say it's "Britain how it used to be". I like to joke that it's "British Switzerland by the sea".

- Guernsey has a booming financial sector, and one that has long been based on specialised skills and reasonable regulation rather than aiding tax evasion or providing shell companies.

For many years, I've considered Guernsey a hidden beauty among European jurisdictions, with its unique assets eventually leading to transformative progress for the island. Most of my readers will know of my personal bias: in 2017, I packed my bags and moved to Sark, Guernsey's neighbouring island. My gut feeling was that bad things were going to happen in Western Europe (primarily: the EU), and that it was time to move A&A ("ass and assets") to a secure bolthole. My friends thought I was nuts.

Fast forward to 2021, and Guernsey is increasingly getting recognised for what I had predicted it was going to become famous for. And quite a turnaround it is, following a decade during which many had thought the island was past its glory days.

During much of the 2010s, the island enjoyed significant affluence thanks to its past (a 30% higher income per capita than in the UK), but its future didn't look particularly dynamic. Guernsey's all-important finance industry was growing, but it gained little recognition outside of a few well-established niches, such as trust funds and private equity vehicles. The island's finance industry was struggling to set itself apart from other offshore finance hubs. Even though Guernsey had never offered secret accounts or anonymous shell companies, the outside world often put it into the same basket as conventional tax havens such as the Cayman Islands. With an ageing population and young people often leaving to pursue their career elsewhere, Guernsey simply did not appear an enticing place for young entrepreneurs and experienced high-rollers to move to.

What Guernsey did pursue during this relatively dull decade was the ongoing introduction of modernised legislation and regulation. The political and regulatory decision-makers aimed at making the island a great place to live, work, and build a business. Creating a more modern and agile approach to attracting high-value, legitimate businesses and residents (and, quite importantly, keeping out the "wrong" kind of businesses and residents) was cumbersome work. It took time, but as is becoming visible now, it was a wise move and transformed Guernsey's prospects for the future.

During the late 2000s, conventional tax havens of the kind found elsewhere in the world came under pressure as hiding places for tax dodgers, criminals and terrorists. Guernsey spotted a public relations opportunity. Right from its creation in 2009, the island formed part of the OECD's so-called "White List" of exemplary jurisdictions, i.e. jurisdictions that cooperate internationally by providing information to the tax authorities of other countries. While other jurisdictions considered the OECD's anti-tax haven campaign a risk to their existing business, Guernsey saw it as an opportunity to show that it had long focussed on offering transparent, legitimate services only – where low or non-existent taxes where merely thrown in as a bonus for those who were able to legally use them.

High praise followed in 2016, when Guernsey was assessed by an international committee of experts on anti-money laundering measures and the financing of terrorism. The assessment found Guernsey to have the highest regulatory standard of all jurisdictions analysed up to this time, both onshore and offshore. Back then, much of the public and the media did not recognise the potential that was inherent to Guernsey's notably different approach (I did, and it was one of the reasons why I moved there). Now that a few years have passed and business in Guernsey is booming, it's becoming increasingly obvious even to the casual observer that the island had long set the right course.

At the moment, Guernsey is busying itself with expanding its approach and service offering to new growth markets, such as crypto-assets. As I hear on the grapevine, the island has successfully courted some crypto-entrepreneurs with the prospect of new regulation aimed at attracting legitimate operators in the space. As Asset Servicing Times reported in its 14 April 2021 issue: "Apex (a Guernsey-based fund administrator) has seen a number of prospective funds based around crypto-currencies. 'There will no doubt be a number of different products brought to the mainstream market this year that seek to harness some of the yields that are being seen in this space', comments Patrick Cummins, managing director of Apex."

In addition, Guernsey's legislative body is preparing laws that will specifically welcome FinTech businesses. Watch this space for further news throughout 2021 and 2022.

Given all that, I expect Guernsey to make quite a few waves over the coming years, as a jurisdiction that did its homework properly and ahead of time. A global minimum corporate tax? Guernsey saw that one coming a long time ago and built its proposition on a broad footing rather than just tax benefits. Stronger supervision of offshore finance centres? Guernsey's long-standing approach of only attracting legitimate businesses is paying off ever more. As a case in point, compare the current issues of the Cayman Islands with the situation of Guernsey.

The Cayman Islands were recently added to the FATF watch list of terror financing, where they now rank alongside Morocco, Burkina Faso, Senegal, and Pakistan. The Caymans had long benefitted from being more accommodating to questionable businesses, which gave the islands' finance industry stronger growth – but it's now come back to bite them in the bum. The regulatory challenges for the Caymans are overwhelming, because the islands are missing even some basic regulatory features, such as cyber-security regulation. I am reliably informed that several Cayman-based funds are already preparing their move to Guernsey (while others are looking at other European jurisdictions). The service offerings of the Caymans will always have their place in the world, but things have started to shift.

The best ever advertisement for Guernsey (The Wall Street Journal, 26 February 2021)

Entrepreneurs in Guernsey, on the other hand, are telling me they love that Guernsey stability allows them to focus on their business instead of worrying about the precarious problems that much of the world is currently struggling with. A stable environment where to build a business and service clients will increasingly become a valuable asset. This has also started to attract entrepreneurs from the EU, including Germany. I know as much because I have received an increasing number of such enquiries myself, from people in my professional network who are asking me about moving their base.

It really does seem like the moment for Guernsey's time in the spotlight has arrived.

And there is one stock that is probably the ideal vehicle to play this trend.

A proxy for Guernsey's growing finance industry

The International Stock Exchange ("TISE", ISIN GG00BYYLRY96) is a Guernsey-based for-profit company that operates a stock exchange, and which is itself listed. You can buy its stock just as you can buy stock in the London Stock Exchange (ISIN GB00B0SWJX34), Deutsche Boerse (ISIN DE0005810055), or the Hong Kong Exchanges & Clearing (ISIN HK0388045442).

Amazingly, the securities listed on TISE have a combined market cap of GBP 400bn. That's nearly 50 times the GDP of Guernsey, when other stock exchanges usually have a market cap that is just one to two times their country's GDP. How come?

TISE has turned itself into a truly global market place. Besides listing a few local companies, the exchange provides a place where to list corporate bonds and many forms of investment vehicles. Among other things, TISE offered listings "SPACs" (special purpose acquisition companies) years before anyone even spoke of them.

I had pointed out the stock of TISE in my January 2020 article:

"Given its low market cap and strong backing, it wouldn't surprise me if this eventually turned into a highflyer on the back of some clever ideas."

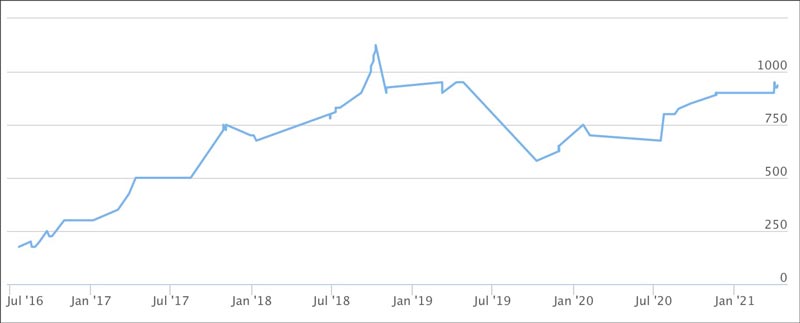

Back then, the stock was trading at GBp 750. It's now up at GBp 950. There could be more gains to come, given the new strategy and vision that are starting to become apparent for the company just now.

A few weeks ago, TISE released its 2020 results, with earnings at GBp 128 per share. Based on its current stock price and last year's earnings, TISE stock is trading at a price/earnings ratio of just 7. Usually, it's only companies without growth prospects or highly cyclical, unsustainable earnings that trade at such a low valuation. TISE, however, has much better prospects than that:

- 2020 saw the second highest number of new listings in the exchange's 24-year history. Even during the year of pandemic, the boom in new listings continued unabated. Current indications are that 2021 will be another strong year.

- TISE has been attracting business that you might have expected to go to other major exchanges. Case in point, TISE's formidable market position in respect of high yield corporate debt. As reported in both The Wall Street Journal on 13 May 2019 and Bloomberg on 9 February 2021, a third of all high yield bonds issued across Europe are being listed on TISE. Even Netflix lists its corporate debt on TISE.

- TISE lists specialist real estate investment vehicles, Real Estate Investment Trusts (REITs) - a business that has rebounded strongly since the initial stages of the pandemic. Research shows that 40% of all UK REITs are listed on TISE, including large UK investment houses such as M&G.

Admittedly, the company is tiny, given its current market cap of just GBP 27m (2.821m shares outstanding). However, it recently attracted some top talent, including a new CEO. Since November 2020, TISE is led by Cees Vermaas, formerly the CEO of Euronext Amsterdam. The Dutchman had also served as CEO of CME Europe, the European subsidiary of CME Group (ISIN US12572Q1058), a USD 75bn giant that operates the world's largest financial derivatives exchanges. Clearly, Guernsey has also started to attract a new kind of resident that you would formerly have expected to live in London, New York, Amsterdam, or Frankfurt. It's all part of the bigger picture that I outlined above. Guernsey has started to punch above its weight.

New record high soon? (link for up-to-date quote)

What are the new CEO's priorities?

As Vermaas put it himself: "Our vision for the future is to scale up and become truly global. On the business-side itself we are looking forward to diversify our business – on products, on geographies, and also on markets."

Currently, trading on TISE is difficult, because it requires a broker that is a member on TISE, such as Ravenscroft (a Guernsey-based finance group with GBP 8bn in client assets). You could either set up an account with Ravenscroft, or instruct your broker to deal with Ravenscroft on your behalf ("institution to institution"). Realistically, though, only sophisticated private investors and institutional investors will be able to do that, and even they might struggle. Will that ever change?

Technology is making for an ever more connected world, and securities exchanges around the world are consolidating into ever larger units and networks. I had long expected TISE's connectivity to improve, and based on the company's recent remarks, it's not unreasonable to speculate that we will soon see just that.

Vermaas: "One priority is to develop and implement a new trading system … This will enable us to diversify our debt products and to have more equity products, and to move further into the secondary markets in order to improve distribution. We want to improve distribution in the Channel Islands but mainly beyond, including the UK but we also need to see what further opportunities might arise from Brexit, and so that might include mainland Europe as well."

That sounds to me like he is aiming for improved connectivity.

In any case, it's clear that under its new leadership, TISE has a different level of ambition: "One of the aims of the next few years is to put ourselves into the major league of professional bond markets. … A few months ago, we hired a top executive in Dublin, who is making huge progress in establishing a specialist bond market for qualified professional investors. That will help us to diversify the types of bonds listed on our market and grow our share of the European debt market."

Video interview of the new CEO of TISE (The European Interviews, 19 April 2021)

Can TISE pull off its own transformation and scaling up?

The company certainly has the means to do so. Given its history as an asset-light, profitable local monopoly, TISE is sitting on significant cash reserves and investments.

Its stock had long suffered under a lack of visibility, and the company didn't have ambitious growth plans (or if it did, the market didn't put much value in them). It looks like TISE is now getting a proper vision in place and the executive team to make it happen.

Vermaas wants his company to be more like "a kind of FinTech global financial services company. That is the type of direction I would like to grow this company going forward."

If you deduct its net cash from its market cap, the current valuation comes out nearer a p/e of 5 – and that's before factoring in the possibility of higher earnings during the current year if trading volumes and new listings remain active. For a company with such high-calibre leadership and ambitious growth plans, and with the possibility of becoming a bit more of an exchange licensed FinTech enterprise with wider appeal to investors, that is almost too good a valuation to be true.

What's not to like? Such a scenario could give the stock plenty of upside, but it shouldn't have too much of a downside given its existing earnings, cash reserves, and leading market position.

With all of these factors taken together, it does feel like TISE (both the company and the stock) is about to make a leap forward. Needless to say, this isn't an investment recommendation and you need to do your own due diligence (here is a link to TISE's annual report 2020). However, it's definitely an opportunity worth highlighting.

Now, if only some of you will be able to trade this stock! Knowing my readers, some of you will want to pursue this opportunity and will succeed in buying stock.

For everyone else, I'll come up with ideas on other hidden gems in Europe soon. There is lots to discover on the old continent, as today's example shows.

Some other ways to benefit from Guernsey

There are three additional, somewhat unusual aspects worth mentioning:

- Moving to Guernsey.

- Setting up a finance-related business in Guernsey.

- Moving to Sark.

These will be irrelevant for 99% of my readers, but I know that 1% of you might be interested.

Did this article whet your appetite for a potential move to Guernsey? Under Guernsey's "Investor Visa" scheme, you can apply for a visa if you invest GBP 750,000 (USD 1m) in the island and fulfil a range of other (reasonable) criteria. This would allow you to rent or buy a house on the so-called Open Market of Guernsey (which makes up 10% of the island's real estate). There is also a regime for entrepreneurs and employees moving to the island. The definitive source of information about all of these possibilities is Locate Guernsey, the island's government-funded agency for this purpose.

Did this article make you think about setting up a financial services business on Guernsey? Guernsey currently has no capital gains tax, which allows entrepreneurs to build up their wealth more rapidly, provided they become a bona fide resident of the island (i.e., having a postbox there won't suffice). Contact the Guernsey Financial Services Commission (GFSC) if you have any questions, or use the broad array of free information on the Guernsey Finance website. The GFSC even has a special email account for entrepreneurs who want to suggest innovations that they could bring to the island and which would require new legislation and regulation. Since October 2020, Guernsey's government is headed by Peter Ferbrache, himself a noted entrepreneur. Entrepreneurs with new, legitimate ideas will find the doors wide open at Guernsey's governmental authorities.

Last but certainly not least, you could also become my neighbour. I have already helped over 100 new residents move to Sark, the island neighbouring Guernsey. You can learn more about it here, or read my 4 November 2020 article "Sark – the world's fastest growing economy in 2021?". Though the boat is filling up fast and I may not offer this service for all that much longer.

If anyone reading this ever needs any intel on Guernsey or introductions to the right people, don't hesitate to reach out to me.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Reduce your tax bill: offset your Membership fee

It's never been easier to claim your Membership fee on tax.

Tax-deductible invoices are now available to download for all Members. Simply log into your Undervalued-Shares.com account and download the PDF from the "Payments" tab.

Happy saving!