Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

ALK-Abelló – Denmark’s next pharma highflyer?

Fast-forward to today, and its stock is up 65 times. The company is now Europe's most valuable pharmaceutical firm, and its EUR 300bn market cap tops the GDP of its home country.

Will Denmark's highly educated workforce give birth to another such success story?

You are unlikely to have heard of ALK-Abelló, but it's a hidden champion that could yet get a lot more attention over the years to come.

The company commands a 35% global market share in immunotherapies for allergies. Just 1% of its 500m strong target market is using these therapies yet, which leaves massive potential for growth.

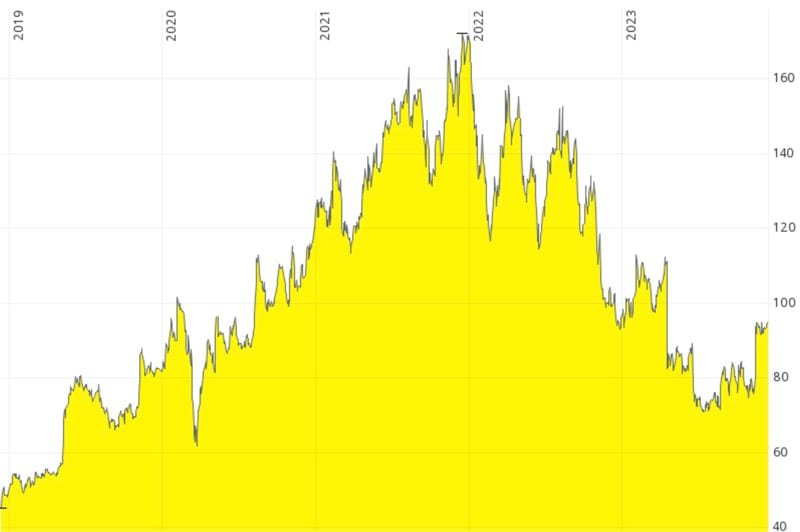

ALK-Abelló's share price is down 40% over the past two years. Is now the right time to add this company to your watchlist?

ALK-Abelló.

A global epidemic

An allergy is hypersensitivity of the immune system to substances that would normally be deemed harmless. Today's most widespread allergies include reactions to food (such as peanuts, shellfish, or dairy), pollen of different kinds, dust mites, and some metals. Symptoms usually include red eyes, an itchy rash, sneezing, coughing, a runny nose, shortness of breath, or swelling. Some sufferers can get severe allergic reactions, known as anaphylaxis. They tend to carry an EpiPen with them, which is the brand name for an auto-injectable device that delivers the drug epinephrine.

Speaking about the root causes of allergies is a minefield similar to debating vaccines.

Today, more than ever before, allergies are common in the developed world. Around 20% of the UK's population suffers from allergic rhinitis, i.e. an inflammation of the inside of the nose caused by allergens such as pollen, dust, mould, or flakes of skin from certain animals. About 6% have at least one food allergy. An article published by The Times this year (see below) even claimed that 40% of the world's population had allergies. Either way, a large number of people are affected.

What caused the rise of allergies?

One popular explanation is that of a correlation between the general decline in family size and the rise in childhood allergies. Having fewer siblings who bring home illness to train your immune system, combined with overzealous cleaning, chlorinated water, antibiotics, and vaccines have "protected" children to such an extent that they have developed these reactions. Other theories consider this explanation as problematic, or at least incomplete. E.g., why has there been such a dramatic increase in peanut allergies? Frequent fliers nowadays barely get through a month without flight attendants asking passengers to refrain from eating peanuts because of a case of extreme peanut allergy onboard. This wasn't the case during the 2000s.

Source: The Times, 11 June 2023.

Whatever the cause may be, it's undisputed that there are now at least 500m sufferers of allergies in the world, 10% of whom are said to be suffering from severe allergies. Allergies cannot be cured, but it's possible to train the immune system to react in a different way. In other words, you can soften the effects and make the condition manageable and bearable.

The majority of allergy patients currently suffer quietly and self-treat with over-the-counter drugs, without seeking the advice of allergy clinics or specialist doctors.

One firm that is on a mission to change that and better the lives of allergy sufferers started in 1923 as Allergologisk Laboratorium København. Today, the company is known as ALK-Abelló, and it's a hidden champion that has so far existed largely off the radar of public market investors.

Hard-earned market leadership

With a 35% global market share, ALK-Abelló is the market leader in its field. However, during the first decades of developing allergy treatments, the firm had to overcome many struggles and the odd hairy situation.

In the 1970s, ALK-Abelló found it difficult to raise sufficient capital from investors to keep going, and as a result it became majority-owned by a Danish foundation. A few years later, it was merged into a Danish food ingredient company.

A landmark in ALK-Abelló's history was the 1992 merger with a Spanish competitor, Abello Pharmaceuticals. The company's current name is a combination of the three initial letters of its original name and the name of its Spanish merger partner.

Its focus on researching how allergies impact the immune system made new and improved allergy treatments available. E.g., in the 1990s, ALK-Abelló was the first company to offer allergy sufferers the option of administering immunotherapies that were delivered as drops placed under the tongue ("sublingual immunotherapy" in industry lingo, or "SLIT"). These drops were first offered for grass pollen, then for other allergens such as ragweed pollen and house dust mites. These therapies now contribute just under 50% of the company's annual revenue of DKK 4,839m (EUR 648m).

The other half of the group's revenue mostly comes from "subcutaneous immunotherapy", or "SCIT". These are drops for traditional injection-based allergy treatment.

Immunotherapies can be a tremendous blessing for the patient, but they also involve a fairly lengthy process where the patient has to get multiple injections or take a tablet many months before the pollen season starts. So far, only 1% of allergy patients have gone down this treatment route. One could say that the market has so far refused to take off and will remain a small niche forever. Alternatively, one could say that companies in this field have the potential to grow by a high multiple if or when allergy sufferers start to adopt these therapies in larger numbers.

Will they, or won't they?

Strengthened fundamentals

Allergie therapies are a market that few investors would have looked at.

ALK-Abelló's closest competitor is Stallergenes Greer, a Swiss firm that has about one-third the annual sales of its Danish peer. It's privately held.

The UK's Allergy Therapeutics (ISIN GB00B02LCQ05, UK:AGY) is publicly listed, but it has annual sales of just a sixth of what ALK-Abelló achieves. Following a 90% drop in share price over unresolved funding issues, its market cap has shrunk to less than GBP 100m.

A couple of other firms in the space are either in clinical trial stage, focused on just a narrow part of the market, active in ancillary areas such as EpiPens, or part of large conglomerates.

In other words, this is not an easy, obvious sector to get exposure to. You'd have to look through Danish companies, and American investors would have to look up the respective company's sponsored ADR programme (ticker symbol AKABY; five ADRs represent one ordinary share).

One of the other reasons why ALK-Abelló hasn't got a stronger profile among investors yet is its 2017 reset. At the time, the company ended a long-standing collaboration with Merck, and a new CEO created a new strategy to achieve faster growth and better profitability. The reset required a share issue to raise more funds and accept lower earnings during the late 2010s, to allow the company to grow faster and become more profitable leading up to 2025. At the time, the market viewed this as a setback, and the stock price dropped.

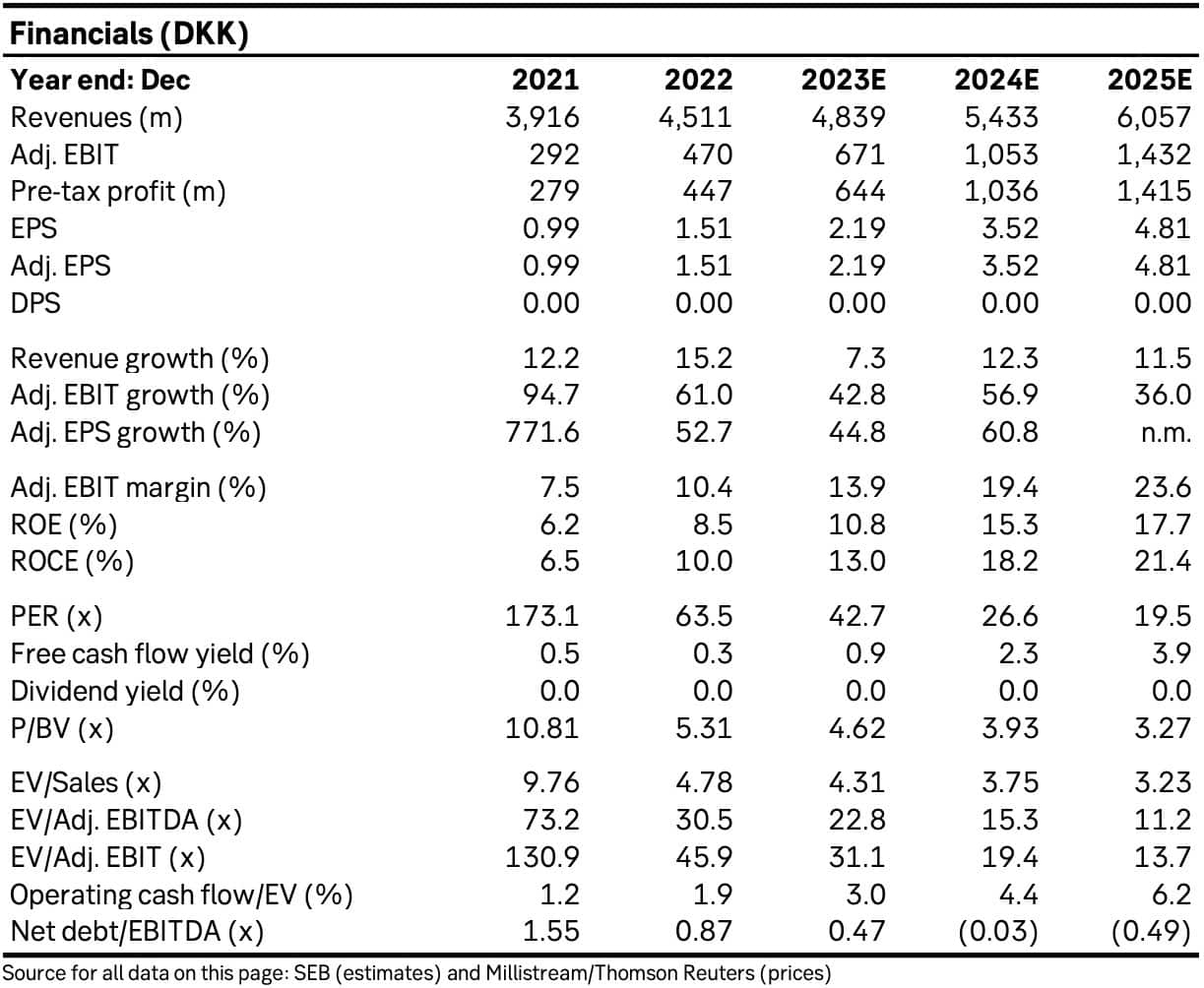

It's not been that widely noted yet that ALK-Abelló has now entered the period of successful execution. The company has a goal of 10% annual sales growth, which it seems to exceed in 2024 given the latest estimates of 12% sales growth next year. It targets an EBIT margin of 25% by 2025. In 2023, the EBIT margin will likely come out at just 13.9%, but SEB Equity Research projects it will reach 19.4% in 2024 and 23.6% in 2025.

The trajectory looks promising. ALK-Abelló wants to become the most relevant company for people with allergies, and the team effort of its 2,700 employees seems to be taking it towards that direction.

Will word spread?

Among the triggers and catalysts that shareholders of ALK-Abelló are unlikely to experience is a bid for the company. The foundation that bought control of ALK-Abelló in the 1970s still controls 40% of the share capital and 67% of the votes. Another 5% are held by a Danish government-controlled pension fund. These appear to be true long-term holders.

What seems more likely to provide uplift is the combination of a reasonable valuation and the undisputed growth prospects of the sector. If the latest set of estimates from SEB Equity Research works out, ALK-Abelló stock is currently trading at a 2025 forward EV/EBITDA multiple of 11. For a global market leader with this kind of growth prospect, that's not a demanding valuation. SEB Equity Research currently has a target price of DKK 130, which is 35% above the current share price of DKK 95 but still way below the 2021 high of DKK 170.

Source: SEB Equity Research, 13 November 2023.

Another analyst following ALK-Abelló is Ole Søeberg, head of Nordic Investment Partners, a family office that organises the annual Nordic Value investor conference in Denmark. Based on a mix of different valuation methods incorporating metrics such as forward EV/EBIT, P/E, P/CEPS and an NPV model, Søeberg gets to a five-year target price of DKK 160-200. His analysis is available for free online.

Two factors that could help along the way: more active investor communication and a bit of luck with product adoption.

ALK-Abelló last held a Capital Markets Day in 2013. Clearly, as a company that has no funding needs and is controlled by a shareholder with a very long-term outlook, there is no great need to woo and please capital markets. Still, it now has a market cap of DKK 19bn / EUR 2.5bn, and as such a slightly more active approach to investor relations would seem called for. To give credit where credit is due, ALK-Abelló did briefly present itself at this year's Nordic Value conference (which is how I came across the stock), and participated in five roadshow events in early 2023.

Another aspect that could help the firm not just with investor relations but with sales and growth would be some kind of cataclysmic event to speed up product adoption by allergy sufferers. This is impossible to predict, but it could happen at some point. A story about a celebrity allergy sufferer appearing throughout global media, or a big screen movie appearance making the treatment go viral – this could provide a sudden boost that could transform the level of interest that investors are paying to the company.

It does remind me somewhat of reading about Novo Nordisk in the 1990s and early 2000s, when diabetes was a well-known issue but few paid much attention to the stock of this Nordic company. In retrospective, how could I miss this one? After all, we all knew that diabetes was only ever going to become yet bigger and there was only one global market leader that dealt with it.

As a world leader in a market that is ridiculously underpenetrated and growing in size, ALK-Abelló seems to have a lot of opportunities. Getting this message out to the public seems to be the major hurdle right now, but one that could be easily resolved and which the company has already started working on to a higher degree.

The allergy epidemic isn't likely to go away, and there are just a few competitors in this space. ALK-Abelló may just end up doing incredibly well over the next decade or two.

Transformation ahead for this UK high-street retailer

If you had bought into this company in 2010, you'd by now have gotten all of your money back through dividends, and retain a stake in a business that is worth 2.5x more than what you invested originally.

In the UK, this company is the most profitable in its sector. Crucially, it's now also turning into a growth play.

You will know the brand name, but you are unlikely to have heard about this new investment thesis before.

Transformation ahead for this UK high-street retailer

If you had bought into this company in 2010, you'd by now have gotten all of your money back through dividends, and retain a stake in a business that is worth 2.5x more than what you invested originally.

In the UK, this company is the most profitable in its sector. Crucially, it's now also turning into a growth play.

You will know the brand name, but you are unlikely to have heard about this new investment thesis before.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: