Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Hingham Institution for Savings or how to analyse stocks

Image by Yingna Cai / Shutterstock.com

How can investors without access to expensive tools or exclusive research gain an edge over others?

Collecting and analysing large amounts of publicly available data is one way. Hingham Institution for Savings, a regional bank in Massachusetts, makes for an interesting case study, and it is quite educational even.

The stock is at its cheapest since the Great Financial Crisis, and it could make for a great compounder investment.

One analyst has figured it all out – data point by data point, in painstaking work!

The strangely diverse US banking market

The US has a staggering 4,700 banks – individual bank companies, that is, not just branches (of which there are 72,000).

This compares to Canada with just 83 banks and the UK with 311. Even Japan and China only have about 112 and 187 banks, respectively.

Just 31 of bank companies in the US qualify as large financial institutions, i.e. the kind of brand name that you'd be familiar with.

The other 99% of US banks are mostly smaller, regional players.

Around 300 of these regional banks are listed on the stock market, which makes the US a country with more listed regional banks than most countries have banks in total.

Why does the US have such a large number of banks?

Their existence stems from the US' particular history. The country's founding fathers argued whether there should be one dominant national bank, or a more open system that allowed to set up regional banks.

The latter argument eventually won, and by the early 1920s the country of then merely 110m people had no less than 30,000 banks. Even the Great Depression and its countless bank failures only managed to get the figure down to 13,000. During the 1980s, the number of banks was back up to 14,000 to serve a market of then 230m people.

Why was there such strong interest in having so many smaller banks? Proponents of the system say that it promotes competition and creates banks that are better at serving the needs of their regional client base. However, this specificity can also make these banks more vulnerable to external shocks. Imagine one region losing its biggest local industry – this sort of development can push a regional bank out of business.

Since 2008, it has become easier for bigger banks to acquire rivals across state borders, something that had been forbidden for decades. As a result, over the past 15 years, the number of banks in the US has dropped by 40%.

Along the way, the sector had its occasional scandal. In spring 2023, three medium-sized banks went bankrupt because of their exposure to crypto deposits. While such cases damage the sector's reputation, three banks out of 4,700 going bust would have been seen as a remarkable success in the olden days when hundreds of institutions went down the proverbial drain.

The sector does have its challenges, but smaller, regional banks continue to have a large, captive client base and certain strategic advantages. You also find some extraordinary gems among them, of the sort that would impress even the most discerning investor interested in long-term compounding.

Introducing: Hingham Institution for Savings

One case that is very much rooted in the sector's history but also stands out as a publicly-listed entity that investors can easily buy stock in is Hingham Institution for Savings (ISIN US4333231029, Nasdaq:HIFS).

Incorporated in 1834, it is one of America's oldest banks.

It's also de facto family-controlled. Following a proxy battle in 1993, the family of Robert H. Gaugen has been the dominant shareholder with 31% of the share capital. The 71-year-old has been CEO ever since, and his 42-year-old son, Patrick R. Gaughen, has been COO since 2018. Speak of a bank manager with skin in the game and continuity of leadership!

As a bank with a market cap of less than USD 400m and a limited free float, this is not a stock that would normally gain wider attention.

Yet, it has proven an incredible compounder for its shareholders over the decades. Since the ousting of its old management, the share price increased from USD 5 in 1993 to USD 408 in 2022. That's a 100-bagger in 30 years. Many investors would dream of landing such a home-run once in their life, let alone with a relatively low-risk, "boring" company rather than a risky venture.

It has recently come back to USD 180, down over 50% since its 2022 high.

How did the small bank pull off this stunning multi-decade run, and does the share price stand a chance of getting back on track?

That's the question that Gwen Hofmeyr, an equity analyst from Vancouver, has recently done a lot of work on.

Her analysis is not just insightful and valuable, but it also teaches a few lessons on how best to go about analysing a stock and coming up with a differentiated viewpoint, even if you are a private investor without access to a USD 2,500/month Bloomberg terminal.

Large-scale data mining among peers

Of late, regional banks have been in the news because of their exposure to lending for real estate in general, and commercial real estate in particular.

After what happened during the Great Financial Crisis, the US' large banks have retreated from lending against real estate. Instead, smaller lenders (those with less than USD 250bn in assets on their balance sheet) recently accounted for about 50% of all US commercial and industrial lending, 60% of real estate lending, and 80% of commercial real estate lending.

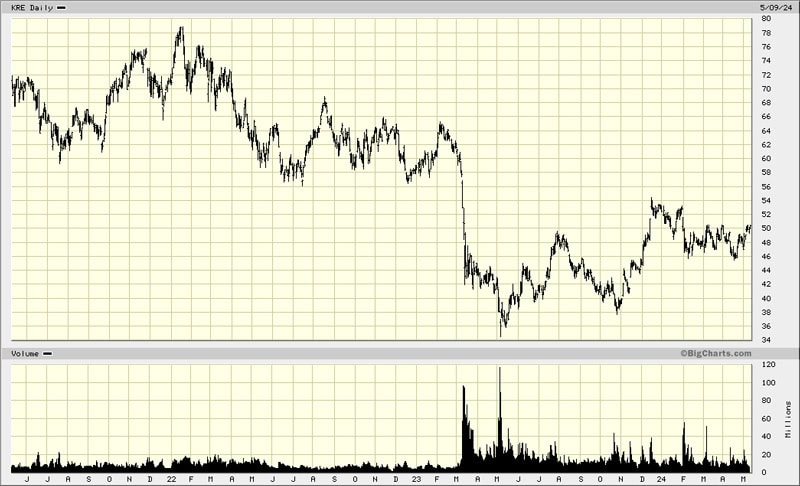

With the recent rising degree of uncertainty over the economic outlook, investors bailed from smaller, regional banks because of the perceived growing risk of losses in lending. The entire sector's stock prices came under pressure. Between January 2022 and May 2023, the price of the SPDR S&P Regional Banking ETF (ISIN US78464A6982, NYSE:KRE) – the de facto index for the sector of regional US banks – dropped by 50%. The fund contains 138 regional bank stocks, though not Hingham as it's too small for inclusion in the index. Still, the stock of Hingham is down about as much as the ETF.

SPDR S&P Regional Banking ETF.

Is the drop justified, and is there potential for the sector to recover?

Over the past few quarters, this entire banking sector did tighten its lending standards further, to levels previously unseen outside of recessions.

How would an actual recession, or the continued issues of US commercial real estate, affect the stocks of the sector in general, and Hingham in particular?

While working for a Canadian family office, Hofmeyr aimed to find out if Hingham would be a contrarian buy ahead of the stock's potential return to its outstanding long-term performance. She collected data from all 138 banks contained in the SPDR S&P Regional Banking ETF, and compared this data to that of Hingham.

Her work is not to be underestimated. Even today, data taken from large databases is often incomplete or laden with errors. Hofmeyr created much of her dataset manually, collecting an impressive 3,600 data points from the investor relations websites of these 138 publicly listed banks. Had she simply taken the data from expensive databases, it would have contained errors. This was real grunt work, but with superbly interesting insights as a result!

Hofmeyr's digging for comparative data enabled her to present the following metrics:

- Even though Hingham has the second-highest loan book allocation to commercial real estate of all banks included in the ETF, it has 0% non-performing loans (NPLs) as a percentage of total loans. Only one bank contained in the ETF can match that achievement.

- During the Great Financial Crisis, the US banking sector had to write off an average 3.14% of its loan book. Hingham wrote off just 0.07%, far lower than the 1.81% average of banks contained in the ETF. In fact, only four other banks in the ETF managed to stay below 0.25% even, never mind get as low as 0.07%.

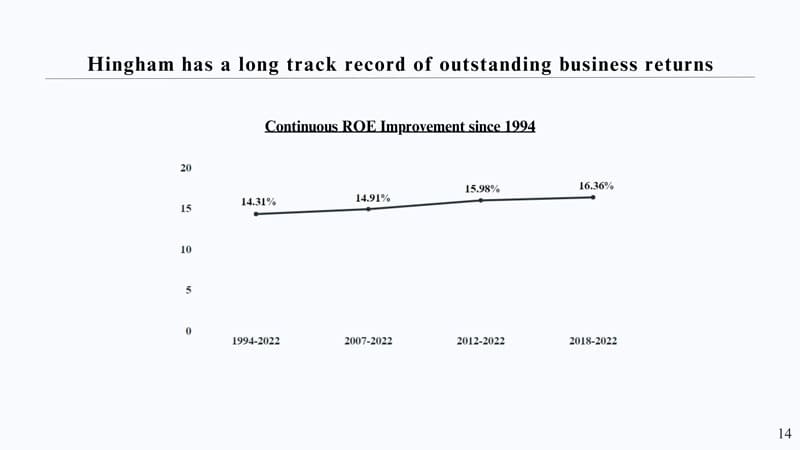

- As a result of its well-managed lending portfolio, Hingham managed to compound its book value at 12% p.a. for 20 years. During this time, the return on equity (ROE) steadily improved.

Source: Gwen Hofmeyr.

How did Hingham achieve this feat?

As Hofmeyr concluded in a 36-page analysis of the case: "Hingham's loan book is a bunker".

Here are just some of the features that make it stand out among banks:

- Hingham stays away from risky lending such as leasing, credit cards, and autos. In many ways, the bank is defined by what it does NOT do. Or as Warren Buffett once said: "Banking is a very good business, unless you do dumb things."

- The bank has an extremely strict approval process. No loan is made without the approval of the bank's eight-member executive committee. If a loan exceeds USD 2m, the entire 15-member board needs to approve it. To check on the collateral, an executive committee member needs to visit properties prior to underwriting.

- The bank keeps the loan-to-value of the commercial real estate portfolio at a conservative 54%, with office properties remaining below 50%. No single borrower exceeds 10% of the loan book.

It really does show that Hingham is an owner-operated bank. Were its lending ever to go haywire, the Gaughen family would lose what it has built over three decades. No doubt, they will watch over the loan portfolio like a true owner, which is very different to what you'd find at most other banks.

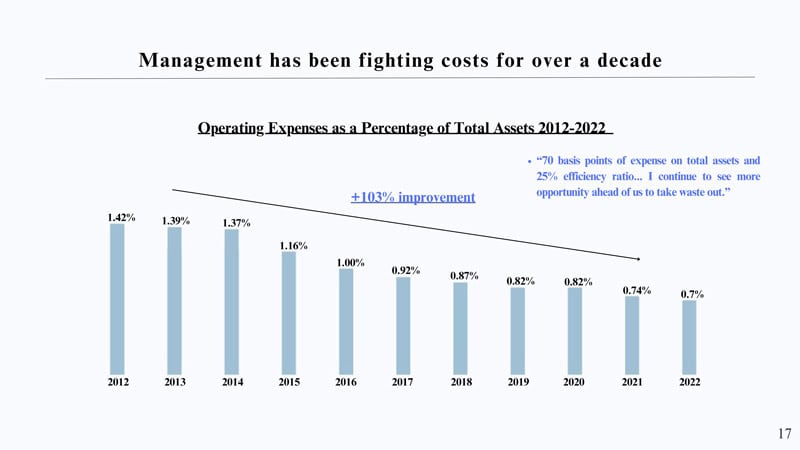

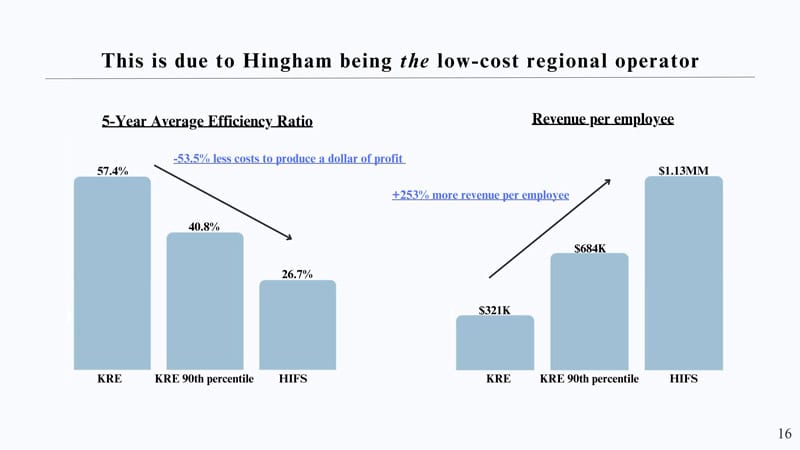

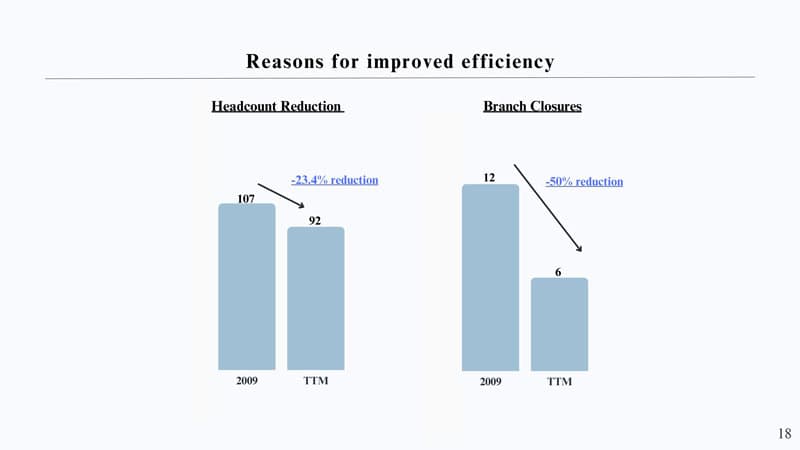

All of this comes combined with a substantial low-cost advantage. Between 2012 and 2022, Hingham's operating expenses as a percentage of total assets decreased from 1.42% to 0.7%. The bank achieved this by reducing its headcount by 23% and closing 50% of its branches.

Source: Gwen Hofmeyr.

Despite these reductions, Hingham has grown its lending portfolio from USD 950m to USD 3.6bn. It now generates USD 1.13m in revenue per employee, compared to an average of USD 321k generated by banks included in the ETF. Even the 10% top banks in the index only reach revenue per employee of USD 684k. The operational strength of Hingham is nothing but remarkable, and a real inspiration to anyone interested in management issues and optimising an operation.

Source: Gwen Hofmeyr.

As a result, even though its super-conservative lending comes with a lower net interest margin, Hingham beats the average bank contained in the index when it comes to ROE.

Source: Gwen Hofmeyr.

It's remarkable to see a bank that combines strong management alignment with a comparatively simple business model and laser-sharp focus. This helped Hingham to post positive ROE even during the Great Financial Crisis:

| ROE | Hingham Institution for Savings | US banking sector |

| 2007 | 8.4% | 7.8% |

| 2008 | 11.1% | 0.7% |

| 2009 | 12.8% | -0.7% |

By anyone's standards, Hingham's metrics are outstanding.

Why should investors care?

The stock is currently trading at just 0.94x book value, which is a valuation last seen during the Great Financial Crisis and the dot-com bust. Both times, it proved a good move to pile into the stock ahead of the good times returning and multiples expanding.

In fact, buying into Hingham the last time its stock was so cheap proved incredibly profitable. Anyone who bought into the stock in 2009 would have achieved returns of 29.8% p.a. when the bank was experiencing its high in 2021/22.

It's remarkable that such a bank exists in the US, and even more remarkable that anyone with a brokerage account can buy shares and invest alongside the Gaughen family.

Hofmeyr summarised her analysis of the bank's past and its potential future trajectory in a dense 36-page document. For anyone who ever thought analysing banks was too difficult to bother, do read the entire paper. For those with less time, Hofmeyr presented a shorter PowerPoint at the MOI Global conference in early 2024, an updated version of which you can download here.

The long-form version of the analysis also includes a chapter that looks at the connection between a bank management's length of tenure and returns for shareholders. Fascinating material, by anyone's standards!

If that wasn't enough already, there is more that investors can learn from Hofmeyr's work.

"The Halfwit Crustacean: Inside the Mind of a First-Year Investor"

Like so many, Hofmeyr stumbled into the world of investing by chance. And just like everyone else, she found it difficult to navigate around at first – think losing money on haphazard micro-trades, and chasing the latest shiny thing. Luckily, reading classic books such as Peter Lynch's "One up on Wall Street" and putting down her own thoughts in a personal blog helped Hofmeyr to hone her skills.

A few years later, she had risen to work as an equity analyst at Folly Partners, the family office of Andrew Wilkinson and Chris Sparling, co-founders of Tiny Capital, an investment firm they like to describe as "the up-and-coming Berkshire Hathaway of internet businesses".

In the meantime, Hofmeyr also published a book that spells out her journey in the world of investing: "The Halfwit Crustacean: Inside the Mind of a First-Year Investor".

I caught up with Hofmeyr, who recently left Folly Partners and is currently looking for her next challenge, when she was on her way home from the Berkshire Hathaway annual general meeting.

Swen Lorenz: Tell us more about the research process involved with your analysis of Hingham. How did you come across the stock idea in the first place, and what did you have to do to gather and analyse the comparative data that allowed you to go deep? Could other investors even emulate this?

Gwen Hofmeyr: I used to follow an investing YouTuber, Investing with Tom. He's a young up-and-comer, and I respect his diligent process to investment selection.

In 2022, Tom mentioned that he had purchased shares of a US regional bank, Hingham Institution for Savings, and I thought it was weird. At the time, I was part of the camp of investors that thought banks to be indecipherable black boxes, and thought myself incapable of ownership. But I respected Tom, and decided to put it on my "To Research" list.

When SVB collapsed in March 2023, Hingham's already beleaguered stock got pummelled further, and I couldn't help but prioritise analysing Hingham.

I was shocked.

I could understand its balance sheet. Management's disclosure was great. The bank had no derivatives, no material HTM securities exposure, and a conservative loan book. Better yet, its business model was simple, and I could assess the economic characteristics of its chosen markets.

After a few weeks of research, I was not only convinced that I had found a great business, but that I had to analyse the entire industry. The fact that nearly every investor and analyst that I met had absolutely no interest in what I had to say, nor did they have an interest in analysing banks in any capacity, suggested that the sector was ripe for dissection.

And once I got into the data collection process, CapIQ turned out to be helpful only 30-40% of the time. If I wanted an accurate loan book profile of a bank, or truly understand the nature of a bank's derivatives, I had to look at the report level. Even innocuous metrics like a bank's equity-to-asset ratio, which is a measure to gauge a bank's overall leverage, could not be reliably used from CapIQ's database, as their equity assumptions include intangibles, like goodwill. To get a true leverage profile for a bank, intangibles must be adjusted out.

Investor interest remains unchanged. I just attended about half a dozen conferences for Berkshire week in Omaha, and in a given room of a hundred investors, at best I would find one or two interested in banks.

As for the replicability of my dataset, any investor or analyst with time and dedication can build a large dataset. As for whether most firms would be okay with a multi-month, even a half-year deep dive, I'm not so sure. I had a meeting a month ago with someone who runs a wealth management branch at Canada's largest bank, and they told me that the level of work I did on Hingham would not be done on other industries were I hired at the firm. I also had a senior PM at a major Canadian pension fund tell me that he didn't look at US regional banks because there were "too many." What an advantage to have your competition be unwilling to work hard!

The useful part about my exercise is that it affirmed a suspicion that I had regarding management incentives. I assumed prior to dataset construction that incentives had a disproportionate impact on economic results among regional banks, and I was right. Where firms stand to lose is that, while the process of analysing the KRE took months, the information derived from my work isn't useful for a few quarters. It's useful for the span of an entire economic cycle. That level of understanding is a grounding force in conditions of uncertainty. Doing deep work is a great way to remain focused on what is true, when others are focused on what might be so.

Swen Lorenz: You first publicly presented this case in January 2024, and the world has since moved on somewhat. The outlook for the US economy, the situation of US commercial real estate, and the likely policies of the FED have all evolved. The stock price of Hingham hasn't really moved at all. From here onwards, where do you see both the bank and its stock going over the coming years, and why?

Gwen Hofmeyr: I wish I had a crystal ball, but sadly I don't, and therefore have no ability to predict the future prospective health of an economy, let alone the US economy (if Keynes couldn't do it, it's probably too hard). That said, as my report shows, home affordability and first-time homebuyer rates are at either multi-decade or all-time lows. The consensus is that the US economy is doing presently well, but home affordability is a practical, late-stage economic indicator that tends to precede recessions. It's socioeconomically unhealthy to have such high unaffordability, and it's a constraint on consumption.

Regarding Hingham's stock price, uncertainty remains as to the direction of interest rates. Recall that Benjamin Graham once said "in the short run, the market is a voting machine, but in the long run, it is a weighing machine." Market efficiency breaks down when faced with uncertainty. Fear of a 70s/80s hyper-inflation repeat has investors wary of liability-sensitive assets, which I believe is preventing people from engaging with Hingham in a rational manner. After all, over 50% of its book will have adjusted or matured by 2026. So, Hingham doesn't require rates to go down to return to profitability over time. As such, I expect that Hingham will continue to leverage its low-cost operating model to underwrite new loans in the years to come, which is already having a positive impact. As of Q1, Hingham's economics have stabilised, and its balance sheet resilience has increased should further hikes occur.

Swen Lorenz: I've read your book, and I loved how it strikes the right balance between being practical and authentic, explaining important technical concepts in an accessible way, and being a very personal account with bits of humour strewn across it. In fact, I now recommend your book to anyone who asks me which investment book they could use to get their children kickstarted in the world of investing. What did writing the book do for you?

Gwen Hofmeyr: I am very flattered that you find my book to be so enjoyable and suitable for upcoming investors. Thank you for taking the time to read it, and to kindly promote it to others in your life. It was a personal project to capture the glee I felt in response to discovering investing as my life's passion, and I am overjoyed that the reader response has so far been positive, including yours!

It may sound trite, but writing the Halfwit Crustacean was really, really fun, as I wrote it as an accountability exercise. No part of the writing process felt like labour. The overarching lesson that I learned from writing it is that all the credentials and intelligence in the world will not translate to positive investment results if an investor's behaviour is poor.

If an investor does not dedicate themselves to the observation and improvement of their own behaviour, it is unlikely that they will develop the ability to separate a business from the movement of its stock price. What is likely to occur is transactions made on the basis of volatility, rather than on the basis of business fundamentals and intrinsic value.

Swen Lorenz: Gwen, many thanks for sharing your insights with Undervalued-Shares.com!

Finding value off the beaten path

How I find the ideas that I feature on Undervalued-Shares.com, and how I go about analysing them rank among the most often asked questions I get.

They aren't easy to answer.

As Hofmeyr put it in the Halfwit Crustacean: "You may come to understand that investing is more art than science."

Still, there are rules and tricks to get ahead in the game. Sourcing and analysing large amounts of publicly available but complex and overlooked data is one way to go about it (see also my Weekly Dispatch "Signature Bank – why the 36,000% rise in 7 months?").

Investing in public markets is highly competitive, and gaining an edge requires diligent work.

It's entirely possible, though.

And for anyone who doesn't want to put in the work, you benefit from living in a time where so much financial wisdom and information are just a mouse click away!

Undervalued liquidation case

Money laying on the streets?

A couple of very smart investors have spotted just that and taken control of the company featured in my latest research report for Lifetime Members.

They will know that i) a liquidation of the company is going to yield a 2x return for shareholders, ii) recent macro tailwinds could make for an even higher return, and iii) an ongoing litigation case could yield an additional windfall profit.

Undervalued liquidation case

Money laying on the streets?

A couple of very smart investors have spotted just that and taken control of the company featured in my latest research report for Lifetime Members.

They will know that i) a liquidation of the company is going to yield a 2x return for shareholders, ii) recent macro tailwinds could make for an even higher return, and iii) an ongoing litigation case could yield an additional windfall profit.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: