Image by Atomazul / Shutterstock.com

If you live in the UK or Ireland, chances are that you have already purchased and consumed products distributed or even produced by C&C Group.

However, few consumers and investors would be aware of the company and the full extent of its business.

One-third of all drinks distributed in the UK get to consumers through the distribution network of C&C Group.

The company also owns some of the best-known drinks brands, such as Bulmers, the leading Irish cider brand with a 58% (!) market share.

C&C Group is facing an interesting year, and one of its best-informed shareholders recently upped their stake to the tune of millions of pounds.

This small-cap stock should not only head higher as we approach 2024, but it may even start on a new long-term trajectory altogether.

C&C Group.

A drinks maker expanding into distribution

Set up in 1827, C&C Group (ISIN IE00B010DT83, UK:CCR) used to be known as Cantrell & Cochrane Limited. It is headquartered in Dublin but listed on the London Stock Exchange.

The company was set up by a Belfast firm of chemists who decided to produce soft drinks. Historians credit Dr Cantrell as the first inventor of "ginger ale", and the company embossed the slogan "The Original Makers of Ginger Ale" on its bottles.

More recently, C&C Group became known as a producer of leading beer and cider brands.

Outside of Bulmers in Ireland, the company also owns Scotland's leading beer brand (Tennent's, 29% market share), and the UK's #3 cider brand (Magners).

On the back of its successful drink brands, C&C Group has also built an unrivalled distribution system in the UK and Ireland. It serves the so-called on-trade sector, which refers to places that sell beverages for immediate consumption, such as bars, restaurants, and pubs (while "off-trade" usually means places like liquor stores, supermarkets, and other places where you don't consume the beverage right away).

C&C Group's presence in the on-trade drinks sector took a massive leap forward in 2018, when the company announced the acquisition of Matthew Clark Bibendum, up to then the largest independent distributor in the sector. C&C Group had spotted the opportunity to buy these assets from a distressed seller, Conviviality, who had tried to combine Matthew Clark and Bibendum but then collapsed into insolvency.

This acquisition put C&C Group onto a new trajectory. Up to then, its income had been dominated by its own high-margin drinks brands, while it is split about half-half since. Also, revenue in distribution is a lot lower-margin than when selling owned brands. Whereas distribution makes up about half of the operating income, it contributes over 80% to group revenue.

C&C Group is now a fairly different animal to analyse, and it also has quite different growth prospects.

An emerging growth story?

Alcoholic drinks have been facing headwinds of late, thanks mostly to the younger generation not taking to alcoholic drinks in quite the same way.

If there was indeed an "age of wellness" in the offing, producers of alcoholic drinks could become a bit like tobacco producers – rich in cash flow, but low on growth and with low valuation multiples.

Whether C&C Group with its much-loved brands and relatively higher pricing power will suffer these issues is still up for discussion. In the meantime, the company's management has carried out a foresightful strategic move to create a new growth story and deepen its involvement in the drinks market of the British Isles.

Following its 2018 acquisition, C&C Group can now offer other drinks producers access to the biggest distribution network in the UK and Ireland, which helps other brands enhance their revenue and margins.

With a 30% market share in distribution in the UK and Ireland, C&C Group is now positioned to become THE consolidator of this industry in its two home markets. A mass business like distribution really needs one player to control 50% or more of the market to be as efficient as possible, and C&C Group will likely gobble up other independent, smaller players. The current macro uncertainty should even help with rolling up the market, and further depress prices that sellers of such businesses can achieve when selling to a consolidator.

All this should eventually lead to investors taking a fresh look at the stock of C&C Group.

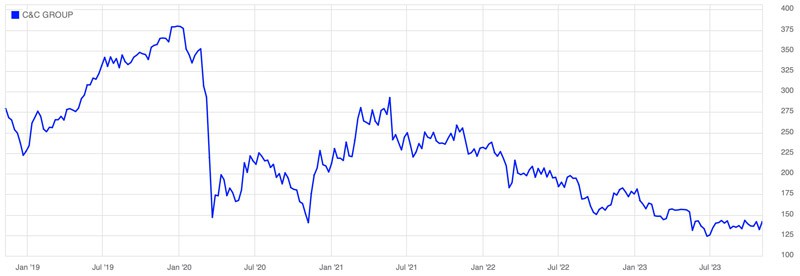

Since early 2020, the stock is down from 380 pence to currently just 143 pence, or 43%. In July 2023, it traded as low as 125 pence. Judging from the chart, the stock may be about to turn the corner.

Will it, and why would it?

Five difficult years

Over the past four years, C&C Group has experienced not the perfect storm but a series of storms.

First, the pandemic lockdowns forced bars and restaurants to close down.

Then, a major cyberattack forced the company to shut down the IT systems of its distribution division.

Right thereafter, the world experienced major supply chain issues, which also affected C&C Group.

Inflation, staff shortages, and rising costs came next.

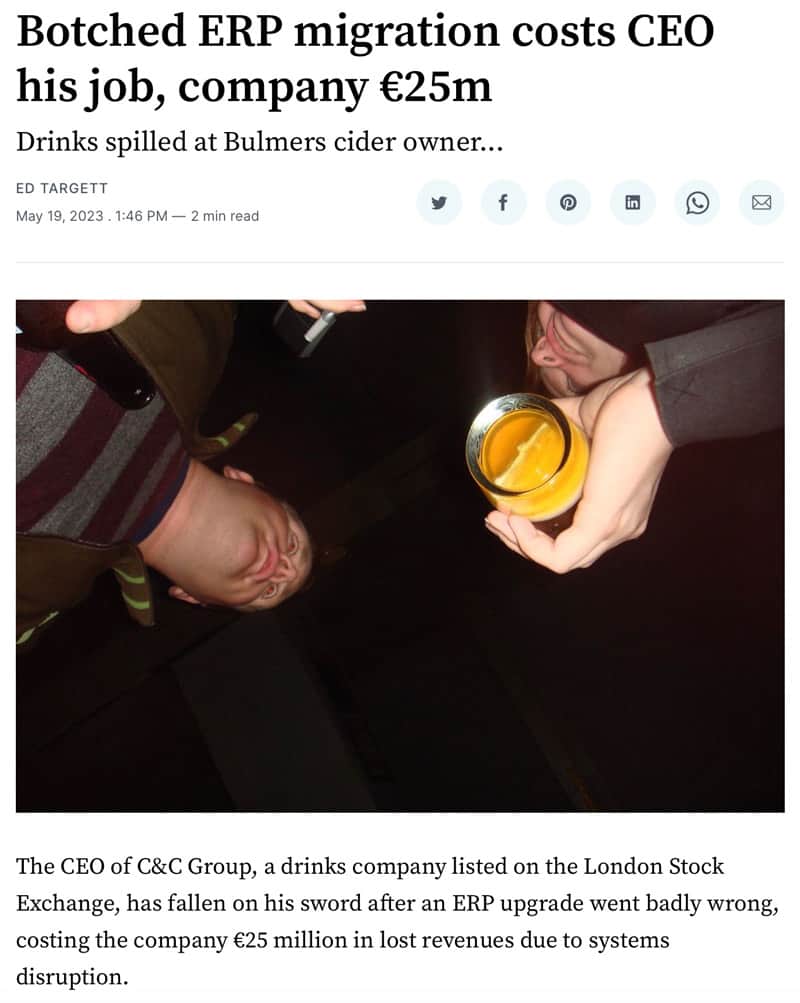

To round it all off, earlier this year, problems with implementing the new enterprise resource planning (ERP) system for C&C Group's distribution business caused a GBP 25m one-off hit to the business' revenue.

The latter also made the CEO pack his bags.

Source: The Stack, 19 May 2023.

This has been a series of challenging years, and it affected the margins of the business.

However, there are now some interesting indications that this difficult period is about to end.

Insider activity to take note of

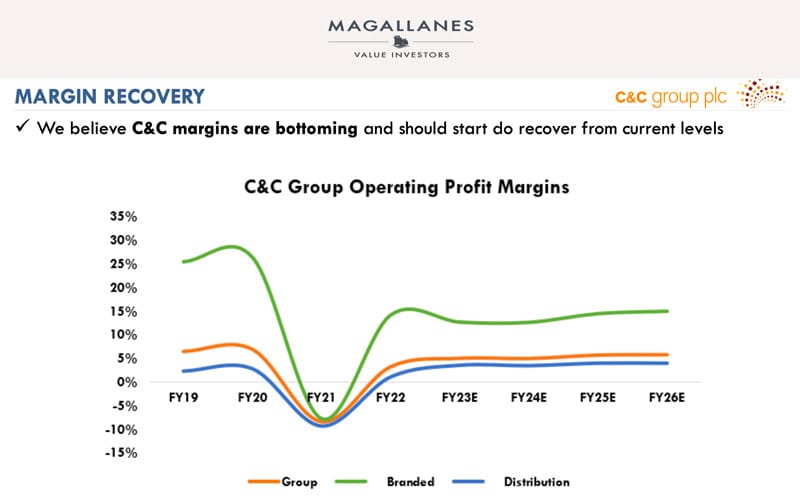

On 2 November 2023, Magallanes Value Investors – a Spanish fund manager specialising in European small- and mid-caps – disclosed that it had upped its stake from 4.28% to 5.12%. The firm had long followed C&C Group, and its team presented their investment thesis at the Value Spain conference in Madrid in March 2023.

The vote of confidence that is intrinsic to such a significant increase is further backed up by C&C Group's board. On 26 October 2023, the company announced that its board had such confidence in the business going forward that it "intends to distribute up to EUR 150m to shareholders over the next three fiscal years, through dividends and other capital returns". This would equate to about one-fifth of the company's market cap!

For what it's worth, C&C Group's Executive Chair also recently bought 26,431 shares worth GBP 34,995.

C&C Group had always been conservatively managed, and the company has always taken pride in having both a strong cash generation and a strong balance sheet. Of late, its net debt amounted to 2.1x EBITDA, slightly higher than the company's target range of 1.5-2.0x. However, this is where C&C Group now expects things to improve significantly going into 2024. Excluding leases, the multiple is already down to 1.6x and projected to further decrease to 1.3x next year. What financing it does have is fixed in a range of 1.6-2.74% and does not require major refinancing until 2030/2032.

The massive task of integrating Matthew Clark Bibendum is coming to an end, and the ambitious strategic move is likely to pay dividends (literally) from 2024. C&C Group also recently pointed out the "encouraging" performance of its own-brand business, where sales were up 10%.

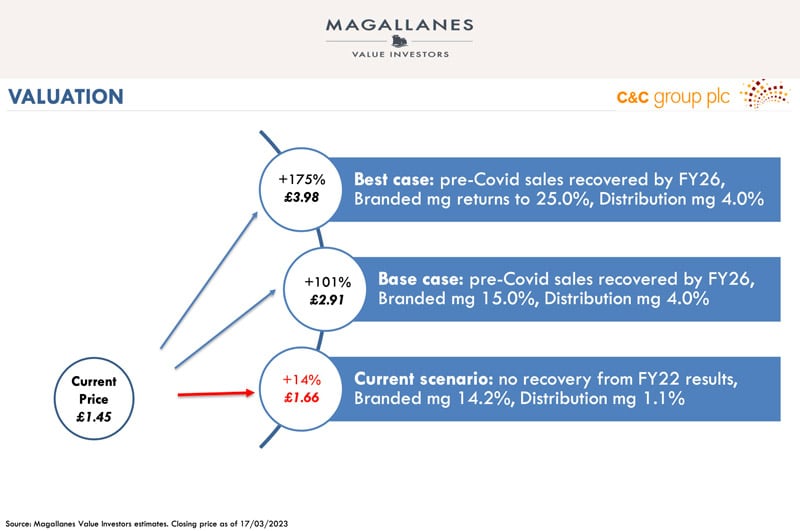

Magallanes Value Investors also seems to believe that the outlook is getting brighter again, based on its presentation about a recovery of C&C Group's margins from 2024.

Source: Magallanes Value Investors, March 2023.

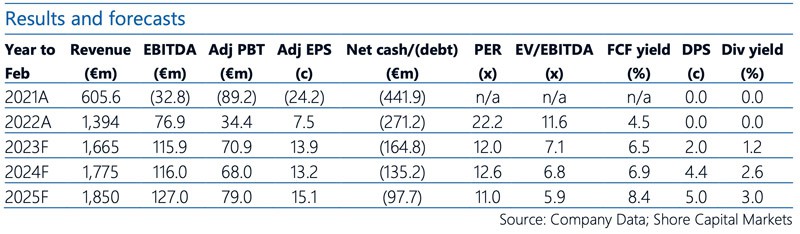

As a small-cap with GBP 550m (USD 680m) in market cap, C&C Group doesn't receive as much analyst coverage as larger companies. The most recent estimates of March 2023 should be largely up-to-date, though, given what the company reported in its most recent shareholder update in October 2023.

Based on these estimates, the stock is trading at about 11x estimated 2025 earnings and 6x estimated 2025 EBITDA. These metrics are below the company's historical multiples and those of peers. Given the inherent strengths of its own brands and the likelihood that C&C Group will become THE consolidator of its industry in the British Isles, a more appropriate valuation would be at least 50% higher and possibly up to double the current stock price.

Source: Shore Capital, 23 March 2023.

These conclusions are not too far off from what Magallanes Value Investors presented earlier this year. Their base case is that a recovery in margins could lead to a doubling of the stock from where it's right now. In a best-case scenario, the stock could do even better and reach GBP 4. If the business didn't manage to improve its margins, the stock would probably simply stick around the current level.

Plenty of upside – and not much downside.

Source: Magallanes Value Investors, March 2023.

Magallanes Value Investors' recent purchase of additional stock worth millions of pounds should speak for itself, shouldn't it?

Based on current valuation multiples and given that 2024 is just around the corner, C&C Group is a pretty decent, overlooked European small-cap for those who fancy this sort of investment. There should be a good chance of increased buying in run-up to the company's next update on 29 February 2024.

It also has many similarities to John Menzies, another British consolidation play that some Undervalued-Shares.com readers will remember from the 2019-2021 period, and which eventually got gobbled up by a bidder.

C&C Group does not have a dominant shareholder, and British companies of this sort have a strong appeal to private equity investors.

It begs the question – how long until we see a bid?

I don't know. However, given the prospect of ongoing distributions back to shareholders, growing margins, and further success in consolidating the drinks distribution market in the British Isles, I can see the logic behind Magallanes Value Investors using the current price level to up their investment.

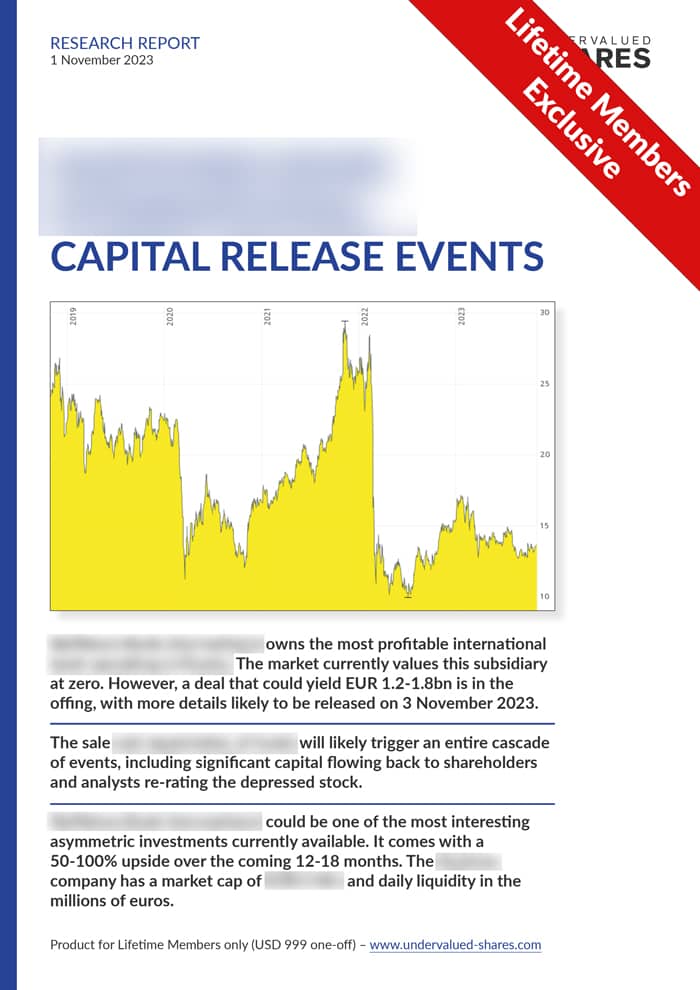

Hot off the press: new in-depth research report

My latest research report – published exclusively for Undervalued-Shares.com Lifetime Members earlier this week – features a European bank stock.

"Yikes!", you might say.

Yikes indeed.

Don’t discard it just yet, though.

The company in question is in a market leading position and has a ≈EUR 5bn market cap. Its stock has daily trading volume in the millions, and a realistic chance of rising 50-100% over the coming 12-18 months.

Too compelling an investment case to disregard!

Hot off the press: new in-depth research report

My latest research report – published exclusively for Undervalued-Shares.com Lifetime Members earlier this week – features a European bank stock.

"Yikes!", you might say.

Yikes indeed.

Don’t discard it just yet, though.

The company in question is in a market leading position and has a ≈EUR 5bn market cap. Its stock has daily trading volume in the millions, and a realistic chance of rising 50-100% over the coming 12-18 months.

Too compelling an investment case to disregard!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: