Allegedly, we live in an era of transparent, efficient markets.

Are there still any publicly listed companies with hidden reserves that are not yet reflected in the stock price? Such opportunities seem to be a thing of the past.

Are they really?

Cyprus-listed Petrolina Holdings proves that potentially exciting opportunities can still be found, if you know where to look and put in the extra mile to do on-the-ground research.

The following article is an Undervalued-Shares.com exclusive.

A booming island nation

The economy of Cyprus has been doing rather well of late, at least for those who own assets in the southern European island nation. During the past 12 months, rents have shot up by 50-100%, and the real estate market got red hot.

As the Washington Post put it on 23 October 2022:

"'There were already serious problems with housing when I moved here: prices doubled, rentals advertised on the websites got scooped up within just a few hours,' said Yevgenia Korneeva, a 28-year-old art manager at a gaming company, who moved to Cyprus from Moscow in April. 'In Limassol, the most expensive city in Cyprus, finding a two-bedroom apartment for less than 2,000 euros is considered lucky.'"

In a country where wages in the tourism sector or for menial work can be as low as EUR 4, such a price level for real estate is extraordinary.

As the short quote gives away, new residents from elsewhere play a major role. For years, Cyprus – which is not a party to the Schengen Agreement but sets its own immigration regime – has been doing things quite different to its European Union peers. E.g., its infamous "Golden Visa" programme enabled wealthy new residents to acquire citizenship (and an EU passport) by spending some time in Cyprus and making a real estate investment.

Combined with Cyprus's friendly tax laws and location in a sunny part of the Mediterranean, this was not just the fastest but also one of the most attractive ways to get EU citizenship. However, it also attracted its fair share of dubious characters, and the idea that EU passports were effectively for sale created some consternation elsewhere in the political block.

In 2020, Cyprus came under pressure to close down the system. However, this didn't stop its economy from benefitting from another influx of residents who bring purchasing power, investment and talent. Recently, a mix of Russian, Ukrainian and EU citizens have fled to the island for a number of reasons:

- Russians are fleeing from their government and international sanctions.

- Ukrainians are fleeing from war.

- EU citizens from countries like Germany are trying to find a spot with more sunshine, lower taxation, and less government intrusion. (Ditto for the Brits, who historically have a strong link to the country.)

Source: Washington Post, 23 October 2022.

Among EU members, Cyprus has a unique approach to immigration, and one that seems strongly geared towards further increasing the population of currently 1.2m. E.g., a non-EU investor can set up a Cypriot company and bring in non-EU nationals as staff – which currently happens with many Ukrainians and Russians who register a company in Cyprus so they can hire Ukrainian/Russian employees who then move to Cyprus. This generous policy will drive further demand for residential real estate and office space. (If you want to speak to someone in Cyprus about this immigration and company set-up opportunity, feel free to contact my friend Loukas at TotalPro Services, [email protected]).

There is always the question how existing residents and citizens feel about a massive influx of new residents, and what such a transformative influx does to the country's economy, culture and social fabric. For real estate developers, however, the situation provides major opportunities.

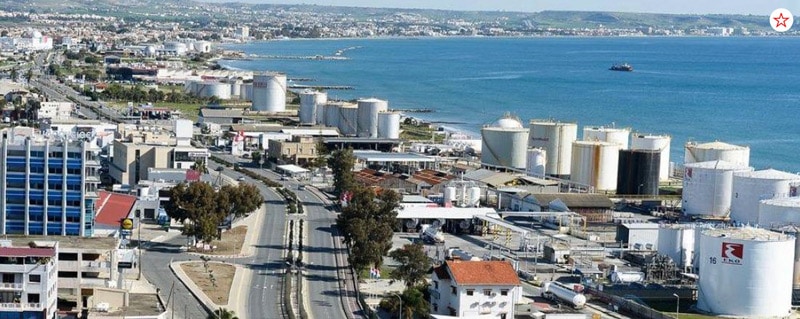

One of those opportunities is currently hiding in plain sight: Larnaca, the often-ignored port city on the south coast of Cyprus.

Larnaca is about to stage a comeback

Just about every international visitor to Cyprus will be somewhat familiar with Larnaca, given that it hosts the country's main international airport.

However, the city of 51,000 residents has long existed in the shadow of two much more famous destinations in Cyprus:

- Limassol, the second largest urban area with 250,000 residents that offers a metropolitan lifestyle and luxurious high-rise buildings.

- Ayia Napa, the resort town known for its beaches and party scene.

Larnaca experienced a boom in holiday visitors during the 1970s, but it has been somewhat neglected ever since. In many respects, it has been Cyprus's "tourism underdog". If anything, people remember driving past a pretty lagoon with flamingos when they leave the airport to drive towards Limassol or Ayia Napa.

However, there are growing signs that Larnaca is going to make a comeback and enter a new cycle of growth, driven by the international interest in Cyprus real estate and the sky-high prices elsewhere on the island.

Most prominent among the current set of changes is the development of the Larnaca marina, a project aimed at redeveloping a central part of the city's coastline. Kition Ocean Holdings, an Israeli-Cypriot consortium, was awarded the tender to make space for 600 berths for yachts. Construction work began in April 2022 and will continue for a number of years. With a marina inevitably come other facilities as well as upmarket housing. At a construction cost of EUR 1.2bn, this is the largest infrastructure investment ever on the island. Notably, Kition managed to sign up Aroundtown (ISIN LU1673108939, DE:AT1) as joint venture partner, one of the largest real estate investment companies in Europe.

Source: Cyprus Mail, 26 October 2022.

The marina project creates a new dynamic for Larnaca, and one that you can see and feel when visiting the city these days. Radisson, which already operates a hotel in Larnaca, is working to open a second hotel in the city. In Larnaca itself, a decent amount of construction work is visible, including several high-rise buildings. It's early stages, but the city seems to be on the move.

All of it pales in comparison with the vast potential that lies in a stretch of beachfront land located just outside of Larnaca, along the road to neighbouring Dhekelia.

As it were, this involves land currently owned by Petrolina Holdings (ISIN CY0006310615, CYS:PHL), a Cyprus-listed oil company.

Cyprus's domestic energy giant

Established in 1959 by four brothers, Petrolina Holdings was Cyprus's first oil company. The company supplies motor, industrial, domestic, marine and aviation fuels, and it has a nationwide retail network of 100 gas stations. Based on a stock price of EUR 1.10, its current market cap is a paltry EUR 96m.

The firm was set up by the local Lefkaritis family. The patriarch, Kikis Lefkaritis, died in 2020 aged 94, but the family remains firmly in charge. Six family members control a total of 63% of the company. There is a fairly complex network of indirect shareholdings, e.g., through parents representing shares held by their children and the use of holding companies. Dinos Lefkaritis holds just 9.4% himself, but controls 44% of the votes. By the look of it, the family pursues a multi-generational approach to investment. The board of directors almost exclusively consists of family members.

Petrolina Holdings had never been an exciting investment per se, but the character (and valuation) of the stock could change in the years to come. Right now, several projects that have been in the making for the better part of two decades are finally coming to fruition.

Keeping a vast fuel storage facility and related operations on a stretch of prime beach land always seemed like an ineffective use. In 2003, Petrolina Holdings decided that it was wise to move its existing facility to elsewhere on the island in order to free up land.

Moving an industrial operation is never easy nor quick, but it got done eventually: in 2021, the facility was moved to Cyprus's new energy hub in Vasiliko, halfway between Larnaca and Limassol. The company spent EUR 60m on creating a new facility.

The entire industrial site in Larnaca – a stretch of two to three kilometres of coastline – is now earmarked for a complete redevelopment.

The Mayor of Larnaca claims to have 15 ambitious redevelopment projects up his sleeve, which, when taken together, promise to change the face of Larnaca entirely. However, none of them is bigger and more ambitious than the plan for the former oil storage site owned by Petrolina Holdings. This land is earmarked for the development of new residential and tourist neighbourhoods, including parks and other facilities needed to effectively create an entirely new part of Larnaca. Not too far from this area is the place where Radisson is currently working to build a new hotel. As I said, Larnaca is clearly showing the first signs of being on the move.

Demolition of some of these facilities is already underway (though much of it was still there when I visited in September 2022). The following images demonstrate just how large an area will become available for redevelopment.

Source: Feasibility Study for the Regeneration of the East Coast of Larnaca (2016).

Source: DOM Live, 18 August 2021.

Petrolina Holdings owns seven "parcels" of land in this area, four of which were used for its industrial operation. It is unclear just how large the area is, who owns which part of it, and what may happen on neighbouring pieces of land. However, it does appear that Petrolina Holdings is the biggest owner and gearing up to play a major role.

In June 2021, Petrolina Holdings purchased an additional 7 hectares of land from ExxonMobil Cyprus. For a company the size of Petrolina Holdings, spending EUR 29m on such a land acquisition represented a major investment.

Petrolina Holdings recently set up a separate subsidiary, the aptly named Petrolina Bayfront Limited. The new subsidiary reportedly hired Arup, the international planning, design, architecture and engineering firm, to come up with a plan for the area.

How much of a game changer could this be for Petrolina Holdings and its shareholders?

It has many of the hallmarks of a project that could completely change the market's perception of the company and its stock, provided management plays its cards well.

The mystery of the company's land bank

As a company listed solely on the Cyprus Stock Exchange, Petrolina Holdings publishes all of its corporate information in Greek. While the company's 2021 annual report includes some information about its real estate holdings, it is not sufficient to provide a detailed calculation as to the company's potential for the Larnaca beachfront land. Two email requests sent to Petrolina Holdings' investor relations team three days and one day ahead of this article yielded no answer. It's not that I had expected an answer. I primarily sent the emails to confirm my suspicion that at this stage, the company has little interest in engaging with shareholders.

Petrolina Holdings has 87,500,000 shares outstanding and a market cap of EUR 96m. Looking at the size of the site on aerial photos, it doesn't take much to imagine that the site's overall value could play a significant role in the future valuation of the company. Besides the current value of the land, Petrolina Holdings should benefit from the possible profits from building and selling real estate. It seems likely that a locally established family would eventually create its own real estate development firm instead of letting someone else benefit from that part of the value creation. Presumably, this is why Petrolina Bayfront Limited was set up.

Beachfront land in Larnaca's north is currently worth about EUR 450 per square metre. In Limassol, land in the city (not along the coast) is worth EUR 1,000 per square metre and more. In Nicosia, the inland capital of the Republic of Cyprus, land prices can go as high as EUR 2,000 per square metre. For its purchase of land from ExxonMobil Cyprus, Petrolina Holdings paid around EUR 400 per square metre. If someone manages to find out the exact size of the company's land holdings along Larnaca's north coast, it would be possible to calculate an approximate value of the land holdings.

However, the entire calculation would then also need some local intel on the density of construction the government will allow. Development land will always come with a limit for the footprint that new buildings are allowed to have. According to local rumours, Petrolina Holdings has a special deal with the government for allowing a higher density of buildings than would ordinarily be the case. The real estate footprint involves not just the square footage that you are allowed to cover with buildings and other construction, but also the maximum building height. A larger footprint and taller buildings make a lot of sense, since you'd want to create a real community with all the necessary facilities and not waste this development opportunity. However, I have not yet found official confirmation as to whether these rumours are true, and what density will be allowed. Of course, the higher the permitted density, the more valuable the land. The ability to build a larger footprint AND high-rise buildings could make for massive developer profits – which would make this land uniquely valuable.

For now, much of this investment case involves guess work – albeit with strong indications that there is a real case to investigate further and keep monitoring.

Two things that also need to be kept in mind: what is the performance (and value) of Petrolina Holdings' core business, and how is the company financed?

In its core business, Petrolina Holdings' operating margin from its chain of petrol stations and wholesale operations has gone down substantially over the past years. According to the company's most recent results for the first half of 2022, gross margins dropped to 7% from 11% in 2021. This can be attributed to the rising oil market. As a wholesale fuel player, Petrolina Holdings experiences a delay in rising sale prices at the pump versus the oil derivatives it purchases internationally. This decreases margins. On an overhead level, expenses rose from EUR 21m to EUR 24m due to inflation, along with expenses that the company onboarded to oversee its expansion in real estate.

Since the early 2000s, the stock price of Petrolina Holdings has never managed to rise above its current level. At times, it's been a fraction of today's price. You'd think that the company runs a profitable, attractive local monopoly of sorts, but the market has had its doubts.

Petrolina Holdings.

Right now, Petrolina Holdings' level of debt and the uncertainty about interest rates will play into its valuation. To build its new facility and purchase additional real estate, the company took on additional debt, now amounting to EUR 170m in bank debt and just EUR 3.4m cash on the balance sheet. The bank loans were taken on with a floating rate of EURIBOR plus 3% margin. So far, this resulted in interest of 2.6%, but in the new environment it is likely to rise to 4.5% with the interest rate reset taking hold after June 2022. Interest rate expenses will increase by about EUR 3m as a result. During the first half of 2022, Petrolinas Holdings had earned a profit of just EUR 1m before interest expenses (compared to EUR 3.75m last year), and during the second half of 2022, the company could even be pushed into a loss. As a result, it is likely to cut or potentially even entirely cancel the dividend. For 2020 and 2021, a dividend of 4 cent and 6.2 cent, respectively, was paid – which now no longer seems sustainable.

Last but not least, will Petrolina Holdings find the money to do the actual developing? For a real estate project of that size, the company would probably need another EUR 150-200m. Given its current level of indebtedness, it's unlikely that the company can find this amount. If it wanted to raise more equity by issuing shares, it could do so only at a relatively low valuation. The family shareholders, too, would have to come up with additional money – which they may or may not have.

This leaves a couple of uncomfortable questions hanging over Petrolina Holdings, at least for now. The entire situation could yet turn out to be an opportunity, though. E.g., Petrolina Holdings could decide to spin off and list the real state operation separately. This would allow to raise funds on better conditions, and probably also help with the company's overall valuation. With its mix of energy and real estate, Petrolina Holdings does not have a clear profile and thus doesn't represent a well-defined target group among investors (never mind the overall lack of liquidity and visibility of the Cyprus Stock Exchange). The local quasi-monopoly that Petrolina Holdings operates in Cyprus could probably be made quite attractive to investors, but it would have to be presented in a better way and with more transparency. The company should probably also consider some more outside directors instead of populating the board with a raft of family members.

Still, there is a real opportunity stemming from the company's enormous land bank, and Cyprus's booming demand for real estate makes it worth keeping an eye on this. The first eight months of 2022 have been the best eight-month period for the property market since 2008. Sales to non-Cypriots were up 76% compared to the previous years, with sales and prices rising across the entire island except Famagusta. Foreign real estate sales were up a whopping 79%, with sales to non-EU nationals increasing by 117%. As a safe-haven destination, the Cyprus real estate market is likely going to be a bit of an exception within Europe, despite the more challenging macro-environment and higher interest rates. One could even argue that the world's troubles will drive further demand.

I was told informally that anyone who can put together a credible real estate project in Cyprus right now can sell the units in advance. Prices are bound to come back a bit if or when the situation in Ukraine gets resolved or becomes less acute, and the market could easily come 20% off its recent high given the amount of froth in the market. Longer term, though, prices probably have a lot further to run because Cyprus is "cheap" compared to similar jurisdictions in the Western world. Also, given the relative lack of quality construction in existing housing stock, someone who can offer high-quality real estate for purchase should be able to charge a premium.

It all makes for an interesting situation for investors, albeit one that is difficult to get exposure to and which will require careful timing. Within all this, adversity could yet turn out to be an opportunity. E.g., if the stock took a dive because of worries about its exposure to rising interest rates, it could force the management's hands and lead more quickly to a spin-off of the real estate division.

When conditions are right, buying stock in Petrolina Holdings could turn out to be an elegant route to get exposure to Cypriot real estate.

I am convinced this will happen

On my recent walk through Larnaca, I could literally feel its potential for redevelopment as well as its first tentative steps towards relaunching itself.

It is the oldest city in Cyprus, and some say that it's also the most authentic. Dating back to the 13th century BC, it's easily visible how different cultures have left their footprints in Larnaca over the centuries. The existing beach promenade is a bit dated but pleasant, and also earmarked for a major overhaul. Few things beat being close to an international airport, which is an advantage that Larnaca can exploit to its advantage. The drive to both Limassol and Ayia Napa is tediously long (Cyprus is much bigger than you'd think!), and quite expensive if you use a taxi.

Impressions of Larnaca:

You can boil it down to the following. Larnaca is in the centre of the island and near the major international airport. Cyprus is dedicated to attracting significant numbers of new residents. Yet, Larnaca real estate is currently 50% the price of Limassol real state. Long term, overall prices in Cyprus should continue to rise. You should see the valuation gap between Limassol and Larnaca get smaller, by way of Larnaca catching up with the higher price level of Limassol. Within Cyprus, Larnaca stands a good chance of being the next hot trend in real estate. This is about growth as well as arbitrage.

Redeveloping the land owned by Petrolina Holdings will take time, and there are a number of unknowns. E.g., even after spending hours trawling the Internet for information about the timetable for demolishing the entire site and dealing with environmental risks, I am still not clear how soon (or not) it's all going to happen. Given the nature of the business that has taken place on the site, dealing with potential pollution could take years, and there is conflicting information on the Internet about that as well. According to Petrolina Holdings, the costs for demolition and subsequent clean-up will amount to EUR 1.8m, which would be a fairly modest outlay unless there are nasty surprises. It's also not clear what may happen on adjacent sites – there being a lot of industrial sites in the area, some of which are apparently owned by the government of Cyprus. In April 2020, Petrolina Holdings had already purchased and leased some additional land in the former Larnaca Free Zone from the government. Evidently, the company is eager to expand its hold over the area, but it's unlikely that anyone but family members are in the know about the long-term strategy.

At least some demolition of oil facilities has already taken place (source: DOM Live, 18 August 2021).

If the stock was more liquid and easier to trade, I would have dedicated more time on researching the details and turning this into the kind of in-depth report that I make available to Undervalued-Shares.com Members. You probably would have seen me check local land registries, and getting myself into trouble by flying a drone across a refinery site. Instead, I saved the Petrolina Holdings idea as a fun but not yet fully matured story to write up while bopping across the ocean in the Galapagos Islands with limited Internet access.

Maybe someone else wants to invest time to dig deeper into this story? This stock is an opportunity for someone who wants to do a bit more investigative research on the ground and be the first to publish details in the investor community.

I have no doubt that Cyprus will become even more of a haven for people to flee to. There are few alternatives within Europe for people to find similarly attractive conditions, and the island now has a lot of momentum on its side. In terms of affordability, logistical access, and open doors to well-to-do immigrants, Cyprus ticks many boxes. Not unimportantly, the island also has a lot of space to accommodate new residents, as well as some other potential aces up its sleeve, such as its offshore gas reserves.

If you aren't based in Cyprus but still want to invest in Petrolina Holdings, you will have to open a brokerage account with a Cypriot broker. This isn't a very large hurdle per se, because Cypriot brokers do like to attract international clients. There could also be other opportunities hiding in this market. For now, however, the lack of ease of trading represents another hurdle for seeing the stock increase in value – especially at a time when there are so many bargains to be had elsewhere and with less trouble.

Still, who ever went wrong with turning underutilised beachfront land into prime development land?

It's definitely a story that is worth watching.

Free webinar: How to Invest Internationally for Higher Returns and Risk Reduction

My 30-minute webinar on how to invest internationally is now only a couple of days away.

If you haven't done so already, don't forget to grab your FREE ticket for this year's Expat Money Summit.

Looking forward to seeing you there!

Free webinar: How to Invest Internationally for Higher Returns and Risk Reduction

My 30-minute webinar on how to invest internationally is now only a couple of days away.

If you haven't done so already, don't forget to grab your FREE ticket for this year's Expat Money Summit.

Looking forward to seeing you there!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: