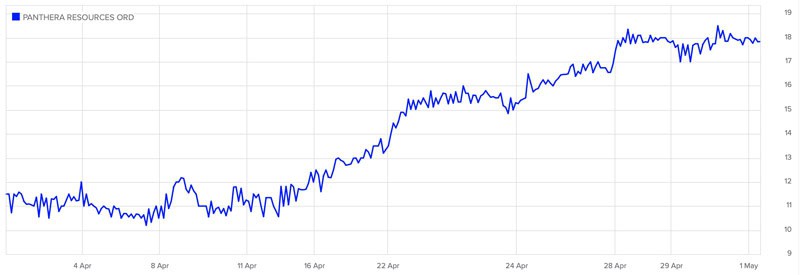

In February 2025, I published an investigative report on the litigation case brought by London-listed Panthera Resources.

The article proved a hit, and the stock has been on a tear.

Panthera Resources has brought the entire subject of litigation finance to the fore, and many of my readers wondered "What other such cases are hiding out there?".

If you want to do a bit of sleuthing, here are summaries of nine other cases. Where it exists, I also link to the research others have already published about them.

The article finishes off with an update of the case that got it all started, Panthera Resources. The company has a crucial date coming up this month.

Panthera Resources.

Why the interest in litigation finance?

Investing in companies whose business primarily consists of pursuing a legal claim isn't new, but it has recently gotten a lot more attention.

If you have no idea what I am referring to, check back to the background information provided in my 28 February 2025 article "Panthera Resources – multi-bagger legal claim?"

Additionally, I published yet more background material about the broader subject of litigation investing in my in-depth research report on Energy Transition Minerals (ISIN AU0000250250, AU:ETM). The full report was an exclusive for Undervalued-Shares.com Lifetime Members and released in early January 2025.

The research report about Energy Transition Minerals explained a little-known subset of litigation finance. This consists of companies that are taking sovereign nations to international arbitration courts using the legal tools provided by bilaterial investment treaties. Using this particular legal constellation and leaning on commercially minded arbitration courts that are operated by the likes of the World Bank, companies can not only get judgments against sovereign nations but also force payment. If necessary, this can include seizing government-owned assets abroad.

Arbitration courts under bilateral investment treaties are a remarkably sharp weapon indeed!

Most – but not all – of the following cases fall under this category.

1: Equatorial Resources

In many aspects, the case of Equatorial Resources (ISIN AU000000EQX3, AU:EQX) is similar to that of Panthera Resources.

A junior mining company listed on a Western stock market raised money to explore for resources in a developing country. The country eventually unlawfully expropriated the project and passed it on to another foreign owner. Unsurprisingly, the company that funded the initial exploration work felt wronged and took the matter to court.

Equatorial Resources explored two iron ore districts in the Republic of the Congo (which is not to be mixed up with the Democratic Republic of Congo).

The company subsequently had to take the Republic of the Congo to the International Centre for Settlement of Investment Disputes (ICSID), an arbitration institution established in 1966 specifically for legal dispute resolution between international investors and states. The company's claim ranges from USD 395m to USD 1.25bn, depending on the valuation methodology the court agrees to adopt. On top of that will come interest, which adds a further USD 134-741m.

These figures compare to Equatorial Resources' current market cap of just AUD 12m (USD 7.7m), which is based on a capital of 132m outstanding shares.

Equatorial Resources.

The claim was filed in 2021 already, and the process has recently reached such an advanced level that a decision by the tribunal has to be expected before the end of 2025.

As a litigation case, Equatorial Resources has a lot going for it:

- No dependence on a litigation financier, i.e. the company funded the legal costs out of its own pocket and the entire awarded claim will go to the benefit of the shareholders (minus a reasonable bonus of up to USD 5m for the executive who is leading the claim on behalf of the company).

- As per 31 December 2024, it had AUD 12.6m (USD 8m) of net cash.

- The company also owns two fledgling iron ore projects in Guinea.

- There is only a relatively small number of stock options outstanding, i.e. no risk of massive dilution.

As one experienced litigation investor told me when we discussed the case (quoted with their permission): "It's clear to me the chance of EQX winning this is very high."

Why, then, is the company valued at such a low market cap?

In this particular case, two major factors have been at play.

The first one is collection. The Republic of the Congo is not only challenged financially, but it also does not own many assets abroad. The country will not have the money to pay for such a potential award, and forcing collection will be difficult if there are no overseas assets that can be seized.

The second possible reason is that almost no one has ever heard of the case. Even though Internet chatter about litigation cases has recently increased markedly, Equatorial Resources is one of those cases that the market has so far not paid much attention to.

The stock is very illiquid, especially on the current bombed-out level. The bid/ask spread can be up to 30%.

Equatorial Resources is also burning through money to pay for its exploration work in Guinea, and it has to pay for the upkeep that comes with being a listed company. The cash pile will likely be nearer to AUD 10m (USD 6.4m) by now.

Throw in the fact that most junior mining companies trade at depressed valuations, and you can start to make some sense of the current price.

That said, a remarkable development could be in the making.

The tribunal had scheduled the final hearing of the case for March 2025. However, the hearing had to be called off at the last minute. The Republic of the Congo had not paid its lawyers, and the judges reluctantly paused the process.

The country got lucky, actually. Given that it blatantly disregarded the court, the judges could have awarded Equatorial Resources the damages in a so-called default ruling. The defendant not even turning up equals the claimant being declared the winner. It's reasonable to assume that the court wanted to look fair in that they were giving the Republic of the Congo every chance to defend themselves, so when the country loses it doesn't look like Europeans beating up on Africa again. Getting one final chance to make the hearing happen is keeping the suspense, but it could yet end in the Republic of the Congo continuing to ignore the case and subsequently having to accept the consequences.

Assuming that Equatorial Resources will achieve some kind of win, the question will then turn to collection.

An Australian firm called Sundance Resources famously has a USD 13bn (!) claim against the Republic of the Congo, stemming from an iron ore project after a legal dispute that started in 2020. In July 2024, the company and the Republic of the Congo signed a confidential settlement of the case. Unfortunately, the country then failed to make the cash payment, and the case is now back at the arbitration court. Sundance Resources used to be a listed company, but it delisted in 2020 and there is no share price to follow.

In difficult cases where a country does not have the resources to pay, external parties may provide a way out. The Republic of the Congo is one of those countries that may end up receiving more aid from the World Bank and similar institutions. These types of international institutions can take a portion of an aid payment to settle arbitration claims. After all, the World Bank itself is a signatory and host of such tribunals, and if such cases remain pending, there is less prospect of a country attracting badly needed new investment. The Republic of the Congo is currently looking to get World Bank funding.

Broadly comparable situations were recently resolved by Tanzania, which lost arbitration cases fought by Indiana Resources (ISIN AU000000IDA0, AU:IDA) and Montero Mining & Exploration (ISIN CA6126483032, CA:MON). Tanzania also has a low GDP per capita and as a result struggled to find the money. The way out for Tanzania was to reduce the size of the payment and pay in instalments, with international institutions helping the country. This did prove lucrative for those investors who bought into the companies when the market had not yet fully woken up to the opportunity, and it brought closure to the issue. Early investors in Montero Mining & Exploration now stand to walk away with nearly 10x their money once the final payment is delivered.

Source: African Law & Business, 31 July 2024.

To have Equatorial Resources get anywhere with such a payout, it may have to play hardball at some stage. One option for the company would be to hire an asset tracker and seize oil and mineral shipments outside the country. The legal situation seems relatively clear, and the Republic of the Congo does not have overly many other outstanding cases against itself. These are two favourable factors for Equatorial Resources shareholders. It requires resources and time, but it appears entirely feasible.

Optimists will say that Equatorial Resources is currently a junior mining company that comes with a potentially significant arbitration case thrown in for free.

More cautious observers will disregard the company's cash and its other exploration projects, and say that the company should be valued solely on the basis of its litigation claim. The current market cap equates to 0.15-0.36% of the claim. Even when taking into consideration the collection issues posed by the Republic of the Congo, this appears like a very low valuation for a legally solid claim.

Given the overall growing interest in this type of special situation and the final decision for this case getting close, the stock is probably going to make up ground over the coming months. A bigger issue will be to get a decent amount of stock in what is a truly illiquid market. That's where private investors with their usually smaller ticket sizes can have an edge, but it does require making a bit of effort and building a position over time.

2: Silver Bull Resources

A case that appears similar at first sight but which may yet be very different is that of Silver Bull Resources (ISIN US8274582092, CA:SVB).

The company owns the Sierra Mojada silver project in Mexico, which has been the subject of an illegal blockade since 2019.

After an unsuccessful attempt to settle amicably with Mexico, the case was subsequently brought to the ICSID. Silver Bull Resources is claiming damages of USD 408m. The company has managed to secure a professional litigation financier to pay for the costs of the case, which speaks for the solidity of the legal case. The case is fought using Boies Schiller Flexner, a legal firm that employs Timothy L. Foden, who is probably the world's most noted litigation practitioner in the mining space.

What's not to like?

Such arbitration tribunals consist of three judges. Each side appoints one judge, and the third judge has to be agreed by both sides. For its own choice, Mexico appointed Prof. Philipe Sands, who is hostile to arbitration cases that are backed by litigation financiers. He views this type of funding as speculation at the expense of poor countries.

Also, the legal basis of the case isn't your typical bilateral investment treaty, but the NAFTA trade agreement between the US and Mexico. There is less of a track record of running such cases on that basis, and awards made in the past under the NAFTA agreement were smaller overall.

Silver Bull Resources has published a useful overview of the case in a July 2024 press release.

The stock briefly rallied by 100% in February 2025 but has since fallen back again. The company's market cap remains at a comparatively paltry CAD 7m (USD 5m).

At first sight, this appears like a case that does have some hair but which is good enough to make it worth following. That said, readers are encouraged (as always) to use this article as a starting point for undertaking their own research and due diligence.

Silver Bull Resources.

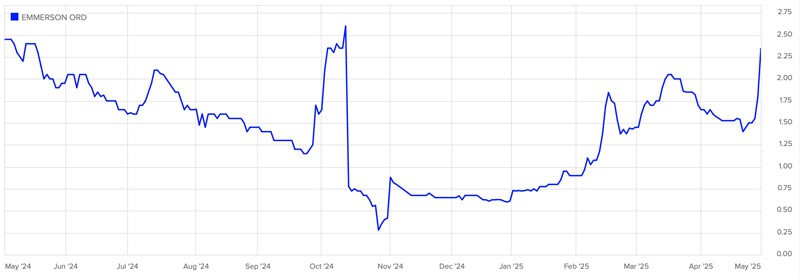

3: Emmerson

The case of Emmerson (ISIN IM00BDHDTX83, UK:EML) would have deserved to come first on the list, because of the quality of available background information and where the entire case is at.

Emmerson is a London-listed potash developer turned litigation play. The company's potash mine project in Morocco ticked many of the right boxes, such as lower quartile price economics, an experienced management team, further exploration upside, and a strategic location. However, the issue came when trying to obtain their environmental permit. In short, it never came.

The Moroccan government blamed prospective water usage for denying the permit. This would make sense given the country's issues with droughts. However, the company found a workaround for this issue, but still did not get the permit. All the while, a state-owned, multi-billion competitor was able to advance without such hindrances. Hypocrisy and nepotism much?

Eventually, Emmerson accepted that the only remaining way forward was litigation.

It is vital to the case that a local (and in this case, state-owned) company got favourable treatment to a foreign investor, as this is exactly the type of constellation that bilateral investment treaties cover. This angle and the clarity it provided further helped Emmerson to secure litigation funding. Unusually, the litigation funder also pays for the company's overhead, meaning there is hardly any risk of dilution while the case is ongoing.

A Polish investor with a real knack for litigation cases – Marcin Michalek – has published an incredibly detailed and insightful dossier about Emmerson. The 80-page humdinger doesn't just cover the case itself but also provides an overview of general aspects and similar cases. It's the single-most informative research report I have seen about such an opportunity, and anyone can download it for free or follow Marcin's regular posts on X.

In the past, Morocco saw through eight such arbitration cases under bilateral investment treaties. Five of these cases ended with a win or settlement for the claimant.

Emmerson will likely end up claiming USD 1-2.2bn. The company currently has a market cap of GBP 23m (USD 31m). Even if a claim is won, it usually involves just a percentage of the claim being awarded. Depending on the solvency of the responsible country, there may then be a settlement for a percentage of the award. E.g., an arbitration court could decide to award a claimant 80% of their claim, only for the two parties then agreeing to settle on a payment of 50% of the award (which in our example would equal 40% of the claim). In the case of Emmerson, the company will have to deal with the payout to the litigation funder, which eats up another significant percentage of the claim.

Still, a win for Emmerson could get investors a very high multiple of their money. Michalek's report contains an estimated net winning for shareholders of GBP 200m. The company released an update about its case on the day before this article came out, making the share price rally by 30% in a single day. Right now, Emmerson stock is trading at 11.5% of that potential amount, i.e. it would have a further upside of around 8x based on Michalek's calculation.

Emmerson.

It looks like a solid case, and one where you can rely on someone else publishing his findings to keep investors updated. That said, the case also experienced delays and setbacks in the past, so keep in mind that nothing is ever guaranteed. As the German saying goes, "On high seas and in courts of law, you are in God's hands."

4: Montero Mining & Exploration

The previously mentioned case of Montero Mining & Exploration (ISIN CA6126483032, CA:MON) is worth mentioning separately, even though it seems that this case is already done and dusted.

Because of the phased payments agreed with Tanzania, the company has had to schedule payouts to shareholders in phases.

The company is going to get 41 cents (Canadian dollars) per share of cash. However, the stock is currently just 31 pence and dipped as low as 26 pence during the market's recent bout of volatility.

Montero Mining & Exploration recently announced that it would distribute 30 pence per share as a return of capital (= tax-free dividend). The remainder will be invested in the company's existing mining projects, including a copper-molybdenum exploration concession in northern Chile's Atacama region.

If you manage to buy the stock in the low 30s, you will get most of your capital back and hold a stake in the mining projects at a low valuation.

In sum, much as this company is now at the very final stage of the litigation journey, the stock may be interesting for some of you for precisely that reason.

Montero Mining & Exploration.

5: Energy Transition Minerals

The case of Energy Transition Minerals (ISIN AU0000250250, AU:ETM) is one that Undervalued-Shares.com readers have already received a lot of information about.

Lifetime Members received a 51-page research report. After the report went viral amid the news on President Trump's interest in Greenland, a free summary of the case was published in a Weekly Dispatch on 24 January 2025.

Energy Transition Minerals was working to develop the Kvanefjeld resource project in Greenland, known as the world's second-largest deposit of rare earth minerals and the sixth-largest uranium deposit. Previously named Greenland Minerals & Energy, by 2020 the Australian company readied itself for taking Kvanefjeld into production. A political storm ensued, prompting Greenland's new left-wing government to reverse a legislation from 2013 to specifically prevent Kvanefjeld from going ahead.

Energy Transition Minerals initiated a legal case against the governments of Greenland and Denmark, using dispute settlement arbitration backed by international treaties. The company is claiming damages of USD 11.5bn, which would be 4x Greenland's GDP. Kvanefjeld was supposed to be part of the solution for Greenland's financial challenges, and instead it has now become a potential death knell for the territory's ambitions to break free from its colonial sugar daddy.

The firm has won the financial backing of Burford Capital (ISIN GG00BMGYLN96, UK:BUR), the world's leading litigation finance firm (and well-known to Undervalued-Shares.com Members through a March 2022 research report). The company offers to walk away from its ruinous financial claim if it was allowed to proceed with the project as had been originally agreed.

The Australians have to fight a difficult case, because it has become a matter of national politics. This particular case also has the added complexity (and risk) of jurisdictional issues as it sits somewhere between Greenland and Denmark – and the defendants will know to use this to their advantage.

The obvious question is, could a deal with the US provide a solution that allowed everyone to move on in a way that is politically face-saving and economically lucrative?

In between Greenland's economic struggles, Denmark's desire to extricate itself from the financially burdensome territory, and the economic heft of the US, an intelligent solution is waiting to be negotiated.

Energy Transition Minerals currently has a market cap of AUD 100m (USD 63m). That's less than 1% of its claim of USD 11.5bn. Much as the arbitration case is in its early phase and the company will have to share any award with its litigation funder, this seems too low a valuation relative to the size and prospects of the case. What the market seems to discount – and rightly so – is the fact that the claim is so large that Greenland could never afford to pay a high percentage of it.

It's a wild story overall, and one that has a political dimension that is at least as important as the legal aspects. The stock will likely experience further waves of speculative interest, just as much as individual days with painful sell-offs. Faint-hearted investors need not apply.

Energy Transition Minerals.

6: ParkerVision

The case of ParkerVision (ISIN US7013543001, OTC:PRKR) does not fall under a bilateral investment treaty. Instead, it's a court case that is going through the legal system of the US. That said, it's too interesting a case with too high a potential upside not to include in this overview, and it further illustrates the diversity of the sector.

ParkerVision has sued Qualcomm (ISIN US7475251036, NYSE:QCOM), the USD 160bn wireless technology, semiconductor and software company, over allegedly stealing its patented technology for wireless receivers. The case is for damages of USD 2.6bn.

Here is what's so interesting about this legal situation:

- There appears to be smoking gun-type evidence in the form of internal emails at Qualcomm, where staff members essentially confirmed that the company infringed on ParkerVision's technology and even did so wilfully.

- For Qualcomm to settle the case and make the problem go away would require a comparatively small amount of money relative to the firm's size.

- For ParkerVision, a win or even a decent settlement would translate into a ridiculously high upside for its shareholders.

The case gained more attention in the investor community when it was analysed in detail in an investor letter from 1 Main Capital. Their partner, Yaron Naymark, continues to cover progress through his X account. His update from October 2024 is worth looking at.

Some will balk at the idea of making themselves dependent on the US court system, which is different and much more difficult to understand than the arbitration system under bilateral investment treaties. Others may see this as an advantage. E.g., in the US legal system, where someone knowingly acted in bad faith, the damages can be increased by 2-3x to give them a punitive nature.

A Federal Circuit Court of Appeals issued a favourable ruling in favour of ParkerVision in September 2024, basically neutralising Qualcomm's best non-infringement argument. The stock then rose by 3x. In late March 2025, the Supreme Court issued a negative ruling in another aspect that ParkerVision had taken to court. As a result, the stock has given up some of its gains.

Without a doubt, it's a remarkable case to follow for nothing else but intellectual curiosity and spectatorship. ParkerVision currently has a market cap of USD 58m. If successful, this could be 20x multi-bagger or more just from the Qualcomm case, and ParkerVision is conducting four additional active litigation for patent infringement, against MediaTek Inc., Realtek Semiconductor Corp., Texas Instruments Inc., and NXP Semiconductors N.V., and, furthermore, has undertaken legal actions against Apple Inc., LG Electronics Inc., and TCL Technology. All of these legal cases insist on the same patents and technologies as in the Qualcomm legal case, and substantially expand the potential upside, should ParkerVision prevail in court against Qualcomm.

The downside is that this case has already been dragging on for 12 years. Qualcomm may simply pursue the strategy of trying to have ParkerVision run out of cash (or patience).

Overall, Qualcomm's strategy does not currently seem to be on a clear winning path. After ParkerVision's legal victory in September 2024, the probability of getting this case to a successful conclusion will have increased. ParkerVision also does not have to pay expensive legal fees as it has done a success-based deal with a US law firm. The lawyers stand to get 33% of a win, but nothing if ParkerVision doesn't succeed. Last but not least, ParkerVision now has a 12-year track record for finding money to fund its cause.

Qualcomm is not new to this game and may yet settle, as it has done in cases fought out with Intel Corp (in February 2023), Hisense (in November 2022), Zyxel Communications Corp. (in September 2021), and Buffalo Inc. (in May 2021).

ParkerVision.

The serious stage of the court process should start sometime in 2025, so the catalysts is not too far out.

For those who are not afraid of going into a US legal situation, this seems like an interesting stock to consider.

A low-effort way to get started and learn more is to use these videos and podcasts:

- "ParkerVision v. Qualcomm Litigation Background"

- "Inside the Shady Details of How Big Tech Giant Qualcomm Ripped Off ParkerVision's Technology"

- "Diving into the ParkerVision (PRKR) Litigation Against Qualcomm (QCOM)"

As this case shows, such special situations can go from total obscurity to quite widely followed investments with (small) institutional investors buying in even.

7: Sarama Resources

I often organise dinners for readers where those in attendance deliver a 2-3-minute pitch of their favourite idea.

One reader from Australia would have loved to attend these dinners to present the case of Sarama Resources (ISIN CA8031604074, CA:SWA), a company he had studied. However, given the distance he wanted to email his pitch instead:

"Sarama Resources had their ~3M oz gold asset expropriated (you be the judge of that) in Burkina Faso and have launched arbitration proceedings under the Canada / Burkina Faso bilateral investment treaty.

As a general rule in expropriations, if you can prove expropriation then you will get a legal award of at least sunk costs + interest. The company spent US$70M+ on this project so you are looking at an award of at least ~US$90M (much more if they can prove a sunk cost multiplier).

Take out an aggressive US$40M (a high number for ultimate conservatism) fee for a funder and that gets you back to US$50M net back to the company in a base case scenario.

Now the market cap as it stands today is just ~AUD$11M."

Indeed, it's a case that fits into the overall assortment of cases.

Has anyone done more in-depth research about this one yet? I wasn't able to find anything substantive, which goes to show the entire sector still remains rather opaque. This, in turn, creates the opportunity to get ahead of the crowd by doing your own research!

Sarama Resources.

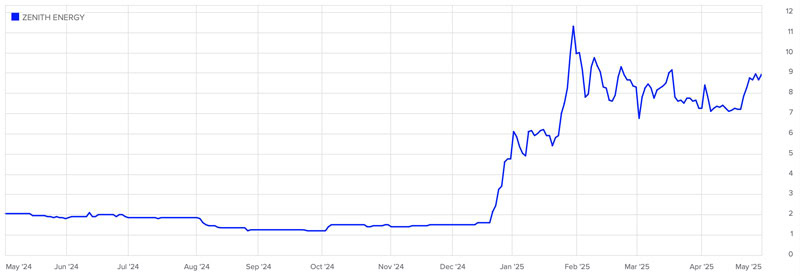

8: Zenith Energy

One of the more advanced cases is Zenith Energy (ISIN CA98936C8584, UK:ZEN), whose share price gained up to 700% between December 2024 and January 2025.

Zenith Energy.

The London-listed company took Tunisia to court under bilateral investment treaties, claiming damage for the expropriation of oil assets. What makes this case special is the fact that Zenith Energy has filed three separate claims, with the first one already awarded USD 9.7m in damages.

Even though this was the smallest claim, it had a game-changing effect. For the other two claims, the matter is now no longer whether the government of Tunisia acted unlawfully, but how much damages are awarded to the company.

The other two claims are for USD 130m and USD 503m, respectively. The decision for these two cases is now expected for mid-2025 and early 2026, respectively.

Tunisia is unlikely to make it easy for Zenith Energy, because countries never make it easy for winning claimants. However, this is a country that has the means to pay, and which owns assets that are vulnerable to being seized by creditors abroad.

Given these developments, Zenith Energy was able to carry out a placement of shares at a price of around 9.5 pence in late January 2025 (NOK 1.34 per share – it's a stock with a dual listing in Oslo). The placement price compared to the share trading at just 1.5 pence two months prior!

The Internet investor community – and Nordic investors in particular – has taken a real liking to this case (see this bulletin board post about the company).

Zenith Energy is now out in the open and a relatively transparent case. With a market cap of GBP 21m, its stock is trading at just under 5% of the claim value. This means the stock could multiply in value yet again, even though it is already up sixfold since December 2025. At the current price of 8.75 pence, you are paying less than the investors who bought into the share placement in early 2025.

As Zenith Energy shows, the multiples investors can achieve with these stocks when such cases work out are nothing but mind-boggling!

9: Almaden Minerals

A new case on the litigation finance scene is that of Almaden Minerals (ISIN CA0202833053, CA:AMM).

In a July 2024 press release, the Canadian company announced having secured USD 9.5m of litigation funding to pursue its international arbitration proceedings against Mexico under the Comprehensive and Progressive Agreement for Trans-Pacific Partnership ("CPTPP").

In a press release published on 21 March 2025, the company announced that it had filed a claim of USD 1.06bn against Mexico.

Is this a case worth following?

Substack Triple S Special Situations Investing just published a free analysis on Almaden Minerals.

Triple S Special Situations Investing is a publication that aims to find people to collaborate with, and it actively invites readers to send in any interesting special situations to review.

Who said the Internet wasn't full of wonderful resources and collaborative characters?

The share price of Almaden Minerals, in the meantime, looks like it is about to gain momentum. At a current market cap of CAD 20m (USD 15m), the company is still valued at less than 2% of the claim. At this stage of the journey, you'd expect it to head towards a valuation of 5%.

Almaden Minerals.

10: Panthera Resources

Amid all these exciting cases, I have to add an update to the case of Panthera Resources (ISIN GB00BD2B4L05, UK:PAT). Since publishing my in-depth analysis on 28 February 2025, a lot has happened.

For anyone who has not yet brought themselves up to speed, I cannot overstate the value of reading the 27-page research report published in December 2024 by VSA (available for free on Research Tree but you need to register). Besides my own article, this report provides all the foundational background. Outside of Marcin Michalek's report on Emmerson and the introductory chapter of my research report on Energy Transition Minerals, it also provides the single-best overview of the sector.

What's worth updating at this stage are the following three aspects:

- How the recent move of the gold price affects the size of Panthera Resources' claim.

- Why the company's "forgotten" West Arican assets are worth paying attention to.

- What type of investor I expect to get interested in this stock soon, potentially laying the groundwork for the next phase of the stock's ongoing re-rating.

Let's dive in!

The gold price has proven an unexpected bonus for this case. As the following section explains, it's reasonable to suspect that it played a role in the stock gaining so much additional momentum since early April 2025.

Panthera Resources.

A layman observer would expect that an expropriation claim was going to value an asset at the time of expropriation. So why does the gold price of 2025 play a role in a litigation case that goes back to 2015?

The world of litigation is its own realm, and within that, commercial arbitration cases negotiated in international courts are their own animal altogether. The way Panthera Resources' claim will likely be calculated is worth explaining further.

If a government dispossessed a house owner because their house stood in the way of a planned new highway, the legal case involves a so-called *lawful* expropriation. The resulting claim would indeed be calculated based on the facts recorded in the moment of expropriation.

Panthera Resources is known to be claiming multiple breaches of the bilateral investment treaty, and there will be different requirements for calculating the claim depending on which clause of the treaty these breaches refer to. An essential breach is that Panthera Resources is the victim of an *unlawful* expropriation. For such cases, the bilateral investment treaty between Australia and India will demand that – technically speaking – the reparations must wipe out all of the consequences of the act and reestablish the situation which in all probability would have existed if the act had not been committed. A layman would say that the company essentially has to be put into the position it would have been in had the unlawful expropriation not taken place.

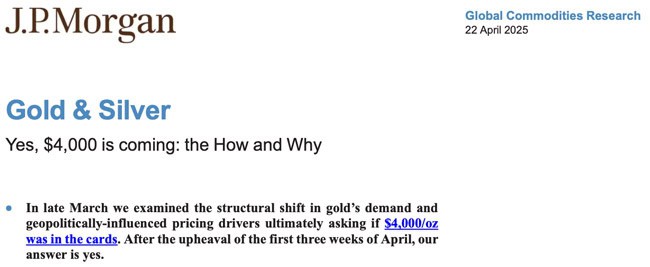

In such circumstances the more common method for calculating the company's claim will consist of calculating the claim based on the facts at the moment the award is made. If the judgment is made at a time when the gold price is USD 3,000 per ounce, then that will be the gold price used for calculating the payout.

Shareholders of Panthera Resources long saw it as a disadvantage that they had to wait for so many years to see their day in court. Suddenly, this delay has become a massive advantage. Gold was at USD 1,100 per ounce when the problems with India arose, but it is now at well over USD 3,000. Each day that gold trades at a higher value further adds to the data that the court will have to use when the damage is awarded. Put another way, Panthera Resources is also an indirect proxy for investing in gold.

It has become widely accepted that we are seeing a structural change in the gold market. No one would be surprised if gold stayed at USD 3,000 for a further two years.

Source: JP Morgan, 22 April 2025.

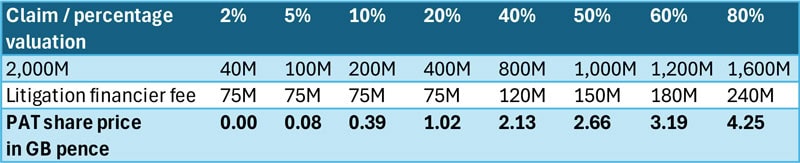

The change in gold price has the potential to make this case quite painful for India. Previously, most observers expected that the "statement of claim" that Panthera Resources is scheduled to deliver by 16 May 2025 will show a claim of USD 800m to USD 1bn. However, the profitability of gold mining ventures increases disproportionately when the gold price increases. Suddenly, even a claim exceeding USD 2bn does not seem out of the question anymore.

With all that in mind, it's not really a surprise that the share price of Panthera Resources has been rallying so strongly and with considerable numbers of shares being hoovered up. If the statement of claim turns out to be the type of scarily high number that some believe is now entirely possible, it'd be a game-changing development for the valuation of the stock.

Much as every case is different, there are some guidelines as to how such cases tend to be valued at different stages of the journey:

- A claim that is left for dead and not actively pursued would typically trade at 1-2% of its value.

- During the first half of a claim being actively pursued, the market would usually grant a valuation of 5-10% of the claim.

- In the later stage and assuming the case is going well, the valuation would usually approach 20% of the claim value.

- Eventually, the shareholders of a winning arbitration case may end up with 30-80% of the claim. E.g., I had early on featured the case of Rockhopper Exploration (ISIN GB00B0FVQX23, UK:RKH), which made a claim of EUR 291m against Italy. It was awarded EUR 190m, which equalled 65% of the claim.

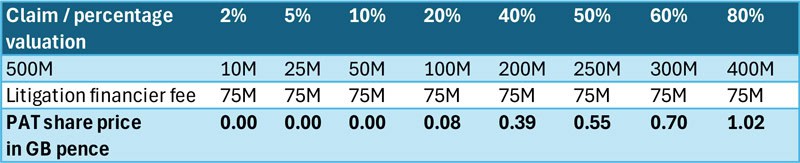

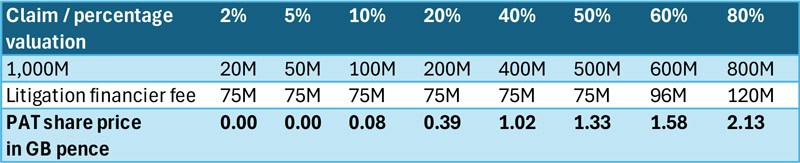

Panthera Resources has a fully diluted share capital of 240m shares. The one other factor that needs to consider is that the company has to share the spoils of a potential win with its litigation funder. Basically, it will have to pay its litigation funder either USD 75m or 15% of the award, whichever figure is higher.

The following are back-of-the-envelope calculations based on three scenarios for the claim size:

- USD 500m

- USD 1bn

- USD 2bn

The figures in the tables show the net result for shareholders, i.e. these figures are already factoring in the share of the litigation financier.

Put simply, if the claim now came out at USD 2bn or above, then a valuation of 10% of the claim would need to see the share price rise to 39 pence. Compared to a current share price of 18 pence, the stock of Panthera Resources seems to have catch-up potential even in the immediate future, provided my analysis of the likely claim will not prove entirely off. Never mind scenarios where the company wins (or settles) and gets awarded 30, 50 or 80% of the claim – and payable from a country that can actually pay. As the table shows, if the company was awarded 80% of a USD 2bn claim, then its shareholders would see 425 pence per share of actual cash.

That's before anyone has even mentioned the company's assets in West Africa.

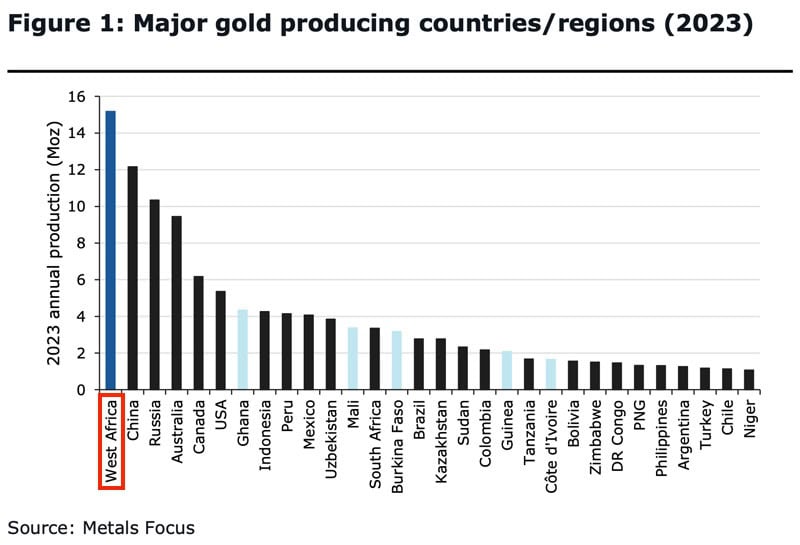

After Panthera Resources got expropriated in India, it set up new gold mining projects in West Africa. There are four projects in Mali and Burkina Faso. The entire region has long had issues with political instability, but it absolutely killed it when it came to gold production. And within the West African gold region, Mali and Burkina Faso outperformed all other countries.

Source: Canaccord Genuity, 16 April 2025.

At the outset of reporting about this investment case, I discarded the West African projects as largely irrelevant. Mali made headlines last year for threatening the arrest of the CEO of Barrick Gold (ISIN CA0679011084, NYSE:GOLD), and early-stage gold exploration projects in general were not exactly the darling of the stock market at the time.

Could this be about to change?

That's the line of argument taken in "Golden opportunity in West Africa", a 32-page report published by Canaccord Genuity on 16 April 2025. The combination of a higher gold price and political changes in the region could bring gold projects in the region back to the fore.

As the report put it (slightly re-arranged for easier readability):

"West Africa (i.e., Ghana, Mali, Burkina Faso, Côte d'Ivoire, Guinea, and Senegal) has emerged over the last decade to now be one of the world's largest gold producing regions (>15Moz in 2024).

In the last 20 years, ~95Moz of gold has been discovered in West Africa, compared to Canada's 61Moz, Colombia's 59Moz, and Australia's 29Moz. Prospective geology has contributed to this high discovery rate

Advantages of operating in the region include generally faster permitting times, lower capital intensities with very few capex blowouts, shorter construction lead times, as well as lower production/exploration costs.

Following a relatively tumultuous 2021-2024 with numerous coups/government changes and revisions to some country's Mining Codes, we think the proverbial dust may be starting to settle. Combined with gold prices near all-time highs, we see opportunity for investors given country risks look increasingly mitigated by strong fundamentals and significant valuation discounts (which we think will narrow as the gold cycle progresses). In our view, investors should be up-weighting exposure to the West Africa region."

What does all that mean for the West African assets owned by Panthera Resources?

I had previously hoped that they would be spun off as soon as possible to make the company a pureplay on the Indian litigation.

It may be time to revise this view.

Thanks to its recent share placement raising GBP 2.7m, Panthera Resources is fully funded for maintaining its stock market listing while seeing through its arbitration claim (whose legal costs are funded separately by a litigation financier). With its strong financial situation and the rising share price, it wouldn't take much for the company to bin its previous spin-off plans and instead raise a million (or two, or three) to first take these West African assets forward itself. To alleviate the fears of litigation-focused investors, raising this funding could be structured in such a way that it also signals a clear intent of eventually fully separating the litigation from the gold play. What Panthera Resources would not want its backers to fear is that any potential win from the litigation claim could be re-routed to West African resource exploration. The company's CEO already committed to paying out any win from the litigation claim as a special dividend, and previous announcements also made it clear that the activities in West Africa will be kept separate from the litigation case. There are a number of obvious options for carrying out such a funding round while committing to the concept of separating these two activities.

Outside of the need to keep these two separate strands of activity separate, the recent structural changes in the gold market and ongoing political changes in West Africa do make you ask why shareholders should give away future potential on the cheap.

Three of the four West African assets of Panthera Resources are currently almost impossible to value. However, it's already clear that the fourth one is potentially rather interesting – Kalaka in Mali. As the company's website states: "Kalaka is located on the highly prospective Baoulé-Mossi Domain of the Man-Leo shield in the West African Craton. The craton is one of the world's great gold provinces and the largest Paleoproterozoic gold-producing region."

Given the recent focus on the company's exciting litigation case combined with just how out-of-favour West Africa had long been, hardly anyone will have spent much time on analysing these gold assets. Undervalued-Shares.com did just that.

This prospective gold field saw Panthera Resources' subsidiary drill in one location. Even though this was just a first drill, it already led to an inferred gold resource of 803,000 ounces. Remarkably, there are 20 (!) geologically similar structures in Kalaka. As the company's material states, Kalaka could turn out to be a multi-million-ounce gold district if only a handful of these other geological structures turn out a success.

Kalaka's problem had long been the relatively low gold concentration of just 0.5 grammes per ton. However, such low-concentration gold projects can become very lucrative once the gold price surpasses a particular level. Their profitability then turns into the famous hockey stick.

What's it all worth for Panthera Resources shareholders?

The internationally accepted valuation of inferred gold resources is USD 30-40 per ounce of gold. Based on the company's 85% stake in Kalaka, this would be USD 20-27m for the inferred gold at Kalaka, plus throw in a West African discount of 10-25%, as shown in the report by Canaccord Genuity. It'd still be a significant value in the context of Panthera Resources' low market cap of GBP 44m (USD 59m). That's before factoring in that this inferred resource stems from exploring just one of 21 interesting geological structures that the company has acquired a right to. Besides, there are the other three assets that could yet turn out to be interesting once a bit more work is invested in them.

Allenby, another brokerage firm that covered Panthera Resources in the past, published its analysis of Kalaka in a note from 5 February 2025. Gold was significantly lower then and the sentiment for West Africa was still dire. Even then, Allenby valued Panthera Resources' stake in Kalaka at USD 8.5m. (The Allenby reports are also available for free on Research Tree.)

Certainly, the West African portfolio is not worth zero, and it should not be given away on the cheap for the sake of a hurried solution for the company's two-fold structure. My instinct is that once a bit more money has been spent on these assets, they would likely be worth in the tens of millions in any case.

Just like the Indian litigation claim, these assets could one day turn out to have been a real steal for those who got in early.

Which leads to the final point – one that is both an update and a conclusion.

Litigation cases like Panthera Resources tend to go through three phases.

The initial phase often involves a broken, left-for-dead company having to build new momentum behind its case. Its previous shareholders will have largely lost interest because the project they invested in did not work out. Oftentimes, sizeable legacy shareholders want out, which weighs heavily on the share price. Institutions shy away from this type of situation, meaning there is just not the weight of money available that would be necessary to restructure the shareholder register. Investors who are interested are usually private investors and "punters". This is where Panthera Resources was during 2024 when its share price languished seemingly forever around 7 pence and the company had a market cap of not even GBP 15m. This is the period when a litigation stock typically trades at 1-2% of the claim value – not that anyone at that time has actual clarity what the claim value will be. Incredibly, at these prices one of the company's disclosed large shareholders was selling and it would have been perfectly feasible to deploy a decent amount of money.

The second phase is about investing in the journey as the instrument gets re-rated. Panthera Resources is on the cusp of entering this second phase. The litigation case is fully funded and about to get "real" because the statement of claim is scheduled to drop by 16 May 2025. Releasing the statement of claim tends to be a transformative moment for a litigation investment because it provides indisputable clarity what the claim actually amounts to. During this middle phase, a litigation stock with as strong a set-up as Panthera Resources may head towards a valuation that is 5-20% of the claim. That's usually 5-10% during the first part of this phase, and 15-20% during the last five minutes of this phase.

During the third and final phase, investors are betting on the collection of the award.

Panthera Resources could soon go from attracting just high-net-worth investors and punters to appearing in one or the other special situations fund. Just like 1 Main Capital did in the case of ParkerVision, it can make sense for smaller funds to invest 0.5% or 1% of their capital into a case like Panthera Resources. Worst case, a negligible amount of the fund's assets are gone. Best case, the fund's performance leaps by 5-20% from a single investment. Given the solidity of the company's legal claim and the fact that it's backed by one of the world's leading litigation financiers, a probability-weighted assessment of this opportunity yields an attractive risk/reward ratio. A revised and updated version of the VSA report – if such a report was forthcoming – could certainly help in attracting the interest of smaller funds.

Combine that with Panthera Resources' market cap gradually getting to the level where it becomes feasible to buy stock for a million (or two) through the open market, and you get an investment case that is maturing to a point where small funds could get interested indeed. Never mind the company's growing ability to raise a bit more equity if needed. Once Panthera Resources has a market cap in excess of GBP 50m, raising a few million to take forward the projects in West Africa shouldn't be too difficult anymore. Whatever the decision for these assets in the end, it's proven a godsend that Panthera Resources didn't choose a hurried option for them in 2024. The company can now negotiate from a position of strength.

It's a remarkable turn of events for a company that had been left for dead until last year.

Is Panthera Resource the feline that is about to become the king of litigation cases?

Each such case is different, complex and – ultimately – fraught with the risks that you inevitably encounter in legal situations. Nothing is guaranteed until the claim is won and the money is actually in the bank.

That said, Panthera Resources does stand out for its combination of factors:

- India has a track record of paying out where it has been ruled against in international arbitration, and up to nine digits. In this regard, India is almost the opposite of the Republic of the Congo.

- The market is starting to recognise the strength of the dynamics of the gold market. What would happen to this claim if over the coming two years of this case playing out the gold price reached USD 4,000 or USD 5,000 per ounce? Some of the scenarios then possibly appear too bonkers to even write about at this stage. Finance nerds would ask if Panthera Resources may be an asset-light way to get exposure to the gold price, i.e. without having to invest into an actual mining operation.

- Backed with plenty of capital from its litigation financier and fresh equity for the maintaining of the listing, Panthera Resources can now focus on India's weakness in the legal case. By putting the expropriated gold field up for auction, India has provided a bit of a smoking gun. The government itself said in the media that the new license now being auctioned off was worth a nine-digit amount. It has become impossible for the government to argue that the license is worthless. Given that the environmental permit comes attached to the new auction, there is also no credible line of argument around environmental factors – which treaty-breaking countries often use as their ultimate defence. In fact, the area where the Bhukia gold field is located is not even inhabited by people but by grazing goats.

Thanks to the current gold price, shareholders may learn from the upcoming statement of claim that even the base scenario now amounts to a scarily high number.

It all makes you wonder if this isn't at some heading towards a settlement. For India, waiting could turn into a painful matter indeed. Politicians are naturally more likely to drag their feet and try to leave a problem for their successor, but the sheer weight of the potential claim could eventually lead to a deal.

Panthera Resources' CEO, Mark Bolton, handled three prior arbitration cases, all settled through settlement. This is not his first rodeo, and he is incentivised through his equity scheme.

Without a doubt, there'll be stretches of waiting coming up for Panthera Resources shareholders. Any case of this magnitude will be prone to procedural delays, not the least as a country like India could drag its feet. Investors will have to be aware that this case will likely take three to four years to come to a decision. During such a lengthy period, there'll be phases of boredom and setbacks.

That all said, it appears that owning some stock in Panthera Resources and tucking it away in the furthest corner of your portfolio may not be a bad idea. Alongside Emmerson, Panthera Resources is now becoming known as a top-tier arbitration play.

The economics and the overall constellation seem great for getting a deal done eventually.

Where next?

Mihail Stoyanov, author of TheOldEconomy Substack, recently summarised his view about the best investments in the current volatile environment:

"The focus will be on event-driven ideas with low correlation and a low center of gravity. In this category fall

- Distressed Debt

- Litigation Finance

- Critical Minerals "

Indeed, litigation finance has recently proven that it's quite independent from overall market volatility. E.g., the share price of Panthera Resources only dipped briefly during the strong sell-off suffered by world markets in early April 2025, and the share price has now doubled year-to-date. Other examples cited above showed similar behaviour.

Clearly, there is growing interest in this niche sector. This brings with it positives and negatives.

Among the positives is the easier availability of research done by Internet sleuths, and the faster share price movement when a case advances.

Among the negatives is growing competition for the generally very small amounts of stock available and less time to build a sizable position.

The good news is, there are 100,000 publicly listed companies in the world – a fact that few people seem to realise in today's age of fascination with Mega Cap companies. Given the sheer number of companies that you can buy stock in through a recognised market, at any given time a few more interesting opportunities will be hiding somewhere. In fact, while writing this article, I realised that I would actually have enough material to write *another* such feature of ten litigation investment cases. My readership, and the type of investor who attend my annual Weird Shit Investing conference (coming up again in June 2025), oftentimes help me locate them.

For now, I'll leave it at reporting on this sector. Undervalued-Shares.com did its part in making this sector better known, and there is now an entire ecosystem emerging of private investors and small institutions that follow the sector and help create transparency. The insane upside of some of these plays is probably going to unfold an effect all of its own.

P/E of 2.5 and >20% dividend yield with this coal stock

Looking for a deeply contrarian, deep value investment with high payouts and buybacks?

The latest Undervalued Shares research report has one such stock in store for you. It's a coal stock, and it's currently trading at a bargain price.

In fact, it's the second time this stock is trading at such low valuation multiples. It was similarly cheap in 2021 and then soared by 15x.

It's unlikely that you'll see this stock do 15x again, but it should be a relatively low-risk 2-3x when the situation normalises – and you'll get plenty of dividends while you wait.

P/E of 2.5 and >20% dividend yield with this coal stock

Looking for a deeply contrarian, deep value investment with high payouts and buybacks?

The latest Undervalued Shares research report has one such stock in store for you. It's a coal stock, and it's currently trading at a bargain price.

In fact, it's the second time this stock is trading at such low valuation multiples. It was similarly cheap in 2021 and then soared by 15x.

It's unlikely that you'll see this stock do 15x again, but it should be a relatively low-risk 2-3x when the situation normalises – and you'll get plenty of dividends while you wait.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: