The single most popular report I've ever published on my (old) investment website was "The secret share that lets you own the best Monte Carlo properties – for free!"

To this day, readers are still sending me emails about it. Which is quite incredible, given that I published this report back in 2004 - 1 ½ decades ago.

By popular demand, an update report is long overdue so I'm heading down to Monaco in two weeks' time (after all, it's best written on the back of an actual site visit).

Besides, visiting Monte Carlo is always good fun!

Here is what's coming my Members' way

Finding out about the shares of the "Société des Bains de Mer et du Cercle des Étrangers à Monaco" (literally: "Society of Sea Baths and Circle of Foreigners in Monaco") was definitely one of the most memorable moments in my equity investing career.

"SBM", as the 150-year-old company is commonly referred to, was a thinly-traded, long-forgotten company traded on the Paris Stock Exchange.

Its property portfolio in Monaco consisted of:

- Four deluxe hotels, including the Hôtel de Paris and the Hôtel Hermitage.

- The world-famous Casino de Monte-Carlo.

- Over 30 bars and restaurants, including the Café de Paris in Casino Square.

- Three spas, including the famous Les Thermes Marins de Monte Carlo.

- The Monaco Opera building.

- Jimmy’z, reputed to be the world's most expensive night club.

- And a few other, similarly high-quality assets.

Do property portfolios come any more exclusive than this?

Throw in the legal monopoly to operate casinos in Monte Carlo for good measure.

As I realised while taking apart its balance sheet, it was one of the most unusual investment bargains available anywhere in the world at the time:

- The company was debt-free, and its net cash reserves were higher than its market capitalisation.

- Since you didn't even have to pay the full price for the company's cash reserves, the real estate was essentially thrown in for free.

- There were exciting entrepreneurial plans in the making at the company, some of which involved Steve Wynn, the US casino magnate.

They say that Monaco is a sunny place for shady people. It appeared to me at the time that it was also a place for shrewd investors seeking incredible investment bargains.

My research report went "viral" (before that word was even invented) and was read by investors around the world. I vividly remember some random guy in Hong Kong asking me about it when he realised that I was the author. Speak of a popular story!

The share didn't do too badly, either.

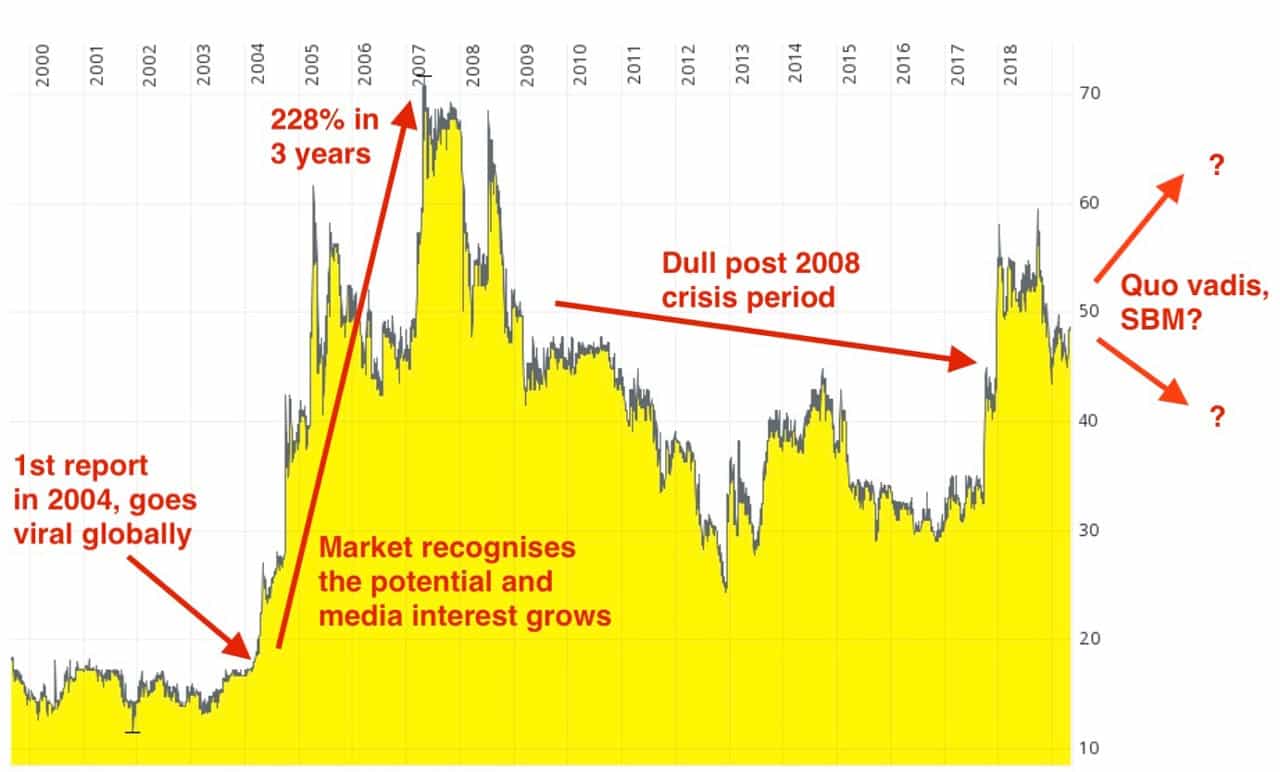

It was trading at EUR 188 when I first wrote about it in Spring 2004, and it rose to EUR 720 by Spring 2007 (a 282% gain). The market had started to appreciate the story, and there was widespread anticipation that exciting times were ahead for the company.

Sadly, not all of this optimism was justified, as we know now.

How the company fared during the 2010s

SBM is majority-owned by the ruling family of Monaco, the Grimaldis, led by Prince Albert. His family owns 64% of the stock, and for all intents and purposes, they could manage it like a privately-owned family company if they so wanted. After all, Prince Albert is the sovereign of the tiny country, and he enjoys near-absolute power over all companies that operate in its territory.

Back in the days, I made several (daring) predictions:

- Monaco was going to expand its landmass by creating a floating city off its coast, and SBM was going to have a part in the project.

- The company was going to use its incredible triple-brand (consisting of "SBM", "Monaco" and "Monte Carlo") to expand its gambling and casino operation elsewhere in the world and online.

- In order to increase its net worth and access to cheap financing, the Grimaldi family was going to implement better investor relations and increase the company's prominence on the stock market.

With the benefit of hindsight, it's now clear that I was (only) partially right:

- Monaco is indeed expanding its land mass by building a new borough on newly created land. If you aren't yet familiar with this incredible project, check out anseduportier.mc. However, not only has this taken bloody 15 years to get underway. SBM was also largely bypassed as far as construction and ownership are concerned.

- The company did make various entrepreneurial attempts to expand the use of its brand names and conquer new markets for its casino division. E.g., it now operates a gambling operation in the Middle East. However, the overall results of the management's achievements in this area are, at best, mixed. Having watched this from afar, I got the impression that these efforts were half-arsed.

- SBM has improved its investor relations and today is a much more modern company than it used to be. Overall, though, they only partially unlocked the company's potential to be more appealing to investors.

What did this all lead to in terms of investment performance?

Like most stocks, the 2008/09 financial crisis and its aftermath led to the share price suffering. By 2012, the share was back at EUR 250, or (to be more precise) EUR 25 because the company had in the meantime carried out a well-intentioned 1:10 stock split to make the stock easier to trade.

During 2017/18, it was back up at EUR 60 because of speculation about various measures to advance the company. In the meantime, Qatar had bought a small stake in the company. However, everything stalled once again and most recently the stock has been trading in a range between EUR 45 to EUR 50.

Looking at it from the perspective of anyone who may have bought into the company back in 2004, this was certainly not a terrible investment (there have also been dividend payments along the way), but it could have done a lot better. No doubt, the majority owners are to be blamed for this – they'd have the power to make it all perform much better!

Though I am saying all of this based on a very initial assessment, and while working from a third world country where it's slow and tedious to research a subject on the web. But fear not, a more in-depth piece of reporting is on the horizon.

After all, there ARE some genuinely noteworthy developments to report on.

Monte Carlo property is more valuable than ever before

Since I wrote about SBM in 2004, property prices in the space-restricted Principality have rallied like never before. Monaco property has been one of the fastest-rising asset classes in the world, producing headlines such as "World's most expensive penthouse changes hands in Monaco for USD 335m."

No doubt, SBM's portfolio of ultra-prime real estate across the Principality is more valuable than ever. They say the rich always get richer and in Monaco, this does have an effect on property prices rising faster than in most other places on the planet. Add to that the fact that many of SBM's properties are serious trophy assets, i.e., they would command a trophy premium if they were sold.

Also, the gambling division could have a few aces up its sleeve (no pun intended). SBM today owns 50% of Betclic Everest Group, a major player in the European online gaming sector with a particularly strong market position in France.

Last but not least, whereas SBM didn't get to participate in the land expansion, it could have a few surprises still coming.

Combine that with a management that has made unquestionable advances with investor relations, and there is a legitimate question to be asked: might SBM be a worthwhile investment for the upcoming years?

Could it be even more undervalued (relatively speaking) than it was back in 2004?

If anything, we'll have some fun looking at this unusual animal of a company

I will look at all of this in more detail.

On 17 and 18 May, I'll be roaming the streets of Monaco for meetings with local contacts. Also, I am a big believer that simply getting a first-hand impression of the situation on the ground always yields valuable clues for an analysis, even if you don't know in advance what exactly you'll find.

The jury is still out, and I have an entirely open-minded as to whether or not SBM is a worthwhile investment. What I have set my mind on, however, is to produce a fact-laden, entertaining report. Even if I conclude that SBM isn't a worthwhile investment going forward, I'll write a summary of my reasoning.

Members of my website get access to ten extensive research reports per year, as well as two bonus reports. These may be about an investment, or something that is of general interest to my readers. In 2019, one of these bonus reports will be about SBM.

Reader feedback is always useful

I always appreciate hearing from readers, whether it's praise, criticism, or questions.

What I've learned from many emails is that SBM is the ONE company that truly deserves an extensive update.

With this in mind, wish me well for my research trip on the shoreline of the Mediterranean!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Want to receive my next research report on the day it is released?

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Updates on previous research reports

- 2 special publications per year

P.S.: Check out my latest in-depth report about an investment opportunity you won’t get to read about elsewhere (yet!). Available for Members only so sign up now to get immediate access.