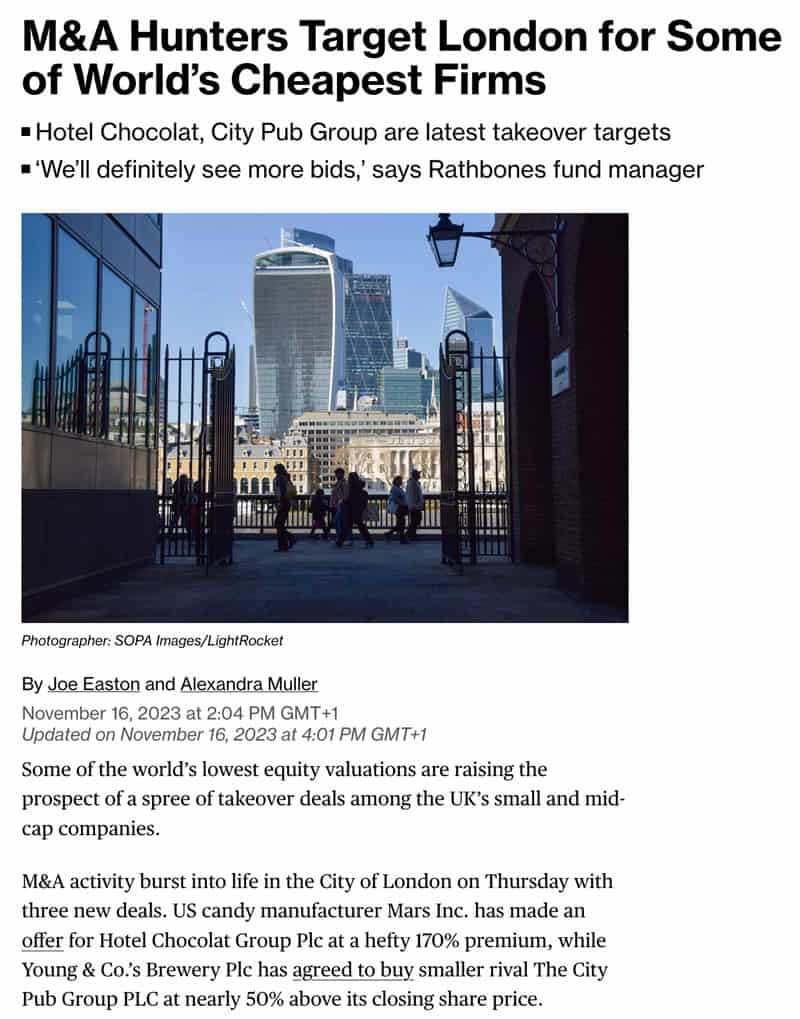

The stock of a well-known British retail chain recently gained a staggering 170% in a single day, thanks to a lucrative bid.

The case caused a flurry of excited media reporting:

"M&A Hunters Target London for Some of World's Cheapest Firms"

"Strike! Another Cheap UK Share Exits the Market"

"Cheap UK shares are now prime bid targets"

Takeover bids for undervalued British companies is something that Undervalued-Shares.com has been droning on for years.

Which British stocks are prime takeover targets in 2024, and which sectors are worth a closer look?

Source: Bloomberg, 16 November 2023.

Tapping my British network

Ahead of writing this Weekly Dispatch, I asked a WhatsApp group of mostly UK-based investors: "Anyone's got ideas for takeover targets in the UK?"

One participant shot right back: "Easier to write a piece about who isn't!"

Indeed, 2023 has been another extraordinary year for takeovers in Britain, with 35 bids made for companies worth over GBP 100m – and the year isn't over yet.

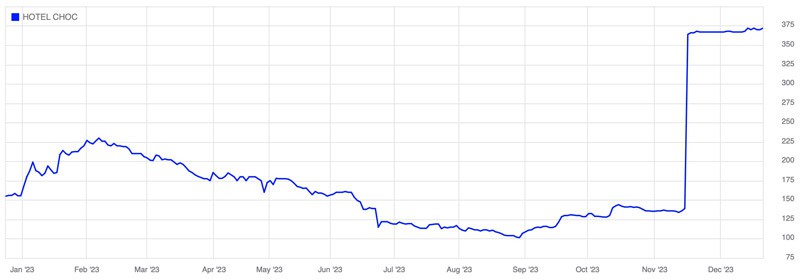

Just as in previous years, many of these bids involved unusually high bid premia. Due to the extremely low valuation of the British market, a bid that values a company at anywhere near its fair value often involves 40%, 50% or even more above the current share price. In the case of upmarket chocolatier chain Hotel Chocolat (ISIN GB00BYZC3B04, UK:HOTC), which became the target of a GBP 500m bid by American confectionary producer Mars, it amounted to a 170% premium.

Hotel Chocolat.

With just 11 new companies listed on its main board in 2023, the London Stock Exchange had a record-low number of IPOs. Is it any wonder that the number of British companies listed on the main board has decreased from 2,700 in 1996 to now just 1,100?

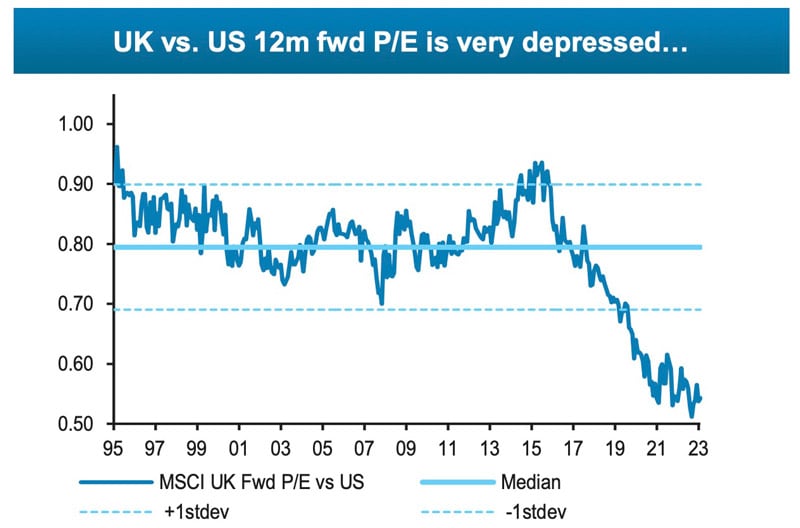

The largest part of these takeover bids continues to come from the US. As the following graph shows, compared to US stocks, British stocks have never been cheaper. Given that "the Channel is wider than the Atlantic" (one of my all-time favourite sayings), US acquirers often view British companies as almost an equivalent to buying a domestic firm. A British firm available at a compelling price will naturally rouse American interest.

Source: Barclays Equity Research, 6 December 2023.

Which sectors and themes are going to be in the crosshairs next year?

1. Private equity buying back their IPOs

Private equity firms floated quite a few of their portfolio companies when markets were buoyant in 2021.

As we all know, private equity is very good at selling companies when their valuations are at their highest – which is why generally, no one should ever subscribe to an IPO where the seller is a private equity company!

During the past months, private equity companies have started to pick up their fallen angels. Swedish firm EQT offered to buy back German software firm SUSE (ISIN LU2333210958, DE:SUSE), Britain's Cinven offered to buy back all outstanding shares in German medical diagnostics firm SYNLAB (ISIN DE000A2TSL71, DE:SYAB), and America's Silver Lake is working to take back Endeavor Group Holdings (ISIN US29260Y1091, NYSE:EDR).

On 20 November 2023, the Financial Times quoted a senior executive of a large European private equity firm:

"We've only seen the beginning, clearly there will be more."

Where is private equity going to strike next?

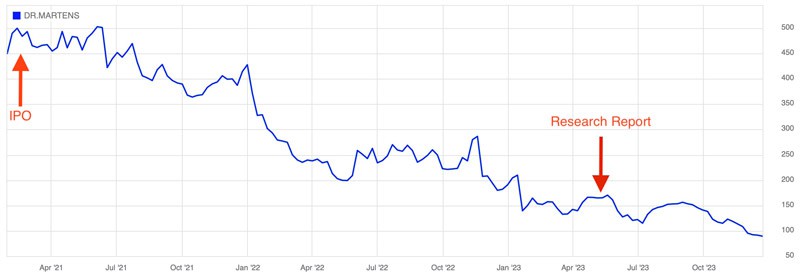

One specific stock that is worth a closer look right now is one where I need to hang my head in shame: Dr. Martens (ISIN GB00BL6NGV24, UK:DOCS). However, my loss can be your gain!

Dr. Martens produces the eponymous boots, commonly known as "Doc Martens", "Docs" or "DMs". It's one of my worst stock picks this past year. After trading as high as 500 pence following its IPO in January 2021, I felt the stock had reached bargain territory when it was trading at 160 pence. As it turned out, my May 2023 research report got it wrong and came too early. Following another profit warning, the stock is now trading at 95 pence.

Dr. Martens.

However, it's noteworthy that Dr. Martens' management is currently buying back stock hand over fist. These buy-backs can easily be followed on the London Stock Exchange website.

A precursor to bid?

Permira, the private equity company that floated Dr. Martens, still owns a 36.4% stake. When it sold a 25% stake as part of the IPO placement, it reaped a GBP 970m in cash. Right now, the entire company is worth just GBP 865m.

The brand is as unique and valuable as it has ever been, and the long-term potential to grow sales in underpenetrated markets around the world also hasn't changed.

As the largest shareholder and having known Dr. Martens for over a decade, Permira is ideally placed to make a bid. Will it be able to resist?

Painful at it is for me to fess up to this ill-timed pick, I think it's now worth taking a closer look at Dr. Martens as a potential takeover target (my report from May 2023 includes a lot of background information – check if out if you haven't already).

2. (Western) energy firms

Russia's invasion of Ukraine forever realigned supply chains, and it demonstrated the strategic value of energy reserves. Just look at how parts of Europe are currently getting industrialised following their loss of access to cheap energy, while the US can power ahead with reshoring manufacturing thanks to its abundant domestic energy reserves.

The year-end period sees the Internet flooded with outlooks for the coming year, though there are now too many documents, with many barely worth skimming through.

One that I found rather exciting to read was Citi Private Bank's "Wealth Outlook 2024", and in particular its section "Our top 10 high conviction potential opportunities".

As the report surmised, the stocks of energy producers, equipment and distributors are going to be in demand again. Western firms, in particular, are needed under geopolitical considerations – they can provide redundancy in energy supplies whenever the proverbial sh** hits the fan in instable regions such as the Middle East. As the report put it:

"The relatively low valuation of most oil and gas producers, pipelines and equipment makers make them worthy portfolio components to consider. Their equities and bonds have reclaimed their traditional role as a potential source of income while also seeking a direct if partial hedge against shocks and inflation."

As it happens, oil and gas stocks make up a hefty chunk of the London Stock Exchange.

In fact, during the years preceding 2022, the ongoing terrible performance of energy-related stocks was to quite some extent responsible for the long-standing weak performance of the FTSE-100 index.

In 2022, energy stocks rallied because of bumper profits following the events in Ukraine. In 2023, the hype subsided. In fact, oil and gas stocks became one of the worst-performing sectors of the year past.

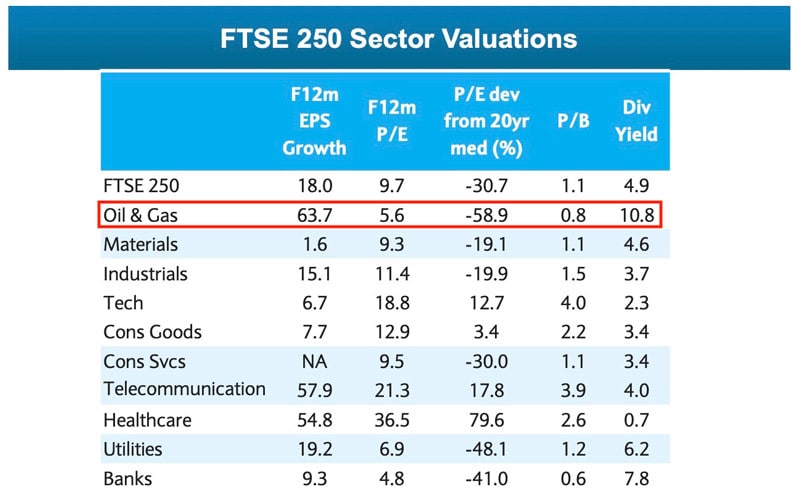

What makes them so interesting in the context of today's subject are their low valuations. Within the FTSE-250 index, oil and gas stocks are now the second-cheapest sector, outdone only by banks. The oil and gas stocks contained in this index are currently trading at an average price/earnings ratio that is a staggering 68% lower than their 20-year average.

Source: Barclays Equity Research, 6 December 2023.

Which stocks stand out?

Surprisingly, Shell (ISIN GB00BP6MXD84, UK:SHEL), and BP (ISIN GB0007980591, UK:BP).

The US recently saw Exxon Mobil (ISIN US30231G1022, NYSE:XOM) unveil a USD 60bn takeover of shale giant Pioneer Natural Resources (ISIN US7237871071, NYSE:PXD), and Chevron (ISIN US1667641005, NYSE:CVX) bid USD 53bn for its American rival Hess (ISIN US42809H1077, NYSE:HES) with the specific aim of getting its hands on gigantic oil fields off the coast of Guyana.

Could Britain's two publicly listed oil and gas giants possibly become a target?

Both Shell and BP are trading at only about half the valuation multiples of their American peers. BP is even cheaper than Shell, because of the company's recent instability.

Could the Americans yet come in with bids? Reuters concluded that for the time being, "mega transatlantic oil mergers are less likely after Exxon, Chevron deals". However, this was primarily based on the Americans currently having their hands full integrating their new acquisitions.

There is also a non-zero chance that Shell could decide to try and gobble up BP. A journalist working for The Telegraph recently argued as much: "Why oil's next mega-merger should be Shell and BP".

In any case, oil is a global commodity, evidenced by the fact that BP and Shell generate 87% and 85% of their sales outside of the UK. A global oil and gas firm trading at half the valuation of an American firm makes little sense.

Outside of the question of mergers or bids, Shell is probably a good investment anyway. It currently benefits from its ongoing return to a management approach that is focused on delivering value for shareholders. As I wrote in my September 2023 research report:

"Following a change in management in January 2023, Shell's leadership is now once again firmly focused on delivering affordable, reliable energy to consumers, and producing the highest possible financial returns for shareholders. The new CEO, Wael Sawan, decided to reallocate investment from so-called renewable energy (lower returns) to cash-starved hydrocarbons (higher returns). …. The stock is trading at a price/earnings ratio of 7 and an EV/EBITDA ratio of just 3. Trading at just three times its cash flow makes it one of the cheapest large-cap stocks in the world. … Cash flow matters once again, and leading oil and gas majors like Shell offer investors a very attractive risk/reward profile."

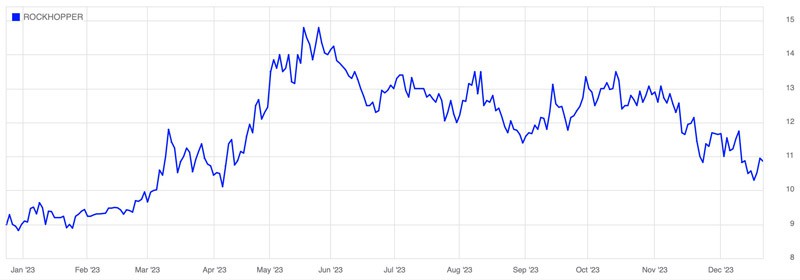

Someone looking for something that also fits this entire narrative but is more spicy should consider Rockhopper Exploration (ISIN GB00B0FVQX23, UK:RKH), a GBP 65m firm involved in exploring for oil in the Falkland Islands. Following Chevron's bid to gain control of oil reserves in Guyana, taking a closer look at this tiny but potentially extremely oil-rich British Overseas Territory is worth the time. The stock of Rockhopper Exploration has lots of potential to rise on the back of increasing attention for the Falklands, but it's also a potential bid target given that it offers ready-made access to an oil region that is far away from the world's conflict hotspots. The company is also currently trading back at an attractive entrance level.

Rockhopper Exploration.

Low valuations, the possibility to rise under their own steam, and the possibility of a bid thrown in for free – what's not to like?

No doubt, someone who digs deeper into UK oil and gas stocks will find plenty more such candidates.

Alternatively, you could also look at…

3. Quintessentially British firms

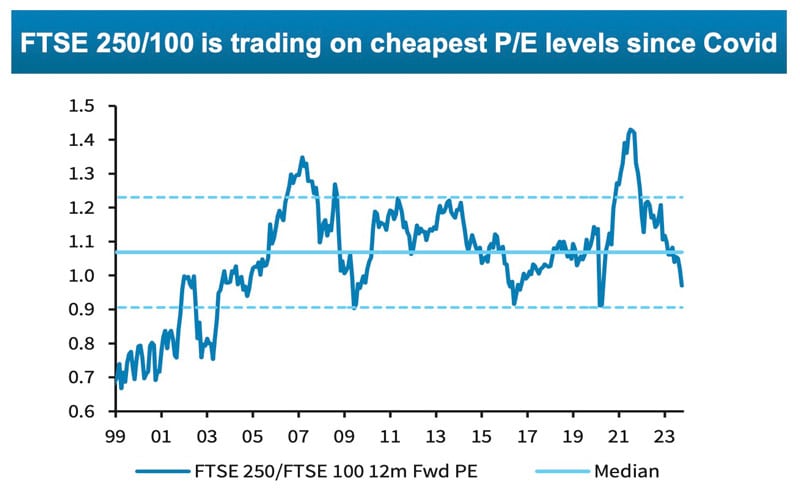

The stocks of British companies from both the FTSE-100 index and the FTSE-250 index are now back to trading at levels almost as low as during the pandemic sell-off in spring 2020.

Source: Barclays Equity Research, 6 December 2023.

British brands are a category of their own. Financial investors have long seen British brands as more valuable than others, primarily because they often lend themselves to ambitious global expansion plans. Bond, Burberry, Bentley… Who can resist?

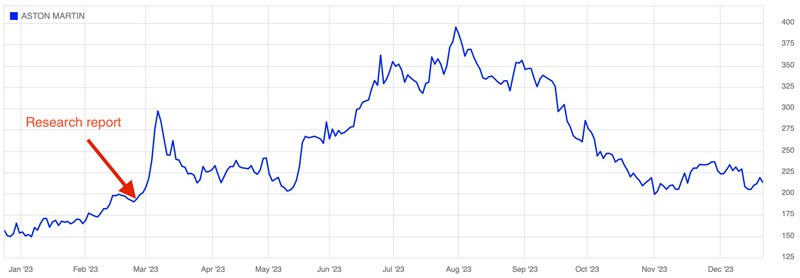

Right into this category fits Aston Martin Lagonda (ISIN GB00BN7CG237, UK:AML). The stock of the legendary British automaker is now worth another look for two reasons:

- Following my research report, the stock quickly doubled. It's now back to just slightly above the February 2023 price.

- The firm could increasingly become the target of a bid. Saudi Arabia recently increased its stake to over 20%. Could Canadian entrepreneur Lawrence Stroll with his 26% stake resist a tempting offer?

Aston Martin Lagonda.

A British company with several iconic brands that flies below the radar and is more of an immediate potential target is British retailer C&C Group (ISIN IE00B010DT83, UK:CCR). The company has a GBP 600m market cap and owns Bulmers (the leading Irish cider brand with a 58% market share), Tennent's (Scotland's leading beer brand with a 29% market share), and the UK's #3 cider brand (Magners). On the back of its successful drinks brands, C&C Group has also built an unrivalled distribution system in the UK and Ireland. It has bought up several smaller distribution firms and now commands a 30% market share in drinks distribution in the UK and Ireland – a business with high barriers to entry, recurring revenue from long-standing customers, and economies of scale.

The stock is trading at just 6x estimated 2025 EBITDA, and the company has a strong balance sheet. C&C Group does not have a dominant shareholder, and it neatly fits into the target profile of private equity companies. Could the hunter soon become prey? In my 3 November 2023 Weekly Dispatch about the company, I asked the question "How long until we see a bid?" Well, the stock seems about to break out of a long sideways trend, and the reason for that could well be: "Possibly sooner than you think."

C&C Group.

As my WhatsApp brain pool would joke, there are now 1,100 takeover targets left on London's main board. Not to be forgotten, there is about the same number of stocks on London's less-regulated AIM market.

2024 will see more of them taken out by a bidder, and I bet that one or two will yet again command a premium in excess of 100%.

The world's cheapest oil stock?

Two years ago, Undervalued-Shares.com featured a stock that was "in the top 1% of the cheapest stocks in the world."

With an EV/EBITDA multiple of 2.2, Pampa Energía was as cheap as they come. Today, the stock is up 200% – such is the power of buying into assets at extremely depressed valuations!

The latest Undervalued-Shares.com research report – out this week – features a stock that is valued at an EV/EBITDA multiple of 0.3 (!) based on 2025 estimates.

There is a catch – but one that should be resolved sometime after February 2024.

Until then, it's worth considering to buy into this opportunity while no one is paying attention.

The world's cheapest oil stock?

Two years ago, Undervalued-Shares.com featured a stock that was "in the top 1% of the cheapest stocks in the world."

With an EV/EBITDA multiple of 2.2, Pampa Energía was as cheap as they come. Today, the stock is up 200% – such is the power of buying into assets at extremely depressed valuations!

The latest Undervalued-Shares.com research report – out this week – features a stock that is valued at an EV/EBITDA multiple of 0.3 (!) based on 2025 estimates.

There is a catch – but one that should be resolved sometime after February 2024.

Until then, it's worth considering to buy into this opportunity while no one is paying attention.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: