Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Petershill Partners – the holding company that Goldman Sachs wants to succeed

Fund management companies aren't always easy to understand, but it pays to make an effort to understand the sector.

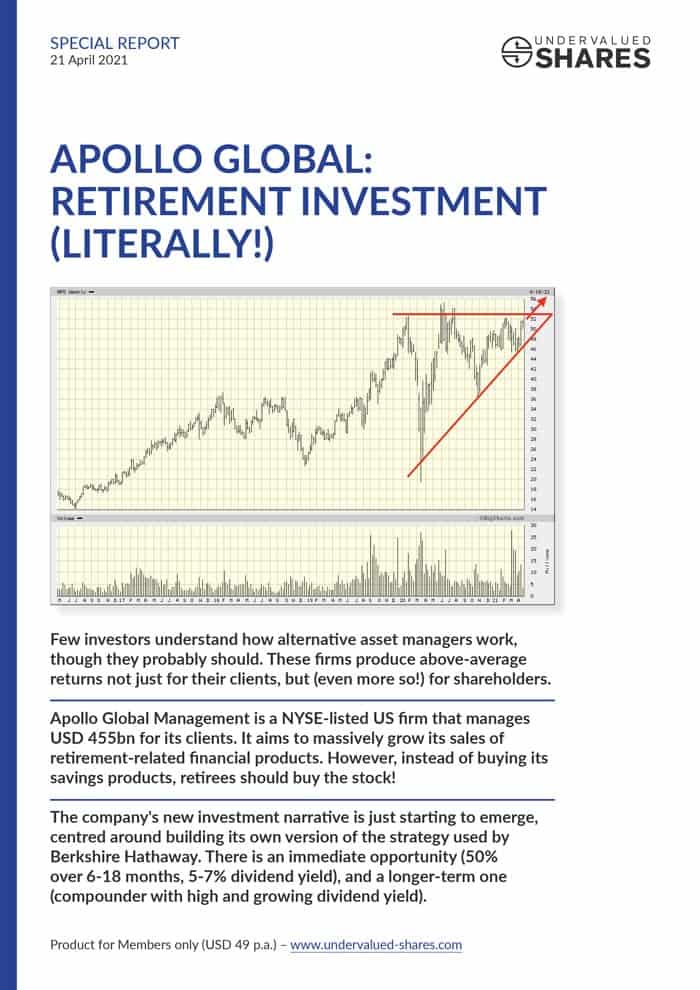

Take Apollo Global Management (ISIN US03768E1055), for example. The company has built a unique but quite complex business model that few outside the industry understand. When I introduced Apollo to my Members in April 2021, I made an effort to explain its workings in great detail. My report helped many readers broaden their horizon, and it also helped them make a profitable investment! Apollo Global was "out" when I first featured it, and it's since become "in", with the stock rising up to 55%.

Petershill Partners (ISIN GB00BL9ZF303) is a similar case. The fund manager originated inside the bowel of Goldman Sachs (ISIN US38141G1040) and two months ago, its stock was first listed on the London Stock Exchange.

The stock is not necessarily an immediate buy, but it has a fascinating background story and is well worth putting on your radar. Two to three years from now, it is highly likely to trade significantly higher. Goldman Sachs has a strong interest in seeing the IPO succeed, and I'll explain to you why that is a crucial factor.

The #1 for "general partner solutions"

Even people in the finance industry often need to remember the crucial difference between a fund and a fund manager:

- A fund is an entity that pools and invests money on behalf of its investors.

- A fund manager makes investment decisions on behalf of a fund, and for doing so receives annual management fees and (during good years) performance fees.

Fund management companies don't have to build factories or buy inventory. All they need are highly-qualified employees, a few desks and some office space. If a fund management company is successful, it generates HUGE returns on the comparatively small amount of capital its owners had to invest to get the company off the ground.

Petershill Partners is a specialised investment holding for investing in fund managers. It doesn't manage any funds itself but provides capital to the operations of fund managers, which in turn raise outside money for the funds they manage.

Petershill Partners pioneered a strategy that to this day few people outside of the industry would even know exists: the company takes minority stakes in fund managers, and it focusses on fund managers that invest in so-called alternative assets (such as private companies, real estate, or hedge funds).

However, Petershill Partners is not your ordinary investor.

"Petershill" is a specialised team that sits within Goldman Sachs Asset Management (GSAM). Goldman Sachs and its asset management division are a powerful service provider and ally to have. After all, Goldman remains one of the best (if not the best) player on Wall Street.

The Petershill team offers not just investment, but also consultant-like services and capital-market solutions to fund managers. In detail, it helps other fund managers to accelerate their growth through providing:

- Access to market intelligence.

- Advice on new strategies.

- Hands-on support for geographic expansion.

- Feedback on how to further improve the firm and its running.

- Endorsement vis-à-vis potential clients.

- Support for fundraising, e.g. through introductions to other Goldman clients.

Put simply, Petershill says: "Let us buy a stake in your business. We'll not only provide you with capital, but we will help you build your business faster and you'll gain access to the unrivalled global network of Goldman Sachs."

If you are a fund management entrepreneur, having a firm like Petershill Partners among your shareholders is a huge strategic asset.

Usually, when fund managers seek a new investor for a minority stake, they speak to multiple potential investors and run an auction-style process. The Petershill team (and now Partnershill Partners as a listed company) have such a thunderous reputation in the industry that they can sidestep the usual auction process. Petershill Partners bought 83% of its stakes in fund managers based on exclusive negotiations.

Success breeds success. Fund managers are now falling over themselves for the privilege of selling a minority stake in their business to Petershill Partners. This also shows in the price. On average, Petershill Partners paid 18% less than comparative transactions elsewhere. Fund management entrepreneurs are willing to give relatively cheap shares to Petershill Partners, because of the additional business they are likely to gain with their help.

The Petershill team pioneered this business model of investing in fund managers in 2007. Its main competitors, Dyal/Blue Owl Capital, Blackstone (ISIN US09260D1072, via its division Blackstone Strategic Capital Advisors), and Wafra, only started to replicate this strategy between 2011 and 2015. In an industry where track record is (almost) everything, having been around much longer than everyone else is a huge asset.

Goldman Sachs is the gold standard of investment banking, and Petershill Partners is the gold standard of the so-called general partner solutions market ("general partners" is industry lingo for "fund managers").

What used to be a team within a division of Goldman Sachs is now a publicly listed company. Since September 2021, you can buy stock in Petershill Partners on the London Stock Exchange.

The current tug of war between bulls and bears

The 19 fund managers that Petershill Partners has invested in manage funds with just under USD 200bn of client money invested across private equity, private credit, hedge funds and real estate. The best-performing fund managers in these asset classes have produced stellar returns for their investors over the past two, three decades. However, funds in this sector have been difficult to invest in. The industry is opaque, and many funds have long required minimum investments not in the millions but in the tens of millions.

Given the unmet demand from investors with smaller sums, there have recently been a couple of IPOs that give investors access to this sector through the stock market.

One such IPO was that of Blue Owl Capital (ISIN US09581B1035), one of Petershill Partners' competitors and a specialist for investing in minority stakes in private equity fund managers. Blue Owl went public through a SPAC earlier this year and its stock is up 60% since then.

Another successful IPO was that of Bridgepoint (ISIN GB00BND88V85) in London, up over 50% since it came to market at a price of 350 pence.

Goldman Sachs spotted a chance to bring an exciting new equity story to the market and raise capital from investors. When Petershill Partners went public in September 2021, the company raised GBP 465m (USD 625m) of additional equity to buy more stakes in fund managers, and its existing shareholders cashed out by selling shares worth GBP 547m (USD 735m).

These two headline figures from the placement nicely summarise the divergent opinions about the IPO. There are currently two diametrically opposed views.

On the one hand, you could say:

- Goldman Sachs IPOed Petershill Partners just as the market is at its most bubbly ever.

- The existing shareholders are taking some of their chips off the table.

- Petershill Partners remains relatively opaque, e.g. it doesn't disclose all details of how its key management members are paid.

- It is tied to Goldman Sachs through contracts that could create conflicts of interest.

- Large amounts of shares are held by private equity funds that will see their lock-up period expire in March 2023. If or when these shares hit the market, there'll be considerable pressure on the stock price.

On the other hand, it is just as valid to say:

- Given its unique track record, Petershill Partners will continue to mop up the best deals in the industry.

- Alternative assets are an asset class that is bound to grow a lot further, as I explained in detail in my report about Apollo Global.

- Following 14 years of building a business, it's entirely justified that existing partners took a bit of money out of the firm.

- All that matters is the amount of cash that the company is going to generate for its shareholders over the coming years – and Petershill Partners scores strongly in this regard.

Whether you are bullish or bearish for Petershill Partners, you can make a convincing case either way.

For now, at least, the market has sided with the bears. Since it came to market at a price of 350 pence, the stock has fallen to as low as 290 pence. At last count, it was trading at 320 pence. Given the advantageous market environment, the performance has been disappointing, to say the least.

However, if there is another sell-off, the stock could be interesting for anyone who approaches the investment with a time horizon of two to three years.

Here is why.

Goldman has a strong reputational interest in Petershill Partners

Goldman Sachs has many similar operations that it could take public, now that the wider market has woken up to the long-term growth opportunity in private assets and alternative assets.

Petershill Partners is probably just the first such IPO to come out of Goldman Sachs. As such, Goldman Sachs has a particular interest in making this IPO a success. If Petershill Partners paid off for its new shareholders, Goldman Sachs could take further such companies to the market and at a higher valuation. If it didn't… Well, Goldman Sachs would pay a price on multiple levels.

It's for this particular reason that Petershill Partners was taken public on valuation multiples that are actually quite advantageous, once you make the effort to look at the numbers in detail.

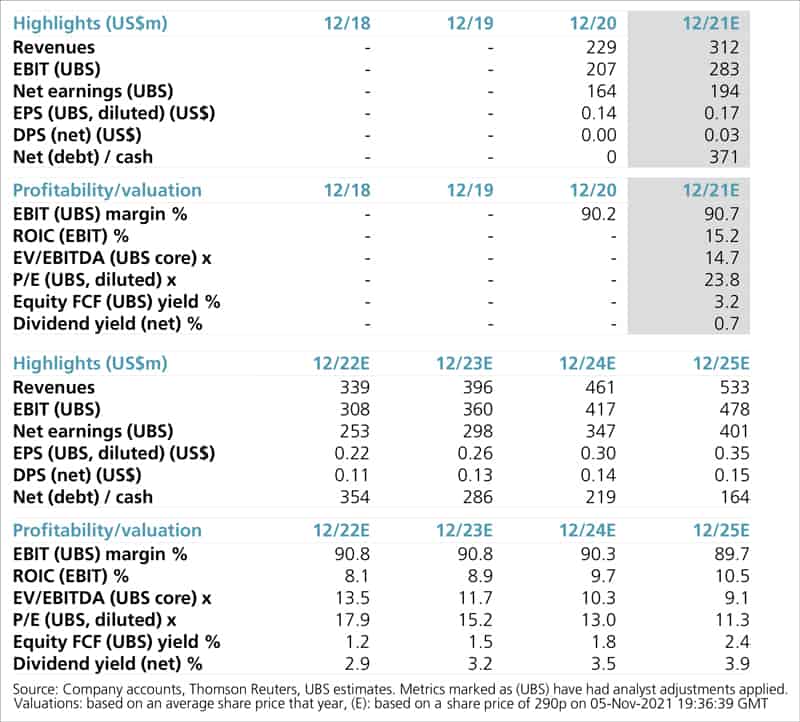

Over the coming five years, Petershill Partners expects to grow its earnings by 19% p.a. This growth is projected to be driven by a reasonable 16% growth rate of the client assets managed by the fund managers that it owns stakes in. Of that, a quarter is projected to come from buying additional minority stakes in fund managers. The stock is trading at 15 times projected 2023 earnings, which gives it a PEG ratio of less than 1 and a discount of about 35% compared to its peers.

Petershill Partners is going to generate a lot of cash from its operation, which will enable the company to pay dividends, carry out stock buybacks, and fund additional acquisitions. Just as it has always done, it is likely to continue generating high returns for its owners and returning cash to shareholders on a regular basis.

The structural weaknesses pointed out by the company's critics are currently weighing on the stock, but dealing with them is also part of the opportunity. Petershill Partners can gradually improve on these points (such as transparency) and deal with bottlenecks (such as placing excess shares with new investors instead of having them hit the market). When it does, the market should expand the multiples it is willing to grant to the company's stock. The combination of ongoing growth and multiple expansion could turn this stock into the next outperformer of the sector.

A key question is, do you trust Goldman Sachs to be making the effort to turn this IPO into a success after all?

Goldman bankers are renowned for having just one interest – their own wallet. Petershill Partners is the IPO by which Goldman Sachs will be measured when it tries to bring similar firms to the market. The company is the long-established #1 of a growing niche in the finance industry, and its future cashflow is currently available at a comparatively low valuation. Given its track record and close affiliation with Goldman Sachs, you could say the company has a strong moat around its business model - quite similar to Apollo Global.

UBS just published a 111-page report which drilled into the inner workings of Petershill Partners and rated the stock a buy with an initial target of 375 pence and a promising long-term outlook. As the sheer length of the report indicates, Petershill Partners is not a company that will appeal to those who are seeking a simple, ordinary business model. However, for anyone who understands the world of fund management, private equity, alternative assets, hedge funds and financial engineering, it could be an all the more interesting company to follow.

The short-term timing of this opportunity is difficult, but over the coming years, this low-maintenance investment will likely pay off (once again) for its backers. It is a bet on Goldman Sachs's ability to access the best deals and pick the best-performing managers – and who would want to bet against Goldman Sachs?

Apollo Global: the new Berkshire Hathaway?

Another complex yet unique business model - and a successful one at that!

If you haven't read it already, check back on Apollo Global, which has seen its stock rise up to 55% since my report in April 2021.

And the company's new investment narrative is just starting to emerge...

Apollo Global: the new Berkshire Hathaway?

Another complex yet unique business model - and a successful one at that!

If you haven't read it already, check back on Apollo Global, which has seen its stock rise up to 55% since my report in April 2021.

And the company's new investment narrative is just starting to emerge...

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: