Image by Timon Schneider / Alamy Stock Photo

At first sight, it looks like an incredible bargain.

Hepsiburada has 12m active customers in Turkey, a country with hugely attractive growth prospects for e-commerce.

The company's market cap is just USD 430m. Yes, you read that right.

When Hepsiburada went public in 2021, it raised USD 800m of additional equity from investors. At its peak, the company was valued at nearly USD 5bn.

Given how bombed-out the stock is today and Turkey's undoubted potential for e-commerce, could it be an interesting turnaround play with an upside of several times its current price?

Hepsiburada.

A Turkish online bazaar

Hepsiburada is derived from the Turkish "hepsi burada", which means "everything is here".

The company is, in essence, a Turkish version of Amazon.

It was founded by Hanzade Doğan Boyner, the daughter of Turkish media billionaire Aydin Doğan. as "Infoshop" in 2000. Initially, the company only sold computers through the Internet but subsequently began to sell everything from cosmetics and home decor to garden appliances and pet toys. By 2020, the company generated USD 733m in revenue from 9m active customers.

The family then used buoyant equity markets to take Hepsiburada public – unusually, in New York. Hepsiburada, or D-Market Elektronik Hizmetler ve Ticaret A.S. as the company is officially called, became the first Turkish company with a primary listing in the US.

The IPO benefited from the fact that the business had quickly grown 50% during the pandemic lockdowns, as Turkey's population turned to online shopping.

Hanzade Doğan Boyner became a billionaire, and the IPO made news worldwide.

Source: Bloomberg, 21 July 2021.

The e-commerce bubble burst

Not only had the pandemic lockdowns stirred up interest in e-commerce plays, but Hepsiburada did seem to have genuinely exciting growth prospects.

At the time, online shopping accounted for only 10% of the Turkish retail industry, compared with more than 20% in much of Europe.

Also, with 84m people (more than Germany) and an average age of just 32 years, Turkey has some exciting demographics.

Hepsiburada built the infrastructure to serve this growing market. The company owns eight distribution centres, and it has built ancillary offerings such as Hepsipay, a payment solution that also allows to offer financing, and Hepsijet, a next-day delivery network.

Despite all that, the stock is currently lingering at just 10% of its former high. Other e-commerce stocks had also suffered when the lockdown boom subsided; Undervalued-Shares.com readers will be familiar with the cases of Allegro (ISIN LU2237380790, WSE:ALE) in Poland and MercadoLibre (ISIN US58733R1023, Nasdaq:MELI) in South America. However, some of these stocks have started to recover, while Hepsiburada hasn't.

Hepsiburada is one of the very few Turkish stocks that Western investors can easily buy and sell, which prompted me to learn more about the company. We didn't manage to see Hepsiburada during the Undervalues-Shares.com investor trip to Turkey in May 2023, but I have now finally taken a closer look.

Tempting metrics, but…

Hepsiburada's allure has always been to invest early on into "the Amazon of the East", as the company used to be called by media outlets.

Hepsiburada processed an impressive 80.4m orders in 2022, up 50% from 2021 despite the end of lockdowns. It increased the number of merchants on its website to 100,000, up 33% from the previous year. The company clearly operates in a rapidly growing market.

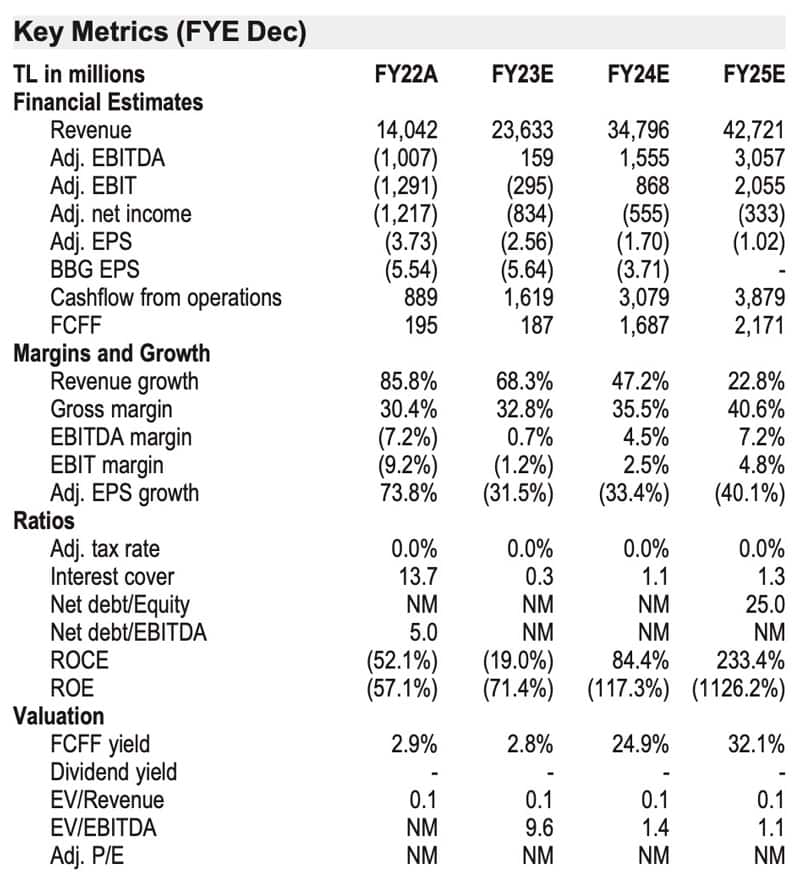

Analysing the investment metrics of a Turkish firm is difficult, not the least because of the country's sky-high inflation rate (80% in 2022). It's since been tamed somewhat, following the recent rise in Turkish interest rates to 40%. Still, making sense of figures denominated in Turkish lira requires some extra effort. By the time a company has published its latest figures, you already need to make complex adjustments to account for inflation.

Little investment research exists on Hepsiburada these days. Even for J.P. Morgan (underwriters of the IPO at the time), the company has dropped off the radar to some extent. The American analysts last published an update in August 2023, and the most recent detailed estimates date from March 2023.

According to these estimates, the stock was trading 0.7 times EV/Gross Merchandise Value, which is several times lower than comparable firms. As J.P. Morgan concluded: "At a 0.7x EV/Gross Contribution based on 2024 JPMe (inflation unadjusted), the valuation is still dislocated against its financial performance, justifying a further rally in shares."

Source: J.P. Morgan, 24 March 2023.

J.P. Morgan gave a price target of USD 4.70, 3x the current share price of USD 1.42.

Should investors now build a position in Hepsiburada, and wait for the stock to eventually make a major recovery?

Not so fast.

The company has some serious issues.

Hepsiburada is merely the #2 in Turkey, after Trendyol, a company that is majority-owned by Chinese e-commerce giant Alibaba Group (ISIN US01609W1027, NYSE:BABA). Thanks to its Chinese backing, Trendyol has massive financial firepower to win the race in what is essentially a winner-takes-all sector.

The market also has doubts over Hepsiburada's governance and the credibility of its founding family. The Doğans once badly screwed minority shareholders of Doğan Holding, making one of my Turkey contacts comment "old hands don't forget". Case in point, following the IPO, Hepsiburada was sued by shareholders for allegedly lying during the IPO process, and the firm agreed to pay USD 14m in compensation. These recent developments only add further suspicion and should make investors cautious.

Add to this the fact that Hepsiburada will probably require more cash if it wants to keep investing into its growth. If it doesn't, its growth metrics will fall behind. Any share issue to raise more capital could be hugely dilutive, not the least in light of the founding family's history.

With all that in mind, the risk/reward proposition suddenly doesn't look so attractive anymore.

If this stock had a 10-20x upside, I'd view it differently. However, many Western European small- and mid-caps are also offering 3x upside, but without the specific risks involved with Turkey and the Doğan family.

Why not look closer to home…

… say, the British Isles?

My latest research report for Undervalued-Shares.com Members investigates one British e-commerce play that ticks many of the boxes that Hepsiburada doesn't.

It's the most profitable player in its sector in the UK, it's run by a conservative management, and – crucially – it's now also turning into a growth play.

In 12-18 months, its stock could trade 40-50% higher.

Why not look closer to home…

… say, the British Isles?

My latest research report for Undervalued-Shares.com Members investigates one British e-commerce play that ticks many of the boxes that Hepsiburada doesn't.

It's the most profitable player in its sector in the UK, it's run by a conservative management, and – crucially – it's now also turning into a growth play.

In 12-18 months, its stock could trade 40-50% higher.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: