Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Hong Kong investor trip – what we learned

Two weeks ago, a dozen Undervalued-Shares.com readers visited Hong Kong.

Over two packed days, we met over a dozen publicly listed companies, and several of the top analysts of BernsteinSG shared their knowledge with us.

With us on the trip was Michael Fritzell, author of Asian Century Stocks and widely recognised as the go-to person for valuable insights into Asia's public equity markets.

Michael volunteered to share his views about the trip, and other ideas relating to investing in the former British Crown colony.

Michael Fritzell of Asian Century Stocks.

Swen Lorenz: To start with the basics, let's summarise what the Hong Kong stock market actually offers. It'd be easy to think there are only few companies listed there, given that it's a jurisdiction with just 7m people. However, 2,000 shares are listed in Hong Kong. These break down into different categories of companies and also different share categories. Can you give us the low-down?

Michael Fritzell: I'd like to think of the Hong Kong market as being divided into Hong Kong domestic companies, Chinese companies listed in Hong Kong, and companies that have almost nothing to do with Hong Kong in the first place.

Among Hong Kong's local companies are property developers such as CK Hutchison and Henderson Land, tourism-related businesses, and finance-related businesses. These used to be a significant part of the Hong Kong market but have been crowded out by a plethora of Chinese companies listed in Hong Kong.

Chinese companies listed in Hong Kong are typically known as "Red Chips", referring to the fact that they come from "Red", Communist China. In the 1990s, when China opened up to the outside world, the government pushed state-owned enterprises to be listed in Hong Kong to introduce accountability and modern governance. A few examples include China Mobile, Bank of China, and the stock that Warren Buffett owned for some time, PetroChina.

Then, you have private Chinese companies listed in Hong Kong. There are hundreds upon hundreds of such businesses across a range of sectors, including real estate developers, tech companies, port operators, pharmaceutical companies, automakers, etc. Most of these are controlled by families, and their governance is influenced by such family ownership. A few examples of private Chinese companies listed in Hong Kong include Tencent, Xiaomi, BYD and Anta.

Finally, there are companies that are listed in Hong Kong but don't have much exposure to China in the first place. Some of them, such as Samsonite, Prada, UC Rusal and L'Occitane, are listed in Hong Kong because of the high valuation multiples that the market used to offer. Others, such as Cambodian casino operator NagaCorp and Indonesian investment holding company First Pacific, chose Hong Kong as a home for their businesses.

To summarise, there's a great variety of companies listed in Hong Kong, but today, the vast majority of them are Chinese businesses that use their Hong Kong listing to access foreign capital.

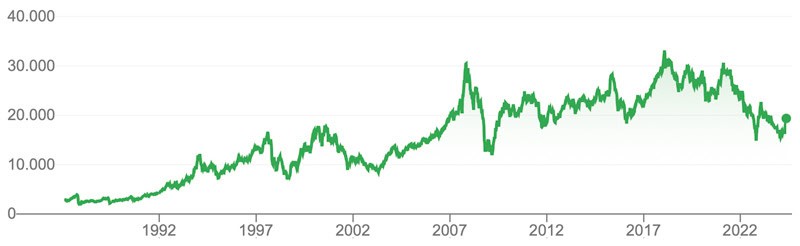

SL: I organised this trip because earlier this year, Hong Kong stocks were truly "down and out". Subsequently, they started to recover. During the two weeks I was in town, Hong Kong stocks rose on nine consecutive days and, technically speaking, the market entered bull market territory. Has the opportunity passed?

MF: That's true; the market has been turning up lately. But I don't think we've reached a ceiling for this bull market. When I look at my Hong Kong-listed holdings, I see many of them trade at double-digit forward dividend yields. It's usually a good sign when the dividend yield number is higher than the P/E ratio. I find it hard to imagine that any buying pressure would be exhausted already.

I started investing actively in Hong Kong in 2008, and since then, I've seen at least four bull and bear markets. A full cycle tends to last 3-5 years, and we're still near an all-time low in terms of Price/Book for the index as a whole.

I will say, though, that this cycle has been different. The crackdown on China's tech giants, the obliteration of China's tuition industry, and the offshore defaults of China's private property developers are almost unprecedented. Japanese journalist Katsuji Nakazawa believes that the crackdown on Alibaba and the other tech giants represents an extension of his anti-corruption campaign to the private sector, partly to correct wrongdoing but also to weed out opposition to party supremacy.

Beijing's refusal to stimulate the economy also signals a departure from the past. China's broad money supply, as measured by the total social financing measure, has been weak in the past few months. Monetary policy is tight, and youth unemployment seems to be reaching high levels. Xi seems to prioritise the strength of the currency. He's also against stimulating consumption purely on ideological grounds. He seems to think that giving away money for consumption would be a waste, whereas investment in manufacturing capacity makes the country strong. So, the loans that are being made are pushed towards strategic industries such as electric vehicles, leading to overcapacity and further deflation pressures.

Beyond the headlines, though, as Nicholas Lardy has argued, China's private sector is doing just fine. It still represents 50% of all investment in the economy. China's private sector continues to take global market share in a variety of industries, such as tech hardware, home appliances, autos, etc.

My key point here is that stocks move in cycles, and while it's hard to predict exactly how these cycles will develop, Hong Kong equities are incredibly cheap at the moment, and I don't see them falling much further.

Hang Seng Index.

SL: No interview about Hong Kong stocks can get away without speaking about real estate companies. Many Hong Kong tycoons and families have made their money in real estate, and the Hang Seng Index contains a dozen large real estate firms. What happened in Hong Kong real estate during the past few years, and where are these stocks at right now?

MF: The Hong Kong property market is small compared to its bigger brother up north in Mainland China. And they've both been affected by the changes that have taken place in China's property industry over the past few years.

The turning point for China's property industry was the Three Red Lines document, which was published in 2020. This document outlined leverage ratio requirements that developers had to adhere to or else face forced deleveraging. The developers that didn't meet the standards all happened to be privately owned.

Party representatives apparently visited bank branches and told them not to lend to this or that developer. Companies that did not meet the Three Red Lines requirements were also disallowed the ability to raise equity capital or project financing. I also hear that banks tightened their requirements for mortgage borrowing, leading to a decline in home buying as well.

Since China's residential property market operates on a pre-sales model, cash flows quickly withered, and the country's private developers soon began defaulting on their offshore debt.

These private companies can no longer afford to buy land or even complete existing projects. And since the Three Red Lines document was introduced, new starts have dropped almost 70%, causing an implosion in construction activity. According to Professor Kenneth Rogoff, real estate development used to represent almost 30% of GDP, so this crackdown must be having a major negative impact on China's economy.

Today, the offshore bond prices of China's private property developers are all moving towards zero. They'll face restructuring. If the GITIC bankruptcy in the late 1990s is any guide, foreigners will be mostly wiped out while onshore lenders and property buyers are made whole.

China's state-owned developers have been given full access to bank loans to acquire assets from their private sector counterparts. So, state-owned developers may end up as winners of this entire mess.

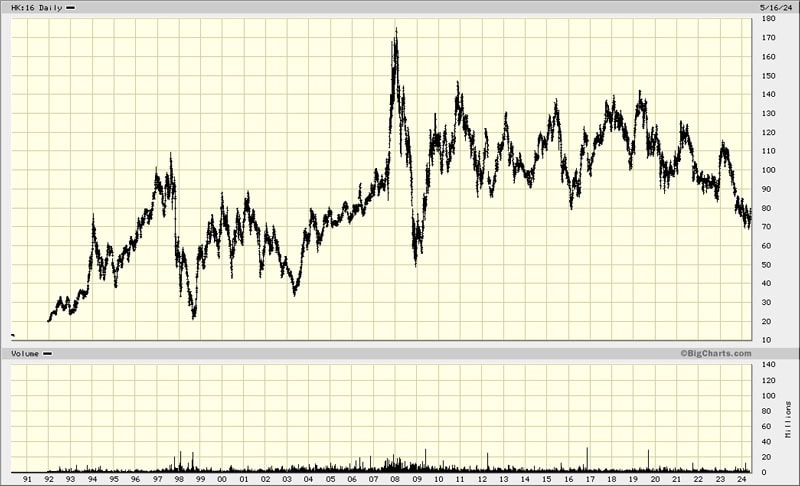

In the Hang Seng Index, you have a mix of Hong Kong-based developers, such as Sun Hung Kai (ISIN HK0016000132, HK:16) and CK Asset (ISIN KYG2177B1014, HK:1113), on top of Chinese state-owned developers, such as China Overseas Land & Investment and China Resources Land. All of them have some exposure to Mainland China, so they're all affected by Beijing's crackdown on real estate lending in one way or another.

Sun Hung Kai.

Hong Kong's domestic property market is having its own set of issues. In the early 2010s, money poured in from Mainland China to Hong Kong, pushing up property prices. Hong Kong is an attractive place to live, with great education, no capital gains tax and low-income taxes. The buying pressure was so immense that the Hong Kong government had to introduce home purchase restrictions, including additional stamp duties, causing volumes to plummet.

Hong Kong's Centaline index of residential property prices continued to rise until 2021. More recently, prices have come off a bit due to the increase in Hong Kong interbank rates, which tend to mirror those in the United States. Mortgage rates have gone up from around 2% to 5%, which has caused the local Hong Kong population to stay away from buying property.

But in early 2024, the government reduced the foreign buyer stamp duties to zero. Since then, the market has come alive again. For example, during the trip, we learned that Sino Land had seen a tenfold increase in the number of units sold per month from January to March, driven primarily by Mainland Chinese buyers.

So, there are plenty of reasons to be bullish on the local Hong Kong residential property market. Now, we just need mortgage rates to come back to more reasonable levels again.

SL: Looking beyond the very conventional real estate angle, I was surprised by the scope of companies we visited. To name a specific example, our entire group was impressed by what we saw when visiting Plover Bay Technologies (ISIN KYG713321035, HK:1523). Can you describe this particular site visit, and what was your impression of, and conclusion about, the company?

MF: I was enthralled by Plover Bay's CEO Alex Chan and his vision about the company's future.

Plover Bay designs SD-WAN routers which are used to create networks across Starlink, 5G and fixed broadband connections. The routers direct data traffic in a way that ensures high performance across the parameters important for each user. And by bundling its routers with a cloud service offering, Plover Bay has been able to enjoy recurring cash flows and decent pricing power beyond what's possible just selling the hardware.

The company has grown its revenues at a 23% compound annual growth rate over the past ten years, and earnings per share have grown even faster at 27%. From this perspective, seeing the stock trade at just 14x P/E is surprising.

During the meeting, we understood more about the challenges faced by the company, including geopolitics and the protection of intellectual property rights. Above all, meeting Alex Chan made it clear what a genius he is. I don't come across such individuals very often.

Plover Bay Technologies.

SL: On this particular trip, we visited blue chip companies but also little-known small-caps. One that I found a surprisingly interesting story was the combo of Lion Rock Group (ISIN BMG6577U1062, HK:1127) and Left Field Printing (ISIN BMG552191022, HK:1540). But let's hear that story from you!

MF: Sure. Lion Rock is run by a shareholder-friendly entrepreneur called CK Lau, with a great track record. Since 2012, Lion Rock's share price has tripled while still trading at just 5.9x P/E with a 7.5% dividend yield.

The company is a printer of books, specifically coffee table books, cookbooks, etc. My initial thought was that this must be a declining industry. But sales volumes are actually holding up okay.

CK Lau's strategy is to buy distressed assets and turn them around with extreme cost control – all while paying generous dividends to shareholders.

One highlight from the meeting was CK Lau's positive guidance, saying that Lion Rock was"looking at the golden years for the printing business". People who know tell me that's out of character for CK Lau. In the past, his guidance has always been cautious. That bodes well for the future.

I suppose there are two potential issues with Lion Rock. One is that Donald Trump may increase tariffs on Chinese printed books from the current 7.5-25% level. Lion Rock would then have to move more business from China to its Malaysian operations.

The other is that Lion Rock is sitting on a large cash pile, just earning interest. CK Lau is looking for acquisition targets but not finding much interest, and some investors are getting impatient.

But I wouldn't worry too much. CK Lau is an eccentric but excellent steward of capital. I'd be comfortable with any of the companies under his control.

There are two companies in the group listed on the Hong Kong Stock Exchange: Lion Rock and Left Field Printing. The former is the parent company, and the latter is a listed subsidiary that owns the group's Australian printing business. I think Left Field Printing is probably the cheaper of the two, but the stock is illiquid, and there's also the risk of a take-out below intrinsic value. Several of the investors I spoke to own both of the stocks.

Lion Rock Group.

SL: I was surprised to learn that Hong Kong had also seen its share of SPAC transactions – both completed and failed. One of them is Hypebeast (ISIN KYG468321040, HK:0150), whose stock is now down 85%. At our group dinner, I chatted with readers who felt there were clear indications the stock was undervalued. Can you summarise the background for us and let us know your verdict?

MF: Exactly. Hypebeast tried to raise a SPAC but eventually gave up on those ambitions. It's a fascinating company, a sneaker blog turned marketing agency turned e-commerce operator. It even runs a streetwear store in Hong Kong. It's rare for a Hong Kong business to become such a big phenomenon in developed countries like the United States, especially in the fashion industry. Founder Kevin Ma is a tour de force in the industry.

Hypebeast's idea has been to monetise fans by helping brands get visibility on the platform. The company's marketing agency "Hypemaker" also helps the same brands with marketing campaigns.

It seems like they're having some issues in the e-commerce business, with growing losses. But Kevin Ma is still involved in the business and determined to scale it down and shift the focus to profitability. That's a promising move because the main marketing agency business is doing well. According to CFO Patrick Wong, they seem to be considering shareholder return measures such as dividends, which we haven't seen before.

While alternative data such as Google search query indices suggest weakness in the "Hypebeast" brand, the marketing agency business alone made HKD 88m after all corporate expenses. Against the current enterprise value of HKD 406m, the adjusted trailing EV/EBIT is only 4.6x. The only question is whether that level of earnings can and will be maintained.

Hypebeast.

SL: You actually published a lengthy piece about this trip and its findings on Asian Century Stocks (a Substack that is well worth following!). Your summary also deals with a few companies that weren't part of this trip, but which you had reported about in the past. I briefly wanted to speak about Café de Coral (ISIN BMG1744V1037, HK:341), one of your favourite stocks that I had never heard about. This chain has a brand that is very well-known and which could expand further, right?

MF: It is indeed a favourite stock of mine and a major position in my portfolio. Café de Coral is the best-known of Hong Kong's restaurant chains, with roughly 500 stores in Hong Kong and Mainland China. It sells typical Hong Kong fare, a mix of Chinese and Western cuisine at affordable prices. A typical meal costs HKD 50, or roughly USD 7. In the past, they've had 300,000 daily customers, making it the second-most visited fast-food chain in Hong Kong after McDonald's.

The company has had a few tough years after the anti-government protests in 2019, and the stock price has dropped from HKD 30 to less than HKD 9. After the protests in the summer of 2019, tourism from Mainland China stopped and foot traffic to Café de Coral's restaurants dried up. And then you had COVID-19, when restaurants had to switch to takeaway orders. And after Hong Kong's National Security Law was introduced in 2020, you also had emigration of some 4% of the population.

But today, Hong Kong is pretty much back to normal. The COVID-19 restrictions are now all gone. The border has opened up. Emigration is partly reversing. So, the conditions are almost all there for a recovery. Indeed, in the last reporting period, we saw Café de Coral's operating margin recover from 1.8% to 5.5%. As labour shortages ease and tourists come back, I believe Café de Coral's pretax margins will soon end up at around 8%.

If that's the case, the stock will end up trading at a P/E of 8x and a 10% dividend yield. Growth is likely to be in the high single digits as Café de Coral expands from 170 to 270 stores in China's Greater Bay Area, which is where growth will come from. It's not necessarily the fastest-growing business, but Café de Coral is a great brand and as blue chip as local Hong Kong companies get.

Café de Coral.

SL: Speaking of which, there is one broader theme I wanted to pick your brain on. I have recently seen the first ads for Chinese fashion brands pop up in London. I have a sense that Chinese firms "going global" could become a major investment theme for China in the next 5-10 years, but I have not done any major homework on it yet. Do you have a view on this idea?

MF: That seems reasonable to me. There's enough competition within China that some will eventually set their sights on overseas markets. We're already seeing this happening across many industries. For example, Midea in home appliances, TCL in televisions, Xiaomi in smartphones, BYD in electric vehicles, Temu in e-commerce, DJY in the drone industry, TikTok in short-form video, etc. The list will get longer over time.

People forget that while Japan suffered several lost decades, there were stocks that did wonderfully. For example, Sony PlayStation dominates the global video console market. Uniqlo has become a household name in the clothing industry. So while I don't think China's construction sector will grow, I do expect some businesses to flourish.

In the mobile game industry, you may have heard of Genshin Impact – a game that has earned revenues of more than USD 5bn. Few people know that the game was developed by a Chinese company called miHoYo in Shanghai. There are thousands of such developers that could potentially create the next Genshin Impact – the next blockbuster game.

And there are many other industries where Chinese companies are slowly gaining ground on their global counterparts. The nation is a sleeping giant, with 1.4 billion hard-working individuals wanting to get rich. As long as there's private sector entrepreneurship and competition, I do think that some companies will come out ahead and eventually set their sights on overseas markets.

SL: How to play such a theme – any initial ideas?

MF: Blogger Global Stock Picking recently wrote about Chinese fashion house JNBY (ISIN KYG550441045, HK:3306). I like that idea. China is famous for being the place where garments are manufactured. But JNBY is a homegrown fashion brand. Its designs are tasteful and could equally well have come from Paris or Milan.

In the past two years, JNBY clothing has started becoming popular in Russia. And I think there's a good chance they can do just as well in other parts of Eastern Europe, Southeast Asia, or even Japan.

Chinese are also turning more patriotic, partly due to the influence of state propaganda. For that reason, they're turning to the top domestic brands, and JNBY is a clear beneficiary of this trend.

Today, JNBY trades at only 8.6x P/E with a 7.6% dividend yield. Their generosity with dividends makes it unlikely that it's a fraud. The company's earnings per share have grown at a compound annual growth rate of 16%. The valuation multiple seems far too low to me, especially as JNBY has continued to deliver.

JNBY.

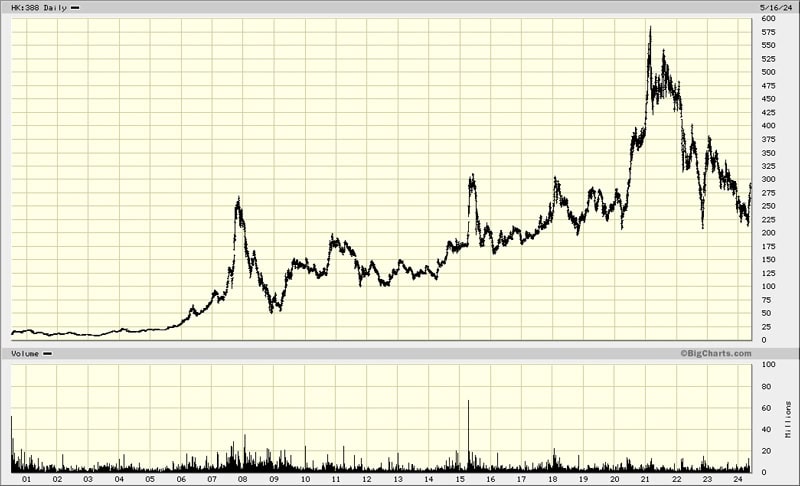

SL: We also visited the Hong Kong Exchanges and Clearing (ISIN HK0388045442, HK:388), which as the name indicates operates the Hong Kong Stock Exchange. They put a lot of emphasis in their presentation on Hong Kong becoming even more of a financial gateway to the region than it currently is. The future of Hong Kong as a jurisdiction, a place to do business, and a financial centre is a hotly debated and very divisive issue. It would go beyond the scope of this interview to explore these underlying issues in more detail. Still, I'd love to hear your impressions of Hong Kong in general, as someone who knows the region and visited previously.

MF: I'm not so sure about that. Since the 1980s, Hong Kong has shifted from being a centre for smuggling to serving Chinese companies wanting to raise capital in foreign currencies. Hong Kong's main advantage is that its currency is pegged to the US dollar and freely convertible. So, if a Chinese company raises capital in Hong Kong, that money can be used anywhere in the world. That's something that competing stock exchanges in Shanghai and Shenzhen do not offer.

Even though the Hang Seng Index hasn't performed well in the past few decades, the total market cap of Chinese equities has risen nicely. The Hong Kong Exchange is like a virtual toll road booth, clipping a fee whenever shares change hands. It even makes money when foreigners buy Mainland equities, as most use the Hong Kong-Shanghai Connect or the Hong Kong-Shenzhen Connect programmes.

In my mind, the big questions are whether the total market cap of Hong Kong equities will rise, and whether trading volumes will continue to go up. Until 2019, the total market cap and trading volumes trended upward.

However, the poor performance of Chinese equities since 2021 has hurt companies' willingness to list there and raise capital. Beijing's crackdown on private property developers, tech companies, and tuition companies has raised the question of whether China is still open for business. I believe it is, but suddenly, we've had to consider whether similar crackdowns might occur in other sectors, like the banking or insurance industries.

In 2021, the government started talking about "the prevention of disorderly expansion of capital". Nobody seems to know what those words mean. However, one interpretation is that Beijing wants to choose who can raise capital and who cannot.

Days after ride-hailing company Didi was listed on the NYSE in 2021, its app was pulled from Chinese app stores, and its market value evaporated. And after the Didi IPO, Beijing has become much stricter in approving overseas IPOs. And when I say overseas, that includes Hong Kong. If private companies can no longer receive approval for Hong Kong IPOs, then the city would certainly suffer, at least on the margin.

Hong Kong Exchanges & Clearing.

SL: Following what happened with Russian ADRs, and given the issues surrounding Taiwan, there are those who call Hong Kong and China uninvestible. Others believe that this isn't a risk worth even thinking about. Yet others are somewhere in the middle, and think it's an issue that you could mitigate against. E.g., my friend Ladislas Maurice of The Wandering Investor points out that you can get an Egyptian citizenship-by-investment and then use that to open a Hong Kong brokerage account, which would leave you outside the scope of any potential Western sanctions. It's certainly a complex, controversially discussed topic. As someone who is equally familiar with the European/Western views and the views held in the region, what's your verdict on this question?

MF: That's a risk that's hard to judge.

China has prepared for war by reducing its reliance on overseas technology and imports. And since 2020, it has stockpiled commodities, seemingly in preparation for a more hostile environment.

I don't think we can rule out a conflict over Taiwan, though I very much doubt we'll see a direct invasion as we saw in Ukraine. The Taiwanese government has prepared for such a scenario for 75 years. If forces were to land on Taiwan's beaches, they would face beach obstacle systems, missiles, rockets and artillery guns. Oil drums with gasoline would also pour out pipelines and turn beaches into burning infernos. The government has built tunnels all across the island filled with weapons, ammunition, mines, obstacles and supplies. Let's just say that any invasion would be a bloody affair.

I'm certain that the Chinese Communist Party will one day like to control the government of Taiwan. Xi Jinping has repeatedly said that this task cannot be passed on to the next generation forever. Taiwan's political parties threaten Communist Party supremacy, even on the Mainland. Such competition is unacceptable in the eyes of the Communist Party.

But they think in terms of decades or even centuries. I think the Communists can gradually gain control without triggering any backlash from the West. For example, they can influence local politics to ensure that laws are passed that enable Beijing to take control. The last attempt in 2014 was thwarted, but they will try again.

Given that China has just introduced a new law that will force high school children to do military service, a near-term invasion or blockade seems unlikely. They'll at least wait a few years until their military readiness improves from the current level.

Regarding what Western countries might do, I can't imagine what would happen if China was cut off from the SWIFT system. The Chinese economy is intertwined with those of the Western economies. Trying to cut all trading with the Chinese would lead to so much disruption that the COVID-19 pandemic would seem like child's play.

Back in 2019, I was worried about an invasion of Taiwan, but people didn't take the threat seriously. Today, it's the only risk that people ever talk about. I'd bet that in 2-3 years, people will find something else to focus on, for example, the success of individual Chinese companies or the outperformance of global stocks in a period of a weakening US dollar.

SL: I also wanted to hear your honest assessment of the value of these company visits. You flew in from Singapore and we had two very busy, long days to whizz across Hong Kong in Uber taxis and on Metro trains. Be entirely frank, please – speaking as an investor and analyst, and keeping in mind all information is available online nowadays, was that time well-invested?

MF: It depends on how much experience you have. If you've never visited Hong Kong or met with Chinese companies, you'll get a better sense of what and who you are dealing with. If you haven't spent much time in Hong Kong, you might not question the current popular narrative about how the city is dying. Visiting the city will help you gain perspective and conviction that despite all that's happened in the past five years, life goes on.

I don't find much value in company meetings anymore. Most information can be found online these days. I will say, though, that after meeting Alex Chan of Plover Bay and CK Lau of Lion Rock, I gained the conviction that these are men you'll want to bet on. And having met them in person, I'll probably be less likely to sell their companies' shares after a weak quarter or on a weak headline.

On the other hand, CEOs have usually achieved their status thanks to their ability to sell – not only a company's products but also the company itself. A person's charisma can lead us astray. So, sometimes it might be better not to meet management teams in person.

At the end of the day, it's numbers that matter. And you can get far in your research process by just reading sell-side research or Substack newsletters.

SL: Thank you, Michael, for sharing your insights so generously! I have been a paying subscriber of Asian Century Stocks almost from inception, and in particular love the emails you send out with a curated link collection focused on Asia-related topics. You are literally my window into Asia, and your work saves me a lot of time. It was a pleasure hosting this trip together with you!

MF: Thanks for inviting me, Swen. It was a pleasure meeting you and coming along on the trip. It was a fantastic experience, and I'll recommend others join you on similar trips in the future.

SL: Maybe we'll tackle another Asian country together in 2025! In the meantime, I am closing with a visual summary of the Hong Kong trip.

Undervalued liquidation case

Money laying on the streets?

A couple of very smart investors have spotted just that and taken control of the company featured in my latest research report for Lifetime Members.

They will know that i) a liquidation of the company is going to yield a 2x return for shareholders, ii) recent macro tailwinds could make for an even higher return, and iii) an ongoing litigation case could yield an additional windfall profit.

Undervalued liquidation case

Money laying on the streets?

A couple of very smart investors have spotted just that and taken control of the company featured in my latest research report for Lifetime Members.

They will know that i) a liquidation of the company is going to yield a 2x return for shareholders, ii) recent macro tailwinds could make for an even higher return, and iii) an ongoing litigation case could yield an additional windfall profit.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: