Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Small-cap stocks – big problems, or big opportunities?

"The next big thing is small" vs "Small stocks, big problems" – two very different viewpoints from Bank of America and Goldman Sachs.

Both have recently issued detailed analysis of the small-cap stock sector, to help predict its likely performance over the next years. Both are major investment banks with world-class analysts and access to huge amounts of data. Yet, they seemingly come to diametrically opposed conclusions.

Who is right, and who is wrong?

Today's Weekly Dispatch summarises their viewpoints, locates some specific areas of opportunity, and invites London-based readers to a dinner-table discussion of the subject.

The clash of titans

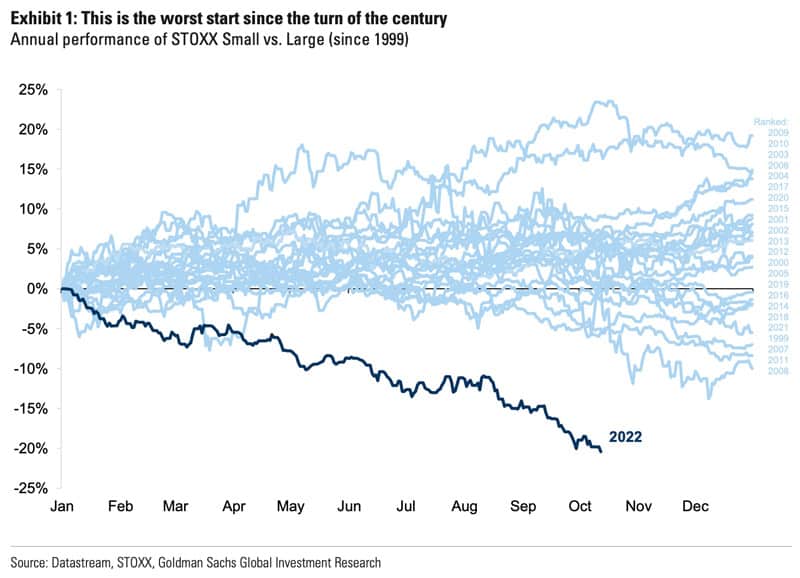

On 14 October 2022, Goldman Sachs issued "Small stocks, big problems".

As the 21-page report summarises:

"Small caps are down 34% year-to-date. They have underperformed Large caps by 20%. This is the worst start since the turn of the century.

We examine 10 reasons why 'small' caps had 'big' problems:

- High Domestic Exposure

- Low Profitability

- High but Unstable Growth

- Poor Sector Exposure

- High Cyclicality

- High Policy Uncertainty

- Low Shareholder Return

- Strong Outflows

- Diminishing Stock-Picking Opportunities

- Slowdown in M&A activity

Our macro outlook suggests that most of these problems will persist (albeit at a slower pace)."

A pretty damning indictment, if ever there was one.

Source: Goldman Sachs, 14 October 2022.

A few weeks later, BofA Global Research, the research subsidiary of Bank of America, countered "The next big thing is small".

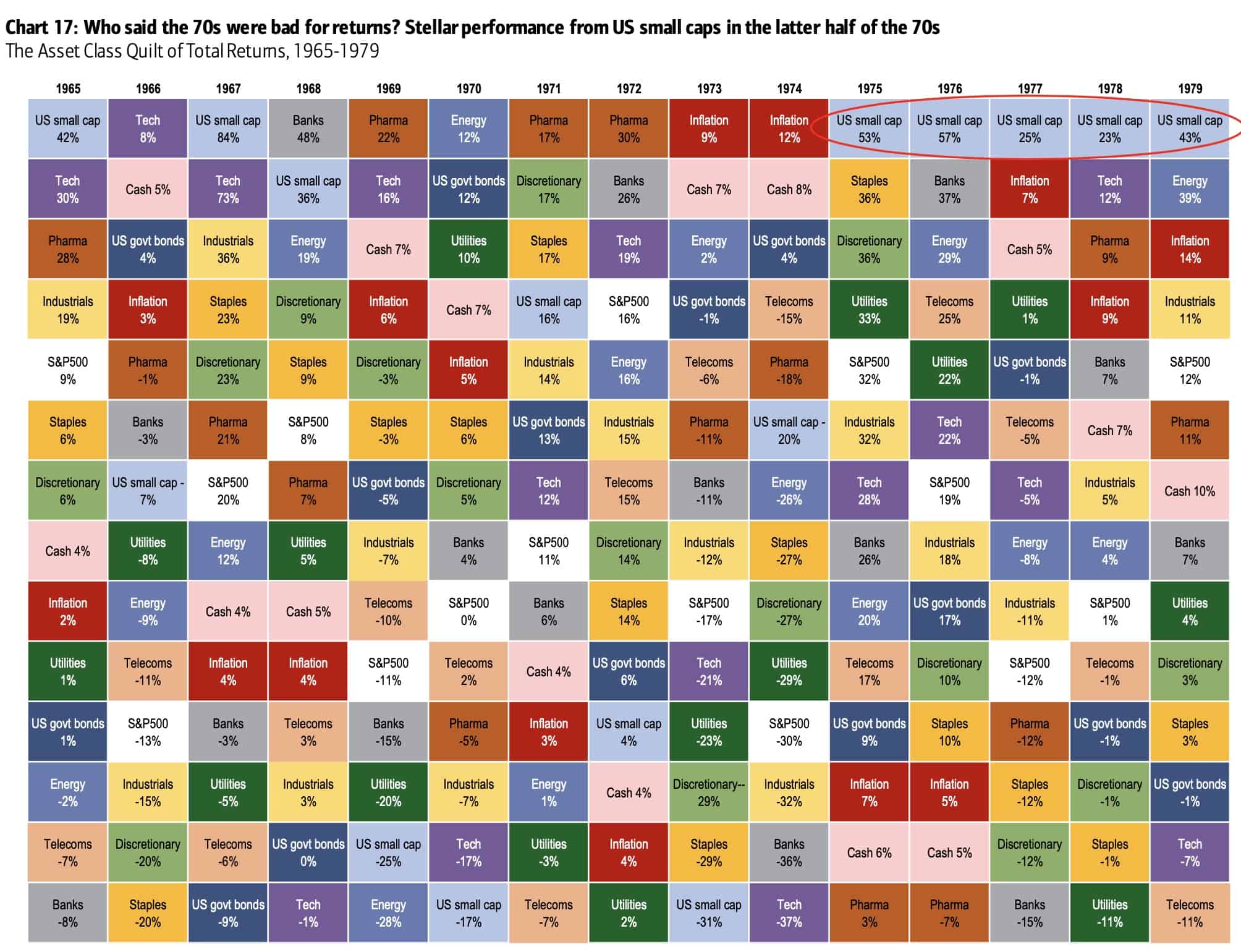

Its 15-page report compares the current situation to that of the 1970s, and shows quite some enthusiasm for small caps over the coming years:

"The Great Bull Market in Small Cap: stagflation continued through late-1970s but once inflation shock of 1973/74 over...US small cap entered one of the great bull markets of all-time; small cap stocks to outperform in coming years of stagflation:

- small cap stocks are price-takers not price-makers so penalized less by inflation;

- localization & fiscal stimulus favors small (globalization & monetary stimulus favors large);

- small company profits less likely to be source of funds for governments;

- small cap outperformance starts in recession (long-term returns for US small cap during recessions since 1936 averaged 11.7% vs just 8.4% for large caps);

- US small cap stocks more correlated with leadership in next bull (industrials, financials, resources);

- US small cap trading at relative multiple discount of 0.74x trailing 12m P/E relative to large cap, near record lows;

- note small cap EM equities just hit an all-time high relative to large cap EM equities as China financials hugely de-rated...same now happening with US tech.

Who said the 70s were bad for returns? US small caps showed a stellar performance in the latter half of the 70s." (click to enlarge the following chart)

Source: BofA Global Research, 4 November 2022. Click on image to enlarge.

Which view is an investor to follow?

I've sifted through many recent publications to analyse the debate, and to see if I can come up with some useful conclusions and recommendations.

Three observations, in particular, stood out as worth keeping in mind.

1. Small caps benefit from localisation

There's no doubt that small-cap companies are, by definition, more local. Smaller companies generate a higher percentage of their revenue in their home country, whereas larger companies generate a higher percentage of their revenue internationally.

During a recessionary environment that entails a weaker domestic currency, small-cap stocks are likely to face particular challenges. They cannot escape the weak economic environment of their home country, and the weaker currency makes their imported materials more expensive – both creating pressure on the companies' profit margin.

Large companies, on the other hand, can compensate more easily. A weaker currency in their home market makes their exports to international markets cheaper and more competitive. When they bring foreign profits back to their country, they benefit from the exchange rate.

This should be a strong argument in favour of large caps, but we may still see some small caps perform unusually well over the coming years. There is one extraordinary factor that didn't apply during previous downturns, and which will make the coming years an exceptional period in at least some aspects.

Given geopolitical developments in the world, we are going to see a strong trend to bring manufacturing closer to home. Countries such as China are likely to lose business to countries with a (perceived) lower political risk. Smaller, more local companies will be seen as being less exposed to risky regions, and they could pick up additional business.

Countries such as Poland or Mexico could be potential winners of this trend. Poland, for example, is cheap, has a highly educated workforce, and benefits from the millions of additional workers that came to its shores through the wave of Ukrainian refugees. Its stock market is one of the cheapest in the world, and there are countless smaller Polish firms that could benefit from new business coming their way.

Localisation should be a huge trend during years to come, and at least some smaller companies could benefit bigly.

Because of factors such as these, one must not lump all small caps together.

2. Lack of liquidity can make for extraordinary opportunities

One of the biggest disadvantages of small caps is their lack of trading liquidity. There is a strong argument that when markets recover, the largest pools of capital will deploy capital into liquid names, first and foremost.

However, this argument also has a flipside.

The lack of liquidity in small-cap stocks works in your favour when taking advantage of the occasional extreme dislocations that happen in these markets.

True, large-cap stocks can get "cheap". However, you'll hardly ever find a large-cap stock that is "screamingly cheap".

A recent, now famous example is that of Thungela (ISIN ZAE000296554, UK:TGA), the South African coal miner that got spun off from Anglo American in 2021. Because of the lack of trading liquidity and forced selling from ESG funds, the stock briefly traded at a price/earnings ratio of 1-2. Some people recognised the extreme dislocation and used the period of forced selling to load up. 15 months later, they were up 17 (!) times.

You won't find such outliers among large caps, but you can often enough find them among small-cap stocks.

In that sense, the recent massive sell-off of small-cap stocks will have laid the foundations for someone, somewhere to strike the next big winner. I am entirely convinced that we currently once again have the kind of dislocation in markets that enables you to find such outlier investments.

If you are in the market to one day land one truly big winner, small-cap stocks are probably the only place to go.

3. Open-mindedness and no constraints are as important as ever

Sifting through an entire pile of small-cap related publications, I was reminded of how important it is to stay flexible, open-minded, and unconstrained.

There is not even a generally accepted definition of "small-cap stocks", and interpretations vary widely. Some people define small caps as stocks with a market cap of less than EUR 500m, or less than 250m. Others have an entirely different definition altogether. Goldman Sachs, for example, considers anything with less than a EUR 5bn (USD 6bn) market cap a *micro* cap.

So much for differing terminology.

Undervalued-Shares.com always strives to keep all options open. Just how important it is not to put yourself under any constraints becomes clear if you look at two of the potentially most interesting sectors right now:

- Shareholders of energy companies could see years of excess returns, because of the combination of low valuations and persistently high energy prices.

- Banks, particularly in Europe, could perform surprisingly well over the coming years, too.

However, you are unlikely to find many energy companies and banks among small-cap stocks. In these two sectors, companies tend to be pretty large, by any definition.

Small caps vs big caps.

ESG vs non-ESG.

Equities vs bonds.

The world is not normally black and white, but a lot of grey.

Much is down to individual cases, and these are down even to factors such as different terminology. Two investors or analysts might use the same term, but talk about something entirely different. The large-cap stock that one investor mentioned to you might be a micro-cap stock in someone else's mind.

In that sense, even just trying to answer whether small caps will fare better or worse than the general market is mostly a waste of time. All you need is to find that ONE big winner to make a lasting difference to your financial situation.

Speaking of which….

Join me – dinner discussion of "small-cap" opportunities

On 22 November 2022, I'll be hosting an informal discussion on "Small and midcap investment ideas – give me your best!". Each participant brings one idea to the table, which they have to explain in two to three minutes while enjoying good food in the private dining room of an upmarket Central London pub. Without a doubt, we'll also be discussing other timely subjects. There are still a couple of places left – check here for more details if you are interested.

Poland's new "Golden Age" for investors

Tim Draper, the Silicon Valley billionaire investor and trendspotter, is expecting a new "Golden Age" for Eastern Europe – and Poland, in particular.

The country had one of the most extended growth periods recorded in world history, and the second fastest ever rise from poverty to high-income (behind South Korea).

Which investments should private investors focus on? I have found ONE stock that could be the ideal proxy for covering the entire Polish market and economy.

Poland's new "Golden Age" for investors

Tim Draper, the Silicon Valley billionaire investor and trendspotter, is expecting a new "Golden Age" for Eastern Europe – and Poland, in particular.

The country had one of the most extended growth periods recorded in world history, and the second fastest ever rise from poverty to high-income (behind South Korea).

Which investments should private investors focus on? I have found ONE stock that could be the ideal proxy for covering the entire Polish market and economy.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: