UK real estate stocks are trading at historically low multiples. Will they ever shake off the current doom and gloom?

Gold Reserve – how David is winning against Goliath

Image by Ken Wolter / Shutterstock.com

In March 2023, I highlighted a tiny Canadian company with a multi-billion expropriation claim against Venezuela. Its stock was trading at USD 1.

The share price is now at USD 3.60.

What's more, it could climb above USD 10 before the year is over. Longer term, it may even reach USD 75.

This is one of the most unbelievable stories in markets right now.

Gold Reserve Limited.

Benefitting from opacity

Two years ago, Undervalued-Shares.com Lifetime Members received a 38-page research report on Gold Reserve (ISIN BMG4R86G1074, US OTC: GDRZF, Canada: GRZ.CA), a Canadian micro-cap with a market capitalisation of then USD 100m/CAD 149m.

As the report explained, the company had an (undisputed) financial claim against the Venezuelan government, totalling nearly USD 1bn, with further interest accumulating at 7% p.a. It also held a (disputed) 45% claim to a large gold, copper and silver project in Venezuela, which could be worth billions.

I highlighted this opportunity because of a crucial piece of news that had made it into the public. Other American creditors of Venezuela had won a court victory that was going to allow them to auction off a Venezuelan-owned asset on US soil: Citgo Petroleum Corporation, a US company generating USD 24bn in revenue from three major oil refineries and 4,000 petrol stations. "Citgo" is owned by Petróleos de Venezuela S.A. (PDVSA), a state-owned Venezuelan oil and natural gas company, through a US entity, PDV Holding. The court determined that PDVSA was an "alter ego" of the Venezuelan government, meaning that US-based assets owned by PDVSA could be targeted to satisfy US creditor claims. This decision dealt a significant blow to the Venezuelan government but promised to provide a multi-billion windfall for investors in certain defaulted Venezuelan claims.

Since then, an epic battle has been underway among creditors. Some of them decided to use their claim against Venezuela as collateral, and joined forces with equity and debt investors to file consortium bids.

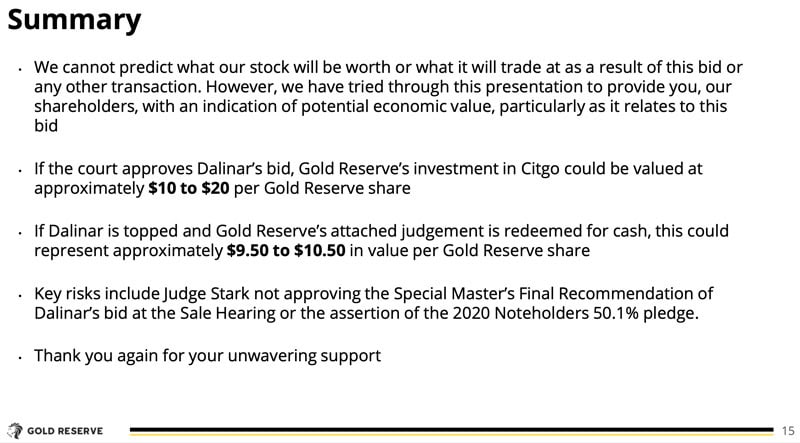

One unusual aspect of this entire legal process was the "waterfall" based on which the auction proceeds were going to be distributed. Because of some legal quirks, the proceeds were not going to be used to pay an equal percentage of claims to all creditors, but to pay creditors in full, though in a certain order of priority – for instance, it would be possible that the creditor ranking 7th in the waterfall would be paid in full whereas the 8th creditor could receive nothing.

Source: Court documents.

The finer details of the ensuing legal tussles would by now fill an entire book. Over the past two weeks alone, the legal documents made available run to 2,038 pages! AI wasn't going to be of much help with anything other than summarising the basics. To make a well-informed call on whether this was a promising investment, it was essential to continuously read up on the latest developments.

Along the way, the share price of Gold Reserve rallied as high as USD 4.67 (CAD 6.40) in June 2024. News about the company's collaboration with other investors to make a bid for Citgo made investors believe it was going to be a major financial beneficiary of the entire process.

However, the stocked dropped dramatically in autumn 2024 when it emerged that the "Special Master" put in charge of the bidding process by a US court gave preference to a USD 3.7bn bid filed by a Red Tree-led consortium over the USD 7.1bn bid assembled by Gold Reserve – a staggering development! Given that Gold Reserve only ranks 11th in the waterfall, it was going to be left empty-handed had the lower Red Tree bid succeeded.

Many gave up hope, and the stock fell back to nearly the level where it had started its journey. In my monthly report update for Lifetime Members, I recommended to hold course and continue to observe proceedings.

In May 2025, I wrote in my monthly update:

"I believe a higher bid from the Gold Reserve-led consortium will find a way to navigate this unusual situation."

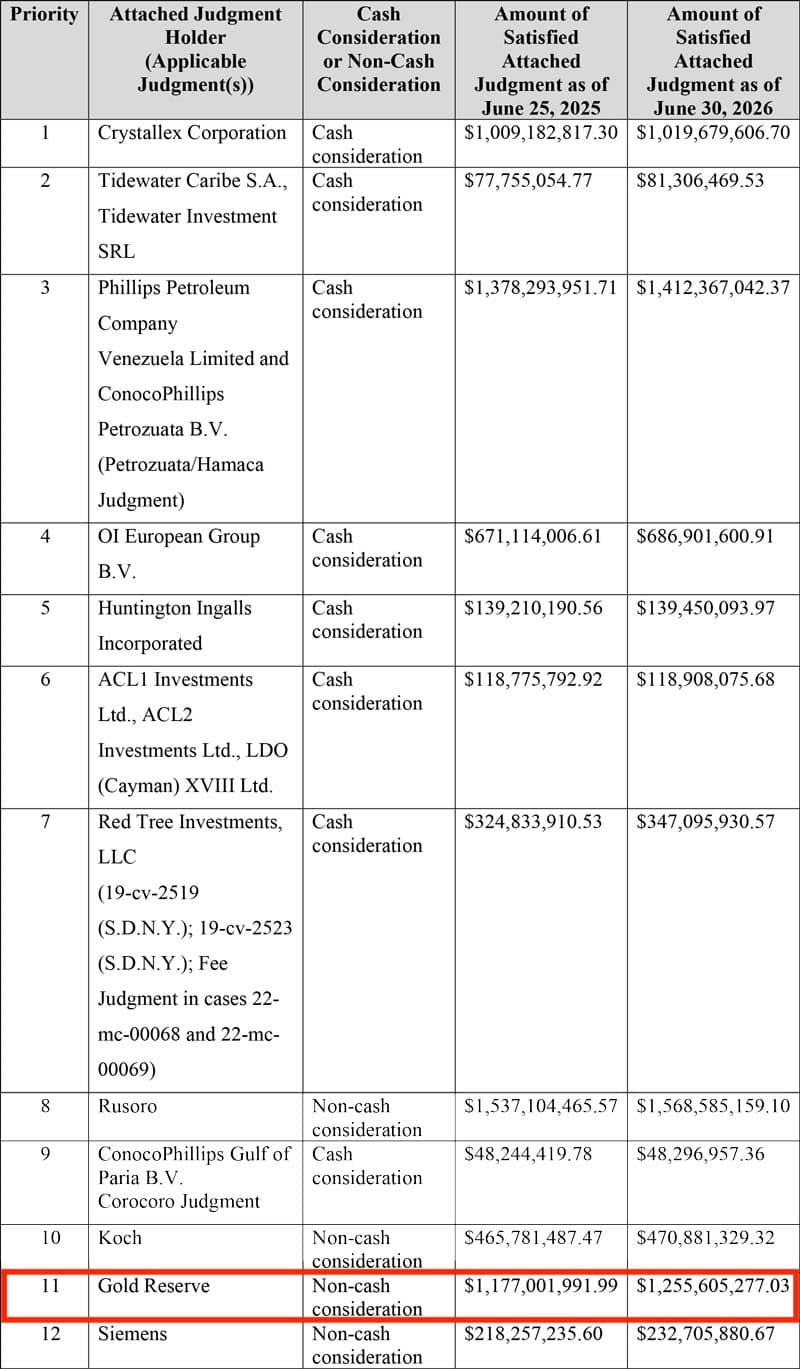

It did, indeed. On 3 July 2025, the Special Master published his final recommendation, backing an improved USD 7.3bn bid made by Gold Reserve and its partners (through a bid entity called Dalinar). The bid wasn't just higher, but it had also seen certain structural improvements.

Source: Reuters, 3 July 2025.

The share price has since shot up to USD 3.60 (CAD 4.97), and the entire story got coverage in major news outlets like Bloomberg, Reuters, and The Wall Street Journal.

Source: Bloomberg, 1 July 2025.

Despite the flurry of reporting, many questions remain.

What's happening right now

The obvious questions to ask at this stage include:

- How would it pay off for Gold Reserve shareholders if it all went ahead?

- What are the chances of the deal closing?

- Which other risks does Gold Reserve have to navigate through?

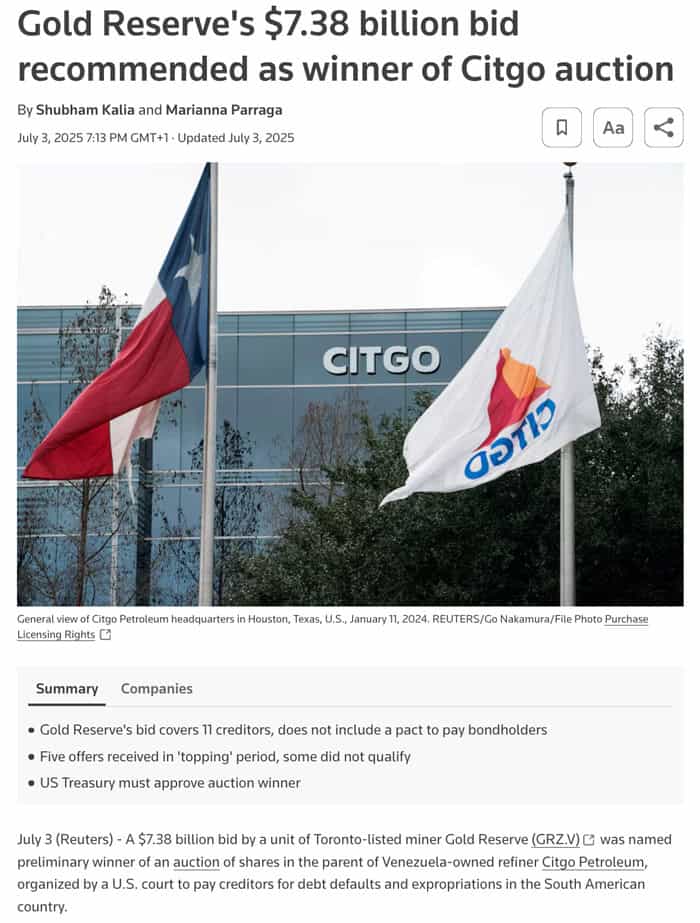

Gold Reserve itself chimed in: in what is likely its first-ever call with investors, the company stated that its stock could be worth USD 10-20 (CAD 14-28) in terms of its underlying asset value if it won its current bid for Citgo. That'd be up 3-6x from current levels.

Somewhat counterintuitively, the stock could still go up by a multiple if Gold Reserve lost the bid. Gold Reserve management tactically chose the price it offered so that ANY higher bidder would see 100% of the company's claim covered under the waterfall mechanism described above. In other words, someone else bidding higher would simply mean that Gold Reserve was repaid its current claim of USD 1.25bn in cash.

With a fully diluted share capital of soon probably 126.3m shares (including options and an ongoing placement to raise USD 30m), this would amount to nearly USD 10 (CAD 14) per Gold Reserve share coming into the company as cash. "Losing" would never have felt sweeter.

There are other variables. For instance, any sale of Citgo must ultimately be approved by the US Office of Foreign Assets Control (OFAC), given that Venezuela is subject to US sanctions and thus any change in Citgo ownership must be authorised.

More immediately, Gold Reserve will have to find a way to deal with another group of creditors that are trying to torpedo the auction: investors that own defaulted Citgo bonds issued by Citgo's ultimate parent company, PDVSA, through its US entity, PDV Holding. These bond holders originally lent PDV about USD 1.7bn and including interest would currently be owed USD 2.8bn. They argue that 51% of the Citgo assets were pledged as collateral for their lending, and that a sale of the asset to Gold Reserve (or anyone else) was not permissible. Gold Reserve is likely to make a settlement offer, but there is currently no certainty around it. It could also turn out that pledging 51% of Citgo to these bond holders was unlawful from the get-go and therefore null and void.

Clearly, the fight is not over yet. Without a doubt, though, Gold Reserve is now in a strong position – and there could even be a lot more money to be made from winning this battle than is commonly perceived.

The little-known second claim

The market should soon discover an additional aspect that could turn Gold Reserve into one of the greatest litigation investments of all time. I first outlined this aspect in my March 2023 report, and it has been progressing quite nicely of late. Amazingly, no one seems to have noticed yet!

While everyone obsessed about the Citgo affair, almost no one realised that Gold Reserve has been quietly advancing a SECOND legal claim that it holds against Venezuela: on 5 March 2025, the company filed another arbitration claim, claiming no less than SEVEN BILLION DOLLARS in compensation for the expropriation of a 45% stake in a mining project.

This arbitration claim is still in the earliest stage, but it's now formally on register. Such an early-stage claim could be worth 1% of the claim's value – if any.

However, some special circumstances apply to this claim: Venezuela has faced nine comparable claims in the past, and it lost all nine cases in arbitration courts.

Simply by way of precedents and Gold Reserve's track record in creating a valid, nine-digit arbitration claim against Venezuela, this additional claim could be worth 1-2% of the claim's value – USD 70-140m, with considerable further upside as the arbitration procedure unfolds.

On 15 July 2025, Gold Reserve announced a share placement of USD 30m at a price of USD 3.10 per share. Assuming the placement gets taken up, the company will have a fully diluted market cap of USD 455m and hold net cash of around USD 100m. The fully diluted share capital will be 126.3m shares.

If you lay an additional USD 7bn claim across the enlarged share capital, you get to a potential value of around USD 55 per share just for this second claim. In total, the stock could be worth USD 65-75.

Not only are these staggering multiples compared to the current share price. The additional optionality provided by this latest arbitration case does not seem priced in yet. In fact, I believe it's currently valued at zero.

In that sense, Gold Reserve in July 2025 could be as attractive an investment as in March 2023. It may also offer a more immediate payoff, since things are now really moving.

Gold Reserve Limited.

Or it might not. There are risks to be considered, such as a potential deal with bond holders eating into the return profile of Gold Reserve stock. There is even a potential worst-case scenario of it all coming to nothing.

For now, though, the percentage likelihoods seem nicely skewed in favour of Gold Reserve.

If unexpected developments lead to further volatility, that could create another window of opportunity to get in.

In any case, it needs lots of careful analysis – which is what I just provided in a 13-page Special Update for Undervalued-Shares.com Lifetime Members.

My initial report on Gold Reserve possibly remains the single best summary of the entire investment case. It's also a case study in how to use public sources to get an edge in markets, and how to make plenty of hay from an opportunity that would be too illiquid for institutional investors but offers plenty of liquidity for private investors.

Of course, you could also stick to getting your news for free from websites like AInvest, which recently published a piece on Gold Reserve: "Citgo's Golden Opportunity: Why Gold Reserve's Bid Presents a Strategic Investment Crossroads".

Reading this AI-generated "analysis" gave me a good chuckle – good luck if you give it any credence in your investment decision!

My early identification of this opportunity gave everyone ample time to gradually build a position in the relatively illiquid stock. Anyone could have accumulated hundreds of thousands of shares at relatively low prices.

In litigation cases – as with all investments – it pays to invest when no one else is looking. (Another great example is, of course, Panthera Resources (ISIN 0BD2B4L05, UK:PAT), as reported on in February 2025, May 2025, and in the recently published Weird Shit Investing Manual.)

Will Gold Reserve turn into one of the most successful litigation plays of recent memory?

You be the judge. Just don't say that I didn't tell you to look into it.

A P/E of 2.1 and a 43% dividend yield…

… that's what recent analyst estimates assign to a little-known coal miner.

The company's shockingly low valuation levels were already highlighted by Undervalued Shares back in April 2025.

The opportunity featured then is as relevant today. Now is a good time to take a(nother) look!

Even at a P/E of 3 and a 20% dividend yield, this is an insanely cheap stock with decades of profitable production ahead.

If you like a deep-value, high-yield, contrarian opportunity, this one's for you.

A P/E of 2.1 and a 43% dividend yield…

… that's what recent analyst estimates assign to a little-known coal miner.

The company's shockingly low valuation levels were already highlighted by Undervalued Shares back in April 2025.

The opportunity featured then is as relevant today. Now is a good time to take a(nother) look!

Even at a P/E of 3 and a 20% dividend yield, this is an insanely cheap stock with decades of profitable production ahead.

If you like a deep-value, high-yield, contrarian opportunity, this one's for you.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: