Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

The day I outed the Rothschilds (and my readers made up to 461%)

I enjoy investigating rich people and writing about their plans and projects. This doesn't always make you popular with them, as evidenced by the fact that some of them unleashed their lawyers on me. But it's definitely been, on occasion, a lucrative pursuit!

A recent headline on the Swiss Stock Exchange's news ticker led me down memory lane, to the days when I reported extensively about some carefully hidden commercial plans of the Rothschild family.

The most famous banking family in history is split between different divisions. I researched a Swiss member of the family, Benjamin de Rothschild.

He was CEO and principal shareholder of a bank that was found by his father, the legendary Edmond de Rothschild (who in his days was a major supporter pushing for the establishment of Israel). I published an exposé how the company was buying back lots of shares in the open market, thereby gradually reducing the remaining free float. My conclusion was that the family was aiming to take the bank private and that there was money to be made from a lucrative buy-out offer.

What followed yielded a whole number of lessons that are useful for other investments, too.

Lengthy detective-work to check what the Rothschilds were up to

All of this started back in 2003. At the time I was the only analyst who bothered investigating the affairs of Banque Privée Edmond de Rothschild(ISIN CH0001347498), a company headquartered in Geneva and listed on the Zurich Stock Exchange.

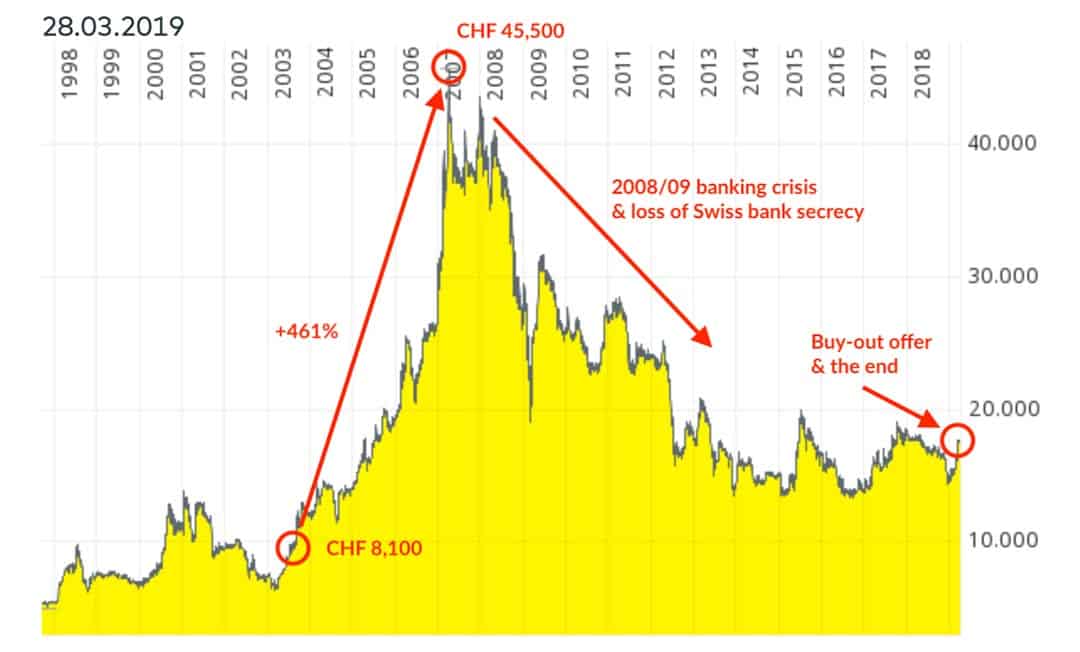

Not entirely unlike Warren Buffett's Berkshire Hathaway, shares of the bank were trading at a seemingly outrageous price. A single share cost CHF 8,100, which at the time was GBP3,645 or $5,750.

The apparently expensive price tag was misleading. As my 40-page report titled "Forensic analysis of a European banking dynasty" showed, this was an undervalued share if ever there was one. It was trading at a p/e of about 7 and the bank's growth prospects were excellent.

What's more, my report showed that between 2000 and 2003, a staggering 39% of all Banque Privée Edmond de Rothschildshares traded on the Swiss Stock Exchange were bought by the major shareholder. Evidently, this major shareholder was keen on buying out the existing shareholders. When I first reported about the situation, only between 5,000 to 8,000 shares were still in free float, representing between 5% to 8% of the share capital.

After pointing out this investment to my readers at a price of CHF8,100, the share price gradually increased to CHF 45,500 over the subsequent four years. That was a pretty good return from a relatively conservative investment, even by the standards of the late 2000's hey-days.

Obviously, Benjamin de Rothschild probably didn't particularly like my reporting. I outed his plans, and his share buy-backs become more expensive because other investors caught on to his game. In the match Lorenz vs. Rothschild, that was 1:0 to my favour.

However, not everything was to go smoothly between then and now.

Paradigm shifts can completely alter long-term projections

In 2008/09, the global banking crisis struck.

Banque Privée Edmond de Rothschildwasn't a particularly risky bank, given that it mostly manages wealth on behalf of private clients. However, even a Rothschild-owned bank isn't able to escape the reality of a dramatically changing industry landscape.

During the height of the crisis, the share lost 60% of its value due to the general market fluctuations. It subsequently fell even further, because the business model of Swiss private banks came under pressure on several fronts, e.g., because of rapidly declining interest rates which cut into a bank's margin.

Swiss banking secrecy came to an end, on top of it all. Many clients repatriated their money because, without tight banking secrecy, they didn't see the point of paying expensive Swiss bank charges.

By 2015, the share price was back at CHF 14,000. The initial five years of ever-rising prices were followed by an entire decade of virtually no one making any money off this company. At best, the share price went sideways.

Until two weeks ago, that is.

Sixteen years after my first report about the intention to take the company private, Edmond de Rothschild finally made his move.

The family is carrying out the predicted going private – but it's not lucrative anymore

Shareholders were offered CHF 17,945 for each share, which was a 7% premium compared to the share price before the announcement was made.

The remaining minority shareholders are now effectively getting "squeezed out" of the company under Swiss corporate law. Once a major shareholder owns a certain (high) percentage of a company's shares, the remaining shareholders can be forced to sell at "fair value." Legislation for this varies from country to country. Sadly, in Switzerland, the regulation is more heavily tilted towards the interests of major shareholders rather than to protect individual shareholders.

The buy-out offer most certainly is way too low compared to the bank's assets, earnings and brand name value. However, unless you are up for a multi-year, expensive lawsuit against the bank, there is no way you will get a higher offer.

For shareholders of Banque Privée Edmond de Rothschild, this is the end of the line for their investment. It's not a terrible end, but depending on when someone bought, it's not a great end either. Also, it took many years longer for the family to launch the final buy-out bid than anticipated. After 2008/09, it was easy for them to take their time and increase their stake very slowly.

The initial idea behind the investment was sound, and the first few years went the right way. But when the entire banking industry changed beyond recognition because of the massive political and economic changes brought about by the 2008/09 crisis, so did this investment's long-term perspective.

At the risk of stating the obvious, from that point onwards, there was just no case anymore for owning any European bank shares. The Central Bank's policies killed off the entire banking industry.

As an investor, you need to be able to occasionally let go of investments that you had planned to hold for the long run, but where circumstances make it necessary to rethink your position. The 2008/09 banking crisis required such a fundamental rethink.

Buy-backs by family shareholders are always an interesting activity to research

What will never change, is the fact that any form of insider purchases of a stock are something that is worth looking into more closely.

In my reporting, you'll regularly get to read about wealthy families and their activities involving stocks of their family companies.

Many publicly listed companies are under majority control of one family or even one individual. These majority shareholders are the people who will know a company and its prospects better than anyone else.

Whenever a significant shareholder buys or sells shares in his own company, it's a strong sign that something is probably afoot. This kind of activity can happen through stock transactions carried out by an individual, or it can consist of the company buying back its own shares (which, if there is a dominant major shareholder, boils down to the same).

What's more, family-controlled companies often get less analyst coverage than companies that are not in the hands of a family. That's especially true for companies in Europe, Asia, and parts of the Middle East.

I do have some interesting cases of this nature on my radar screen, and you'll definitely get to read more about this area in the months to come. There might even be a link to the Rothschilds again! Every so often, the world turns out to be a small, inter-connected place…

Until then, best regards!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Want to receive my next research report on the day it is released?

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Updates on previous research reports

- 2 special publications per year

P.S.: Check out my latest in-depth report about what I consider to be the best equity opportunity in Germany - Porsche SE! Available for Members only so sign up now to get immediate access.