Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

The Gym Group – 3x upside with this undervalued British small-cap

Britain has one of the world's cheapest stock markets.

Bids for undervalued companies are coming in hard and fast, including for multi-billion targets.

To snatch the biggest bargains, you now have to look at forgotten stocks among its small- and mid-caps.

Today's Weekly Dispatch features one such candidate. Its stock has already started to move.

The Gym Group.

Britain is back on the menu

Undervalued-Shares.com has long been going on about undervalued British stocks.

The entire theme is not exactly a secret anymore:

"UK's 'staggeringly cheap' stocks trade at record discount to US"

Financial Times, 23 March 2024

"Think UK Stocks Are Cheap? Try Buying a Whole Company."

Bloomberg, 4 April 2024

"British stocks represent golden buying opportunity, says HSBC"

Daily Telegraph, 20 May 2024

The market has also started to move quite a lot recently:

"The FTSE 100 is flying – is it time to buy UK stocks?"

The Times, 27 April 2024

"UK stocks are finally shining"

Financial Times, 10 May 2024

"Takeover interest in UK companies hits highest since 2018"

Financial Times, 13 May 2024

To find undervalued British stocks with considerable upside, you now have to dig a little deeper.

The #2 national low-cost gym group

One company worth taking a closer look at is The Gym Group (ISIN GB00BZBX0P70, UK:GYM), the UK's second-largest low-cost gym group with 230 outlets nationwide and 900,000 members. The market leader has 300 outlets, but the #3 is a lot smaller.

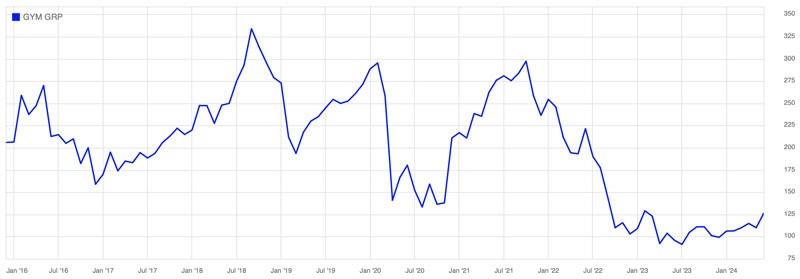

Like any other gym group, The Gym Group got caught out by pandemic lockdowns. During the March 2020 crash, the stock fell from 300 pence to as low as 138 pence. It subsequently recovered the entire losses, only to then fall to a new low of less than 100 pence by spring 2023.

With gyms closed during lockdowns and fixed costs eating away at the company's balance sheet, The Gym Group had to recapitalise: in 2022, it received GBP 300m from a private equity fund. In comparison, the company's market cap is currently just GBP 227m, but it also has net debt of GBP 670m, making for an enterprise value of nearer to a billion pound.

Now that gyms have reopened, it'd be easy to think that gym usage must be back to where it was before the lockdowns. British gyms now have 20% less members on average, though – just where the previous members have gone is unclear.

A good bet is that these comprised relatively inactive members who had previously kept their gym membership nevertheless. With the cost-of-living crisis biting, many people have by now probably identified their little-active gym membership as an easy saving.

Unexpectedly, users generally didn't trade down their mid-tier gym membership to a lower-cost one. For companies like The Gym Group, the benefit of trading down has thus been minimal.

Still, low-cost gyms are now the only segment of Britain's gym market that is growing.

Cheap valuation

The stock of The Gym Group is currently trading at just 80% of the replacement value of the company's gym equipment. The other 20% of the equipment and the actual business are thrown in for free.

That's the analysis of Kaspar Daljajev, an Estonian value investor who presented at this week's Nordic Value conference, an annual invite-only event near Copenhagen.

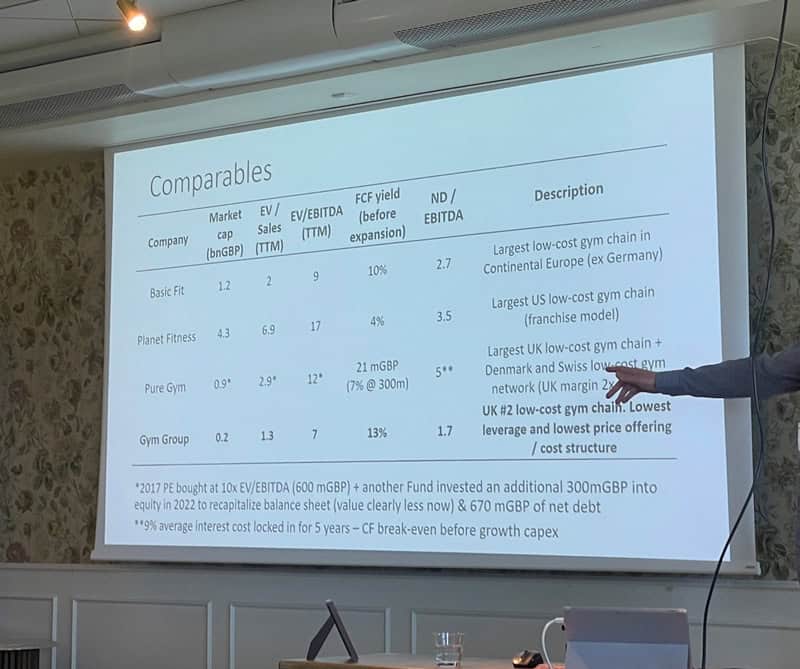

According to Daljajev's analysis, the stock is currently trading at an EV/EBITDA multiple of about 7, even though The Gym Group still has 30% lower margins than before the pandemic.

Improvements seem to be on the horizon. According to Daljajev, "the Gym Group has the lowest cost base, it is the Ryanair of the gym industry. The top two, including The Gym Group, are taking market share. … "There is a new strategy. The members who did stay are hardcore fans. The Gym Group is now raising prices."

The stock is currently trading at the lowest valuation multiples among publicly listed European gym companies.

Kaspar Daljajev at the Nordic Value investor conference.

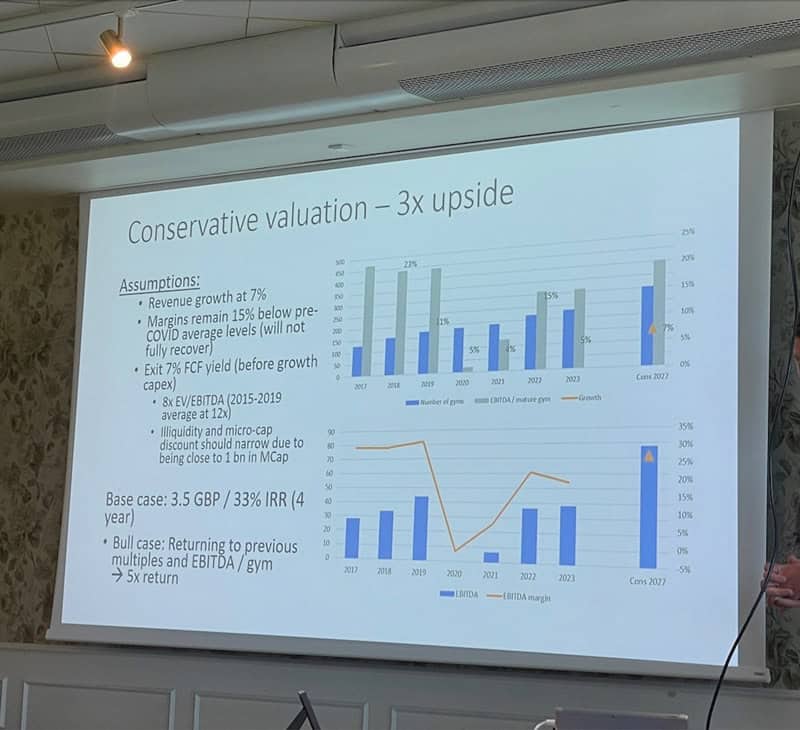

If The Gym Group got back to growing revenues at 7% p.a. and even with margins never recovering to their pre-pandemic levels, the stock would need to rise by 3x to get back to a fair valuation. In a more aggressive scenario, it could even be a 5x candidate, according to Daljajev.

Kaspar Daljajev at the Nordic Value investor conference.

An analysis published on Value Investors Club in August 2023, when the stock was trading at 109 pence, came to a similar conclusion:

"We believe this earnings normalization will come in the next 3 to 5 years and, as a result, the market will revalue the company to reflect its currently 'hidden' profitability. Taking this into account, in a scenario where the EBITDA per mature gym returns to close to 2019 levels and the gyms opened over the past two years reach maturity, we would be talking about 0.43m GBP of EBITDA (after rent) per gym times ~240 gyms (assuming 10 net opens), or ~100m EBITDA. Netting 20m in central costs gets us to 80m EBITDA (3x current EV). An exit at 6x, coupled with cash generation until then, would be enough for a ~30% IRR."

The UK market has seen a lot of bids and rising prices already, but there remain bargains to be had!

Another British bargain to be had

British retailer Frasers Group is another of the British stock market's overlooked, underanalysed opportunities.

At its current level, the stock is trading at less than 5x EV/EBITDA. Its price/earnings ratio of 8 is 50% below the stock's own ten-year average, even though earnings per share will likely grow by 14% p.a. between 2024-2026.

On the current level, the highly cash-generative company is buying back stock.

This is a stock that fulfils the criteria for low downside, significant upside – and a catalyst!

Another British bargain to be had

British retailer Frasers Group is another of the British stock market's overlooked, underanalysed opportunities.

At its current level, the stock is trading at less than 5x EV/EBITDA. Its price/earnings ratio of 8 is 50% below the stock's own ten-year average, even though earnings per share will likely grow by 14% p.a. between 2024-2026.

On the current level, the highly cash-generative company is buying back stock.

This is a stock that fulfils the criteria for low downside, significant upside – and a catalyst!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: